Paternity Affidavit Form Oklahoma

Description

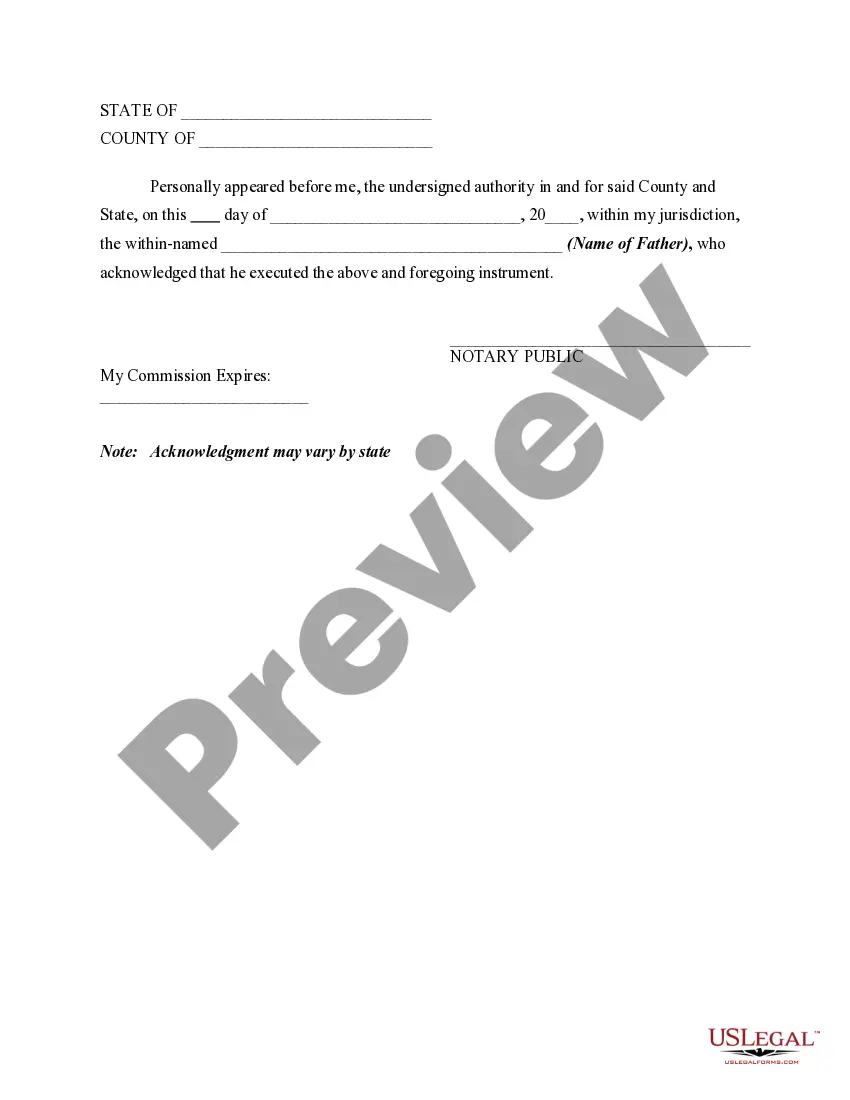

How to fill out Acknowledgment Of Paternity With Declaration That Child Shall Share In Father's Estate?

Creating legal documents from the ground up can frequently feel somewhat daunting.

Specific situations may necessitate extensive research and significant financial investment.

If you’re looking for an easier and more affordable method of generating the Paternity Affidavit Form Oklahoma or any other paperwork without having to navigate obstacles, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal forms covers nearly every facet of your financial, legal, and personal matters. With just a few clicks, you can swiftly find state- and county-specific templates meticulously designed for you by our legal experts.

Review the document preview and descriptions to ensure you are on the correct document you are seeking. Verify that the form you choose meets the standards of your state and county. Select the most appropriate subscription plan to acquire the Paternity Affidavit Form Oklahoma. Download the form, then complete, sign, and print it out. US Legal Forms boasts an impeccable reputation and over 25 years of experience. Join us today and make document processing simple and efficient!

- Utilize our platform whenever you require a dependable and trustworthy service that allows you to promptly find and download the Paternity Affidavit Form Oklahoma.

- If you’re a returning user and have set up an account with us in the past, simply Log In to your account, find the template, and download it right away or access it again in the My documents section.

- Not registered yet? No problem. It only takes a few minutes to sign up and explore the collection.

- But before diving straight into downloading the Paternity Affidavit Form Oklahoma, keep these pointers in mind.

Form popularity

FAQ

To get a copy of the acknowledgment of paternity in Oklahoma, contact the Oklahoma State Department of Health or your local health department where the form was originally filed. You may also look into services like USLegalForms, which can help you easily locate and request copies of the necessary documents. Having a paternity affidavit form Oklahoma on hand can streamline this process.

You can obtain an acknowledgment of paternity form in Oklahoma through various sources, such as hospitals at the time of a child's birth, local health departments, or the Oklahoma State Department of Health. Additionally, you can visit USLegalForms to access the paternity affidavit form Oklahoma conveniently online. This platform offers easy navigation, ensuring you find the right documents without hassle.

Accept Only Cashier's Checks A cashier's check offers the greatest protection to the recipient as they can't be reversed. Cashier's checks are treated as guaranteed funds because the bank, rather than the purchaser, is responsible for paying the amount. The same goes for a wire transfer to your company's bank account.

What Happens If I Write a Bad Check in Colorado? Value of Property, Items, or Services DefraudedCriminal Offense Type$50 or more but less than $300Class 3 Misdemeanor$300 or more but less than $750Class 2 Misdemeanor$750 or more but less than $2,000Class 1 Misdemeanor$2,000 or more.Class 6 Felony1 more row

How safe are paper checks? Banks use security measures like watermarks and gradient backgrounds to prevent checks from being reproduced by fraudsters, and to help financial institutions and businesses validate them easily.

If you can, try to cash the check at the issuer's bank so that if it bounces again, you won't get hit with another NSF charge by your bank. Send a ?bad check? demand letter: If you're having trouble getting a response from the check issuer, send them a bad check demand letter.

Under Colorado law, it is a crime to pay with a check knowing that you do not have enough money to cover the funds. Issuing a bad check is a petty offense that carries penalties of up to 10 days in jail and $300 in fines.

§ 18-5-205 CRS is the Colorado statute that defines the crime of check fraud. This section makes it a crime to pass a bad check with the intention of defrauding someone for the payment of goods or services. Check fraud may result in petty offense, misdemeanor or felony charges depending on the amount of money involved.

How to Prevent Check Fraud Order checks from a reputable source. ... Fill out check properly. ... Safeguard checks and account information. ... Segregate duties. ... Reconcile accounts promptly. ... Use a positive pay service.

The Demand Letter Your demand letter must request that you be paid the full amount of the check, any bank fees and the cost of mailing the demand. It also tells the person who gave you the bad check, that if they do not pay within 30 days of your mailing the demand letter, you can sue for the check plus damages.