Lien Foreclosure Action With Seller

Description

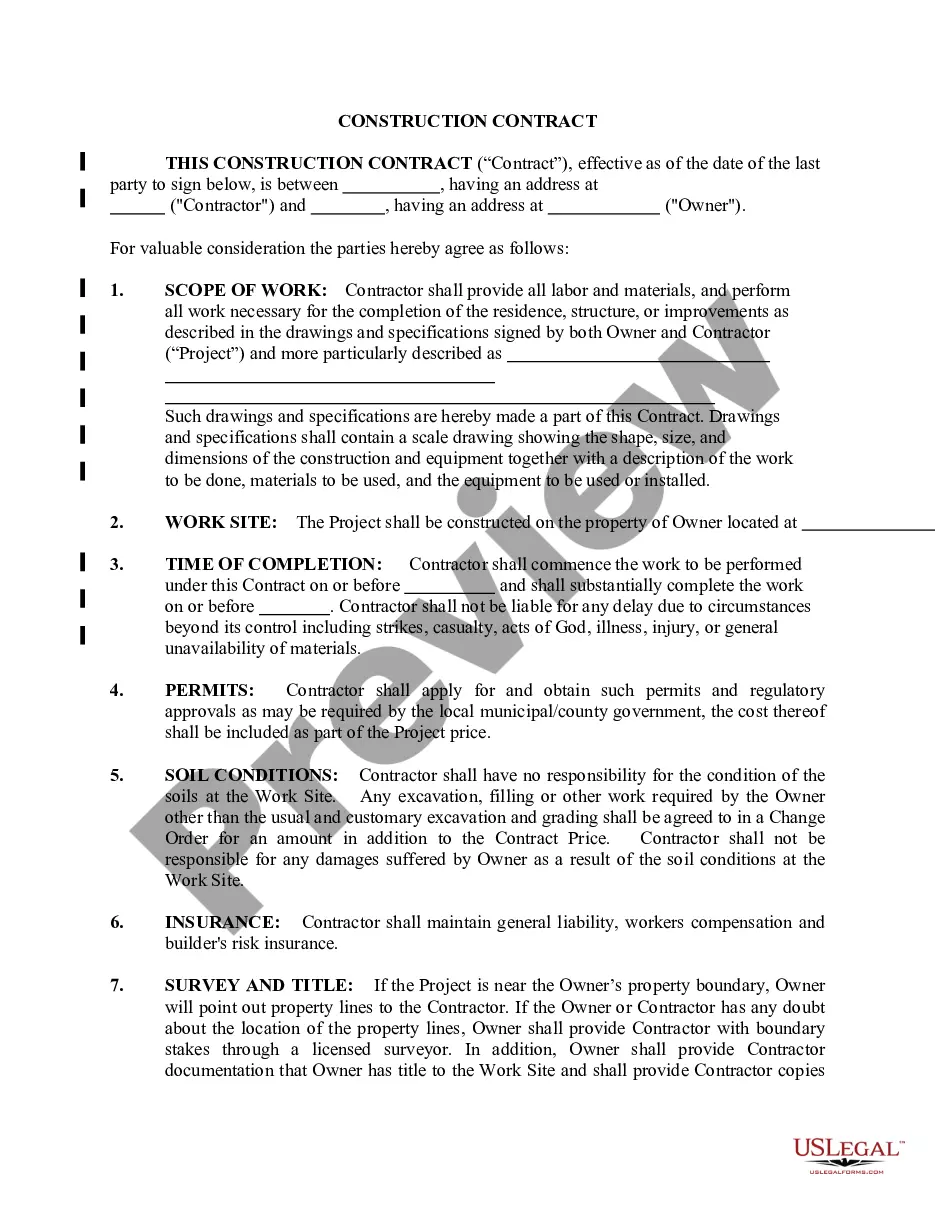

How to fill out Complaint Or Petition To Foreclose On Mechanic's Lien?

