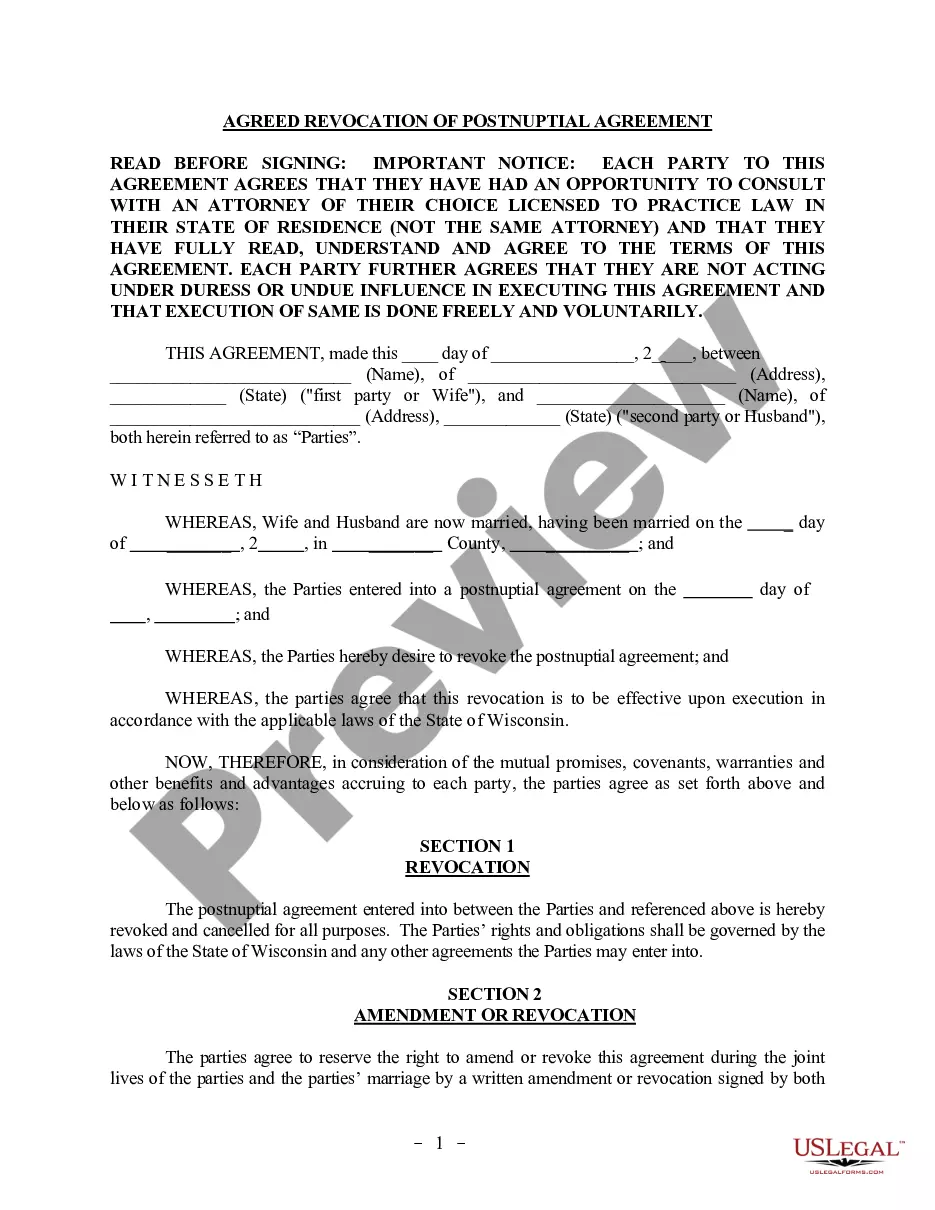

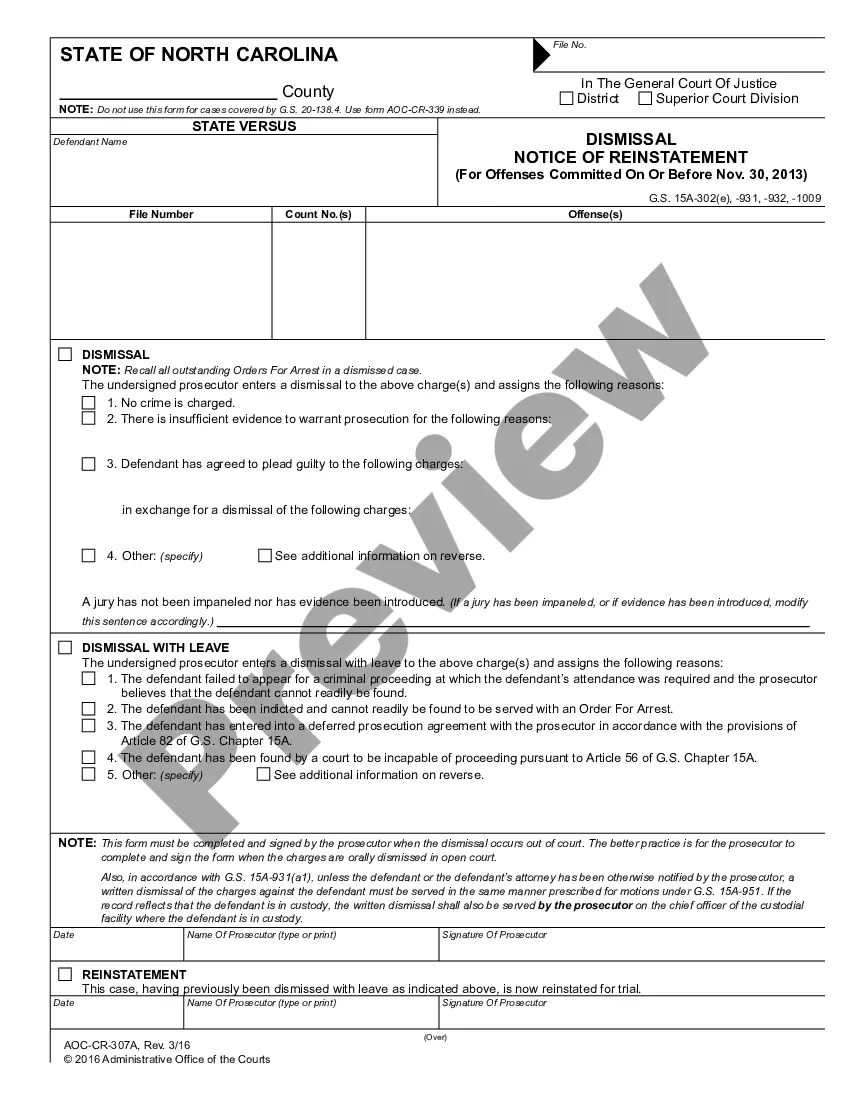

This form is a sample of an agreement by a nurse staffing agency to supply nurses and nursing assistants to a hospital on an as needed basis. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Healthcare Staffing Contracts With

Description

How to fill out Agreement Between Hospital And Nurse Staffing Agency?

Creating legal documents from the ground up can frequently be intimidating.

Certain situations might require extensive investigation and substantial sums spent.

If you are seeking a more straightforward and cost-effective approach to generate Healthcare Staffing Contracts With or any other forms without navigating through obstacles, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal affairs.

But before proceeding to download Healthcare Staffing Contracts With, consider these suggestions: Check the form preview and descriptions to confirm that you are on the correct document you are seeking. Verify if the template you select meets the standards of your state and county. Choose the most appropriate subscription option to purchase the Healthcare Staffing Contracts With. Download the file. After that, complete, validate, and print it. US Legal Forms boasts a robust reputation and over 25 years of experience. Join us today and simplify and streamline your document completion!

- With just a few clicks, you can swiftly obtain state- and county-compliant templates meticulously prepared by our legal professionals.

- Utilize our platform whenever you require trusted and dependable services to quickly find and download the Healthcare Staffing Contracts With.

- If you’re already familiar with our services and have set up an account with us previously, simply Log In to your account, find the form and download it immediately or retrieve it later in the My documents tab.

- Don't have an account? No worries. It takes minimal time to register and explore the collection.

Form popularity

FAQ

