Hoa Liens Foreclosure With Florida

Description

How to fill out Complaint Or Petition To Foreclose On Mechanic's Lien?

Regardless of whether it's for professional reasons or personal issues, individuals inevitably encounter legal matters at some point in their lives.

Filling out legal paperwork demands meticulous attention, starting with selecting the appropriate form template.

After it's saved, you can complete the form using editing software or print it out and fill it out by hand. With an extensive array of US Legal Forms available, you won't need to waste time searching for the right template online. Utilize the library's user-friendly navigation to find the correct form for any circumstance.

- For example, if you choose an incorrect version of the Hoa Liens Foreclosure With Florida, it will be rejected upon submission.

- Thus, it's crucial to have a trustworthy source of legal documents like US Legal Forms.

- If you aim to acquire a Hoa Liens Foreclosure With Florida template, adhere to these straightforward steps.

- Locate the template you require by leveraging the search bar or catalog browsing.

- Review the description of the form to confirm it aligns with your circumstances, state, and county.

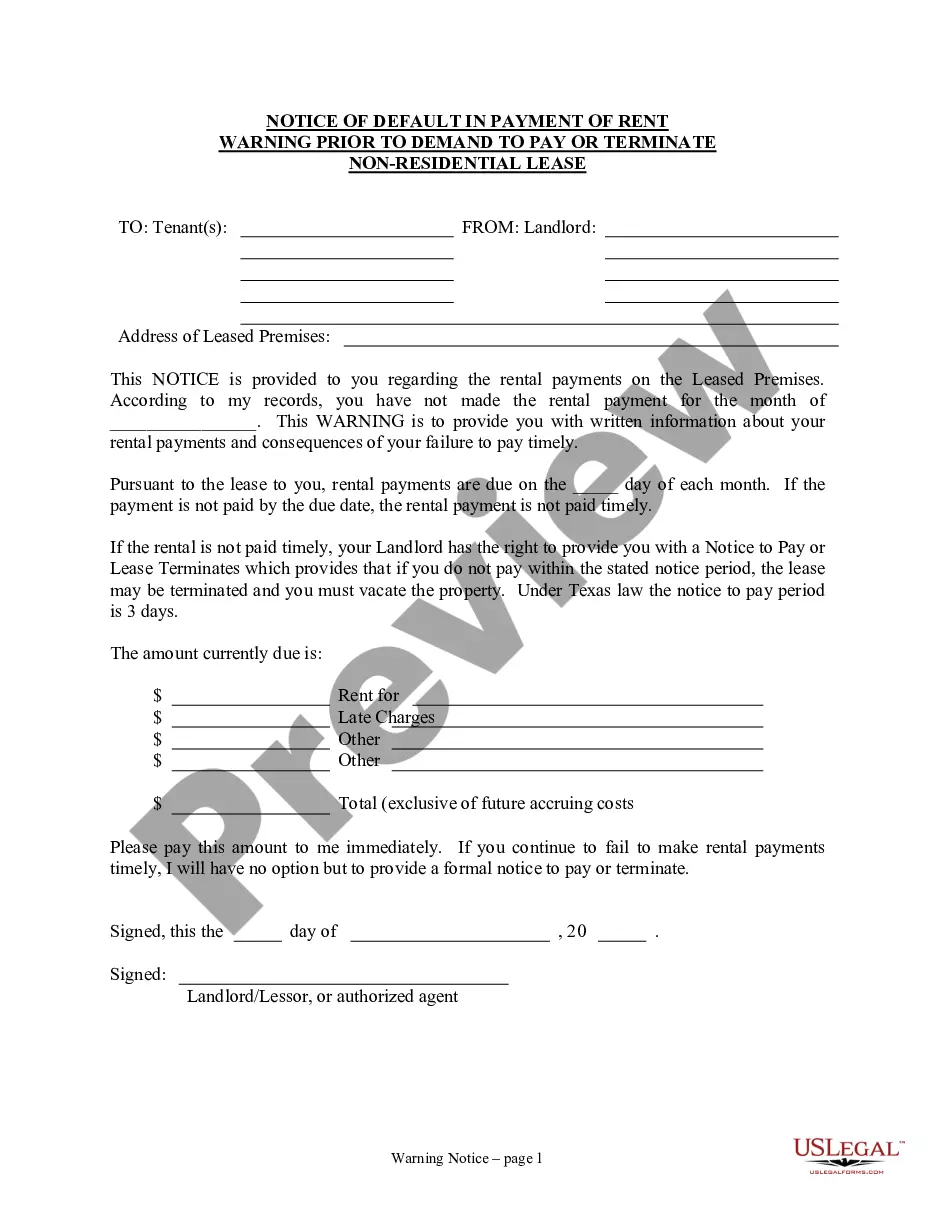

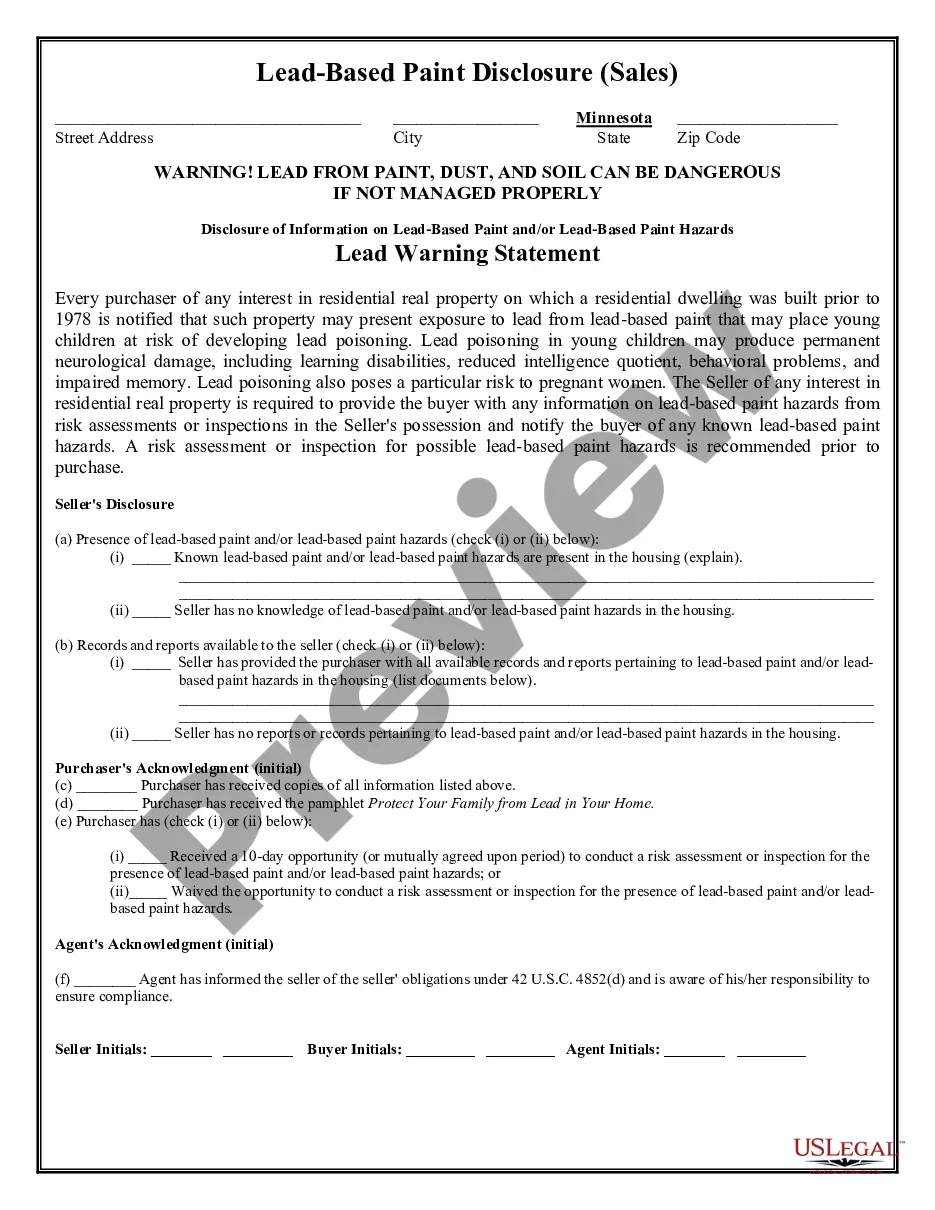

- Click on the form's preview to inspect it.

- If it is the incorrect document, revert to the search tool to find the Hoa Liens Foreclosure With Florida sample you need.

- Obtain the file once it satisfies your requirements.

- If you possess a US Legal Forms account, simply click Log in to access previously stored documents in My documents.

- Should you not have an account yet, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Fill out the account registration form.

- Choose your payment method: a credit card or PayPal account.

- Select your desired file format and download the Hoa Liens Foreclosure With Florida.

Form popularity

FAQ

To foreclose on an owner-financed property in Florida, the owner must first consult the terms of the seller financing agreement. If the buyer defaults, the seller can initiate foreclosure proceedings, following similar steps as in traditional foreclosure. Utilizing a platform like uslegalforms can help streamline this process and clarify the necessary legal actions. Understanding hoa liens foreclosure with Florida plays a vital role in ensuring a smooth transition to ownership.

