Changing Name After Marriage With Bank

Description

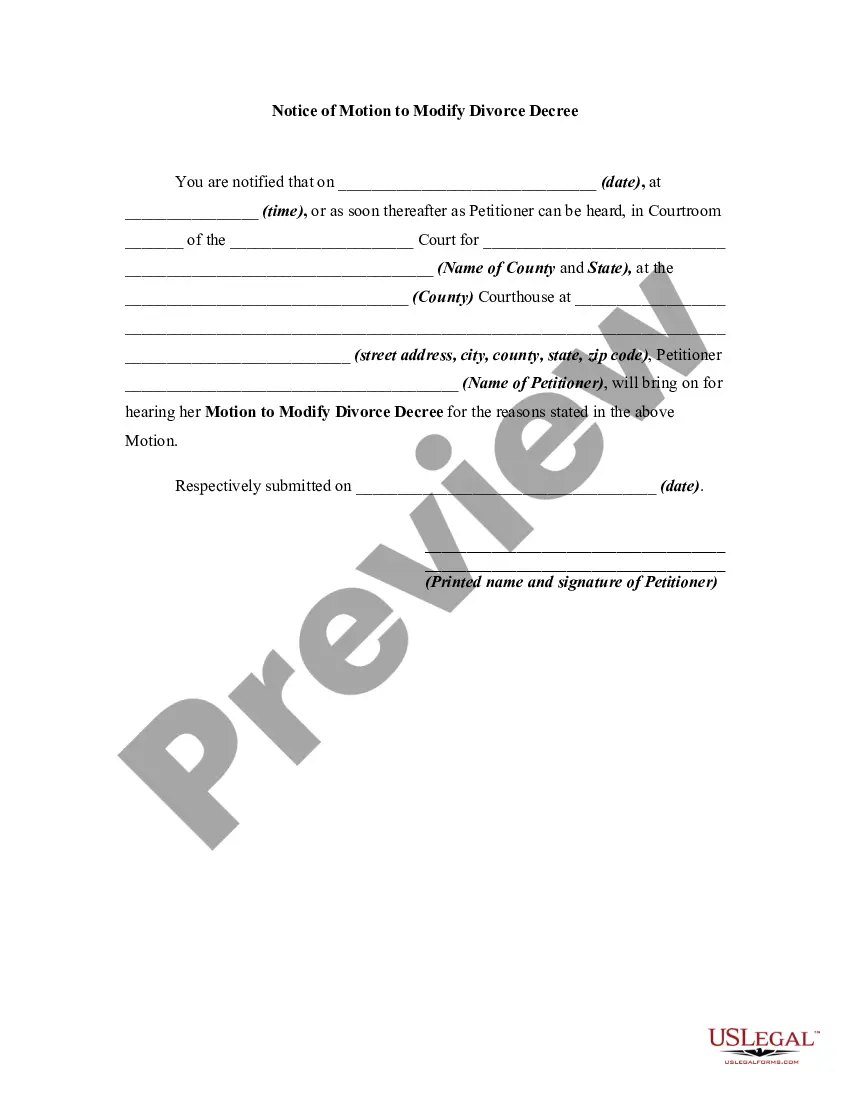

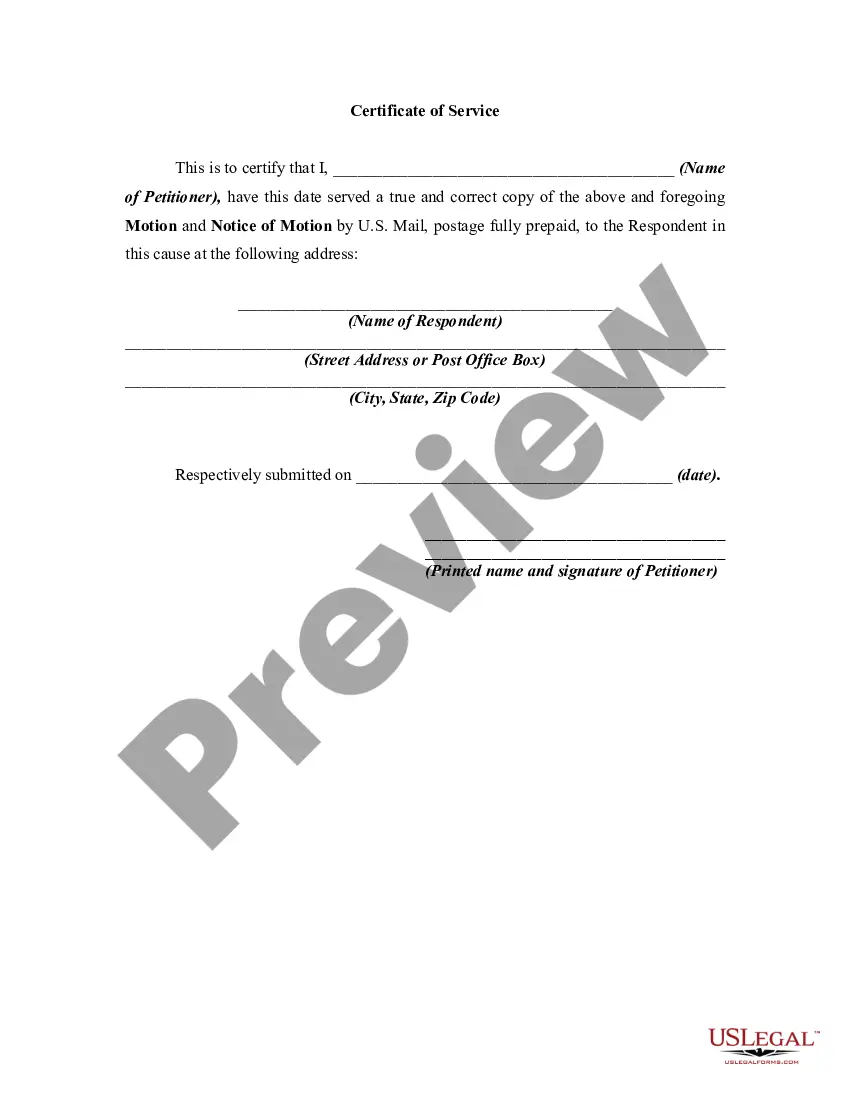

How to fill out Motion To Modify Or Amend Divorce Decree To Change Name Back To Married Name?

It’s clear that you cannot transform into a legal expert instantaneously, nor can you acquire how to swiftly prepare Changing Name After Marriage With Bank without having a specialized background.

Assembling legal documents is a labor-intensive undertaking necessitating specific education and expertise. So why not entrust the creation of the Changing Name After Marriage With Bank to the professionals.

With US Legal Forms, one of the most extensive legal template collections, you can discover everything from court documents to templates for internal communication.

Select Buy now. Once the payment is processed, you can access the Changing Name After Marriage With Bank, complete it, print it, and deliver or mail it to the appropriate individuals or organizations.

You can regain access to your documents from the My documents tab at any time. If you’re a current customer, you can simply Log In and find and download the template from the same tab.

- Commence with our website and obtain the form you need in just minutes.

- Locate the form you seek using the search bar at the top of the page.

- Preview it (if this feature is available) and review the accompanying description to decide whether Changing Name After Marriage With Bank is what you require.

- Start your search anew if you need a different template.

- Create a free account and select a subscription plan to purchase the form.

Form popularity

FAQ

However, the law does not allow a court to decide not to publish a name change. The law requires the court to publish the name change, even if the person has very good reasons to want to keep it confidential.

