Trustee Empresa

Description

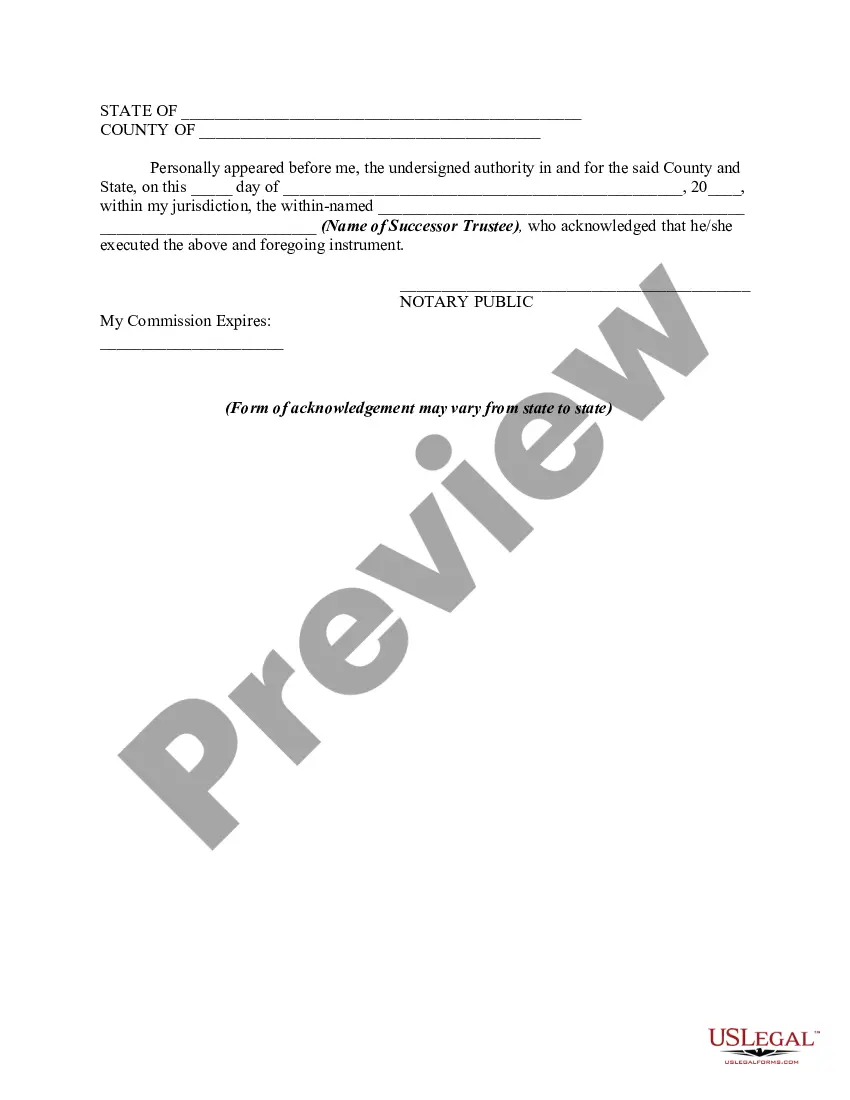

How to fill out Consent Of Successor Trustee To Appointment Following Resignation Of Original Trustee?

- If you're a returning user, log in to your account and download your desired form by clicking the Download button, ensuring your subscription is active.

- New to our service? Begin by browsing through the form descriptions and preview mode. Confirm that you select the correct document that aligns with your jurisdiction.

- If you find that the initial form isn't suitable, utilize the Search tab to look for alternatives. Once you've found the right form, proceed to the next step.

- Purchase the document by clicking on the Buy Now button. Choose your preferred subscription plan, and register an account to access our extensive library.

- Complete your payment by entering your credit card information or using your PayPal account to finalize the subscription.

- Download the selected form and save it to your device. You can easily revisit it later in the My Forms section of your profile.

In conclusion, US Legal Forms empowers you to efficiently manage your trustee empresa with its vast collection of over 85,000 legal forms. Whether you're a returning user or just getting started, our platform ensures a user-friendly experience.

Take control of your legal documentation today with US Legal Forms and simplify your trustee management. Start now!

Form popularity

FAQ

A trustee can be either a person or an entity, depending on the specific trust structure and requirements of the beneficiaries. Individual trustees can offer a personal touch, while entity trustees may provide more comprehensive resources and expertise. It's essential to evaluate the pros and cons of each option before making a choice. Engaging with a reputable trustee empresa can help clarify which arrangement suits your situation best.

A trustee can be an entity, such as a bank or a trust company, or an individual person. When selecting a trustee, consider whether an institution or an individual best aligns with your needs and goals. The choice can impact the management and oversight of the trust. A trusted trustee empresa can provide stability and professional administration of assets.

Legally, a trust does not count as a distinct entity like a corporation or a partnership, but it serves as an arrangement that governs the ownership of assets. The trust holds assets, which are managed by a trustee in the interest of its beneficiaries. This structure allows trusts to accomplish goals such as estate planning or asset protection efficiently. By leveraging a trustee empresa, individuals can effectively utilize the benefits of trust arrangements.

A trust is primarily a legal relationship, defined by the agreement between the trustor, trustee, and beneficiaries. This relationship creates a framework for managing assets in a way that meets the intentions of the trustor. While the trust itself is not an entity, it can involve various organizational structures for management purposes. Recognizing this distinction is important when setting up a trustee empresa.

The role of a trustee is to manage and protect the assets held in a trust for the benefit of the beneficiaries. This includes making investment decisions, distributing income or principal, and ensuring compliance with legal requirements. The trustee acts in the best interest of the beneficiaries while maintaining transparency and accountability. Trusts administered by a trustee empresa are designed to safeguard assets and ensure proper management.

A trustee can indeed be a person, but it can also refer to a business entity. The choice between an individual or an organization often depends on the specific needs of the trust and its beneficiaries. Regardless of form, the trustee must fulfill fiduciary duties effectively to manage trust assets responsibly. Therefore, understanding the options available for a trustee empresa is essential.

The ESOP trustee is a designated individual or entity that manages the assets within an Employee Stock Ownership Plan (ESOP). This trustee has a fiduciary duty to act in the best interest of the plan participants. By overseeing the trust and ensuring compliance with regulations, the trustee ensures that employees benefit from ownership in their company. Ensuring transparency and adherence to legal standards is crucial in the role of the trustee empresa.

Qualifications for a trustee typically include financial literacy, experience with trust management, and strong ethical judgment. It’s important for a trustee to understand legal obligations and responsibilities that come with managing a trust. Consider a professional trustee empresa if you seek expertise.

A suitable trustee must possess qualities like reliability, financial understanding, and integrity. Family members, friends, or professionals can fulfill this role, but each choice has considerations. You might find a professional at uslegalforms helpful for a neutral and informed approach.

A family trust can provide protection and tax benefits, but it also has drawbacks. For instance, family dynamics might complicate decision-making if disagreements arise among family members. It's crucial to navigate these relationships thoughtfully to ensure smooth management.