Deed Of Partition In Uk For A Trust With The Irs

Description

How to fill out Deed Of Partition In Uk For A Trust With The Irs?

You no longer need to waste time looking for legal documents to meet your local state regulations. US Legal Forms has compiled all of them in a single location for easier access.

Our website provides over 85,000 templates tailored for both business and personal legal matters, organized by state and area of application.

All forms are properly drafted and validated, ensuring that you receive a current Deed of Partition in the UK for a Trust with the IRS.

Choose the most suitable pricing plan and either register for an account or Log In. Proceed to pay for your subscription using a credit card or PayPal. Pick the file format for your Deed of Partition in the UK for a Trust with the IRS and download it to your device. Print your form to fill it out by hand or upload the template if you prefer online completion. Organizing official documents in compliance with federal and state laws is quick and easy with our library. Experience US Legal Forms today to maintain your documentation efficiently!

- If you are already acquainted with our platform and possess an account, ensure that your subscription is active before downloading any templates.

- Log In to your account, select the document, and click Download.

- You can also access all previously acquired documents anytime by visiting the My documents tab in your profile.

- For those who have not interacted with our platform before, the process involves a few additional steps.

- Here’s how new users can acquire the Deed of Partition in the UK for a Trust with the IRS from our catalog.

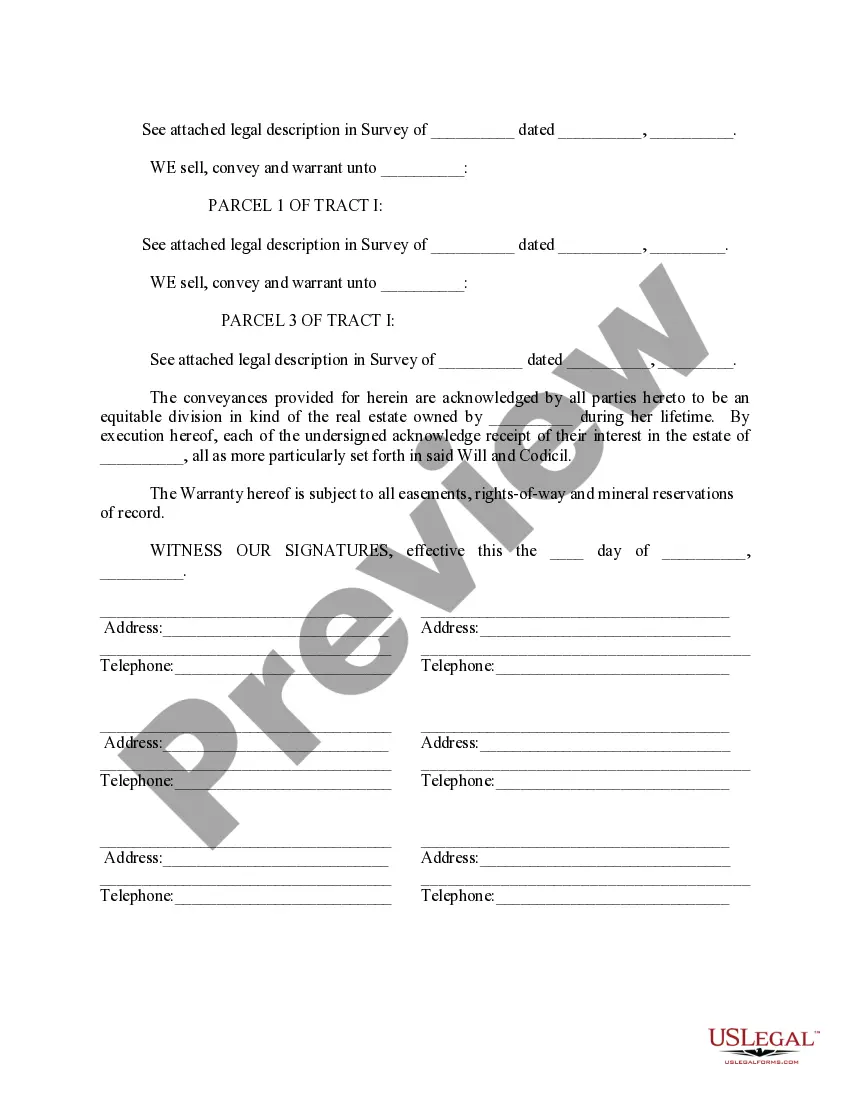

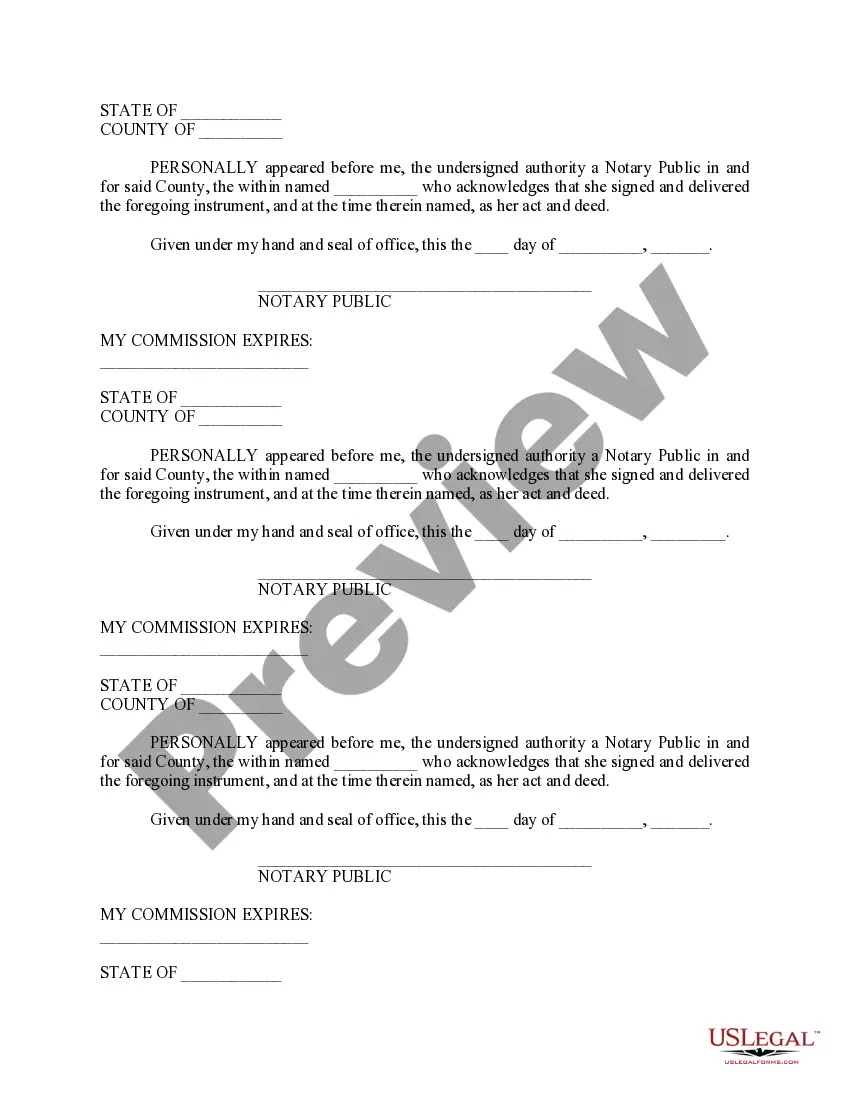

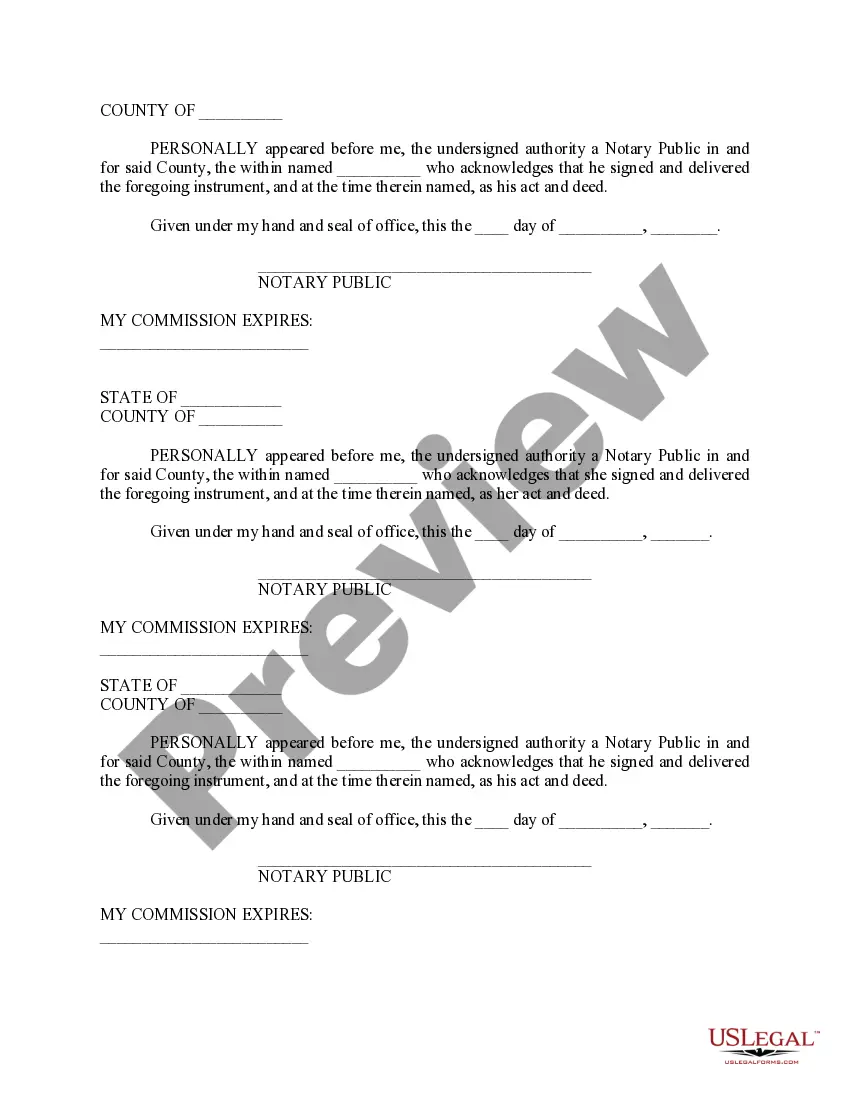

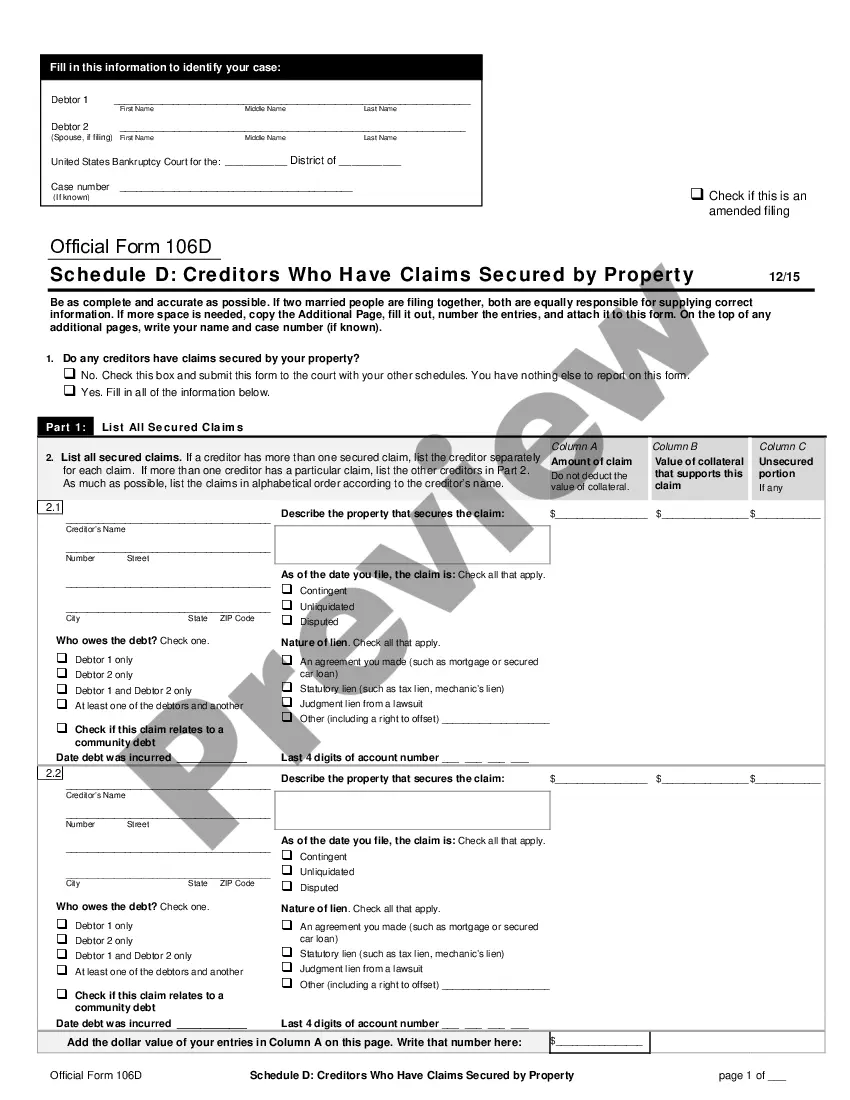

- Carefully review the page content to ensure it includes the sample needed.

- To assist, use the form description and preview options if available.

- If the current template does not suit you, use the search bar above to look for another template.

- When you find the appropriate one, click Buy Now beside the template title.

Form popularity

FAQ

While trusts offer several advantages, they also have downsides, such as ongoing management costs and potential tax implications. If not properly structured, a trust may incur higher tax liabilities than anticipated. The use of a Deed of partition in uk for a trust with the irs can mitigate some of these issues. Being informed about your trust's obligations will aid you in making better choices.

One of the biggest mistakes parents make is failing to communicate their intentions clearly to their children and beneficiaries. This lack of communication can lead to misunderstandings and conflict later on. Furthermore, not enforcing a Deed of partition in uk for a trust with the irs can result in legal complications. Transparency and structured guidance are key to a successful trust fund setup.

