Promissory Note Payment Schedule For Loan

Description

How to fill out Agreement To Modify Interest Rate, Maturity Date, And Payment Schedule Of Promissory Note Secured By A Mortgage?

Individuals often link legal documentation with something intricate that solely an expert can handle.

In some respects, this is valid, as creating a Promissory Note Payment Schedule For Loan demands considerable proficiency in subject criteria, including state and county laws.

Nevertheless, with US Legal Forms, everything has turned more reachable: pre-made legal templates for any personal and business circumstance tailored to state regulations are gathered in a singular online directory and are now accessible to everyone.

All templates in our collection are reusable: once purchased, they remain saved in your profile. You can access them anytime needed via the My documents tab. Experience all the benefits of utilizing the US Legal Forms platform. Enroll now!

- US Legal Forms offers over 85,000 current documents sorted by state and usage area, making it easy to find a Promissory Note Payment Schedule For Loan or any specific template in just a few minutes.

- Existing users with an active subscription must Log In to their account and click Download to obtain the form.

- New users of the service will first need to create an account and register before they can save any files.

- Here’s a step-by-step guide on how to acquire the Promissory Note Payment Schedule For Loan.

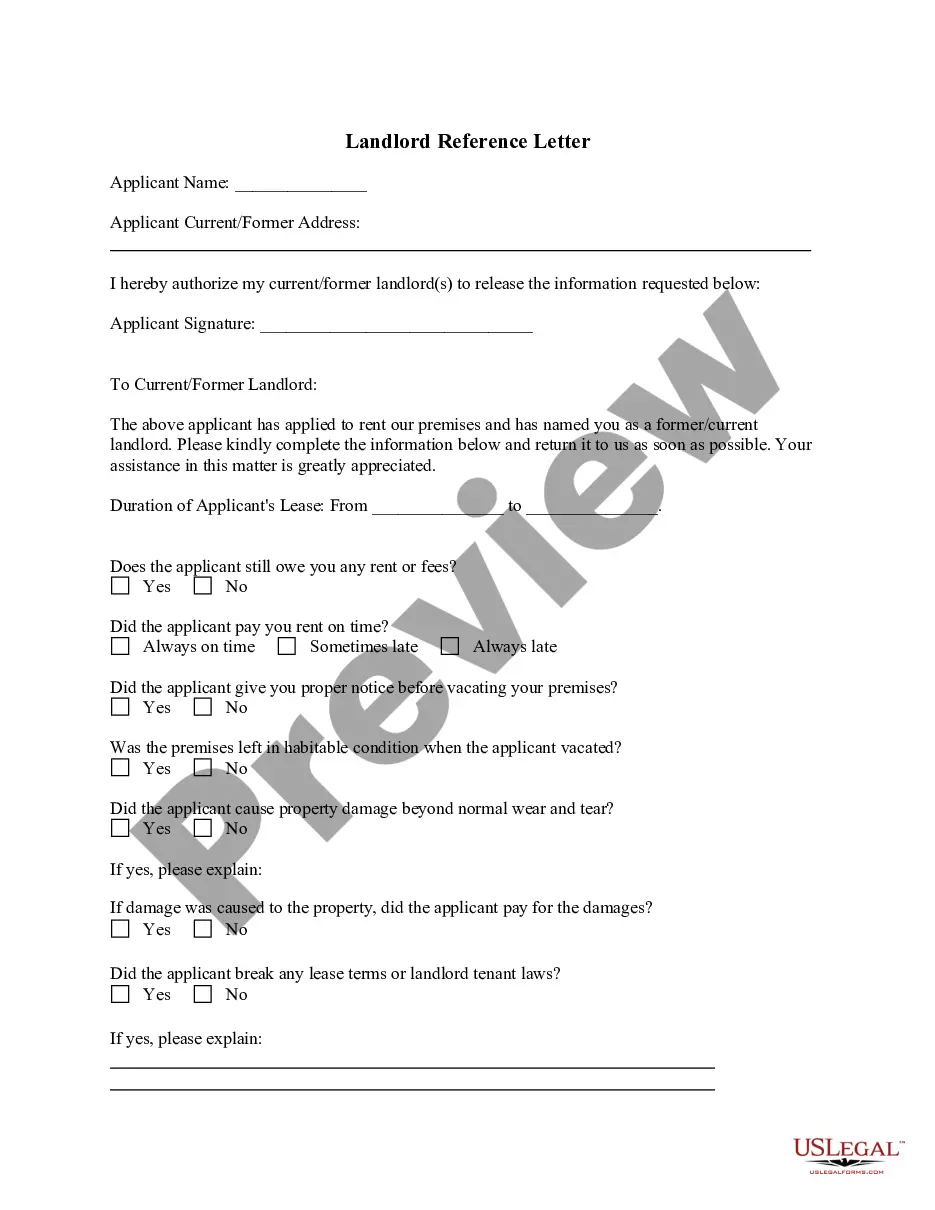

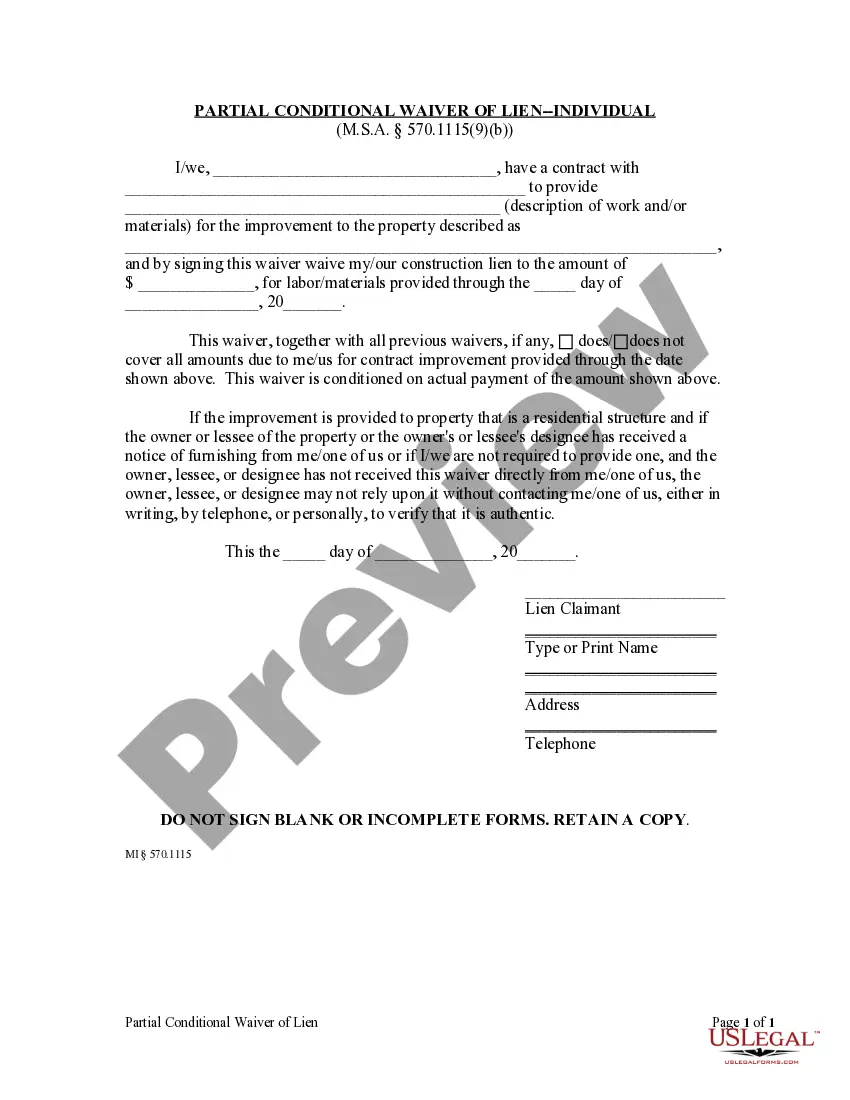

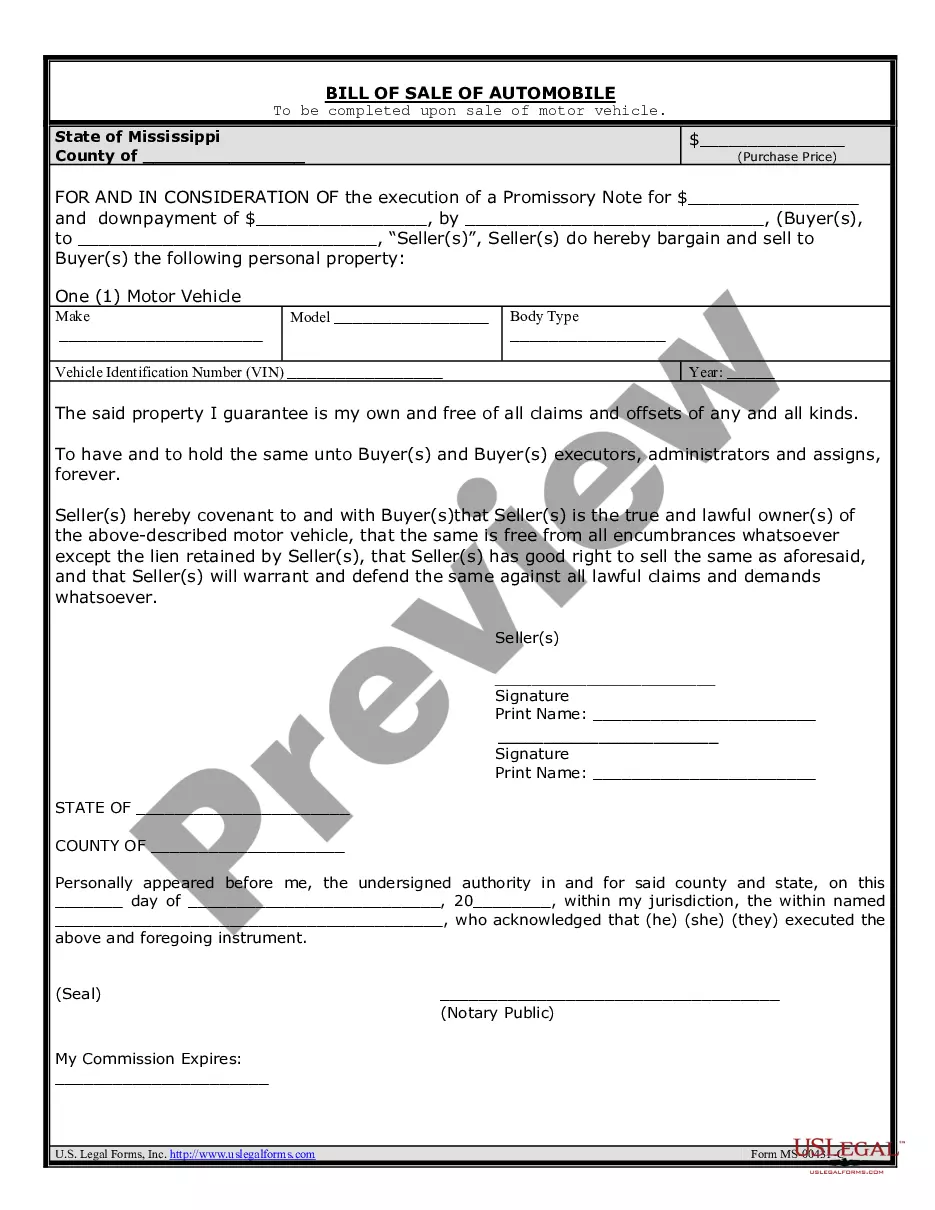

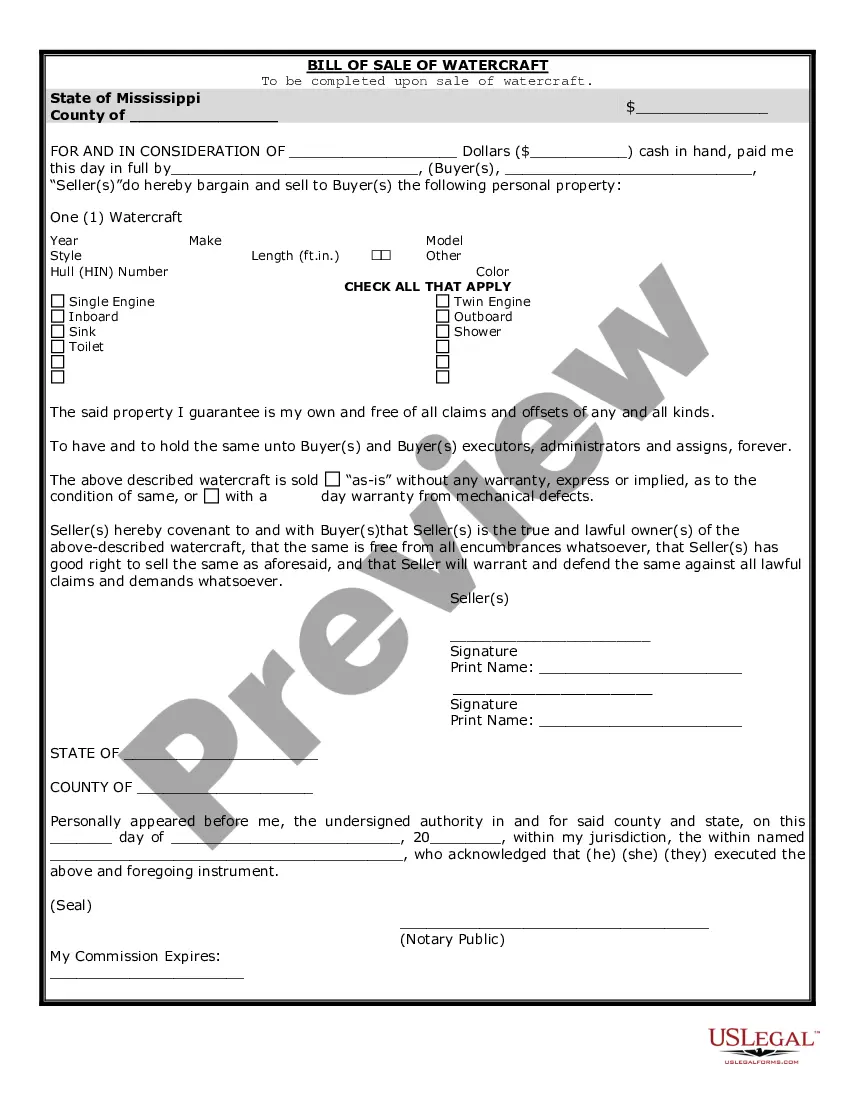

- Examine the page content carefully to confirm it meets your requirements.

- Read the form description or view it via the Preview option.

