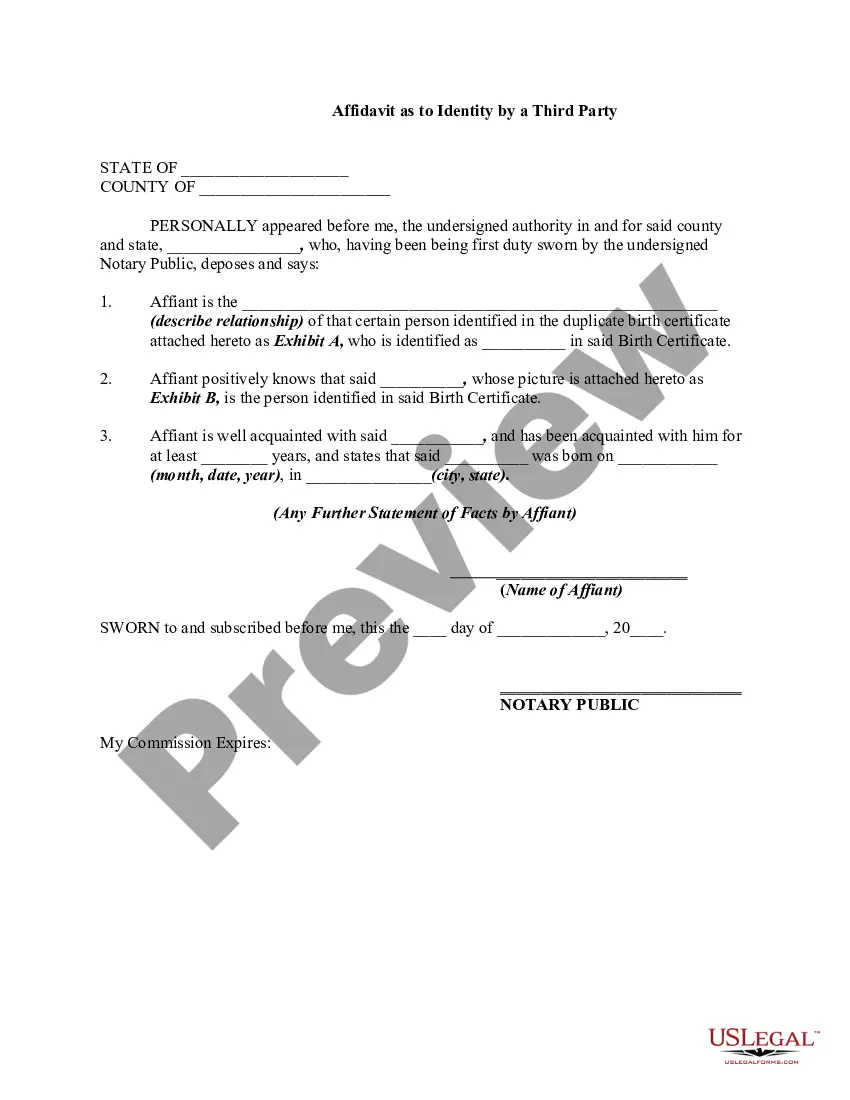

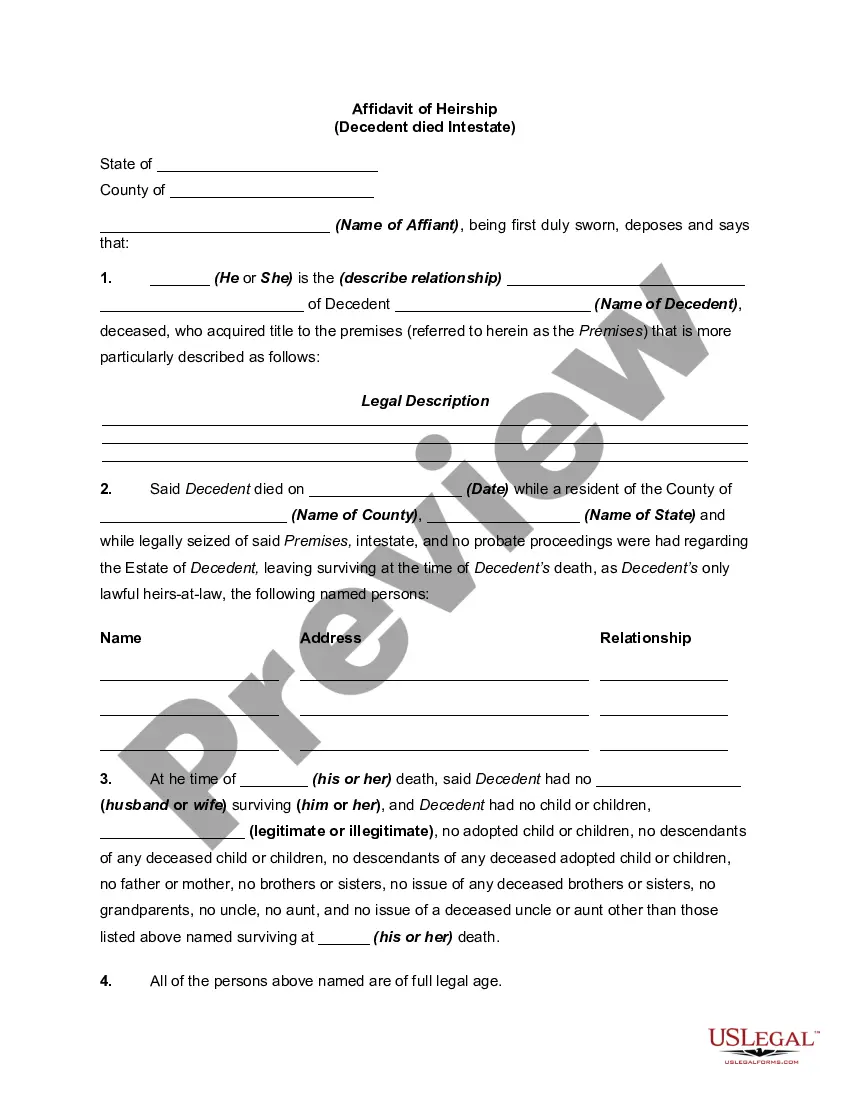

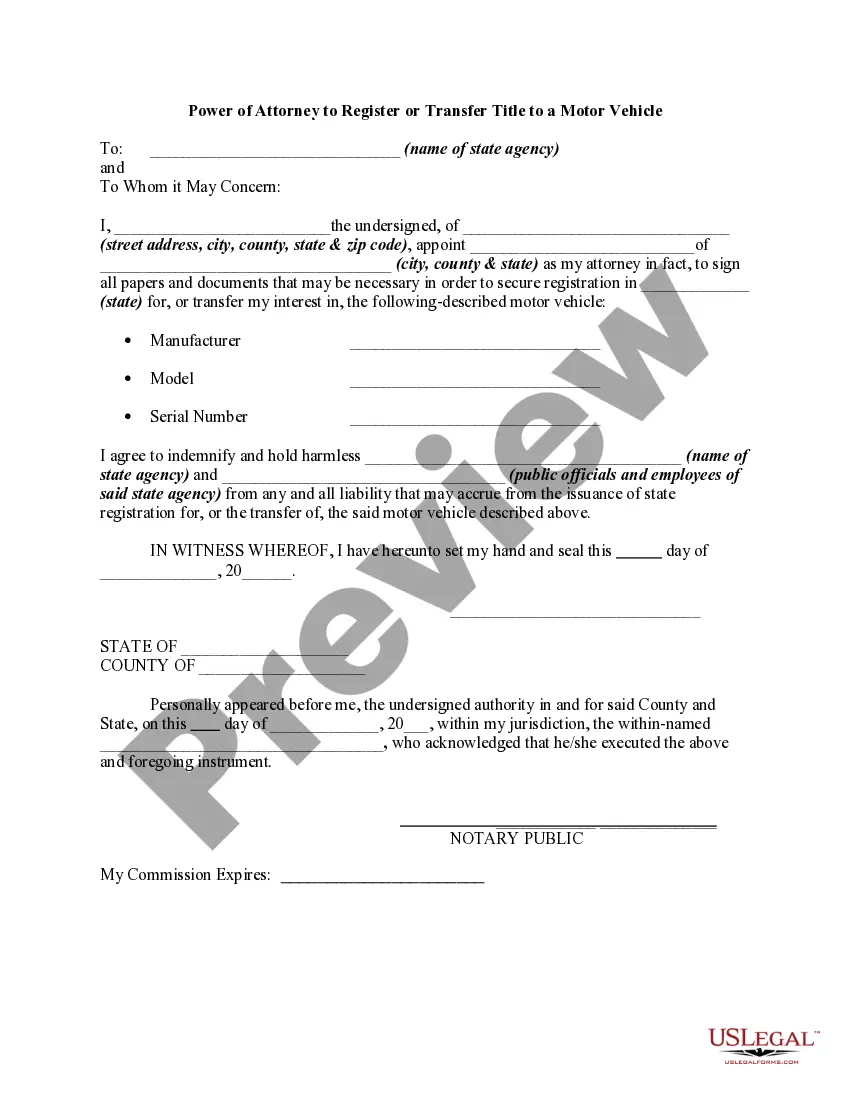

This form may be used in various situations where it is necessary to prove a person's identity and that his/her social security number has not yet been issued.

