Agreement Trust Irrevocable With Power Of Appointment

Description

How to fill out Irrevocable Trust Agreement For Benefit Of Trustor's Children And Grandchildren?

Obtaining legal document examples that adhere to federal and local regulations is essential, and the internet provides numerous options to choose from.

However, why spend time d searching for the suitable Agreement Trust Irrevocable With Power Of Appointment template online when the US Legal Forms digital library already has such forms collected in one location.

US Legal Forms is the largest online legal repository with more than 85,000 fillable documents crafted by attorneys for any business and personal matter. They are easy to navigate with all documents categorized by state and intended use. Our experts monitor legislative updates, ensuring your forms are current and compliant when obtaining an Agreement Trust Irrevocable With Power Of Appointment from our site.

Once you've found the correct form, click Buy Now and select a subscription plan. Create an account or Log In, and make a payment using PayPal or a credit card. Choose the format for your Agreement Trust Irrevocable With Power Of Appointment and download it. All templates found through US Legal Forms are reusable. To re-download and complete previously acquired documents, access the My documents tab in your account. Take advantage of the most comprehensive and user-friendly legal document service!

- Acquiring an Agreement Trust Irrevocable With Power Of Appointment is quick and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document example you need in the desired format.

- If you are unfamiliar with our website, follow the steps outlined below.