- If the prior sample doesn't suit you, find another by using the Search bar in the header.

- Once you locate the appropriate Promissory Note Payment Schedule For Loan, click Buy Now.

- Choose a pricing plan that suits your needs and budget.

- Create an account or sign in to move to the payment page.

- Make payment for your subscription using PayPal or your credit card.

- Select the format for your template and click Download.

- Print your document or import it into an online editor for quicker completion.

Form popularity

FAQ

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

If our payments are monthly, then we divide our annual interest rate by 12. The P stands for the fixed monthly payment amount that we will have to pay. To find the total amount that we end up paying, we multiply this fixed monthly amount by the total number of payments.

Simple Promissory Note SampleInclude the date you are writing or the date you plan to send the note at the top. Write the total amount due in both numeric and long-form. Add a detailed description of the loan or note terms. For example, you'll need to include what the loan or payment is for, who will pay it and how.

Give the age, father's name and residential address of the Lender and Borrower. Mention the relationship between the Lender and Borrower. Write the amount of loan that has been lent to the Borrower. Mention the purpose of the loan like conducting wedding, hospital charges, investing in a business or any other purposes.

To draft a Loan Agreement, you should include the following:The addresses and contact information of all parties involved.The conditions of use of the loan (what the money can be used for)Any repayment options.The payment schedule.The interest rates.The length of the term.Any collateral.The cancellation policy.More items...