Retail Security Agreement With Australia

Description

How to fill out Retail Installment Contract And Security Agreement?

There's no longer a necessity to squander hours searching for legal documents to fulfill your local state stipulations.

US Legal Forms has assembled all of them in one location and optimized their accessibility.

Our platform provides over 85k templates for various business and personal legal situations organized by state and area of usage. All forms are correctly drafted and verified for authenticity, ensuring you can confidently acquire an up-to-date Retail Security Agreement With Australia.

Select the desired subscription plan and set up an account or Log In. Make the payment for your subscription using a credit card or via PayPal to proceed. Choose the file format for your Retail Security Agreement With Australia and download it to your device. Print your form for manual completion or upload the sample if you prefer to edit it online. Preparing legal documents under federal and state laws is quick and convenient with our library. Try US Legal Forms today to maintain your documentation systematically!

- If you are acquainted with our platform and already possess an account, ensure your subscription is active before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also retrieve all obtained documents whenever necessary by accessing the My documents tab in your profile.

- If you've never utilized our platform before, the process will involve a few additional steps.

- Here's how newcomers can locate the Retail Security Agreement With Australia in our library.

- Carefully examine the page content to verify it contains the sample you need.

- To do so, utilize the form description and preview options, if available.

- Use the Search field above to look for another sample if the previous one did not meet your requirements.

- Click Buy Now next to the template title once you identify the appropriate one.

Form popularity

FAQ

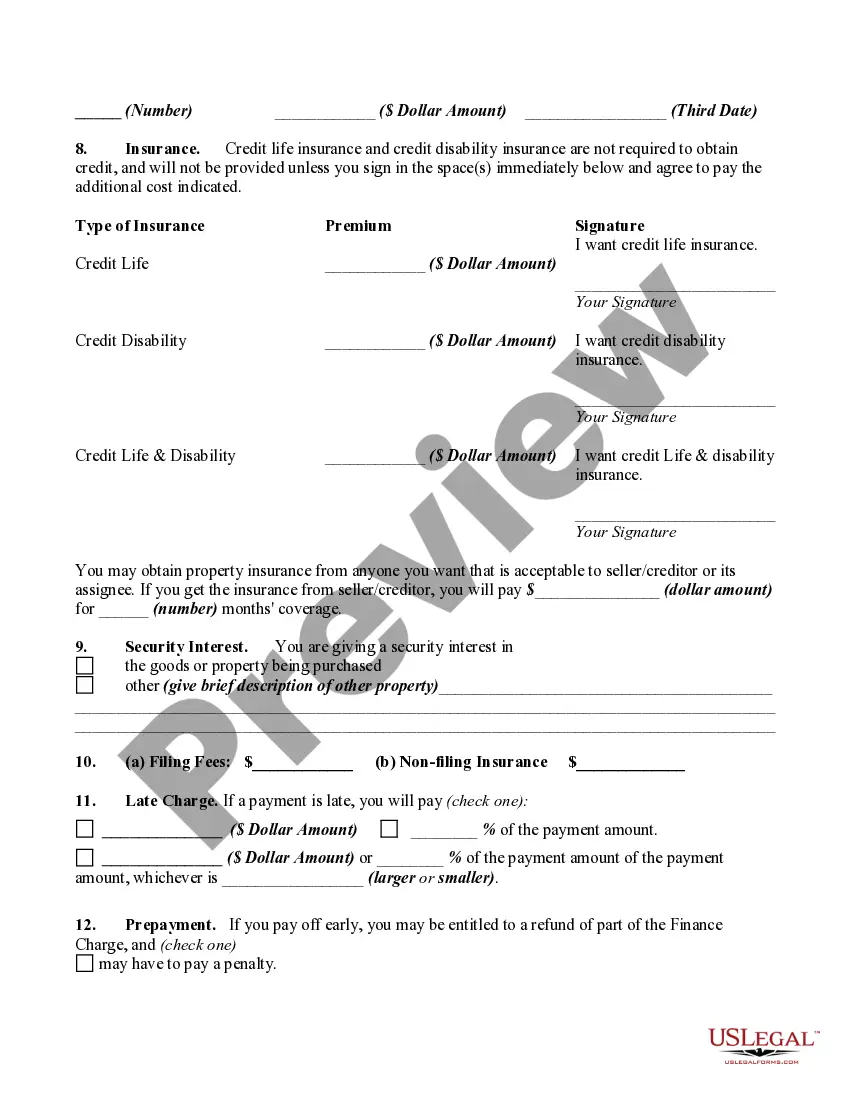

The security agreement must: be signed (or authenticated) by the debtor and the owner of the property, contain a description of the collateral and. make it clear that a security interest is intended.