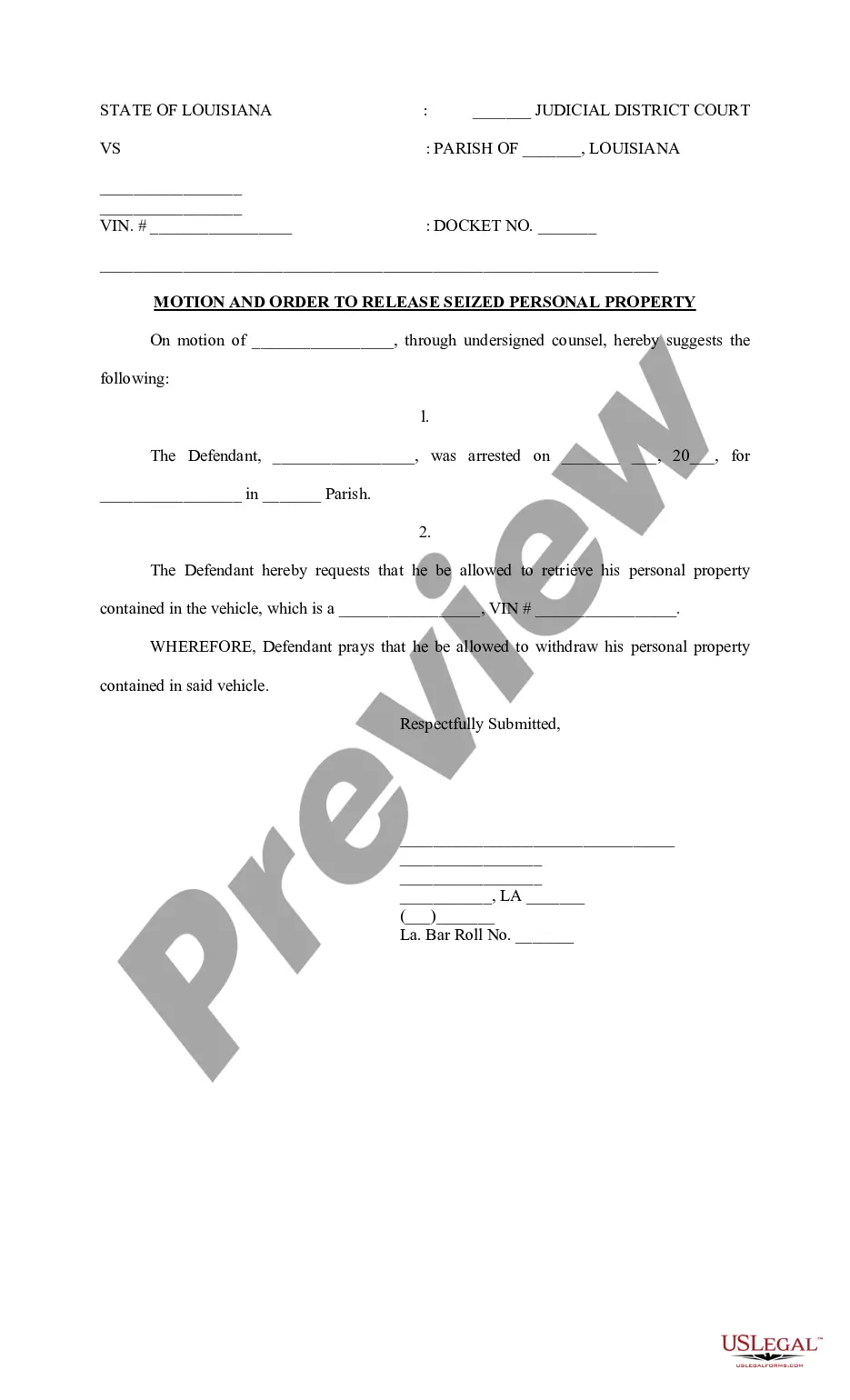

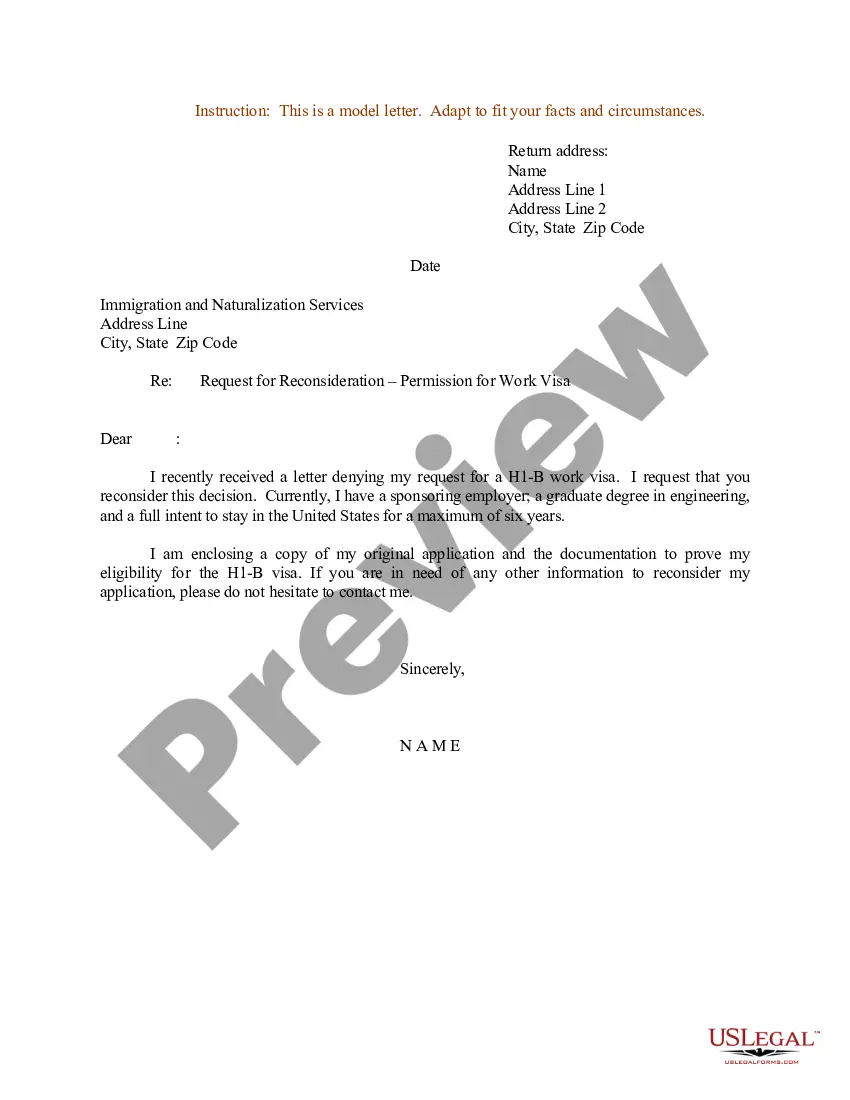

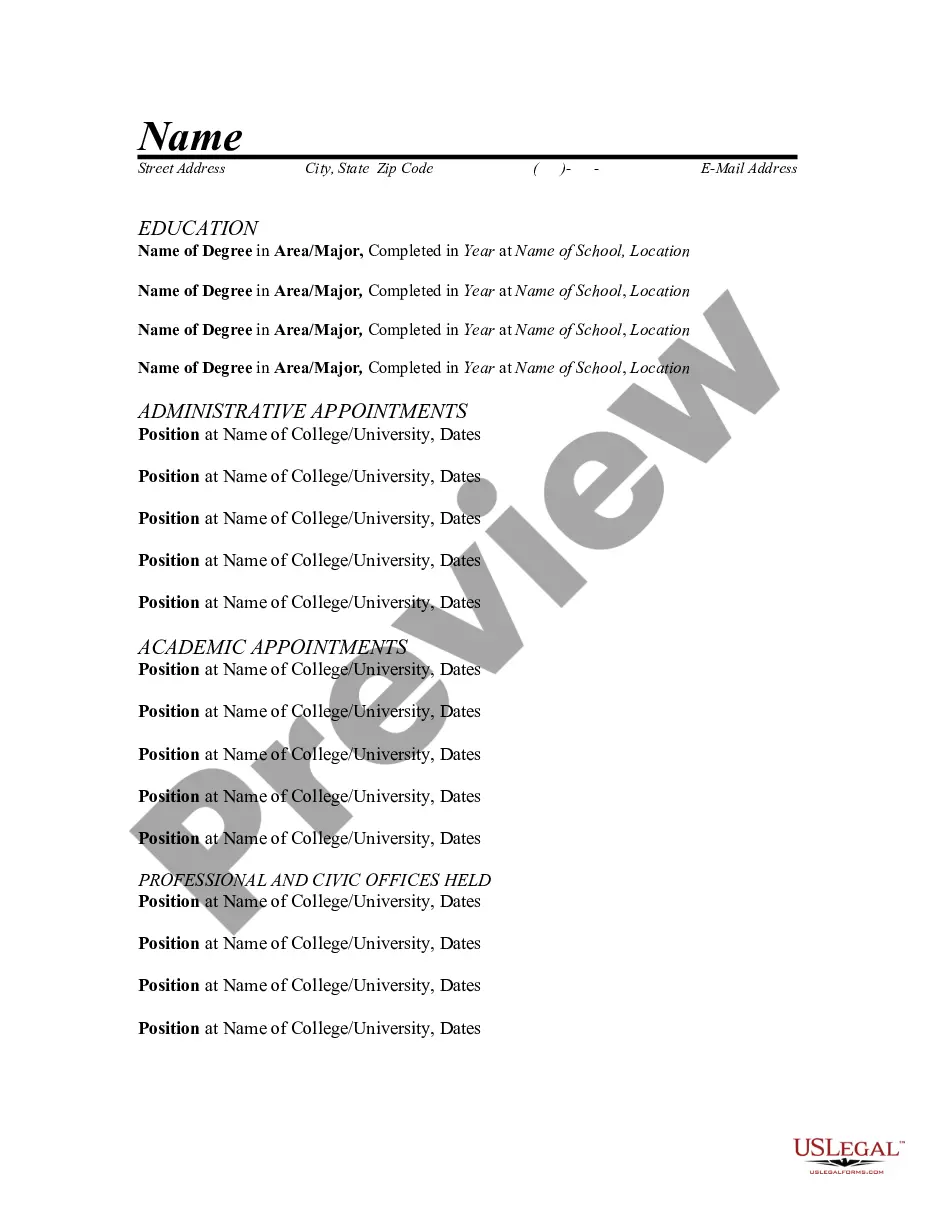

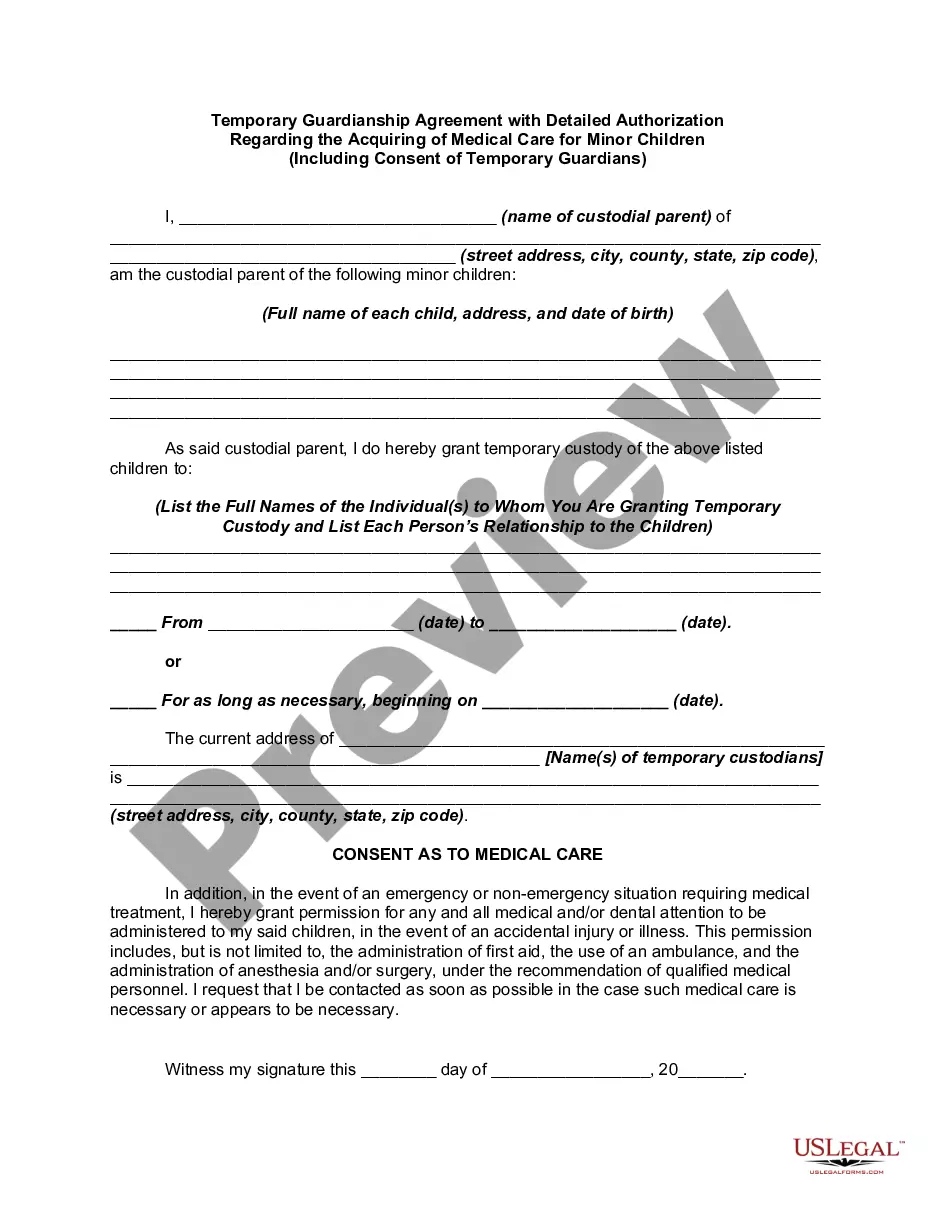

- Review the template using the Preview feature or by examining the text outline to ensure it satisfies your needs.

- If needed, find another sample with the search tool at the top of the webpage.

Form popularity

FAQ

The biggest mistake parents often make when setting up a trust fund, such as an agreement trust irrevocable with power of appointment, is failing to clearly define their intentions. Without proper guidelines, beneficiaries may misinterpret the trust's purpose, leading to conflicts. Another common error is not regularly reviewing the trust to ensure it meets current family needs and laws. Engaging with services like USLegalForms can provide the necessary support to avoid these pitfalls.

A significant downside of putting assets in a trust, particularly an agreement trust irrevocable with power of appointment, is the loss of control over those assets. Once assets are transferred, the grantors cannot easily make changes or withdraw them. Additionally, if not structured correctly, trusts may face unforeseen tax consequences. Seeking advice from a platform like USLegalForms can help mitigates these issues.

The power of appointment in an agreement trust irrevocable with power of appointment allows the designated trustee or beneficiary to decide how and when the trust's assets should be distributed. This feature adds flexibility to the trust, enabling adjustments based on evolving family needs or changing circumstances. By including this power, trust creators can ensure their intentions are respected while still adapting to future events. Consulting with professionals, like those at USLegalForms, can help clarify this power's implications.

