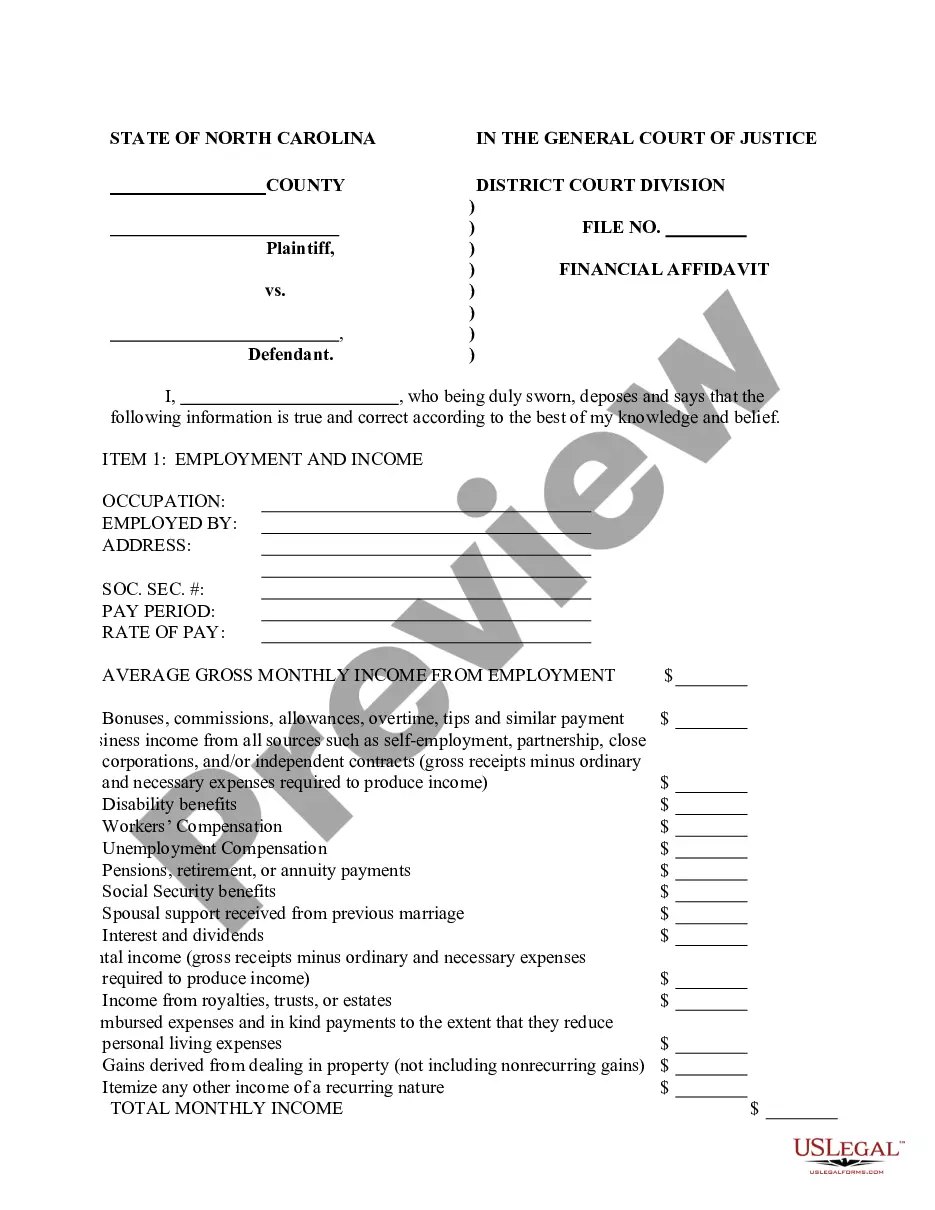

Note Mortgage Statement For Self Employed

Description

How to fill out Agreement To Modify Promissory Note And Mortgage To Extend Maturity Date?

Managing legal documents and tasks can be a lengthy addition to your schedule.

Note Mortgage Statement For Self Employed and similar forms usually require you to search for them and comprehend how you can fill them out efficiently.

Consequently, whether you are handling financial, legal, or personal issues, possessing a comprehensive and user-friendly online collection of forms readily available will greatly assist.

US Legal Forms is the premier online platform for legal documents, providing over 85,000 state-specific templates along with various tools designed to aid you in completing your forms effortlessly.

Is this your first time using US Legal Forms? Register and establish your account in just a few minutes, granting you access to the form collection and Note Mortgage Statement For Self Employed. Then, follow the steps outlined below to complete your form.

- Explore the collection of relevant documents available to you with a single click.

- US Legal Forms offers state- and county-specific templates that can be downloaded at any time.

- Protect your document management processes by utilizing a high-quality service that enables you to prepare any form in minutes without any extra or hidden charges.

- Simply Log In to your account, find Note Mortgage Statement For Self Employed, and obtain it immediately from the My documents section.

- You can also access forms you have downloaded previously.

Form popularity

FAQ

Mortgage lenders typically evaluate your net income from your tax returns, as well as any additional income sources. They also consider the documentation you provide, including a note mortgage statement for self employed. Understanding what lenders look for helps you prepare a stronger application.

Yes, as a self-employed individual, you can write off mortgage interest on your taxes. Keep in mind that you will need the 1098 form and a note mortgage statement for self employed to substantiate your claims. This deduction can significantly reduce your taxable income.

To prove your income as a self-employed person, compile your tax returns, bank statements, and a note mortgage statement for self employed. This combination of documents supports your income claim and helps lenders assess your capacity to repay. Always ensure your records are organized and up-to-date.

Proving income for a mortgage when self-employed involves collecting financial documents that reflect your income. This includes tax returns, business licenses, and a note mortgage statement for self employed. Such documentation provides lenders with a clear picture of your financial health.

To secure a mortgage as a self-employed borrower, you generally need your last two years of tax returns, a profit and loss statement, and a note mortgage statement for self employed. These documents demonstrate your earnings and financial reliability. The more detailed your proof of earnings, the better your chances of approval.

To calculate your self-employed income for a mortgage, you'll need to gather relevant financial documents, including your tax returns and a Note mortgage statement for self employed. Lenders often average your income over the past two years to assess consistency and reliability. Additionally, maintaining accurate records of your earnings and expenses will help you present a clear picture of your financial situation. Utilizing platforms like US Legal Forms can streamline this process by providing templates and resources for necessary documentation.

Mortgages for self-employed individuals operate similarly to those for traditional employees, but with some key differences. Lenders typically require additional documentation, such as a Note mortgage statement for self employed, to verify income stability. This documentation may include tax returns, profit and loss statements, and bank statements. By providing this information, you can demonstrate your financial health and improve your chances of securing a mortgage.

To write a proof of income letter for self-employed individuals, start by including your personal information, such as your name and contact details, along with your business name and address. Clearly state your income sources, including a summary of your earnings and expenses from your business. Make sure to indicate that this letter serves as a note mortgage statement for self employed, which can help lenders understand your financial situation. If you need assistance, consider using US Legal Forms, which provides templates to simplify the process.