Hoa Lien Foreclosure Without Notice Illinois

Description

How to fill out Complaint Or Petition To Foreclose On Mechanic's Lien?

Creating legal documents from the ground up can frequently feel somewhat daunting.

Certain situations may require extensive research and significant monetary investment.

If you’re looking for a more straightforward and economical method of generating Hoa Lien Foreclosure Without Notice Illinois or other documents without excessive hassle, US Legal Forms is always accessible.

Our online repository of over 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal affairs. With just a few clicks, you can swiftly access state- and county-compliant templates meticulously crafted for you by our legal experts.

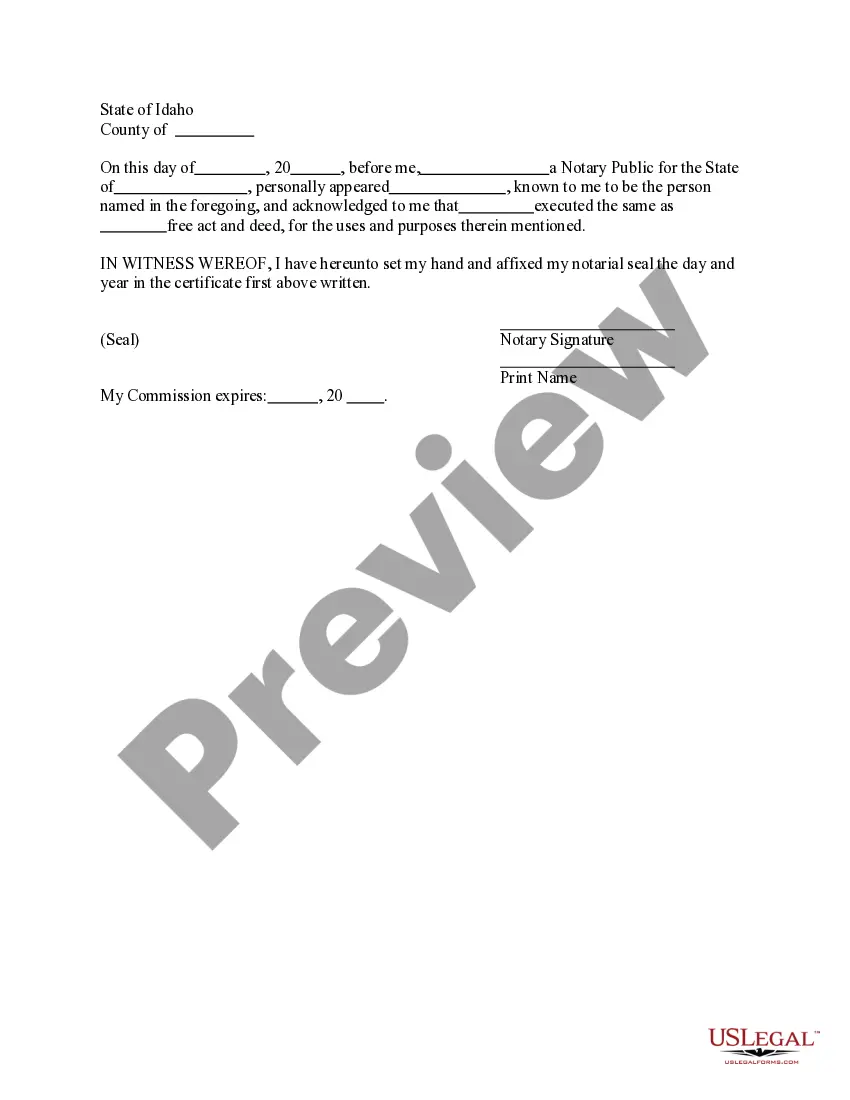

Examine the document previews and descriptions to ensure you have located the form you need. Confirm that the template you choose adheres to the laws and regulations of your state and county. Select the most suitable subscription plan to obtain the Hoa Lien Foreclosure Without Notice Illinois. Download the form, then complete, validate, and print it. US Legal Forms has established a solid reputation over 25 years of experience. Join us today and simplify the process of form completion!

- Utilize our platform anytime you need dependable and trustworthy services through which you can easily locate and download the Hoa Lien Foreclosure Without Notice Illinois.

- If you’re familiar with our site and have created an account before, simply Log In to your account, choose the template and download it immediately or re-download it at any time in the My documents section.

- Don’t have an account? No worries. It requires minimal effort to register and browse the catalog.

- Before directly downloading Hoa Lien Foreclosure Without Notice Illinois, consider these suggestions.

Form popularity

FAQ

Check the status of your West Virginia state tax refund using these resources. State: West Virginia. Website: . Refund Status Phone Support: 1-304-558-3333. Hours: a. ... General Tax Information: 1-800-982-8297. Email Tax Support: TaxHelp@WV.Gov.

QUALIFIED FUNERAL TRUST FILING REQUIREMENTS Form IT-141 marked as QFT is required when the Federal 1041-QFT is filed ing to §685 of the Internal Revenue Code to permit certain trusts to elect Qualified Funeral Trust Status (QFT).

How do I file an amended West Virginia return? Use the version of Form IT-140 that corresponds to the tax year to be amended and check the ?Amended Return? box. These forms and corresponding instructions are available on our website at Tax.WV.Gov on the Individuals page.

Where do I mail my forms? If you are getting a Refund: West Virginia State Tax Department, PO Box 1071, Charleston WV 25324-1071. If you have a Balance Due: West Virginia State Tax Department, PO Box 3694, Charleston WV 25336-3694.

You can file your amended return electronically, or on paper. If you file electronically, follow the instructions for your software provider. In either case, make sure to indicate that it's an amended return before filling it out.

Option 1: Sign into your eFile.com account, modify your Return and download/print WV Form IT-140 under My Account. Check the "Amended return" box to report that it's an amended tax return. Option 2: If you don't have an eFile.com account follow the step by step instruction on how to prepare a tax return/amendment.

Allow approximately six weeks from the receipt of the requested information to review and complete the processing of the return. If the West Virginia Tax Division needs to verify information reported on your return or request additional information, the process will take longer.

To amend a return that has already been amended, complete the following steps. Open the previously amended return. Verify that the information on Form 1040 matches the information reported on the previous amended return. ... Open the Amend screen in the Separate Filings folder. Choose Edit > Delete screen data.