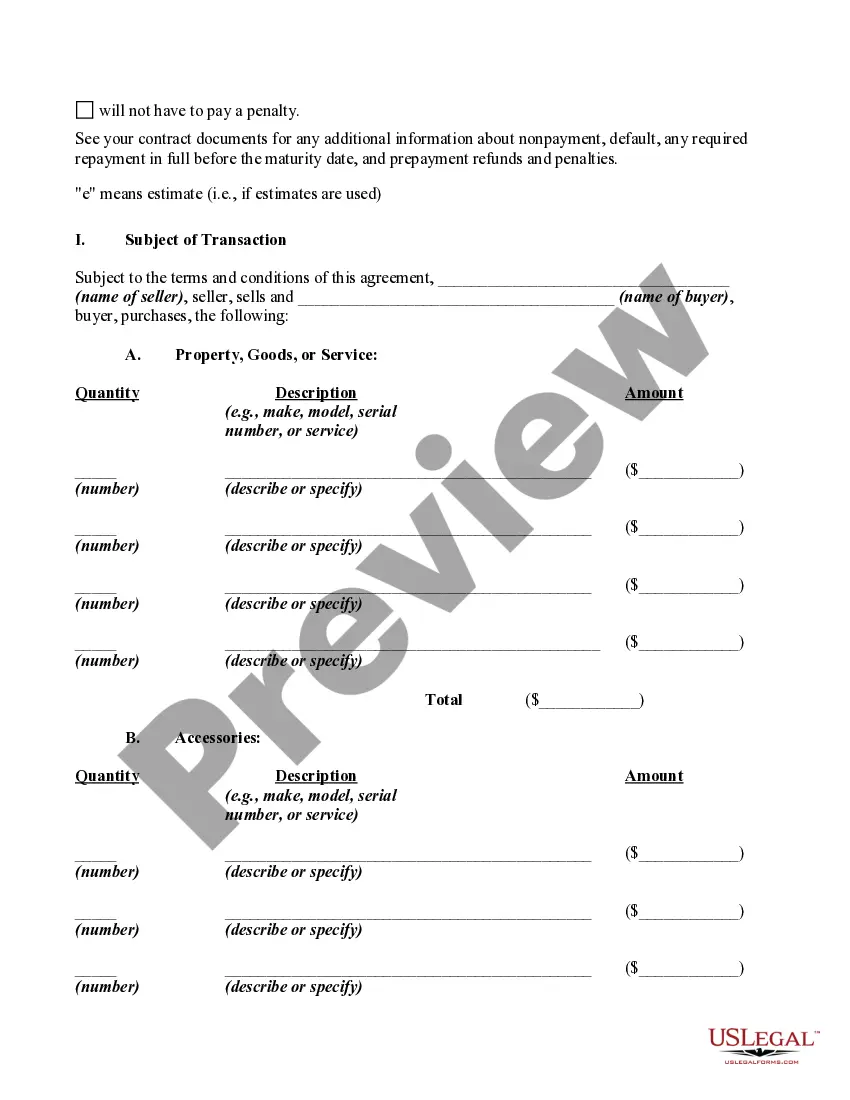

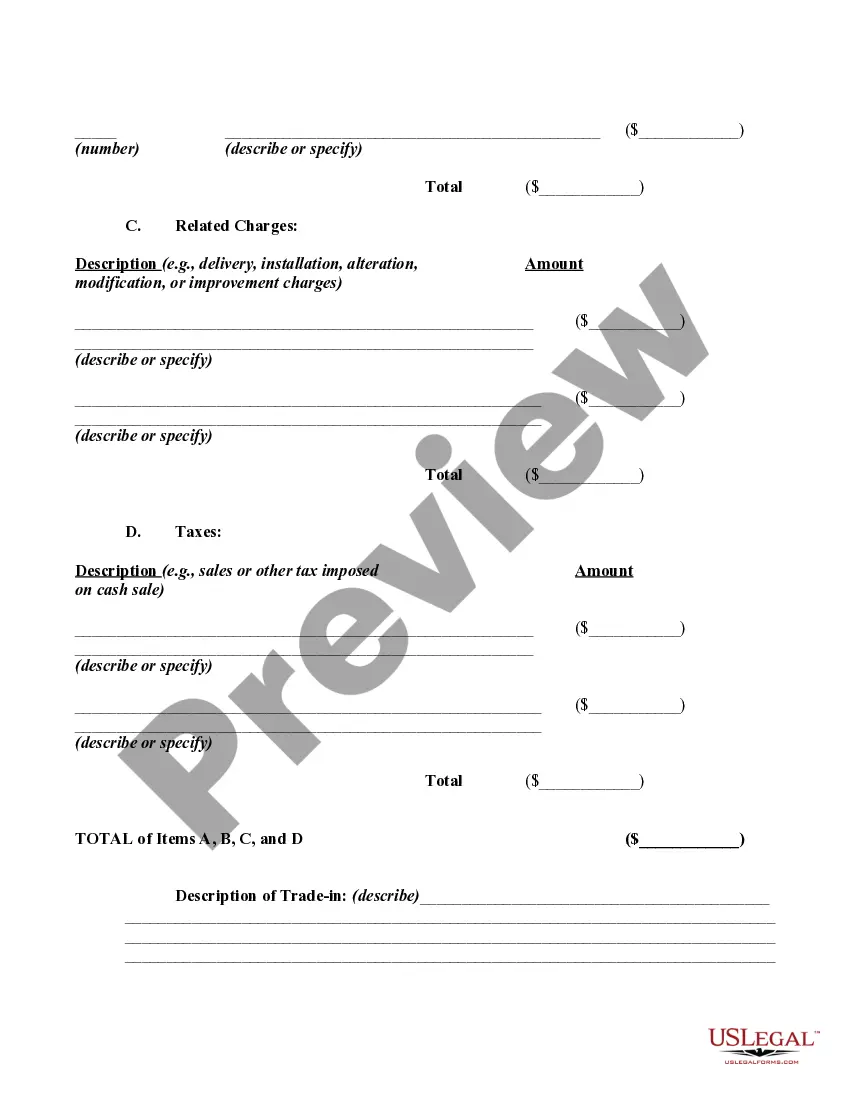

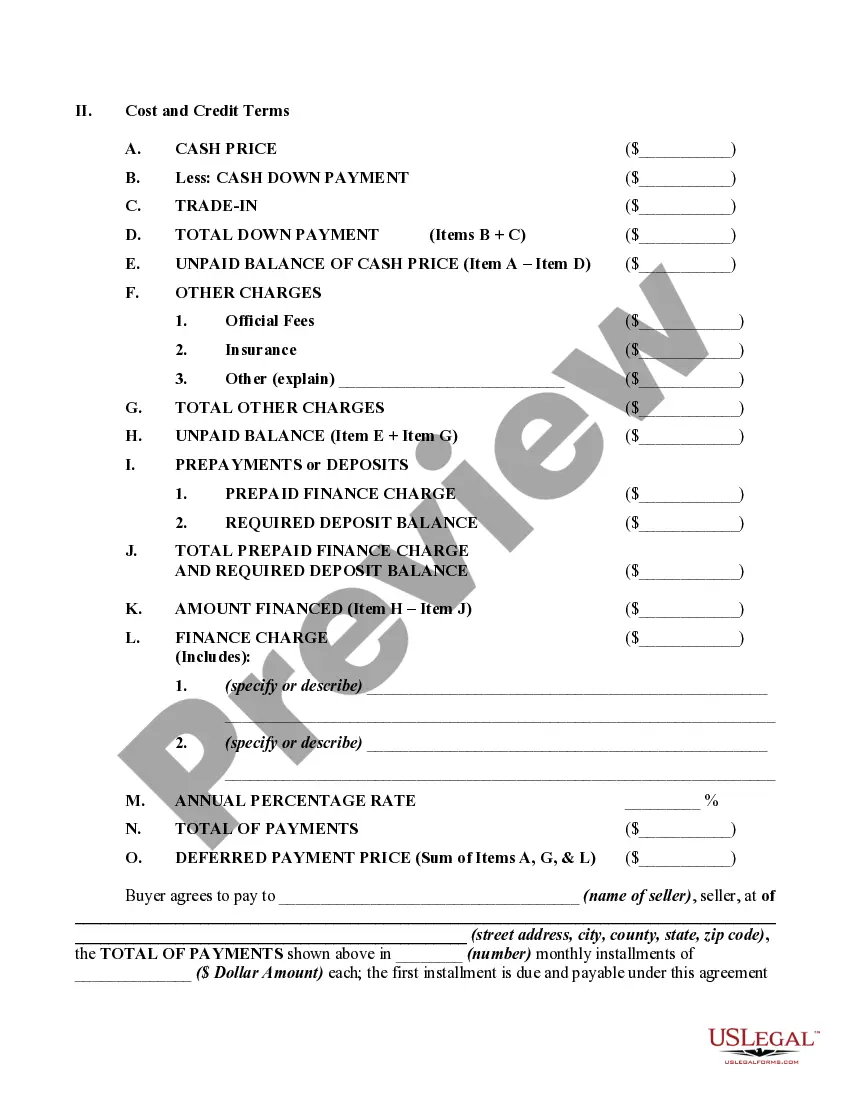

Terms Contained in a Security Agreement A basic security agreement should have the description of the parties involved, the collateral and the statement of intention of providing security interest along with signatures from all parties.

What is a general security agreement? After the enactment of the Personal Property Security Act 2009 (PPSA), lenders and borrowers can enter into a general security agreement. Under a general security agreement, a lender will have rights upon a default or failure to pay against the assets of your company.

Article 9 contains a statute of frauds which requires a security agreement to be in writing unless it is pledged. See § 9-203(1) of the code. A pledged security agreement arises when the borrower transfers the collateral to the lender in exchange for a loan (e.g., a pawnbroker).

In order for the security agreement to be valid, the borrower must usually have rights in the collateral at the time the agreement is executed. If a borrower pledges as collateral a car owned by a neighbor, and the neighbor does not know of and endorse this pledge, then the security agreement is ineffective.