Take the Publication of Notice of Hearing form (SCAO form PC 50) to a local newspaper for publication. a. The Publication of Notice of Hearing must be published at least 14 days before the name change hearing.

If your petition is approved, the judge will complete and sign the order changing your name. The order is one of the documents that you can get by using the Do-It-Yourself Name Change tool. There is a $10 fee to have the court enter the order. A certified copy of the order costs another $11.

To download an application form with instructions, go to 'Correct a Birth Record'. If you have questions or need further assistance, you can contact the Changes Unit directly at 517-335-8660.

Can I Change My Name for Free? The legal procedure to change your name will require you to pay filing and court fees. Additionally, you will also need to pay for new identification, such as an updated driver's license or healthcare card. However, you don't need to pay to update your name on your Social Security card.

If your petition is approved, the judge will complete and sign the order changing your name. The order is one of the documents that you can get by using the Do-It-Yourself Name Change tool. There is a $10 fee to have the court enter the order. A certified copy of the order costs another $11.

Depending on the age of the applicant, the requirements for filing are slightly different. The process begins with filing a petition for name change, form PC 51 or form PC 51c, along with MC 97a. The filing fee for this petition is $175.

The Michigan Department of Health and Human Services will issue a new birth certificate with corrected name and/or gender upon receipt of an Application to Correct or Change a Michigan Birth Record, a copy of a court ordered change of name, and/or a Sex Designation Form.