Modify Amend Withholding

Description

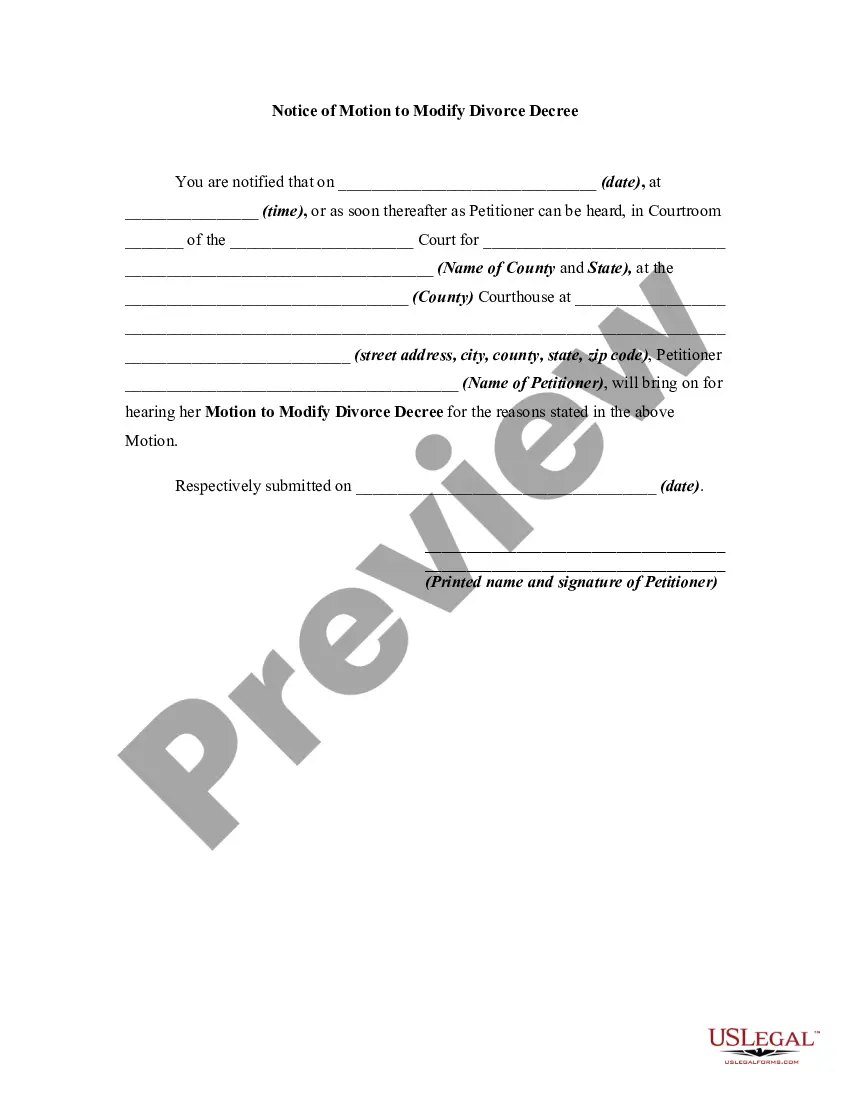

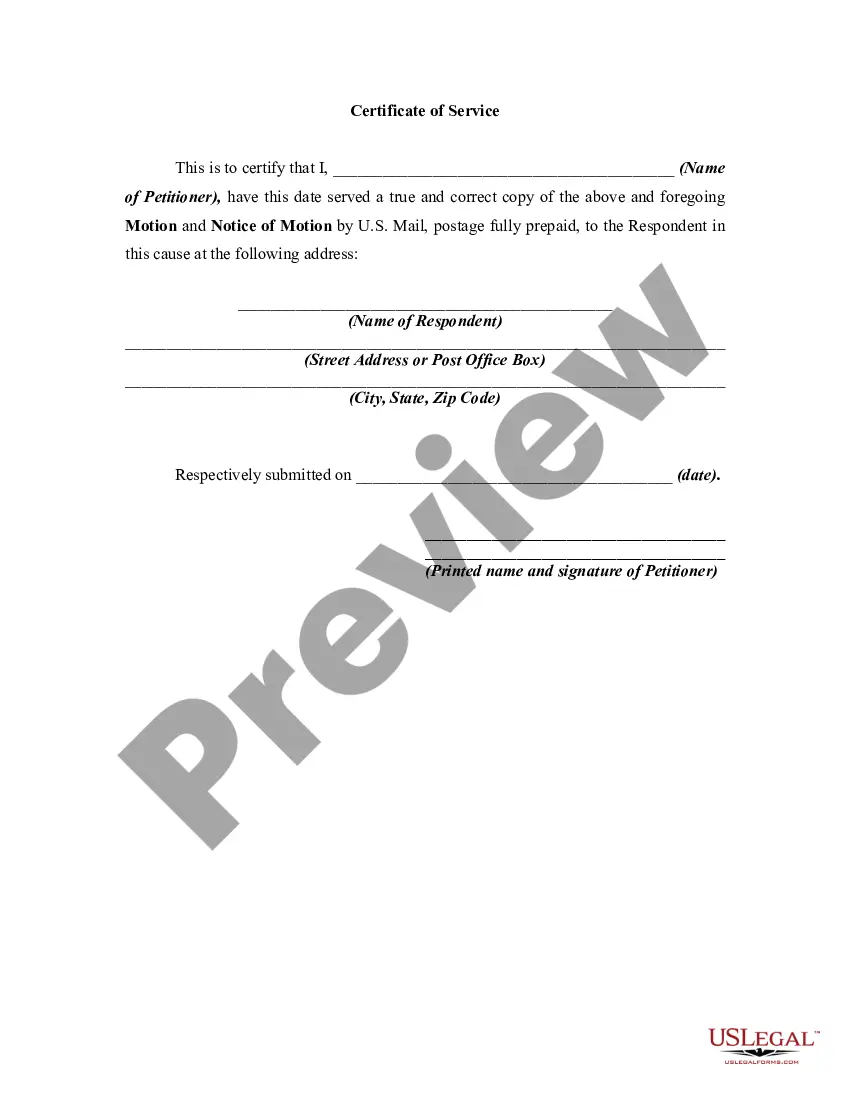

How to fill out Motion To Modify Or Amend Divorce Decree To Change Name Back To Married Name?

Drafting legal documents from scratch can sometimes be daunting. Some cases might involve hours of research and hundreds of dollars invested. If you’re looking for a an easier and more cost-effective way of creating Modify Amend Withholding or any other documents without jumping through hoops, US Legal Forms is always at your fingertips.

Our virtual library of over 85,000 up-to-date legal documents covers virtually every aspect of your financial, legal, and personal matters. With just a few clicks, you can instantly get state- and county-compliant templates diligently put together for you by our legal professionals.

Use our platform whenever you need a trustworthy and reliable services through which you can quickly find and download the Modify Amend Withholding. If you’re not new to our services and have previously set up an account with us, simply log in to your account, locate the template and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No problem. It takes little to no time to register it and navigate the catalog. But before jumping straight to downloading Modify Amend Withholding, follow these tips:

- Check the form preview and descriptions to ensure that you are on the the document you are searching for.

- Make sure the form you select complies with the requirements of your state and county.

- Pick the best-suited subscription option to buy the Modify Amend Withholding.

- Download the form. Then complete, sign, and print it out.

US Legal Forms boasts a good reputation and over 25 years of experience. Join us now and transform document execution into something simple and streamlined!

Form popularity

FAQ

For faster service, submit your request electronically using Change my Return in My Account or ReFILE. See our check processing times tool for more information. You can request a change to your income tax and benefit return by amending the amount entered on specific lines of your return.

Send two copies of the amended or cancelled slips to the employee. Send one copy of the amended or cancelled slips to any national verification and collection centre with a letter explaining the reason for the amendment or cancellation.

Amending NR4 slips After filing your information return, you may notice that you made an error on an NR4 slip. If so, you will have to prepare an amended slip to correct the information.

You have to report amounts on an NR4 slip if the gross income paid or credited during the year is $50 or more. However, if you paid less than $50 and you still withheld tax under Part XIII , you have to report the gross income and the tax withheld on an NR4 slip.

How to file an amended tax return Download Form 1040-X from the IRS website. Gather the necessary documents. ... Complete Form 1040-X: Add your personal information, details of what's changed, and your explanation for the changes. ... Submit your completed amended return: You can send it by mail or e-file.