Ownership Limited Liability Company Foreign

Description

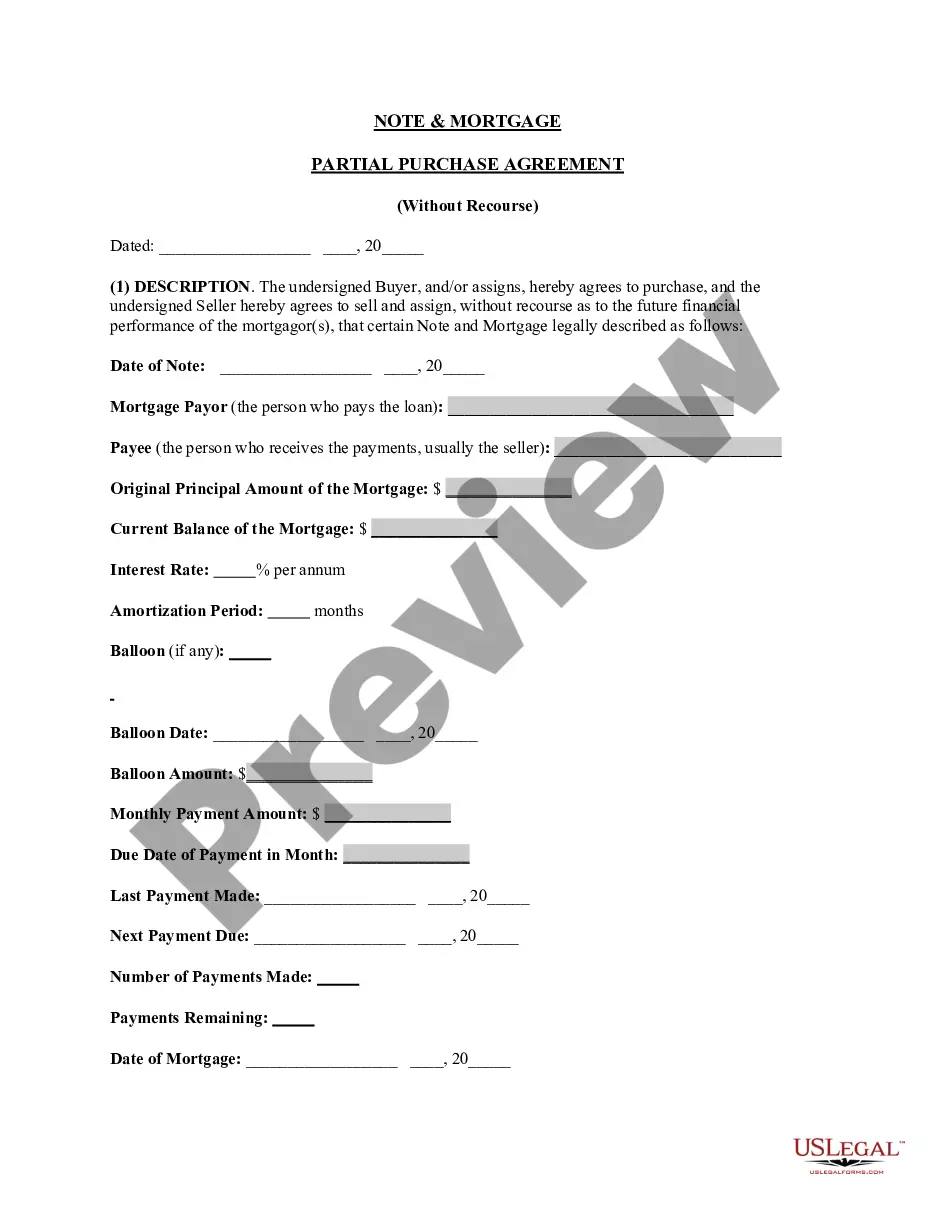

How to fill out Sale And Assignment Of A Percentage Ownership Interest In A Limited Liability Company?

Getting a go-to place to access the most recent and relevant legal templates is half the struggle of handling bureaucracy. Choosing the right legal files needs accuracy and attention to detail, which explains why it is crucial to take samples of Ownership Limited Liability Company Foreign only from reliable sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to be concerned about. You may access and see all the details regarding the document’s use and relevance for the circumstances and in your state or county.

Consider the following steps to complete your Ownership Limited Liability Company Foreign:

- Utilize the catalog navigation or search field to locate your sample.

- Open the form’s description to see if it fits the requirements of your state and region.

- Open the form preview, if there is one, to make sure the form is definitely the one you are searching for.

- Get back to the search and locate the appropriate template if the Ownership Limited Liability Company Foreign does not suit your needs.

- When you are positive about the form’s relevance, download it.

- When you are a registered customer, click Log in to authenticate and access your selected forms in My Forms.

- If you do not have an account yet, click Buy now to obtain the template.

- Pick the pricing plan that suits your needs.

- Go on to the registration to complete your purchase.

- Complete your purchase by picking a transaction method (bank card or PayPal).

- Pick the file format for downloading Ownership Limited Liability Company Foreign.

- When you have the form on your device, you may alter it with the editor or print it and finish it manually.

Eliminate the headache that comes with your legal paperwork. Check out the extensive US Legal Forms library to find legal templates, examine their relevance to your circumstances, and download them on the spot.

Form popularity

FAQ

1. Can a foreign person or foreign corporation own a U.S. LLC? Yes. Generally, there are no restrictions on foreign ownership of any company formed in the United States, except for S-Corporations.

1. Can a foreign person or foreign corporation own a U.S. LLC? Yes. Generally, there are no restrictions on foreign ownership of any company formed in the United States, except for S-Corporations.

Can an LLC Have a Foreign Owner? Yes, a US LLC can be owned entirely by foreign persons. The state of Florida is one of the most common states used to incorporate and in Florida the taxes, management costs and formations costs are usually less than in many other jurisdictions.

Members in an LLC can be individuals, corporations, other LLCs, foreign entities or a mix of any of these legal personalities.

An LLC is a domestic company in one state ? its state of organization. It is considered a foreign company in every other jurisdiction. If an LLC wants to transact business in a state other than its state of organization, it will have to register as a foreign LLC with that other state's business entity filing office.