Trust funds can pose several risks, including potential mismanagement of assets and disputes among beneficiaries. When setting up a trust, it’s vital to clarify roles and responsibilities to mitigate conflicts. Additionally, not utilizing a Deed of partition in uk for a trust with the irs may expose the trust to unnecessary tax liabilities. Regular monitoring and clear communication can help safeguard your trust.

The average amount in a trust fund in the UK can vary greatly, but it often ranges from tens of thousands to several million pounds. Many factors, such as the type of trust and the assets involved, can influence this amount. A Deed of partition in uk for a trust with the irs may help maximize the fund's value. Understanding these dynamics can aid in planning your financial future.

To avoid inheritance tax, consider setting up a trust that uses a Deed of partition in uk for a trust with the irs. This strategy allows you to transfer assets while maintaining control over them. Regularly reviewing your estate plan can help ensure your trust remains tax-efficient. Engaging with professionals who understand the nuances of tax laws is essential.

A deed of trust for tenants in common in the UK outlines how co-owners share ownership of a property. Each individual holds a distinct share that can be inherited differently, allowing for customized arrangements among co-owners. If you are considering a deed of partition in the UK for a trust with the IRS, such an arrangement can assist in delineating ownership and responsibilities among tenants in common.

Acquiring a deed of trust in the UK typically involves drafting a legal document that specifies the terms of the trust, including the assets and beneficiaries. You should work with a legal professional to ensure that the deed meets legal standards and reflects your intentions. This step can be crucial when dealing with a deed of partition in the UK for a trust with the IRS, providing clear instructions on managing your assets.

To obtain a deed to your house in the UK, you usually need to apply for a copy from the Land Registry. This process involves providing details about your property, such as its address and your ownership details. Once you receive the deed, you can consider how a deed of partition in the UK for a trust with the IRS might enhance your estate planning.

Yes, you can place your house in a trust even if you have a mortgage in the UK. However, it's important to consult your mortgage lender, as they may have specific policies regarding this. By creating a deed of partition in the UK for a trust with the IRS, you can ensure that the property is managed according to your wishes while also addressing any tax implications.

While putting a house in trust may help manage inheritance tax, it is not a straightforward solution. The IRS has specific rules regarding trusts, and improper structuring can lead to tax implications. Engaging with professionals familiar with the Deed of partition in uk for a trust with the irs can provide clarity on how to achieve your goals while remaining compliant.