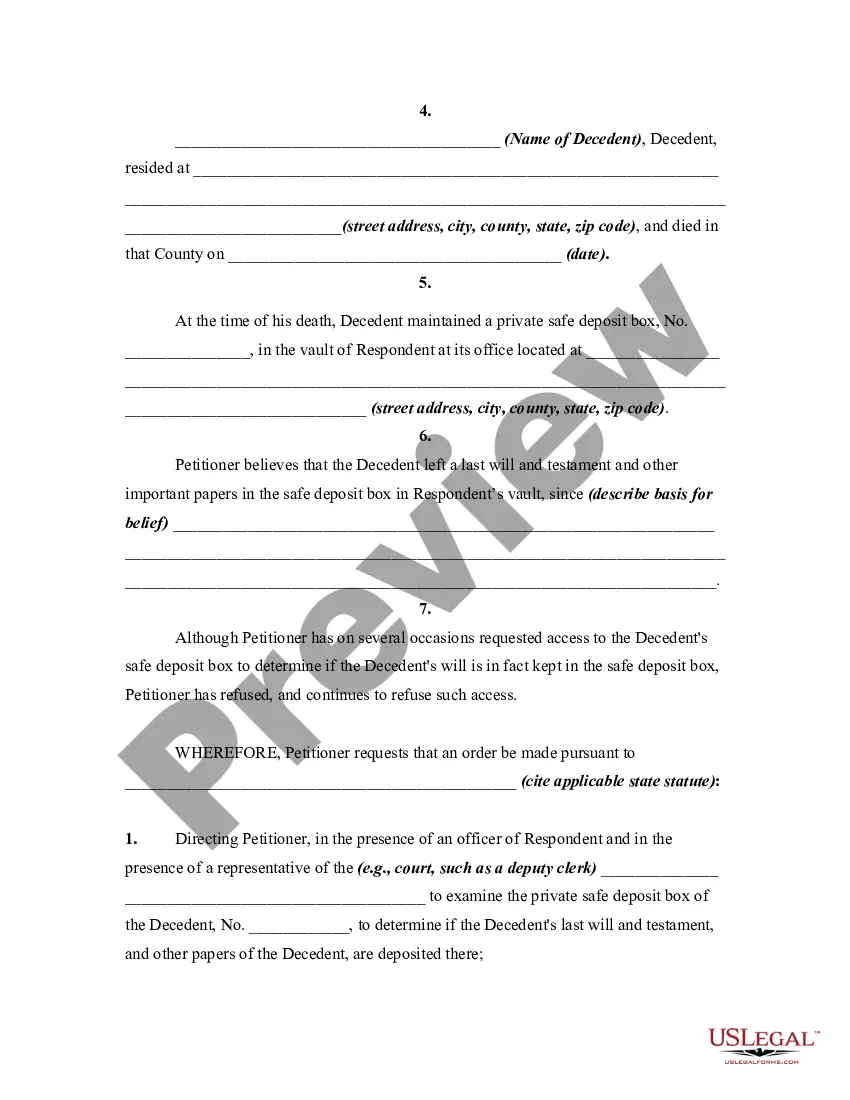

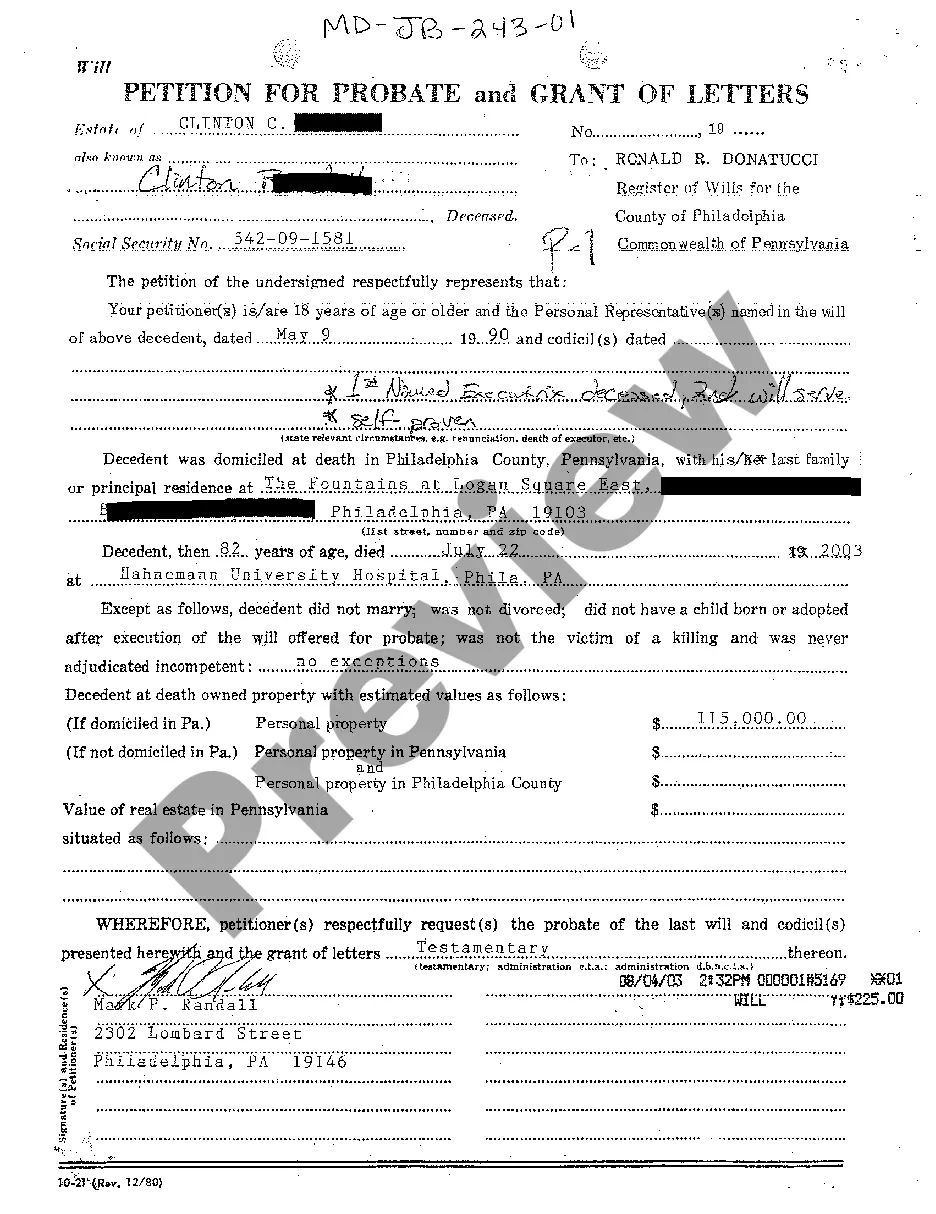

Whether your will should be in a safe deposit box at a bank or elsewhere, such as with your attorney, depends on what your state law says about who has access to your safe deposit box when you die. The recent trend in many states is to make it relatively easy for family members or the executor to remove the will and certain other documents (such as life insurance policies and burial instructions) from a deceased person's safe deposit box. In those states, it might be a good idea to leave your will in the safe deposit box. However, in some states, it may require a court order to remove the will, which can take time and money.

