Notes Mortgage Sample Within 1 Year

Description

How to fill out Agreement To Modify Promissory Note And Mortgage To Extend Maturity Date?

Handling legal documentation can be daunting, even for the most skilled professionals.

When you're seeking a Notes Mortgage Sample Within 1 Year and lack the time to spend searching for the correct and up-to-date version, the experience may be taxing.

US Legal Forms addresses any necessities you might have, from individual to business documentation, all consolidated in one location.

Use advanced features to fill out and manage your Notes Mortgage Sample Within 1 Year.

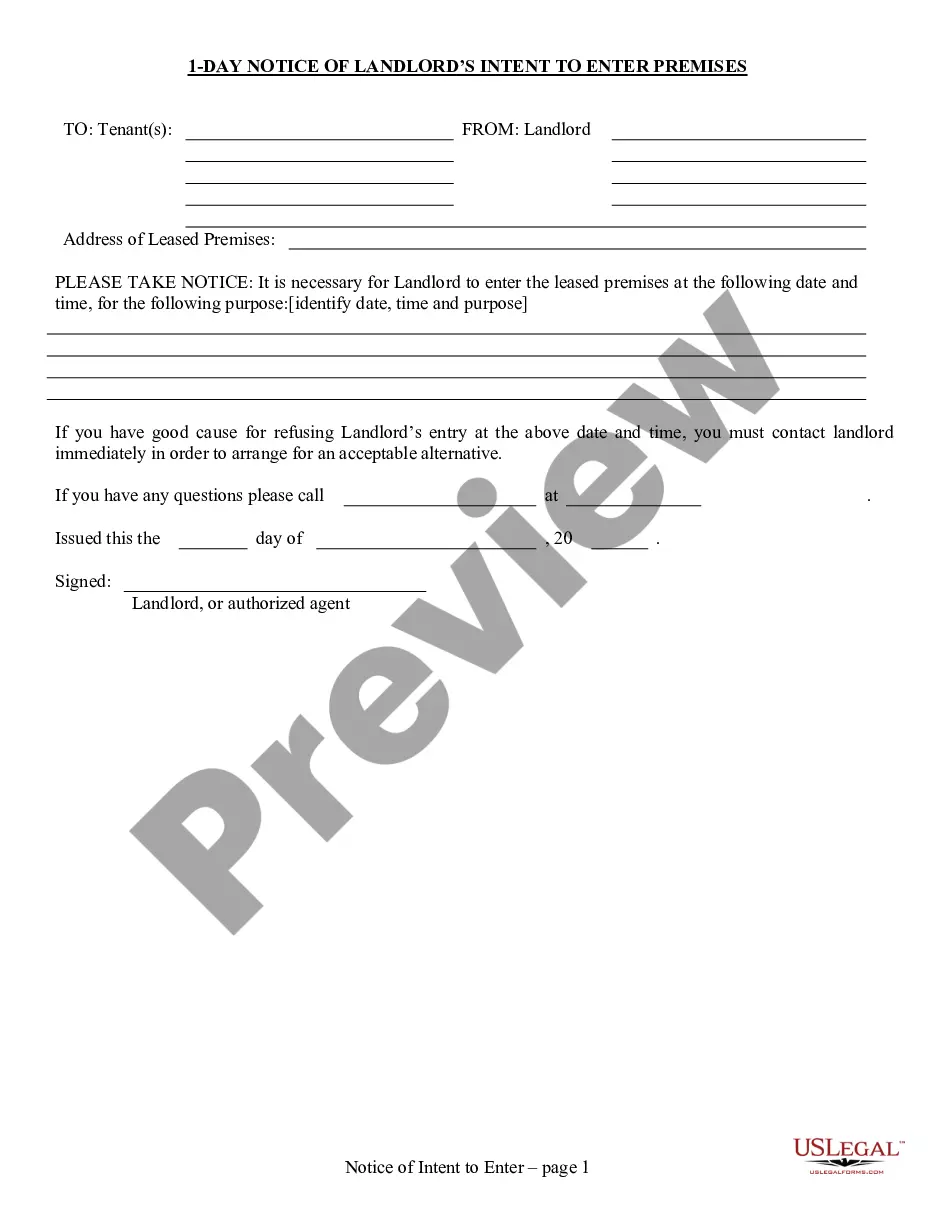

Upon retrieving the form you require, follow these steps: Confirm that this is the correct document by previewing it and reviewing its description.

- Access a valuable repository of articles, guides, and materials related to your situation and requirements.

- Conserve time and effort searching for the documents you need, and use US Legal Forms' sophisticated search and Review tool to find and obtain the Notes Mortgage Sample Within 1 Year.

- If you hold a subscription, Log In to your US Legal Forms account, locate the form, and retrieve it.

- Check your My documents tab to view the documents you have previously downloaded and manage your folders as needed.

- If this is your initial experience with US Legal Forms, create an account and enjoy unlimited access to all the benefits of the library.

- Utilize a comprehensive web form library that can transform the way you manage these tasks effectively.

- US Legal Forms stands as a leader in the online legal forms sector, offering over 85,000 state-specific legal documents available to you at any time.

- Gain entry to legal and business forms specific to your state or county.

Form popularity

FAQ

The 3 7 3 rule is a guideline that helps borrowers understand their mortgage payment structure. It indicates that for every $100,000 borrowed, the payment will be roughly $3,000 for the first three years, $7,000 for the next seven years, and then it may adjust based on market conditions. Understanding this rule can assist you in managing your finances effectively. For practical examples, consider looking at a notes mortgage sample within 1 year.

The following information will be included in a mortgage note: The exact amount borrowed, which is the total amount you owe on the mortgage. Interest rate. Down payment amount. Your full legal name. Name of the lender. The repayment plan (including the start date and maturity date of the loan)

Note Date means the date that the Note is funded or such other date that Lender locks in the interest rate in effect on the Note as of the date prepayment. Note Date means the date of the Promissory Note.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

Short term notes payable are obligations to pay a specified sum, plus interest, within one year. These notes payable usually refer to the repayment of loaned funds in the near term.

Mortgage Note Details The dollar amount of the mortgage loan. The interest rate that borrowers will pay. ... The down payment amount. Whether monthly or bimonthly payments are required. Whether a prepayment penalty is imposed. The penalties for late payments.