Child Support Calculator For Illinois

Description

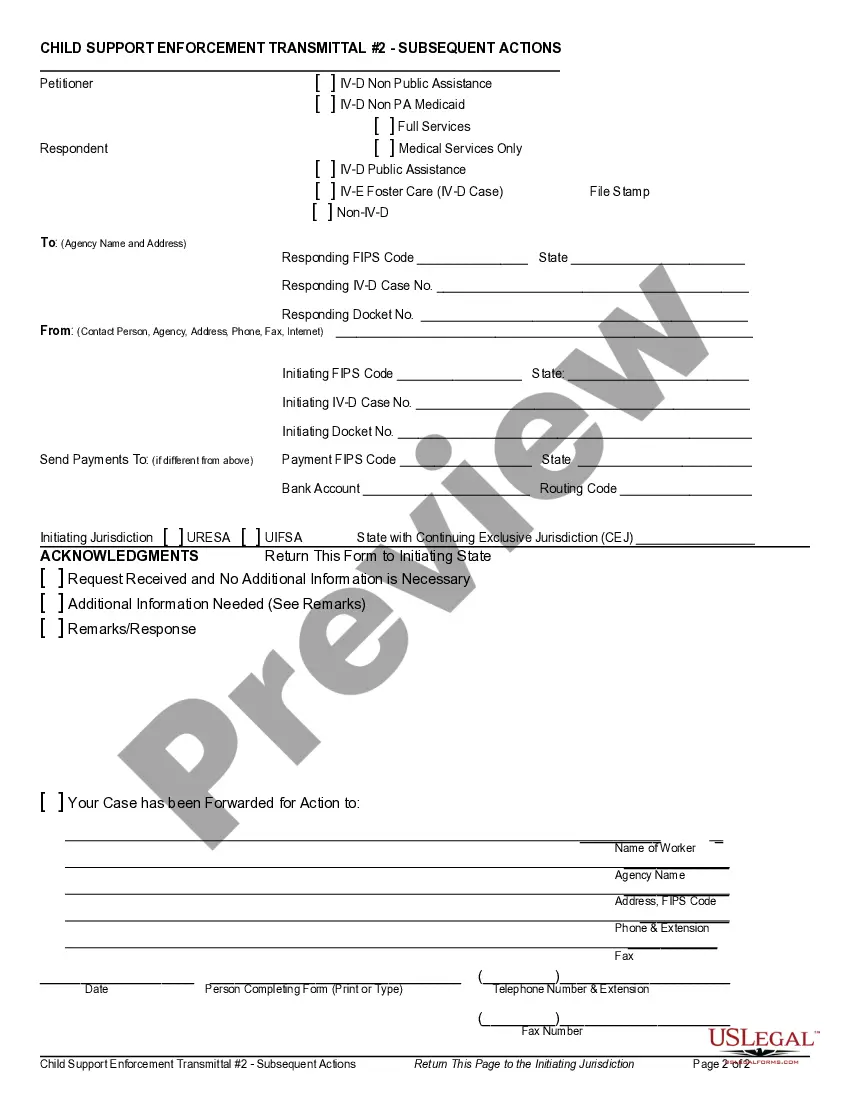

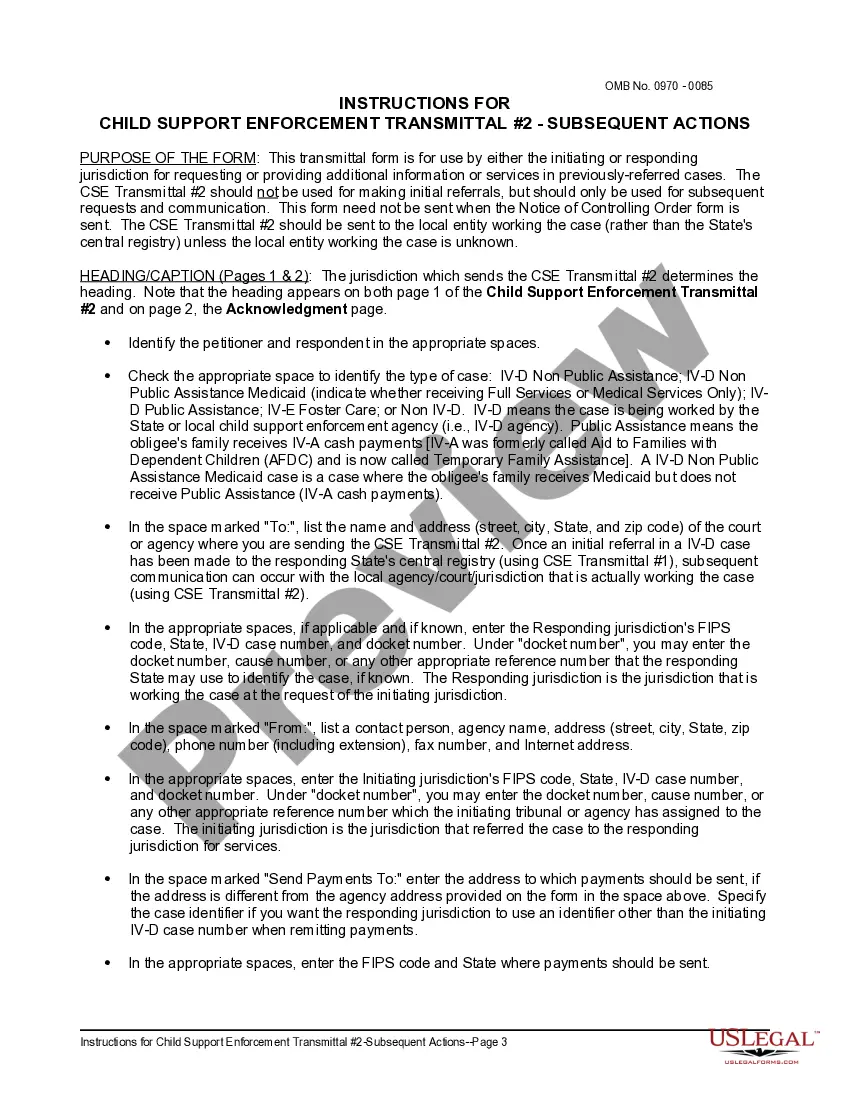

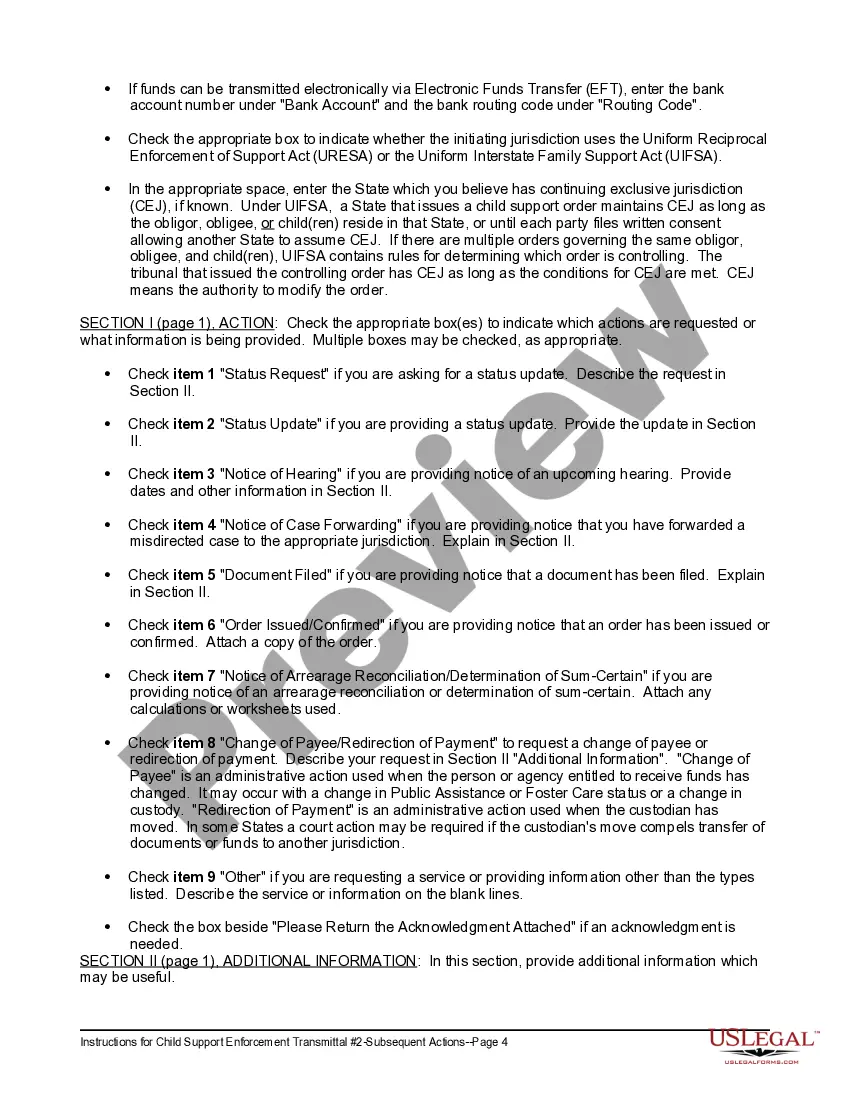

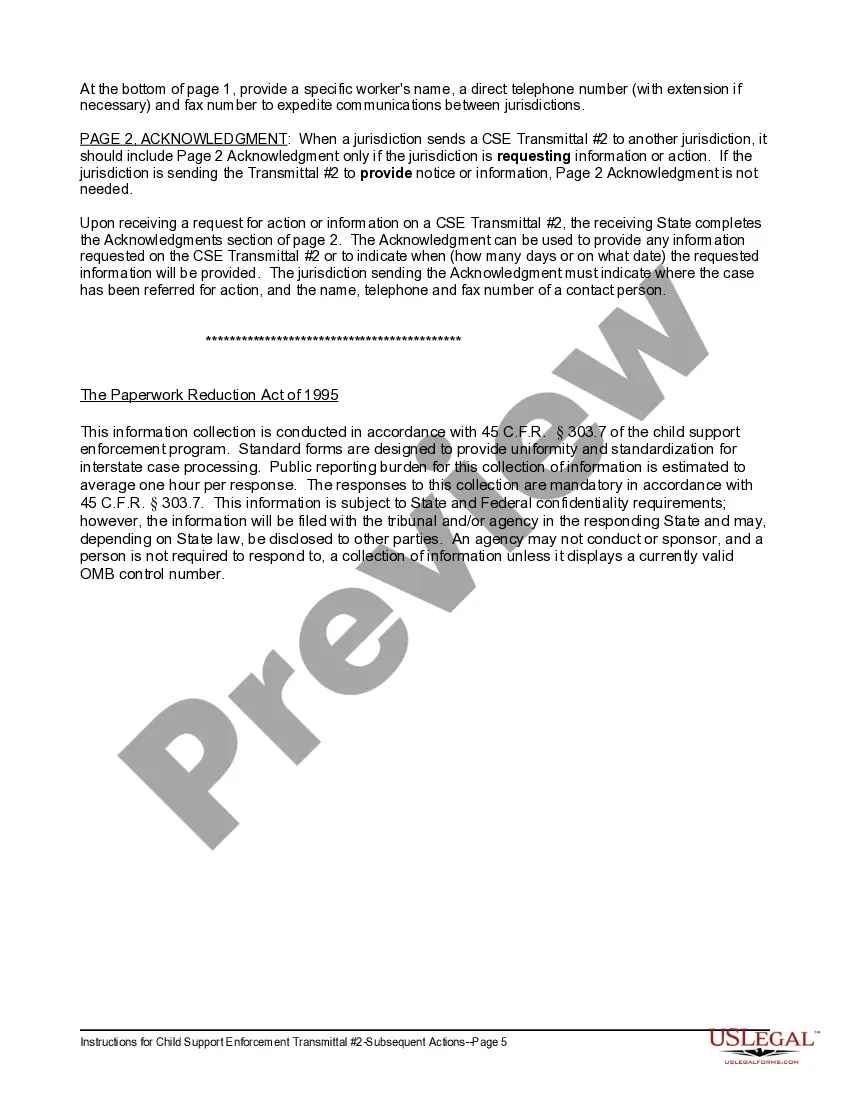

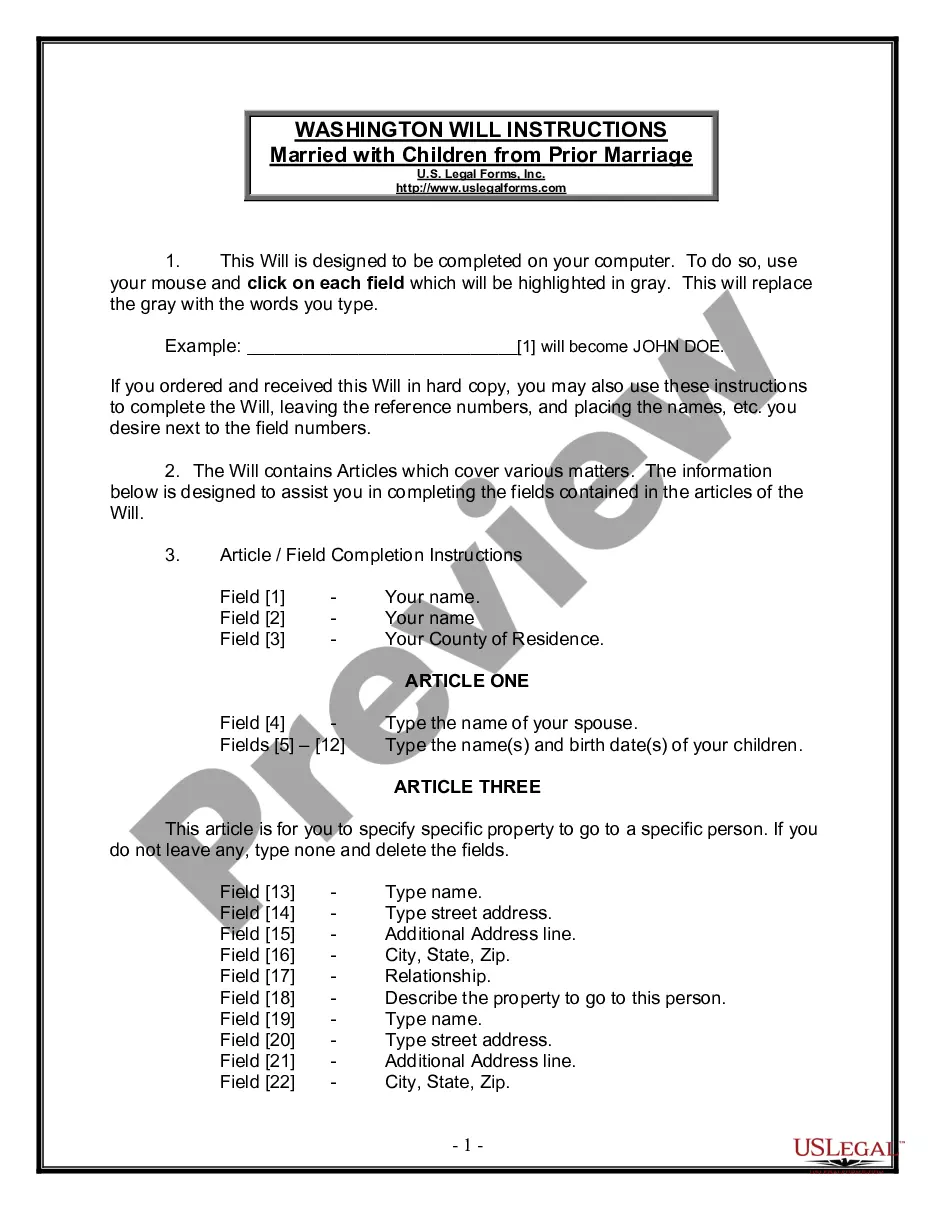

How to fill out Child Support Transmittal #2 - Subsequent Actions And Instructions?

Handling legal papers and procedures could be a time-consuming addition to the day. Child Support Calculator For Illinois and forms like it often need you to search for them and understand how you can complete them correctly. Therefore, regardless if you are taking care of financial, legal, or personal matters, using a thorough and convenient web library of forms when you need it will significantly help.