Safe Deposit Box Form With A Power Of Attorney

Description

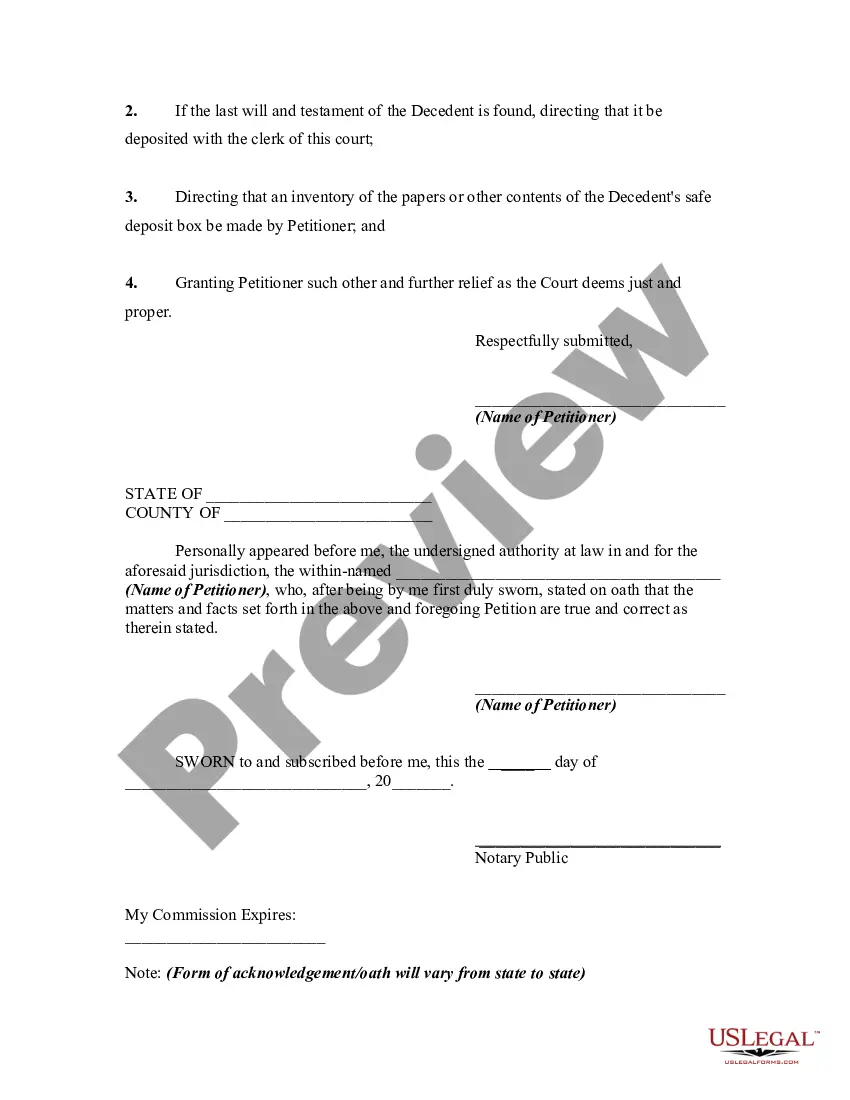

How to fill out Petition For Order To Open Safe Deposit Box Of Decedent?

