Writ Of Garnishment Meaning

Description

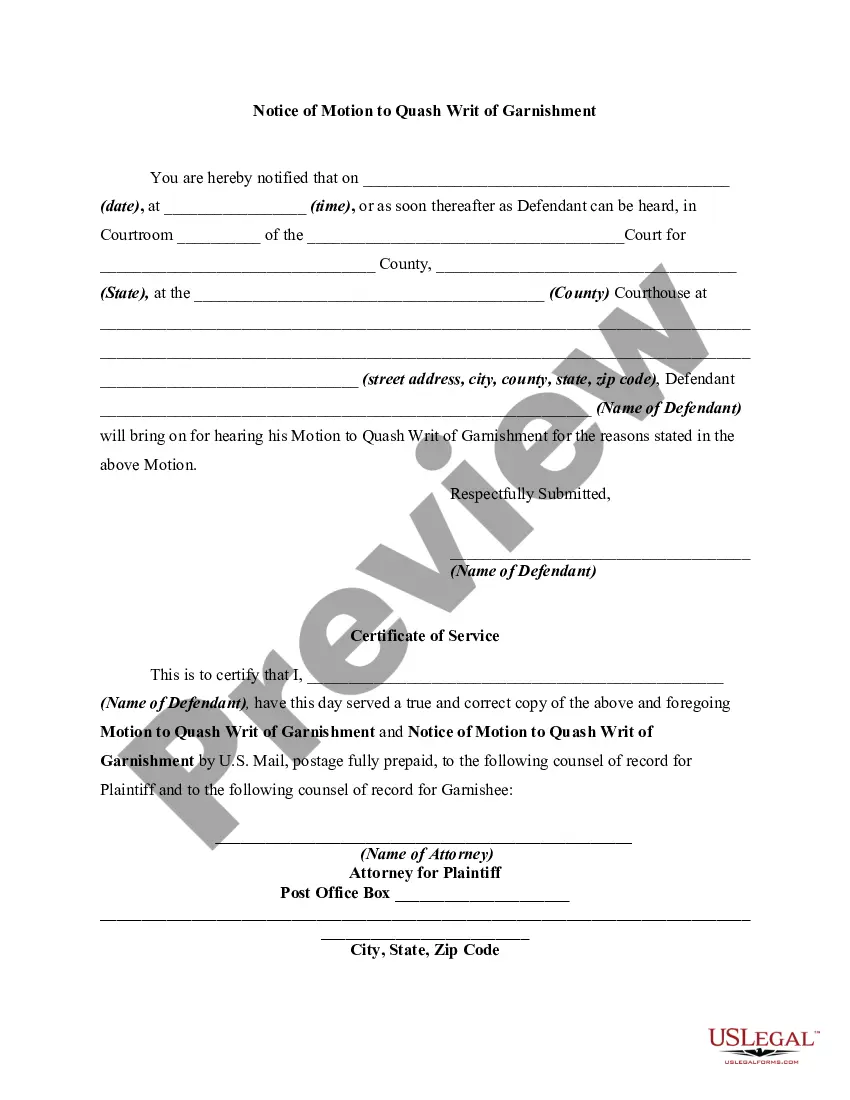

How to fill out Motion Of Defendant To Discharge Or Quash Writ Of Garnishment And Notice Of Motion?

- If you are a returning user, log into your account and find the required form in your library. Ensure your subscription is active or renew it if needed.

- For newcomers, start by checking the document preview and its description to confirm it meets your needs and local regulations.

- If necessary, utilize the Search function to find an alternative template that fits your requirements.

- Purchase the document by clicking on the Buy Now button and selecting your desired subscription plan, then create an account to access the forms.

- Complete your payment by entering your credit card information or using your PayPal account to finalize the subscription.

- Download your selected form to your device for completion, and also access it anytime later in the My Forms section.

In conclusion, US Legal Forms provides an extensive and user-friendly platform that empowers clients to navigate the complexities of legal documentation. With over 85,000 fillable forms and access to premium expert assistance, your documents are guaranteed to be precise and compliant.

Don’t wait—begin your legal journey today with US Legal Forms!

Form popularity

FAQ

After a judgment is issued, a creditor usually has a specific time frame to collect the debt, which often ranges from 5 to 20 years depending on the state’s laws. This period is crucial because it defines the creditor's rights to pursue collection efforts, including the use of a writ of garnishment. Knowing the writ of garnishment meaning can empower you to understand how these processes affect you. If you need assistance with debt collection issues, US Legal Forms offers a wealth of information and tools to guide you.

The duration for processing a writ of garnishment can vary based on jurisdiction and the specifics of the case. Typically, it may take a few weeks from the time the paperwork is filed until the funds are actually garnished. Understanding the writ of garnishment meaning is crucial, as it helps clarify this process. To navigate these timelines effectively, consider using US Legal Forms, which offers resources to help you understand and expedite the process.

After receiving a writ of garnishment, it’s important to review the order and understand its implications. Consider discussing with a legal expert to explore your options. You may want to negotiate with the creditor or consider ways to contest the garnishment. Having a clear grasp of the writ of garnishment meaning will empower you as you make decisions moving forward.

Typically, the amount garnished from your paycheck cannot exceed 25% of your disposable income, as defined by federal guidelines. However, some debts may have specific regulations that could affect this percentage. It's crucial to know the writ of garnishment meaning as it relates to your financial situation. If you're facing this issue, consider consulting resources available on uslegalforms to better understand your rights.

The maximum amount that can be garnished from your wages generally depends on your disposable income and state laws. Under federal law, the maximum garnishment is usually 25% of your disposable earnings. This can have a significant impact on your finances. Understanding the writ of garnishment meaning can help you navigate these limits effectively.

To write a letter to stop garnishment, begin by clearly addressing the relevant parties involved in the garnishment action. Include your personal details and the details of the court case. Explain your reasons for requesting the cessation of the garnishment, incorporating the writ of garnishment meaning to strengthen your argument. A well-structured letter can effectively communicate your intent, and resources from US Legal Forms may assist you in drafting this letter.

Filling out a challenge to garnishment form involves several steps to ensure accuracy and compliance with legal requirements. Start by clearly stating your personal information, including your name, address, and the case number. Then, provide a concise explanation of your objections to the garnishment, referencing the writ of garnishment meaning to support your position. Utilizing the resources on the US Legal Forms platform can simplify this process further.

In legal terms, a writ is a formal order issued by a court. It directs an individual or entity to take a specific action. Understanding the writ of garnishment meaning helps clarify this process, as it typically commands a third party to withhold funds or property to satisfy a debt owed by another party.

Receiving a writ of garnishment can be alarming, but it's essential to stay calm and take action promptly. First, verify the legitimacy of the writ by reviewing the court documents. Understanding the writ of garnishment meaning can help you navigate your options, whether that's negotiating with your creditor or seeking legal help. For a clearer understanding of your rights and steps to take, consider the resources available through US Legal Forms.

The federal law typically allows garnishment to reach a maximum of 25% of your disposable income. However, special cases, such as child support or federal tax debts, can carry higher limits. Understanding the writ of garnishment meaning is vital for recognizing how much of your income creditors can legally take. If you're unsure about calculations or laws, look to US Legal Forms for resources that can assist you.