Trustee E Trust

Description

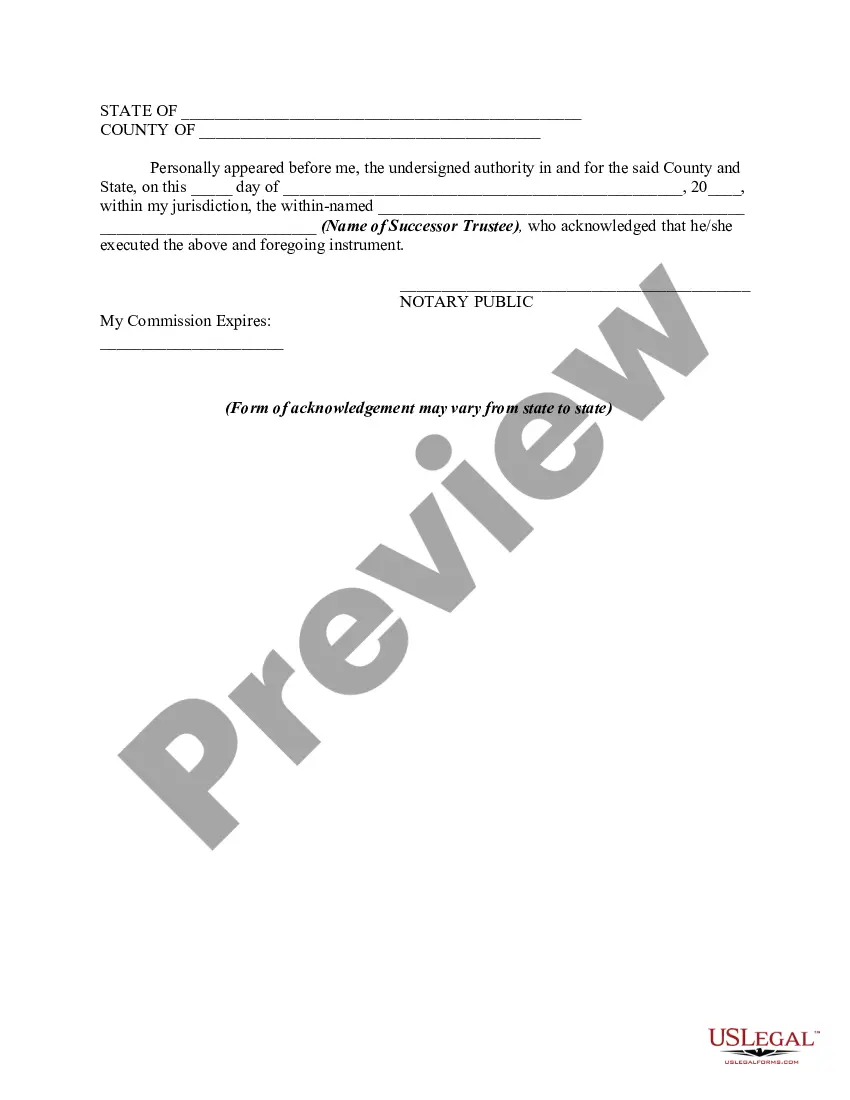

How to fill out Consent Of Successor Trustee To Appointment Following Resignation Of Original Trustee?

- Access your account: If you’ve used US Legal Forms before, simply log in to your account. If not, create one to begin your journey.

- Select your document: Browse the extensive library and check the previews and descriptions closely to confirm the form meets your legal needs and jurisdiction.

- Search efficiently: If you need a different template, utilize the Search tab to find suitable options that ensure accuracy and relevance.

- Purchase your chosen form: Click the Buy Now button and select a subscription plan that suits you best to unlock the full library of forms.

- Complete your transaction: Input your payment details—credit card or PayPal—and finalize your purchase to gain access to your forms.

- Download your document: Save the form onto your device for easy completion and find it anytime in the My Forms section of your profile.

With US Legal Forms, you can rest assured that you are relying on a robust system that offers a wide variety of legal documents, more than what competitors provide at a similar cost. You can also access premium expert assistance for form completion, making sure your documents are correct and legally binding.

In conclusion, navigating the legal landscape is made easier with US Legal Forms. By following these steps, you can efficiently manage your legal document needs. Don’t hesitate—get started today and secure the forms you require!

Form popularity

FAQ

The three types of trusts commonly encountered are revocable trusts, irrevocable trusts, and charitable trusts. Each type serves a unique purpose, from providing flexibility in managing assets to ensuring that charitable contributions are fulfilled. These trusts can efficiently manage wealth and meet specific financial goals. It’s important to evaluate which option suits your needs when planning your trustee e trust.

A trustee has various powers, including managing the trust assets, making investment decisions, and distributing assets to beneficiaries according to the trust provisions. Essentially, the trustee acts in the best interest of the beneficiaries while adhering to the terms set forth by the granter. This responsibility can be significant, emphasizing the importance of selecting a trustworthy individual or institution to serve as the trustee in your trustee e trust.

An irrevocable trust is owned by the trust itself, not by the granter. Once the assets are transferred into the trust, the granter relinquishes control over them, which can offer potential tax benefits and asset protection. This unique structure helps in estate planning and ensures that assets are held for the benefit of the beneficiaries. Understanding this concept is vital when considering the establishment of a trustee e trust.

The three main types of trusts include revocable trusts, irrevocable trusts, and testamentary trusts. Revocable trusts can be altered by the granter during their lifetime, while irrevocable trusts cannot be changed once established. Testamentary trusts are created through a will and become effective after the granter's death. Each type serves different purposes, so choose the one that aligns with your goals in establishing a trustee e trust.

No, a trustee is not the same as a trust. The trustee is the person or entity responsible for managing the trust’s assets and follows the terms set out in the trust document. In contrast, the trust itself is a legal arrangement that holds assets for beneficiaries. Thus, understanding the distinct roles is crucial when setting up your trustee e trust.

The most common form of trust is the revocable living trust. This type allows individuals to manage their assets during their lifetime while providing a clear plan for distribution after death. With a revocable living trust, the granter can alter the terms at any time, ensuring flexibility. Utilizing a revocable living trust can help streamline the estate planning process and avoid probate, making it a favored choice.

Finding the right trustee for a trust involves assessing potential candidates' trustworthiness and expertise. Start by discussing your needs with family or close friends who may be suitable, or consider hiring a professional trustee from a reputable institution. You can also use platforms like uslegalforms to explore options and review candidates' qualifications conveniently. A well-chosen trustee e trust can help ensure your trust operates smoothly and meets its goals.

To become a trustee, one typically needs to be at least 18 years old and mentally competent. It's also beneficial to have a basic understanding of financial management and legal obligations. While having a background in finance or law can help, being honest and committed to the beneficiaries' best interests is paramount. The trustee e trust invites you to seek resources or guidance if you are unsure about meeting these requirements.

Not everyone can serve as a trustee of a trust; the individual must be legally competent and often must meet certain qualifications specified in the trust document. While close relatives or friends are common choices, professionals like attorneys or accountants can also be appointed. Understanding these criteria is vital to ensure that your trustee e trust functions effectively for your needs.

When choosing a trustee for a trust, consider an individual or a professional who is trustworthy, responsible, and knowledgeable about financial matters. Ideally, this person should have a good understanding of the trust's objectives and the needs of the beneficiaries. Family members, friends, or professional advisors often serve well in this capacity. Choosing the right trustee e trust can make a significant difference in ensuring the trust's success.