Personal Property Exchange Agreement With Qualified Intermediary

Description

How to fill out Contract Or Agreement To Make Exchange Or Barter Of Real Property For Personal Property?

Drafting legal documents from scratch can often be daunting. Certain scenarios might involve hours of research and hundreds of dollars invested. If you’re searching for a more straightforward and more cost-effective way of creating Personal Property Exchange Agreement With Qualified Intermediary or any other documents without jumping through hoops, US Legal Forms is always at your disposal.

Our virtual catalog of over 85,000 up-to-date legal documents addresses almost every element of your financial, legal, and personal affairs. With just a few clicks, you can quickly access state- and county-specific templates diligently put together for you by our legal professionals.

Use our platform whenever you need a trusted and reliable services through which you can quickly locate and download the Personal Property Exchange Agreement With Qualified Intermediary. If you’re not new to our services and have previously set up an account with us, simply log in to your account, locate the template and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No problem. It takes little to no time to register it and explore the catalog. But before jumping directly to downloading Personal Property Exchange Agreement With Qualified Intermediary, follow these tips:

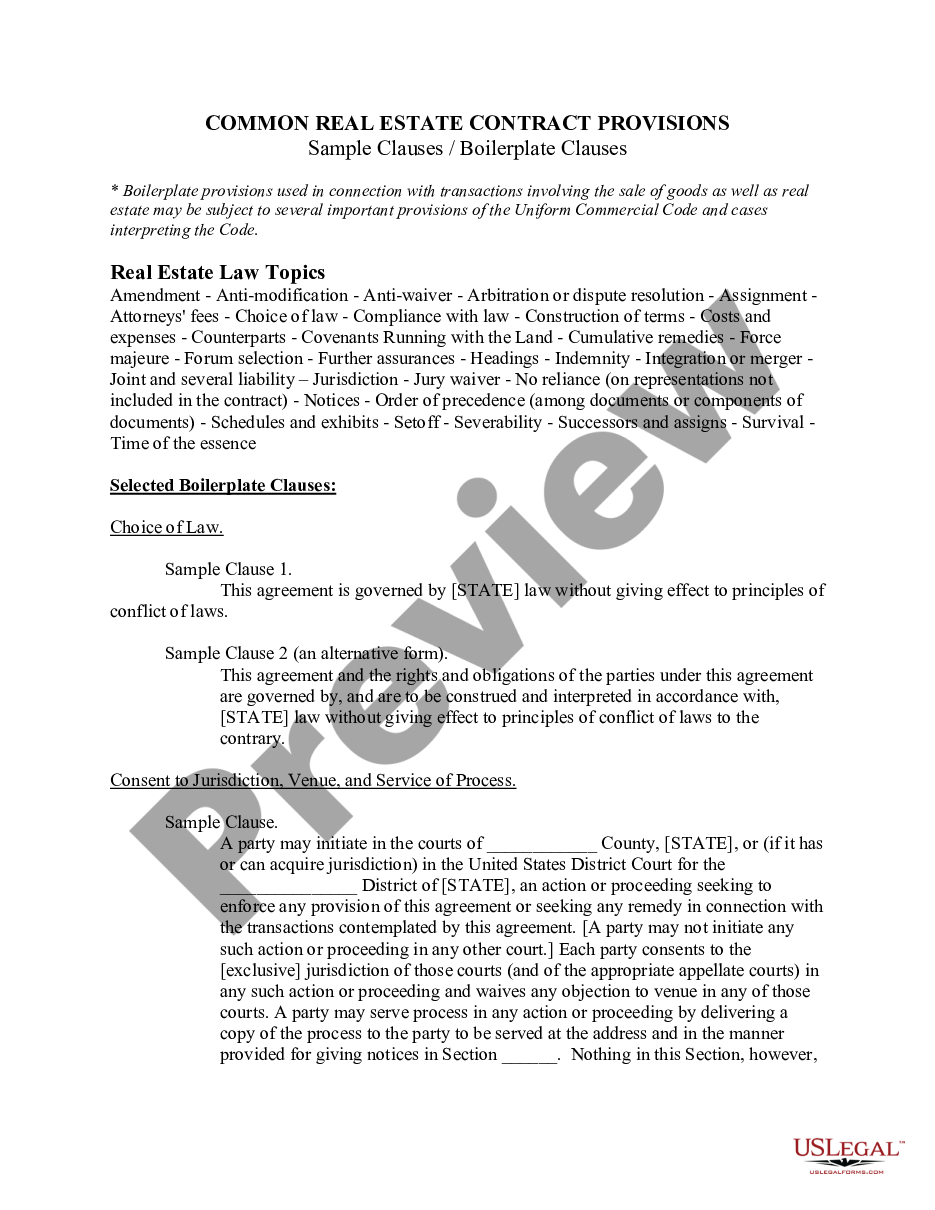

- Check the document preview and descriptions to ensure that you are on the the form you are looking for.

- Check if template you choose complies with the requirements of your state and county.

- Pick the best-suited subscription option to buy the Personal Property Exchange Agreement With Qualified Intermediary.

- Download the file. Then complete, sign, and print it out.

US Legal Forms has a good reputation and over 25 years of expertise. Join us today and turn form execution into something easy and streamlined!

Form popularity

FAQ

What is a 1031 Exchange? Step 1: Find a Qualified Intermediary. ... Step 2: Identify The Property to Sell. ... Step 3: Identify Property To Purchase. ... Step 4: Purchase The Replacement Property. ... Step 5: Inform the IRS About The Transaction.

Steps to Successfully Complete a 1031 Exchange Identify Your 1031 Exchange Objectives & Property Search. ... Find a Qualified Intermediary. ... Add a Cooperation Clause in Your Sales Contract. ... Provide a Copy of the Contract to the Intermediary. ... Funds for the Exchange are Wired to the Exchange Account.

