Promissory Note Payment Schedule For Enrollment

Description

How to fill out Agreement To Modify Interest Rate, Maturity Date, And Payment Schedule Of Promissory Note Secured By A Mortgage?

Precisely composed official documents are among the essential assurances for preventing issues and legal disputes, but obtaining them without the assistance of an attorney may require time.

Whether you are seeking to swiftly locate a current Promissory Note Payment Schedule For Enrollment or any other templates for work, family, or business matters, US Legal Forms is always ready to assist.

The process is even more straightforward for current users of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and press the Download button next to the chosen document. Additionally, you can access the Promissory Note Payment Schedule For Enrollment later at any point, as all documents ever acquired on the platform stay accessible within the My documents tab of your profile. Conserve time and resources on preparing official documents. Try US Legal Forms today!

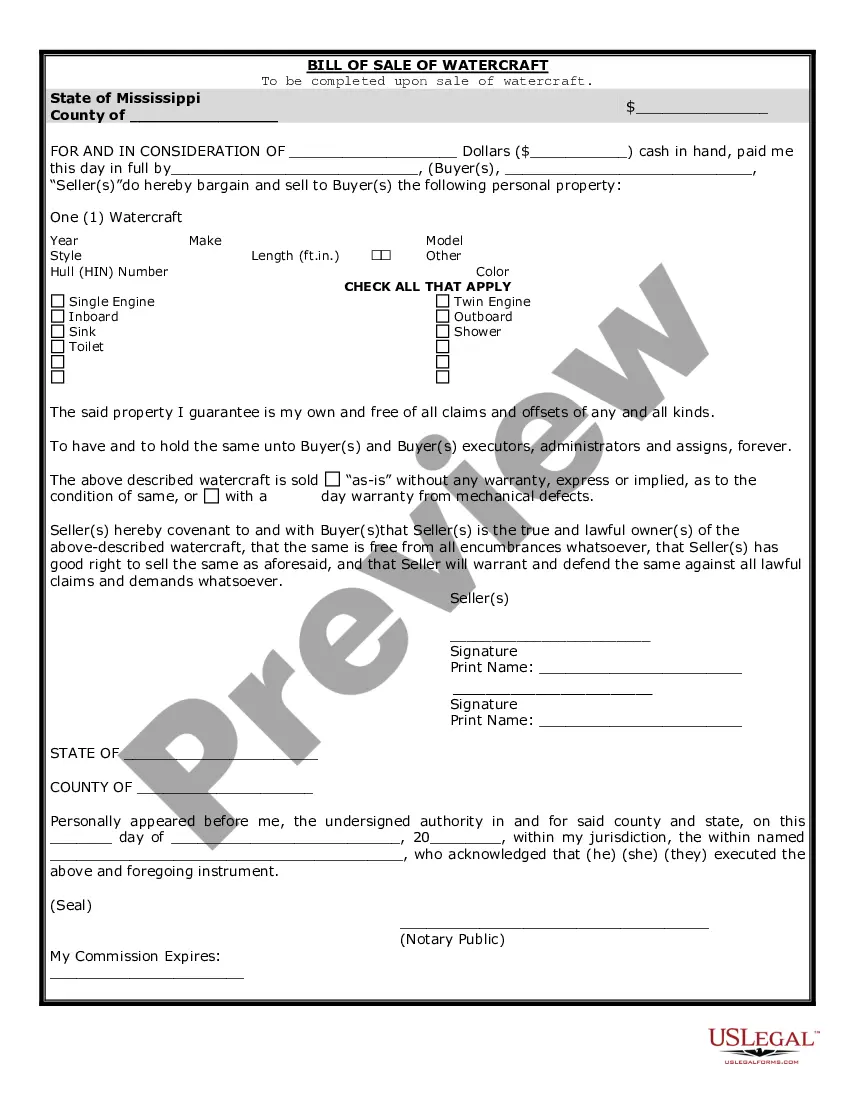

- Confirm that the form is appropriate for your situation and locale by examining the description and preview.

- Search for another example (if necessary) using the Search bar located in the page header.

- Hit Buy Now once you find the right template.

- Choose the pricing plan, sign in to your account or create a new one.

- Select your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Choose PDF or DOCX file format for your Promissory Note Payment Schedule For Enrollment.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

Students must sign a Master Promissory Note before receiving a federal loan for college. The promissory note is a legally binding agreement whereby the student agrees to repay the loan, accrued interest, and fees to the Department of Education.

The Master Promissory Note (MPN) is a legal document in which you promise to repay your loan(s) and any accrued interest and fees to the U.S. Department of Education. It also explains the terms and conditions of your loan(s).

Complete Master Promissory Note Go to and log in using your FSA ID. Select Complete Loan Agreement (Master Promissory Note). For loan type select MPN for Subsidized/Unsubsidized Loans and then Start. Complete each step of the MPN and click Sign & Submit once you have finished.

Simple Promissory Note SampleInclude the date you are writing or the date you plan to send the note at the top. Write the total amount due in both numeric and long-form. Add a detailed description of the loan or note terms. For example, you'll need to include what the loan or payment is for, who will pay it and how.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.