Tax Receipt Example

Description

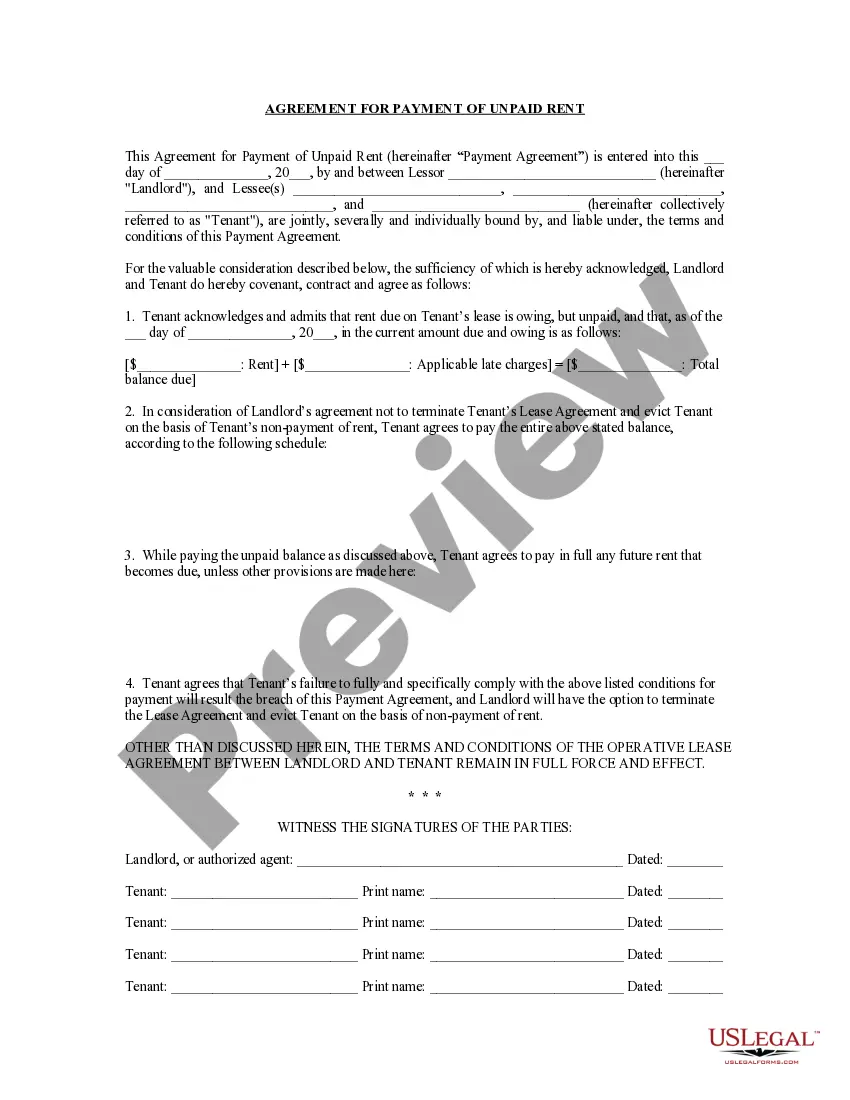

How to fill out Receipt For Payments - Template?

Creating legal documents from the ground up can occasionally be intimidating.

Certain situations may require extensive research and significant financial investment.

If you’re searching for a simpler and more economical method of preparing Tax Receipt Example or any other documents without unnecessary complications, US Legal Forms is always available to assist you.

Our online library containing over 85,000 current legal documents covers nearly all aspects of your financial, legal, and personal concerns.

Before directly downloading the Tax Receipt Example, keep in mind these recommendations: Review the document preview and descriptions to confirm you’ve located the form you need. Ensure that the form you choose is compliant with your state's and county's regulations and laws. Select the most appropriate subscription plan to obtain the Tax Receipt Example. Download the document, then fill it out, sign it, and print it. US Legal Forms boasts an impeccable reputation and over 25 years of experience. Join us today and make document processing an easy and efficient task!

- With just a couple of clicks, you can promptly access state- and county-compliant templates carefully crafted for you by our legal professionals.

- Utilize our website whenever you require trustworthy and dependable services to swiftly locate and download the Tax Receipt Example.