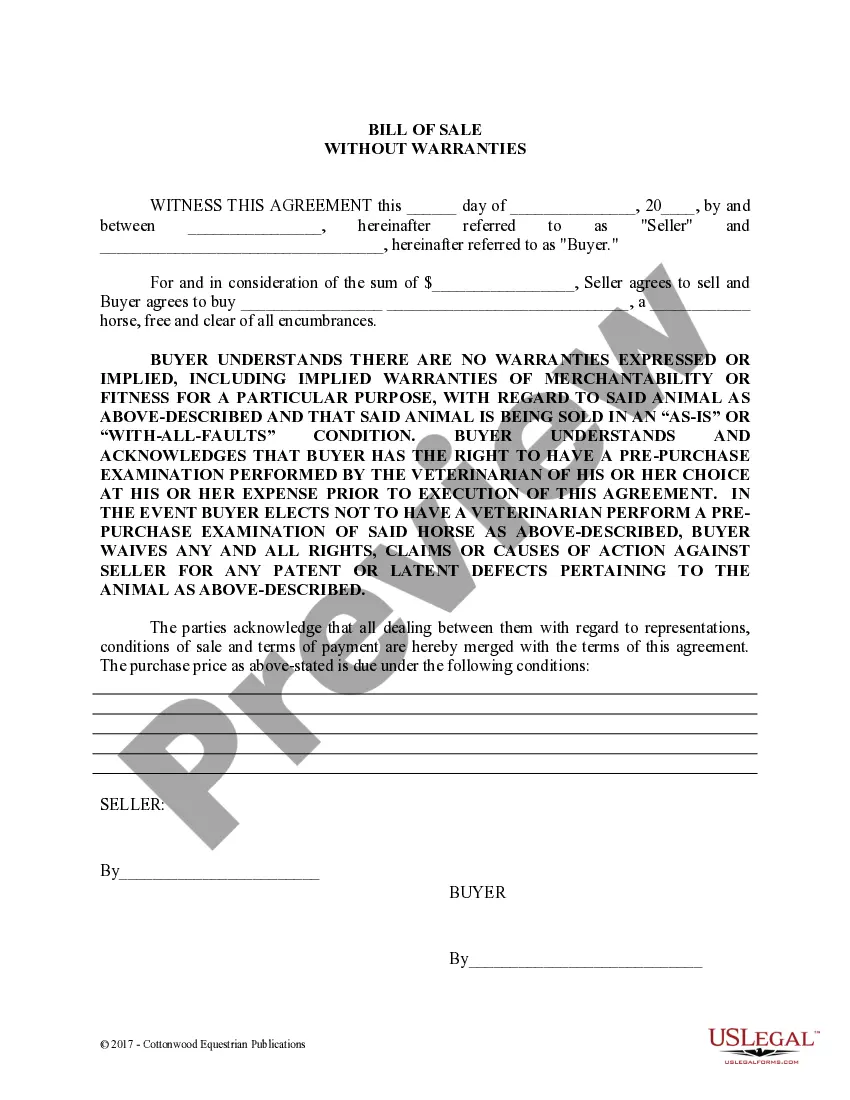

Working with legal papers and operations might be a time-consuming addition to your day. Safe Deposit Box Form With A Power Of Attorney and forms like it usually require you to search for them and navigate how you can complete them effectively. Consequently, if you are taking care of financial, legal, or personal matters, using a thorough and hassle-free online library of forms at your fingertips will go a long way.

US Legal Forms is the number one online platform of legal templates, offering more than 85,000 state-specific forms and a number of tools that will help you complete your papers quickly. Check out the library of relevant documents available with just one click.

US Legal Forms offers you state- and county-specific forms offered by any time for downloading. Protect your papers administration processes using a top-notch services that lets you prepare any form within minutes without any additional or hidden cost. Just log in to the account, locate Safe Deposit Box Form With A Power Of Attorney and download it immediately within the My Forms tab. You can also gain access to previously saved forms.

Would it be the first time utilizing US Legal Forms? Register and set up your account in a few minutes and you’ll have access to the form library and Safe Deposit Box Form With A Power Of Attorney. Then, adhere to the steps listed below to complete your form:

- Make sure you have the right form using the Review feature and looking at the form description.

- Choose Buy Now once all set, and select the subscription plan that is right for you.

- Select Download then complete, eSign, and print out the form.

US Legal Forms has twenty five years of experience supporting consumers deal with their legal papers. Find the form you need today and streamline any process without having to break a sweat.

Form popularity

FAQ

California Probate Code 331 controls access to a safe deposit box after the death of decedent. If the decedent owned the safe deposit box with a spouse or another person, then that person will have access to it.

You will need to visit your bank with the person you want to give access to. The person will need to provide their ID and signature. As a result, they will have equal access to the contents of your box. The person will have unrestricted access to your safety deposit box and be considered a joint renter.

Texas law allows the decedent's spouse, parent, descendant who is over 18 years of age, or the person who is named as executor in the decedent's will (if the person is able to produce a copy of the will), access to the decedent's safe deposit box.

Unlike with a regular deposit account, you generally can't just close a safe deposit box online or over the phone. You have to show up to the bank branch in person with the keys, fill out paperwork, and then empty the contents of your box.

Generally, third parties can't access your safe deposit box unless you've given them authorized access (such as by giving them a key and adding their name to the rental agreement).