Affidavit Of No Social Security Number Massachusetts Withholding Tax

Description

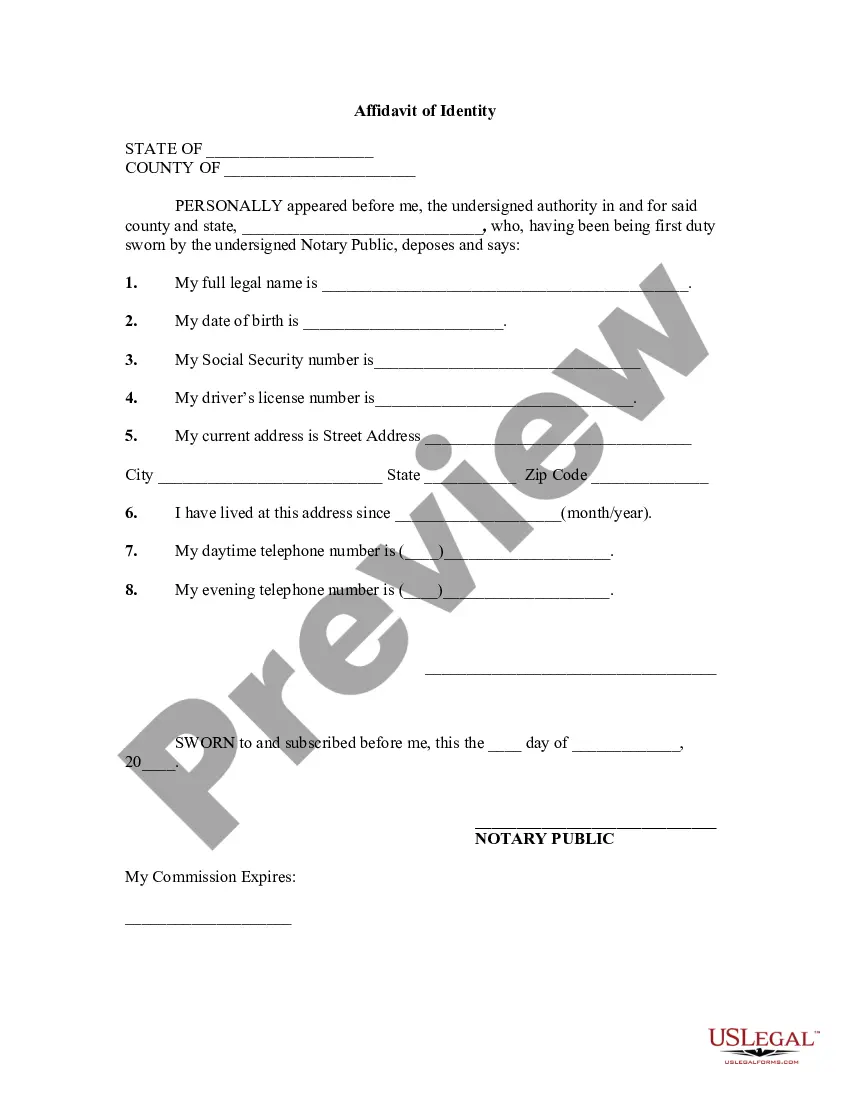

How to fill out Affidavit Of Identity And Lack Of Social Security Number?

Drafting legal documents from scratch can sometimes be a little overwhelming. Some cases might involve hours of research and hundreds of dollars invested. If you’re searching for an easier and more cost-effective way of preparing Affidavit Of No Social Security Number Massachusetts Withholding Tax or any other forms without the need of jumping through hoops, US Legal Forms is always at your disposal.

Our online collection of over 85,000 up-to-date legal documents covers virtually every element of your financial, legal, and personal affairs. With just a few clicks, you can quickly get state- and county-compliant forms diligently put together for you by our legal experts.

Use our website whenever you need a trusted and reliable services through which you can easily locate and download the Affidavit Of No Social Security Number Massachusetts Withholding Tax. If you’re not new to our website and have previously set up an account with us, simply log in to your account, select the form and download it away or re-download it at any time in the My Forms tab.

Not registered yet? No worries. It takes minutes to register it and navigate the catalog. But before jumping straight to downloading Affidavit Of No Social Security Number Massachusetts Withholding Tax, follow these recommendations:

- Check the form preview and descriptions to make sure you have found the form you are searching for.

- Make sure the form you choose conforms with the regulations and laws of your state and county.

- Pick the best-suited subscription option to purchase the Affidavit Of No Social Security Number Massachusetts Withholding Tax.

- Download the file. Then complete, certify, and print it out.

US Legal Forms boasts a good reputation and over 25 years of expertise. Join us now and transform form execution into something easy and streamlined!

Form popularity

FAQ

Massachusetts Employee's Withholding Allowance Certificate.

If you're a Massachusetts employer with a nonresident employee, you still need to withhold wages paid to the nonresident for services performed in Massachusetts. However, if a nonresident employee doesn't work in Massachusetts, even if they're paid from a Massachusetts office, you don't have to withhold.

Find Your Massachusetts Tax ID Numbers and Rates You can look this up online or on any previous correspondence from the MA Department of Revenue. If you're unsure, contact the agency at 617-887-6367.

A Social Security number is required to complete IRS Form W-4. Withholding will default to single and zero allowances if IRS Form W-4 is not submitted. Special rules apply to nonresident aliens for tax purposes filling out IRS Form W-4.

You can find your Withholding Tax Employer Identification Number on notices received from the Massachusetts Department of Revenue. If you cannot locate this document or identification number, please call the Massachusetts Department of Revenue at (617) 887-6367 to request it.