The California annual franchise tax is exactly what it sounds like?a tax that the state's business owners must pay yearly. It is simply one of the costs of doing business if you choose to register your entity in California.

Subchapter S Corporations, Partnerships and Limited Liability Companies engaged in activities in Vermont must file a Business Entity Income Tax return with the Commissioner of Taxes. This includes entities receiving income as a shareholder, partner, or member.

The Bank Franchise Tax is paid by banks and other financial institutions with Vermont deposits. The tax is computed monthly on average monthly deposits for the previous 12 months. Tax is paid monthly, with a return filed quarterly. This tax is instead of corporate income tax.

Ways to Get Your. Vermont Income Tax Forms. Download fillable PDF forms from the web. Order forms online. Order forms by email. Order forms by phone. For a faster refund, e-file your taxes! For information on free e-filing and tax assistance for qualified taxpayers, visit .tax.vermont.gov.

Who Must File. A partnership (including REMICs classified as partnerships) that engages in a trade or business in California or has income from a California source must file Form 565. See definition of ?doing business? in General Information A, Important Information.

A partnership must file an annual information return to report the income, deductions, gains, losses, etc., from its operations, but it does not pay income tax. Instead, it "passes through" profits or losses to its partners.

Partnerships file an information return to report their income, gains, losses, deductions, credits, etc. A partnership does not pay tax on its income but "passes through" any profits or losses to its partners.

Vermont State 1099 and WHT-434 Filing Requirements The State of Vermont mandates the filing of 1099 forms, including 1099-NEC, 1099-MISC, 1099-INT, 1099-DIV, 1099-B, 1099-G, 1099-K, and 1099-OID. The State of Vermont also mandates the filing of Form WHT-434, Annual Withholding Reconciliation.