While trust funds can offer security, an agreement trust irrevocable with power of appointment may come with some drawbacks. They can be expensive to set up, requiring legal fees that may not be justifiable for smaller estates. Additionally, managing a trust fund can introduce complications in administration and potential for mismanagement. Careful planning and expert guidance are essential to navigate these challenges.

One disadvantage of a family trust, including an agreement trust irrevocable with power of appointment, is that it may limit access to the assets. Once assets are transferred to the trust, the grantors generally lose direct control over them. Moreover, these trusts can incur maintenance costs and complex tax obligations. It’s crucial to evaluate these factors before deciding to establish a family trust.

Creating an agreement trust irrevocable with power of appointment can provide significant benefits for your parents. It helps manage and protect assets while allowing for specific control over how those assets are distributed. This type of trust offers tax advantages and can prevent family disputes over inheritance. Engaging with a legal service like USLegalForms can simplify the process of setting up a trust.

The special power of appointment in a trust allows the appointor to direct distributions to specific individuals or groups, often excluding others. This limitation can help target benefits more effectively, ensuring that assets go to intended recipients, without indiscriminate distributions. Understanding this feature is vital when dealing with an agreement trust irrevocable with power of appointment, as it strengthens the overall estate plan.

In simple terms, the power of appointment refers to the authority given to a person to decide who will receive property or assets from a trust. This means that the appointed person can effectively control distributions, making adjustments based on family needs. The concept is a fundamental part of an agreement trust irrevocable with power of appointment, blending control with trust security.

An example of a power of appointment in a trust might occur when a grandparent creates a trust and gives the power of appointment to a trusted relative, allowing them to choose which family members will benefit from the trust income. This setup can adapt to family dynamics, making sure help goes to those in most need. It illustrates the significant advantages of utilizing an agreement trust irrevocable with power of appointment.

An example of a power of appointment trust could involve a parent establishing a trust for their children, granting one child the power to decide how the assets will be divided among siblings upon the parent’s passing. This arrangement provides clarity and reduces potential disputes among heirs. Such a structure falls under the agreement trust irrevocable with power of appointment, ensuring that the appointed child has a say in the distribution.