US Legal Forms is the top web platform of legal templates, boasting over 85,000 state-specific forms and a number of resources to assist you complete your papers effortlessly. Explore the library of pertinent documents available to you with just one click.

US Legal Forms provides you with state- and county-specific forms offered by any moment for downloading. Safeguard your papers managing procedures using a top-notch support that allows you to prepare any form within a few minutes without any additional or hidden charges. Just log in to your account, identify Child Support Calculator For Illinois and download it right away from the My Forms tab. You can also gain access to previously saved forms.

Could it be your first time making use of US Legal Forms? Sign up and set up an account in a few minutes and you’ll get access to the form library and Child Support Calculator For Illinois. Then, adhere to the steps below to complete your form:

- Ensure you have discovered the right form by using the Preview option and reading the form description.

- Select Buy Now as soon as all set, and select the monthly subscription plan that is right for you.

- Select Download then complete, sign, and print out the form.

US Legal Forms has twenty five years of expertise assisting consumers control their legal papers. Find the form you need today and enhance any operation without breaking a sweat.

Form popularity

FAQ

Even when parents have 50/50 parenting time, the court can order either party to pay child support. Child support depends on how much each party makes and the amount of time each party has with the child.

Assuming 9% interest, child support arrears are calculated based on the amount of unpaid child support plus the accumulated interest. If a parent in Illinois fails to pay $1,000 in child support for one year, the parent's child support arrearage balance is $1,090 ($1,000 + 9% interest).

The past due delinquent child support must be paid at minimum rate of 20% of the current support. So, if you owed $ 1000 a month in current child support but you missed child support payments for a year so had an arrearage of $ 17,000 in child support payments, you'd have to pay a total of $ 1200 a month ongoing.

Illinois puts one child's basic child support level at $1,215 per month; however, this number is a starting point on which additional factors are added or subtracted. Relevant factors must be considered and calculated to understand better what a person may pay in child support in Illinois.

Illinois child support law has traditionally been calculated by taking the obligor's net income (gross income, minus taxes and other deductions), and applying a certain percentage based on the number of minor children, for example.