- Log in to your US Legal Forms account if you have used the service before, ensuring your subscription is active. If not, renew it according to your plan.

- If you're a first-time user, start by previewing the form descriptions to ensure you've selected the correct document for your situation.

- Use the Search tab to find any additional documents if the current selection doesn't meet your needs.

- Click on the Buy Now button once you've found the right form and select your preferred subscription plan.

- Complete your purchase by entering credit card or PayPal information to secure access to the library.

- Download your selected template to your device for easy completion and future reference in the My Forms section of your profile.

US Legal Forms stands out with its extensive collection of over 85,000 fillable and editable legal forms, more than competitors offer for a similar cost. Additionally, users can access premium experts for assistance, ensuring all documents are precise and legally sound.

In conclusion, tackling a lien foreclosure action with a seller can be straightforward with the right resources at your disposal. Start using US Legal Forms today to streamline the process and get the legal support you need!

Form popularity

FAQ

In a lien foreclosure action with a seller, multiple parties can experience losses. Homeowners typically face the most significant losses, but lenders also incur financial setbacks due to unpaid loans. Families often face displacement, and communities may suffer as well from reduced property values and increased vacancies. Understanding these dynamics can help all parties make more informed decisions.

The biggest cause of foreclosures often stems from financial hardships, such as job loss, medical emergencies, or divorce. These situations can lead to missed payments, culminating in a lien foreclosure action with a seller. High-interest loans and unexpected expenses also contribute to the issue. Addressing these warnings early can help prevent potential foreclosure.

Those who suffer the most in a lien foreclosure action with a seller are typically the homeowners and their families. They endure not only financial losses but also emotional distress and instability. Community and neighborhood dynamics may also be affected, as foreclosures can lead to increased property vacancies and declining home values. Understanding these broader impacts can help foster support systems for those in need.

Recovering from a lien foreclosure action with a seller can be quite challenging. Homeowners often experience a decline in credit scores, making it harder to secure loans or mortgages in the future. Emotional impacts also play a role, as many feel stress and uncertainty during the recovery process. However, with time and proper financial planning, individuals can rebuild and restore their financial health.

In a lien foreclosure action with a seller, the greatest financial loss typically falls on the homeowner. They face the loss of their invested equity and may also incur additional costs related to legal fees and moving expenses. Additionally, sellers may suffer reputational damage, making future transactions more difficult. Overall, the financial burden can be significant and long-lasting.

The 120-day rule for foreclosure refers to a requirement in some states that lenders must wait at least 120 days after a borrower defaults before initiating foreclosure proceedings. This period allows the borrower time to address their financial issues and potentially avoid foreclosure. Knowing this rule can be advantageous in your lien foreclosure action with a seller, as it outlines essential timelines for all parties involved.

No, a lien is not the same as foreclosure; they refer to different stages in the debt recovery process. A lien allows the creditor to secure their interest in the property, while foreclosure is the final step to reclaim the property after the owner has failed to meet their financial obligations. Understanding these terms can help you navigate a lien foreclosure action with a seller more effectively.

A lien is a claim against a property to satisfy a debt, while foreclosure is a legal process used to recover the owed amount when the borrower defaults. When a lien foreclosure action with a seller occurs, it signifies that the seller seeks to collect on a lien through the foreclosure process. This distinction is important for both buyers and sellers involved in real estate transactions.

The duration a lien can be placed on a property varies by state and the type of lien. Generally, most liens have specific time limits, which can range from several years to decades, depending on legal stipulations. If you are concerned about a lien foreclosure action with a seller, knowing these timelines can help you manage your situation effectively. You may want to consult legal documents available on US Legal Forms for specific details.

In South Carolina, lien laws specify the rights and procedures related to property liens, including foreclosures. These laws outline how creditors can place liens, the duration of such liens, and how foreclosure processes should be followed. Familiarizing yourself with these laws is essential, especially if you navigate a lien foreclosure action with a seller. You can find detailed legal forms and information on the US Legal Forms platform.