Option 1: Sign into your eFile.com account, modify your Return and download/print WV Form IT-140 under My Account. Check the "Amended return" box to report that it's an amended tax return. Option 2: If you don't have an eFile.com account follow the step by step instruction on how to prepare a tax return/amendment.

Yes. Every business in West Virginia needs to file a Business Registration with the State Tax Department. Additionally, you'll need to get a General Business License from your city. And there may be other licenses needed depending on what industry you're in.

Most city and state endorsements must be renewed annually. You will receive a renewal notice the month before your endorsement(s) expires. To avoid penalties, submit and pay fees by the expiration date. For faster service renew online through My DOR.

Renew and pay with credit card or e-check. Electronic: Renewal The West Virginia Department of Insurance encourages you to renew early and electronically. Business Entities may renew the license beginning March 1. Business Entity licenses expire June 30 annually.

All business licenses expire on June 30 of each year. Business license fees are not prorated. Below is a list of general information regarding the application process: All applicants must have a valid West Virginia Business Registration Certificate prior to obtaining a City of Huntington Business License.

Business licenses are valid January 1st through December 31st of any given year. Filing of your gross receipts and payments are due March 1st of the current filing year. Penalty for late filing is $10 or 10% of the tax whichever is greater.

To obtain a legal name change in West Virginia, an applicant must submit a petition to the court. At least ten days before the hearing, the applicant must publish notice of the hearing time and place in a Class I legal advertisement. A certified copy of the order will be filed in the county clerk's office.

Justice signed HB 2526 immediately reducing the income tax in tax year 2023 by an average of 21.25%. The bill contains provisions for additional annual personal income tax rate cuts in future years beginning as early as 2025 to the extent that actual State revenue growth exceeds consumer inflation.