Trustee Site

Description

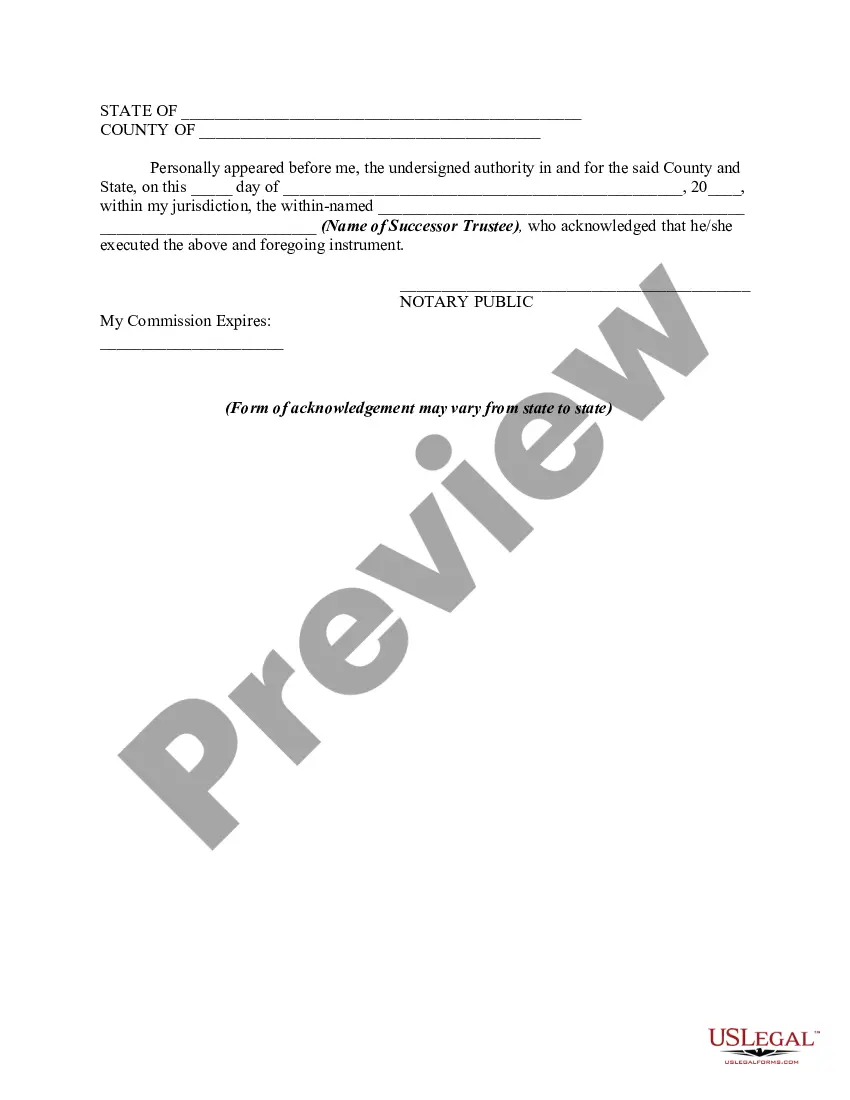

How to fill out Consent Of Successor Trustee To Appointment Following Resignation Of Original Trustee?

- Log in to your existing account if you have previously used the US Legal Forms service. Click the Download button to save your desired form template, ensuring your subscription is currently active. If it's expired, renew it based on your payment plan.

- For first-time users, start by checking the form descriptions and Preview mode. Verify you have selected the right document that aligns with your needs and complies with local jurisdiction requirements.

- If necessary, use the Search tab to find an alternative template. Ensure the selected form fits your requirements before progressing.

- Proceed to purchase the document by clicking the Buy Now button and selecting a preferred subscription plan. Register for an account to access our extensive library.

- Complete your purchase by entering your credit card details or utilizing your PayPal account. Once confirmed, download your form.

- Save the template on your device, allowing you to fill it out easily. Access it anytime through the My Forms menu in your profile.

In conclusion, utilizing the trustee site of US Legal Forms enables users to access an extensive collection of over 85,000 legal templates. This service not only simplifies the document preparation process but also connects them to premium experts for guidance.

Start your journey towards streamlined legal documentation today!

Form popularity

FAQ

Trustees are not personally liable for the trust's income taxes as long as they act within their duties. However, the trust itself may owe taxes on its income. It’s important to understand the distinction and maintain proper accounting for the trust’s financials. A trustee site can provide valuable insights into managing tax responsibilities.

The best person to appoint as trustee is someone trustworthy, organized, and knowledgeable about financial matters. This individual should have a clear understanding of their responsibilities and act impartially in the best interest of the trust beneficiaries. Consider discussing your options on a quality trustee site to find the right fit for your needs.

Yes, a trustee is required to file a tax return if the trust earns income. Filing ensures compliance with IRS regulations and helps avoid potential penalties. Each trust’s tax obligations may differ, so it’s wise to consult tax professionals or use a trustee site for specific guidance related to your situation.

Reporting trustee income involves filling out Form 1040 and including the income received from the trust. You should maintain precise records of all transactions to simplify this process. Additional forms may be required based on the situation, so it’s beneficial to consult a professional or utilize resources from a trustee site for clarity.

Yes, trustee fees must be reported to the IRS as they are considered taxable income. The trustee must provide appropriate documentation of the fees earned for the work performed. This ensures transparency and helps maintain trust integrity. You can find resources on a trustee site to better understand how to report these fees.

Serving as a trustee means you are entrusted with the responsibility of managing assets for the benefit of others according to a legal agreement. This role involves fiduciary duties, requiring you to act in the best interests of the beneficiaries while adhering to the trust's terms. Understanding your obligations and responsibilities is crucial for anyone serving in this capacity. You can find ample guidance on the US Legal site to help navigate this important role.

When you are a trustee, you take on significant legal and ethical responsibilities regarding the management of trust assets. This role involves making important decisions about investments, distributions, and the overall administration of the trust. Fulfilling these duties requires diligence and transparency to ensure that the beneficiaries' interests are prioritized. The US Legal site provides valuable resources to help trustees understand their obligations.

In the context of land, a trustee refers to an individual or organization that holds the title to real estate for the benefit of another party, known as the beneficiary. This arrangement allows the trustee to manage, sell, or lease the property according to the terms set forth in the trust. Understanding the nuances of land trusts is important for property owners and investors alike. The US Legal site can guide users through these complex scenarios.

To find out who a trustee is, you may review the trust document itself or court records if the trust has been subjected to legal proceedings. Additionally, beneficiaries can request information from the trustee or seek legal advice for assistance. Understanding the trustee's identity is crucial for beneficiaries to ensure transparency in the management of the trust. The US Legal site offers useful tools for locating this information.

Yes, a trustee can go to jail if they commit a crime such as embezzlement or fraud while managing trust assets. Mismanagement of funds or failure to act in the best interest of beneficiaries can lead to legal consequences. It is essential for trustees to understand their obligations and the potential repercussions of their actions. Resources available on the US Legal site can further explain these legal responsibilities.