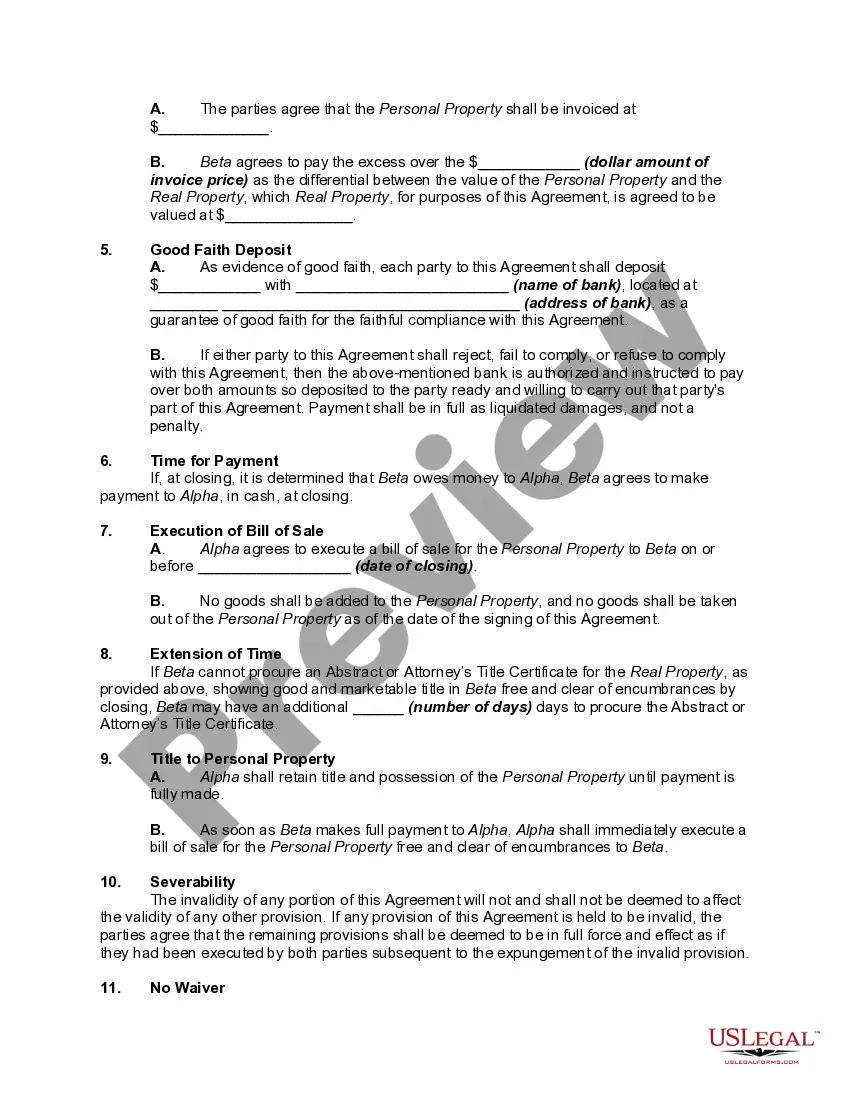

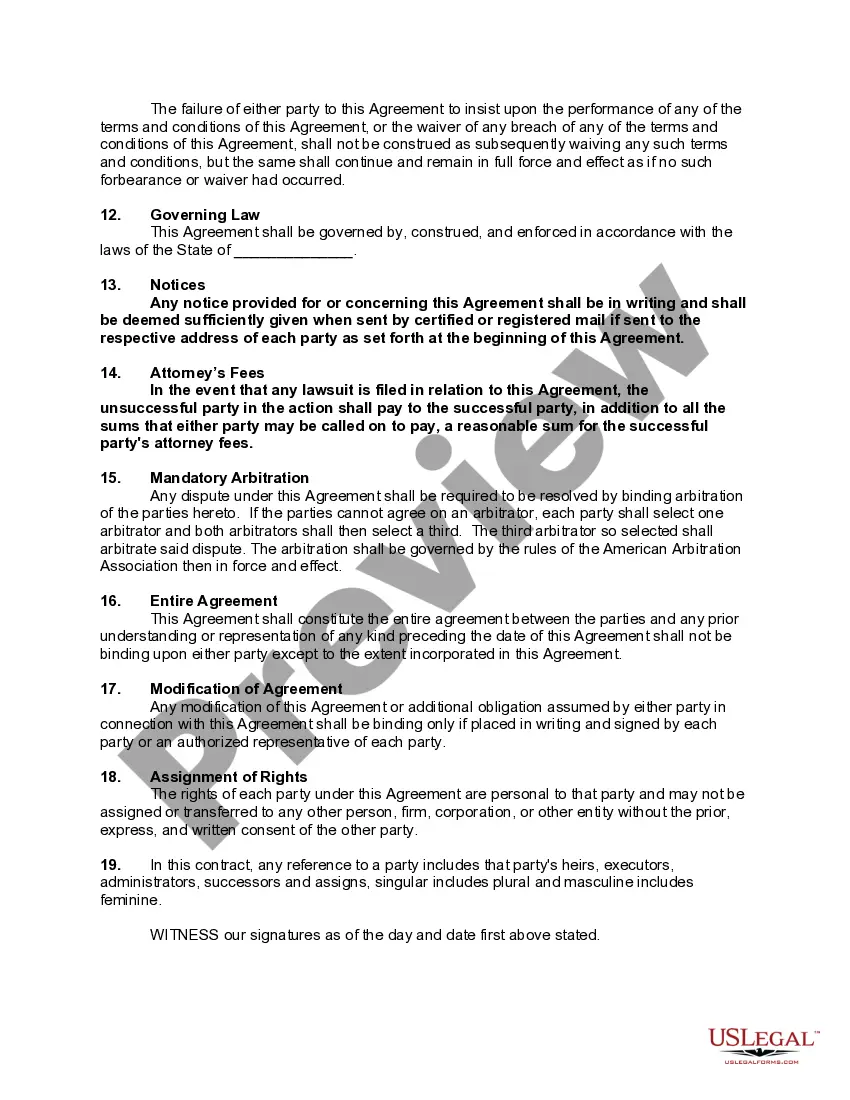

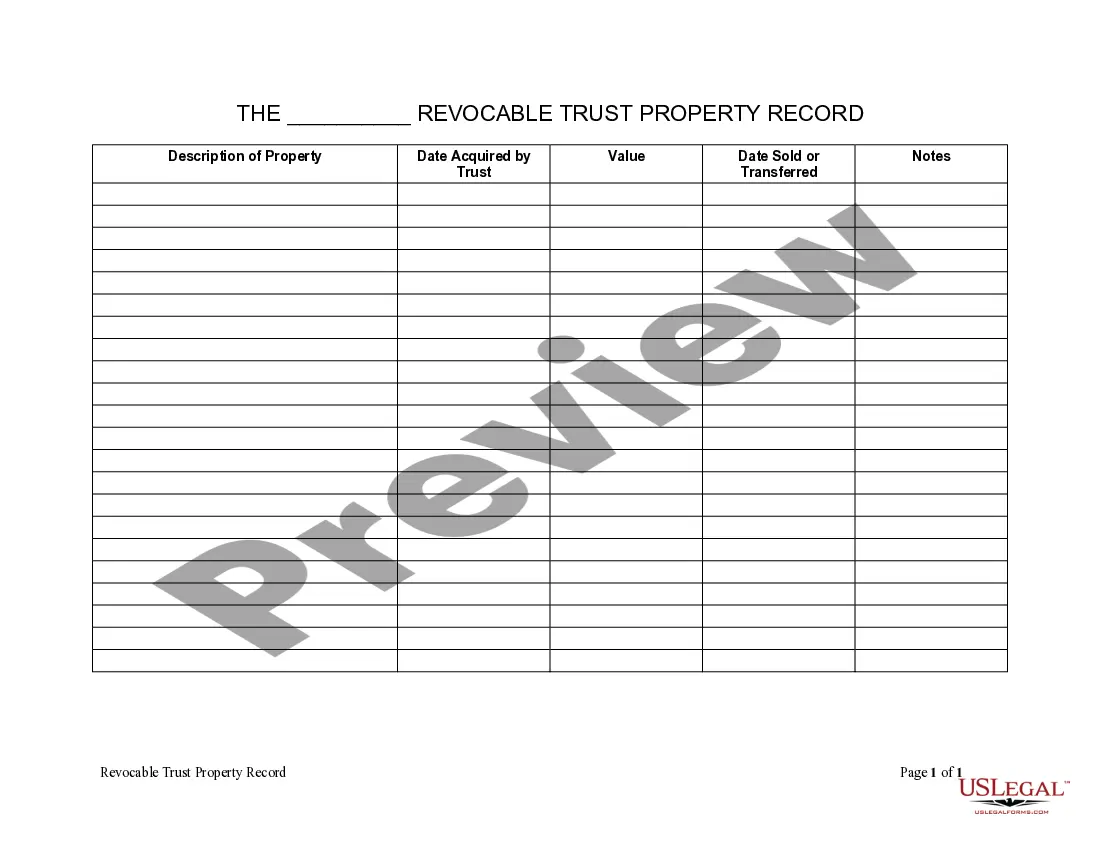

Qualified Intermediary (QI) Some of the important tasks the QI handles in the exchange transaction include: Prepares all required exchange documentation, including the Exchange Agreement, the Assignments of the Agreements of Sales and applicable Acknowledgements among others.

What to Look for in a 1031 Qualified Intermediary Experience Level. The first thing you will want to know about a potentially qualified intermediary is their experience and track record. ... Insurance, Bonds and Funds Management. Another crucial consideration is the financial aspect. ... Customer Service. ... Costs and Fees.

A Qualified Intermediary is an entity that creates documentation supporting a taxpayer's intent to initiate an Internal Revenue Code Section 1031 tax deferred exchange and holds the exchange proceeds in a manner that preserves principle and liquidity.