- If you’re a returning user and have set up an account with us previously, simply Log In to your account, find the form you need and download it, or access it again at any time in the My documents section.

- Don’t have an account? No problem. It only takes a few minutes to create one and explore the catalog.

Form popularity

FAQ

Always keep proof of your gift, such as a bank or credit card statement, canceled check, or written acknowledgement from the charity showing the date and value of the donation (if greater than $250).

The IRS requires proof of all cash donations big or small, such as a canceled check or a statement or receipt from the receiving organization. If you make a donation of more than $250 in any one day to any one organization, your cancelled check is NOT enough.

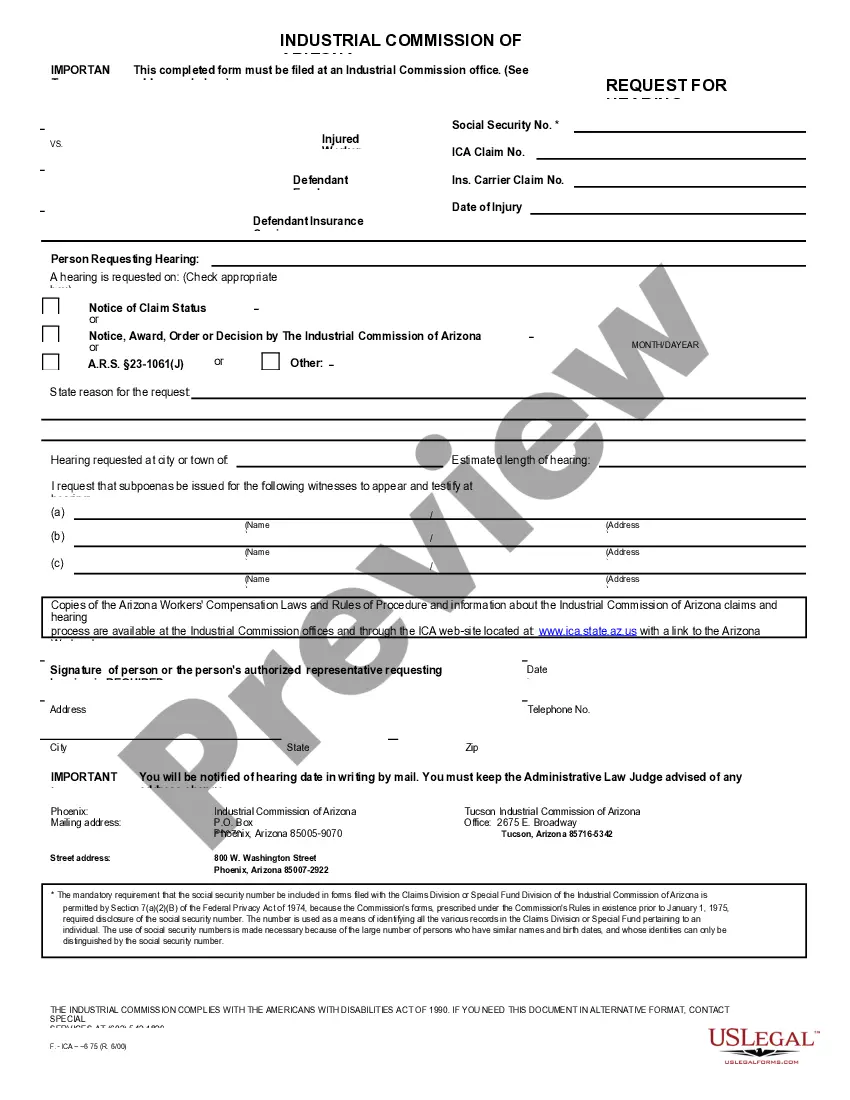

Ing to the IRS, donation tax receipts should include the following information: The name of the organization. A statement confirming that the organization is a registered 501(c)(3) organization, along with its federal tax identification number. The date the donation was made.

Here are basic donation receipt requirements in the U.S.: Name of the organization that received the donation. A statement that the nonprofit is a public charity recognized as tax-exempt by the IRS under Section 501(c)(3) Name of the donor. The date of the donation. Amount of cash contribution.

The IRS considers a business tax receipt to be any documentation that shows proof of the expense. This means that a business needs to hold on to any receipts it plans to show as proof of purchase when considering deductions from state and federal income tax returns.