Promissory Note With Variable Interest Rate

Description

How to fill out Agreement To Modify Interest Rate On Promissory Note Secured By A Mortgage?

When you need to finalize a Promissory Note With Variable Interest Rate that aligns with your local state's laws, there exists a multitude of choices to select from.

There's no obligation to verify each form to ensure it satisfies all the legal requirements if you are a subscriber of US Legal Forms.

It is a reliable resource that can assist you in obtaining a reusable and current template on any topic.

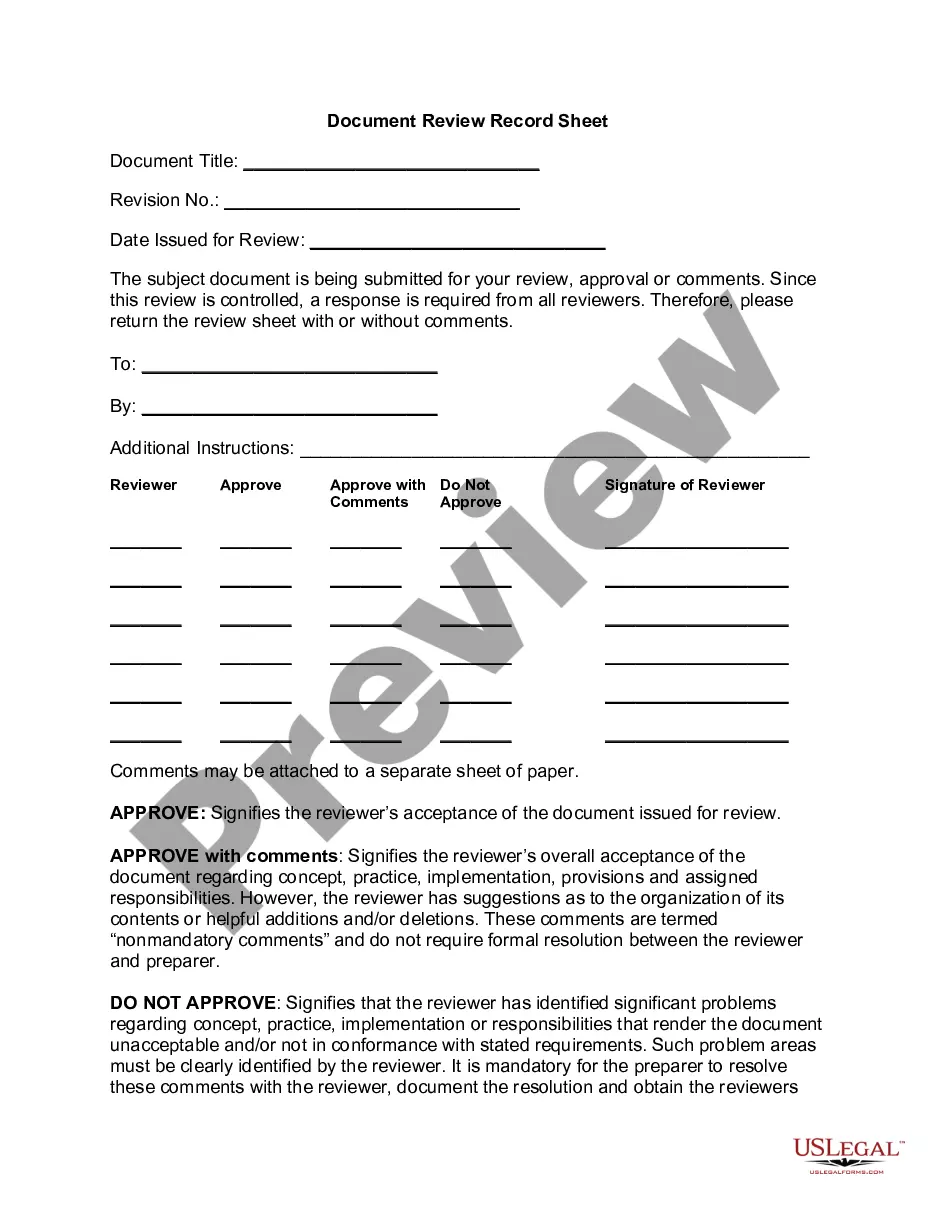

Utilize the Preview mode and examine the form description if it is provided.

- US Legal Forms boasts the most comprehensive online collection with a repository of over 85k ready-to-utilize documents for both business and personal legal needs.

- All templates are verified to comply with each state's regulations.

- Thus, when downloading the Promissory Note With Variable Interest Rate from our site, you can be assured that you possess a legitimate and updated document.

- Acquiring the essential template from our platform is quite simple.

- If you already have an account, just Log In to the system, confirm your subscription is active, and save the chosen file.

- Subsequently, you can access the My documents tab in your profile and maintain access to the Promissory Note With Variable Interest Rate whenever you need.

- If this is your first time using our library, please follow the instructions below.

- Review the suggested page and check it for alignment with your requirements.

Form popularity

FAQ

If interest on your loan is calculated as simple interest, the formula for calculating interest begins with the total principal balance multiplied by the interest rate. For example, if the principal is $5,000 and the interest rate is 15 percent, multiply 5,000 by 0.15 to equal 750.

A simple promissory note will state the full amount is due on the stated date; you won't need a payment schedule. You can decide whether to charge interest on the loan amount and include the interest in the document if needed.

Find the principal amount of the loan as stated in the promissory note. Use a free online amortization calculator to calculate the amount of monthly interest. Divide the monthly interest amount by the principal loan amount to get the monthly interest rate.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.19-Aug-2021

Promissory notes usually call for monthly payments. Interest is calculated each month based on the outstanding balance of the loan, called the principal. Suppose you take out a loan for $1,000 and the promissory note stipulates a 12 percent annual interest rate and a monthly payment of $50.