Agreement Futures Contract With Gold

Description

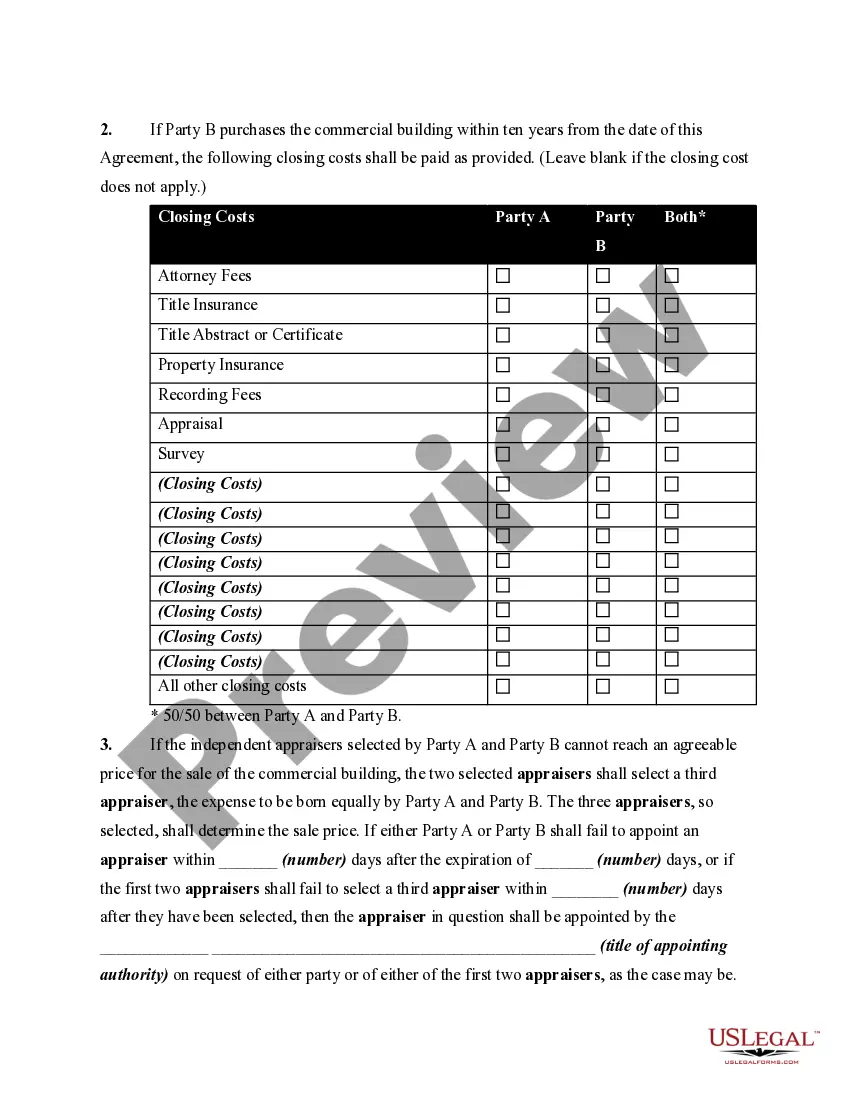

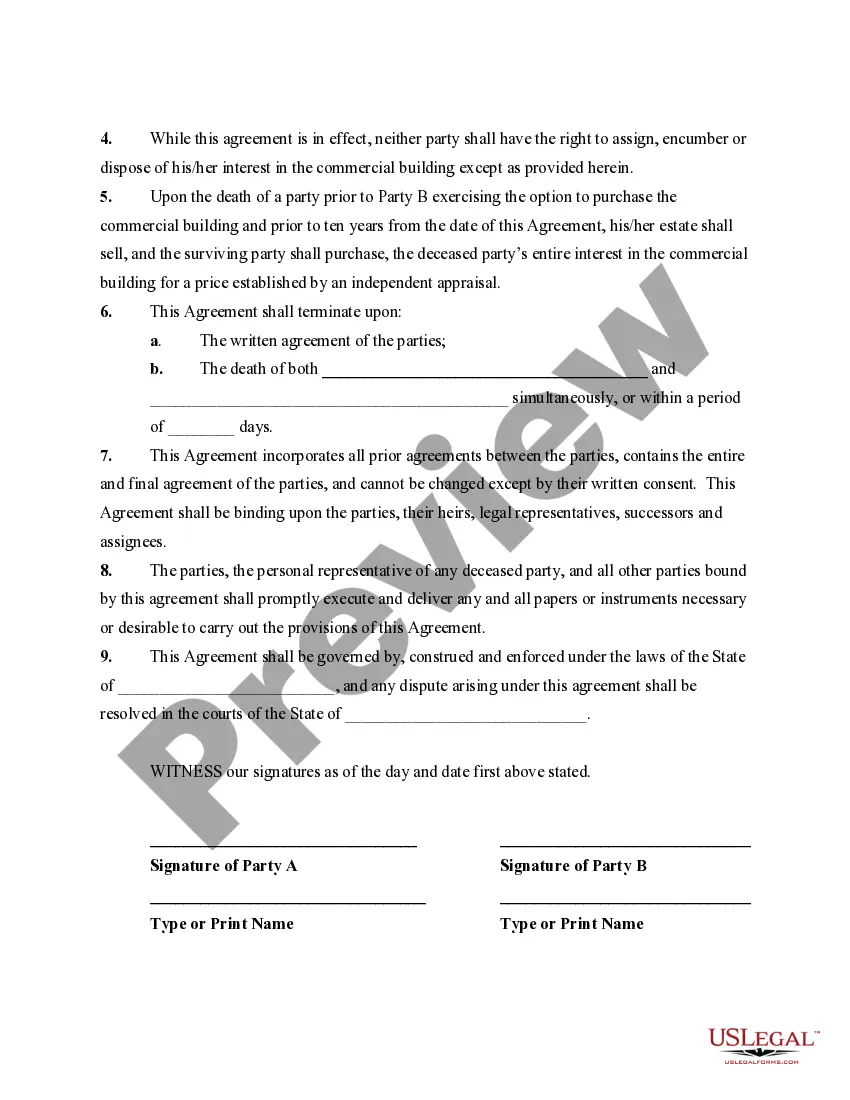

How to fill out Agreement Between Partners For Future Sale Of Commercial Building?

There’s no longer a necessity to squander hours searching for legal paperwork to adhere to your local state regulations.

US Legal Forms has compiled all of them in a single location and enhanced their availability.

Our site provides over 85,000 templates for any business and personal legal needs categorized by state and area of application.

Utilize the search field above to look for another template if the current one doesn’t suit your needs.

- All documents are properly drafted and verified for legitimacy, ensuring you can be confident in acquiring an up-to-date Agreement Futures Contract With Gold.

- If you are acquainted with our service and already possess an account, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved documents at any time by opening the My documents section in your profile.

- If you haven't used our service before, the process will involve a few additional steps.

- Here's how new users can access the Agreement Futures Contract With Gold from our collection.

- Carefully examine the page content to ensure it contains the sample you need.

- To assist with this, use the form description and preview options if available.

Form popularity

FAQ

Interactive Brokers offers trading on various COMEX precious metal futures and eligible clients can take physical delivery of COMEX silver or gold futures. Physical delivery is in the form of a registered warrant or automated certificate of exchange (ACE) for each full size or E-micro futures contract.

To be delivered against a futures contract, a precious metal must be deposited in one of the exchange's designated depositories. A depository provides secure storage of metal and provides inventory management to the exchange and its members.

The standard gold futures contract is for the delivery of 100 troy ounces of gold. Gold futures have a range of contract dates including monthly for the next two months and up to six years in the future.

The value of a futures contract is derived from the cash value of the underlying asset. While a futures contract may have a very high value, a trader can buy or sell the contract with a much smaller amount, which is known as the initial margin.

A gold futures contract is for the purchase or sale of 100 troy ounces of . 995 minimum percent fine gold. A silver futures contract is for the purchase or sale of 5000 troy ounces of . 999 percent minimum fine silver.