Statement Social Security Sample For Taxes

Description

How to fill out Letter Or Statement To Social Security Administration In Order To Establish Claimant's Date Of Eligibility For Benefits?

Creating legal documents from the ground up can occasionally be intimidating.

Certain situations may require extensive research and substantial financial commitment.

If you seek a simpler and more economical method of preparing Statement Social Security Sample For Taxes or any other forms without unnecessary obstacles, US Legal Forms is readily accessible.

Our online repository of over 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal matters.

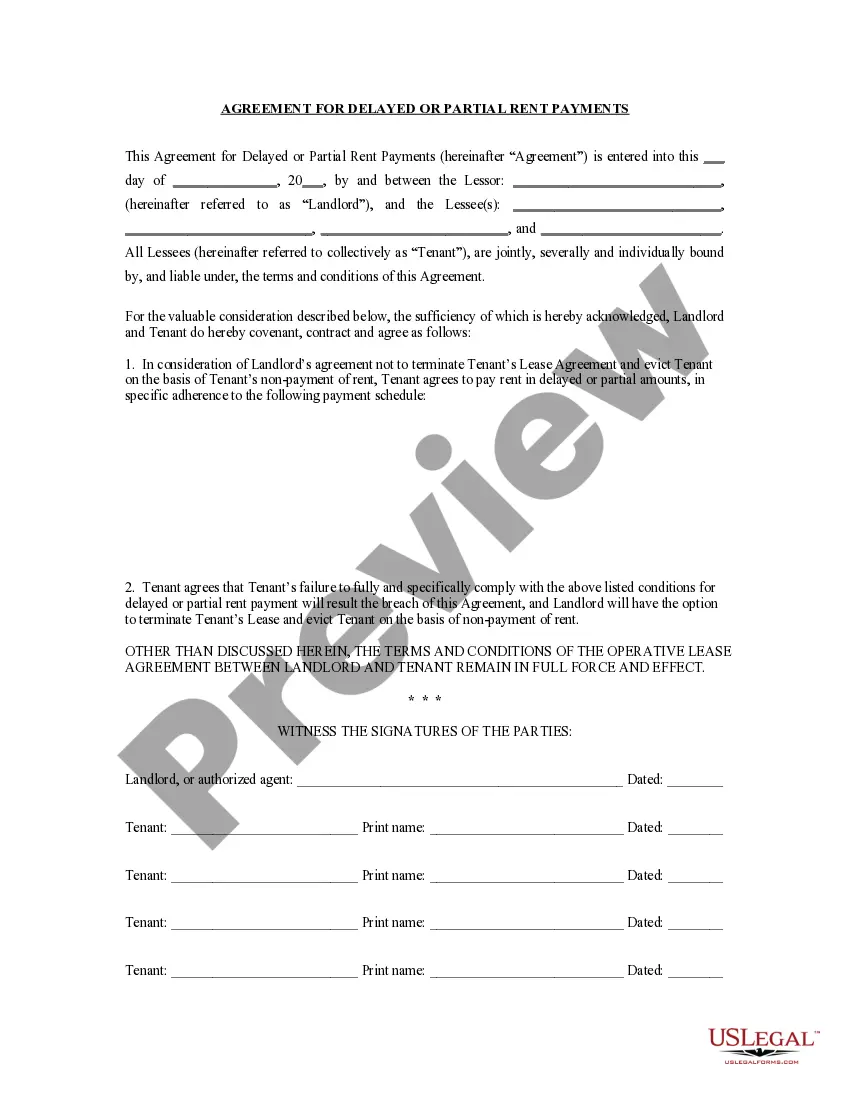

Review the form preview and descriptions to confirm that you have located the document you need. Ensure that the form you choose complies with the laws and regulations of your state and county. Select the most appropriate subscription plan to acquire the Statement Social Security Sample For Taxes. Download the document, then complete, sign, and print it. US Legal Forms enjoys a solid reputation and over 25 years of experience. Join us today and make document preparation a straightforward and efficient process!

- With just a few clicks, you can swiftly obtain state- and county-specific templates meticulously crafted by our legal professionals.

- Utilize our platform whenever you require a dependable and trustworthy service to easily locate and download the Statement Social Security Sample For Taxes.

- If you're familiar with our site and have previously established an account, simply Log In to your account, find the template, and download it or access it again later in the My documents section.

- Don't have an account? No problem. Setting it up takes just a few minutes, allowing you to browse the library.

- Before rushing to download the Statement Social Security Sample For Taxes, adhere to these guidelines.

Form popularity

FAQ

Your Social Security Statement shows how much you have paid in Social Security and Medicare taxes. It explains about how much you would get in Social Security benefits when you reach full retirement age.

Each January, you will receive a Social Security Benefit Statement (Form SSA-1099) showing the amount of benefits you received in the previous year. You can use this Benefit Statement when you complete your federal income tax return to find out if your benefits are subject to tax.

How can I get a form SSA-1099/1042S, Social Security Benefit Statement? Using your personal my Social Security account, and if you don't already have an account, you can create one online. ... Calling us at 1-800-772-1213 (TTY 1-800-325-0778), Monday through Friday, am ? pm.

The Social Security 1099 (SSA-1099) or Benefit Statement is a tax form Social Security mails each year in January. It shows the total amount of benefits you received from Social Security in the previous year, so you know how much Social Security income to report to the IRS on your tax return.

A Social Security card is legal proof of an SSN. In most cases, the actual card is not necessary but, if your agency or organization requires proof, and the person can't produce a card, there are other documents that show their SSN. If other documents are not available, that person will need a replacement card.