Continuing Writ Garnishment Florida Without Notice

Description

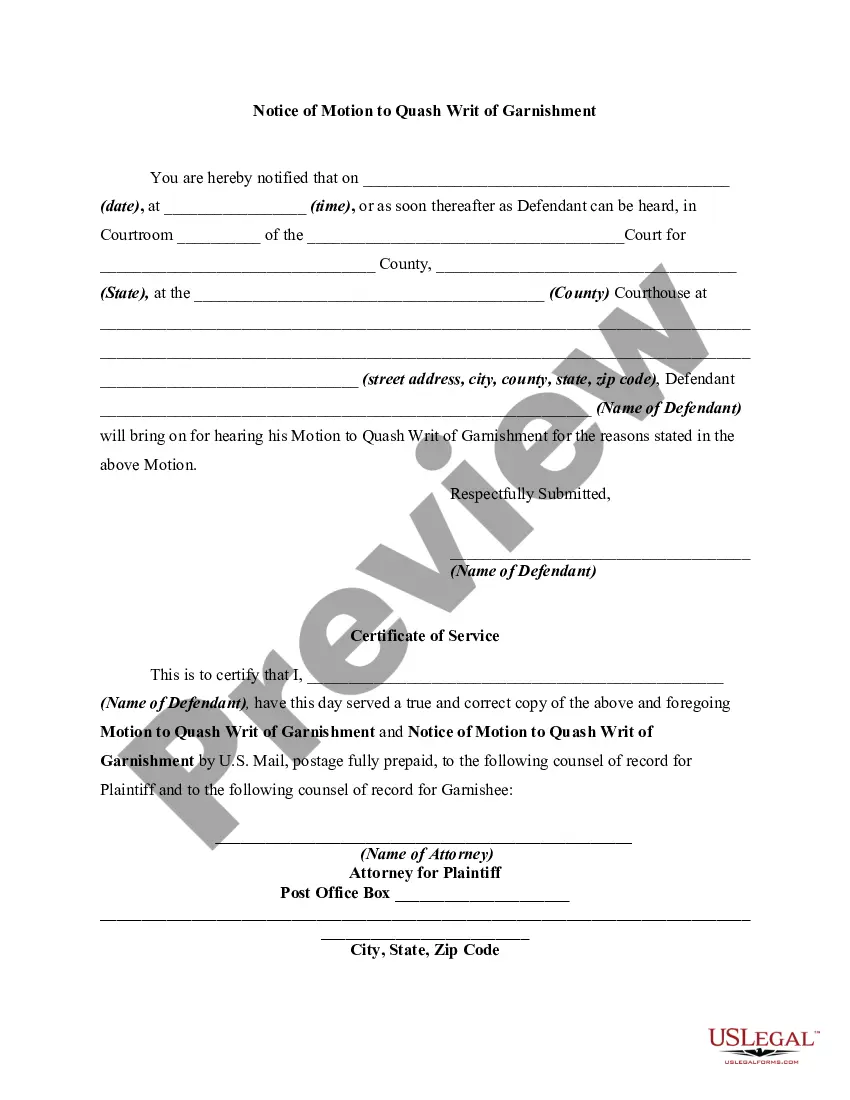

How to fill out Motion Of Defendant To Discharge Or Quash Writ Of Garnishment And Notice Of Motion?

Locating a reliable source for accessing the latest and suitable legal templates is a significant part of navigating bureaucracy.

Identifying the appropriate legal documents requires accuracy and meticulousness, which is why it is crucial to obtain samples of Continuing Writ Garnishment Florida Without Notice exclusively from trustworthy sources, such as US Legal Forms. An incorrect template can consume your time and delay your situation.

Eliminate the inconvenience associated with your legal documents. Browse the extensive US Legal Forms catalog to find legal templates, verify their applicability to your situation, and download them instantly.

- Utilize the catalog navigation or search bar to find your template.

- Review the form's description to confirm it meets the requirements of your state and locality.

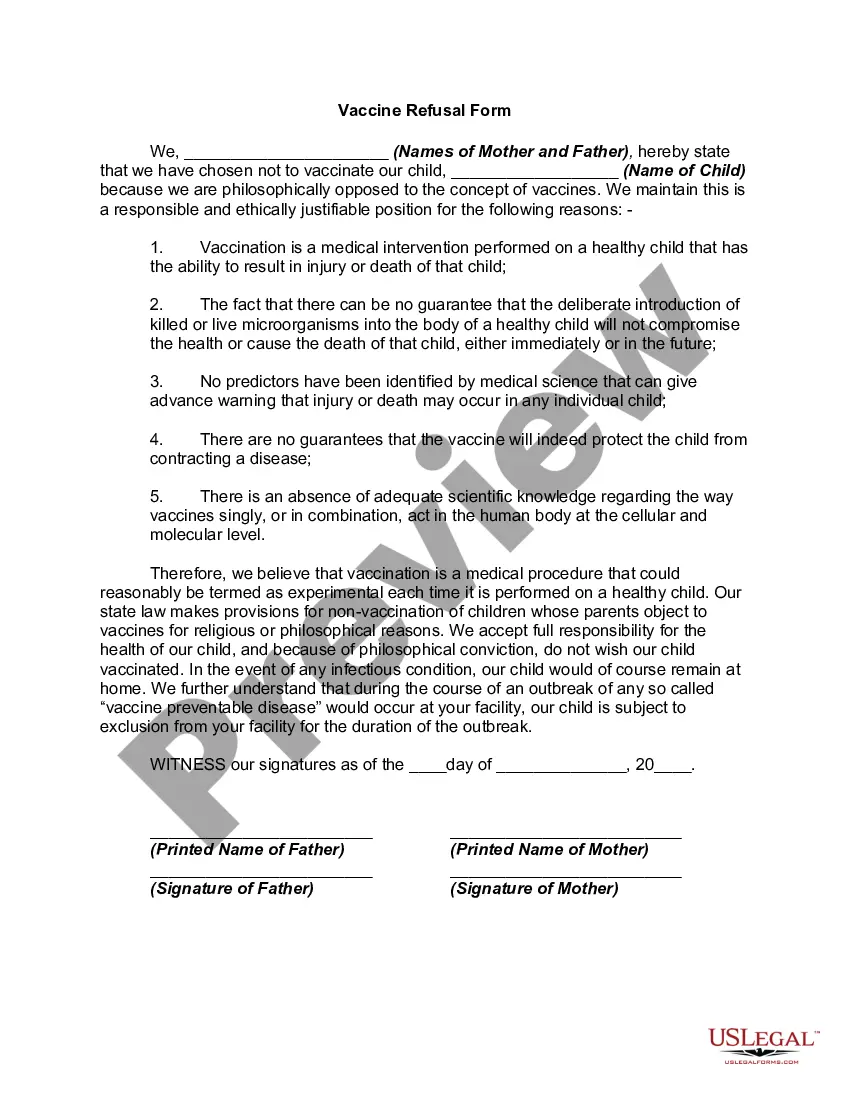

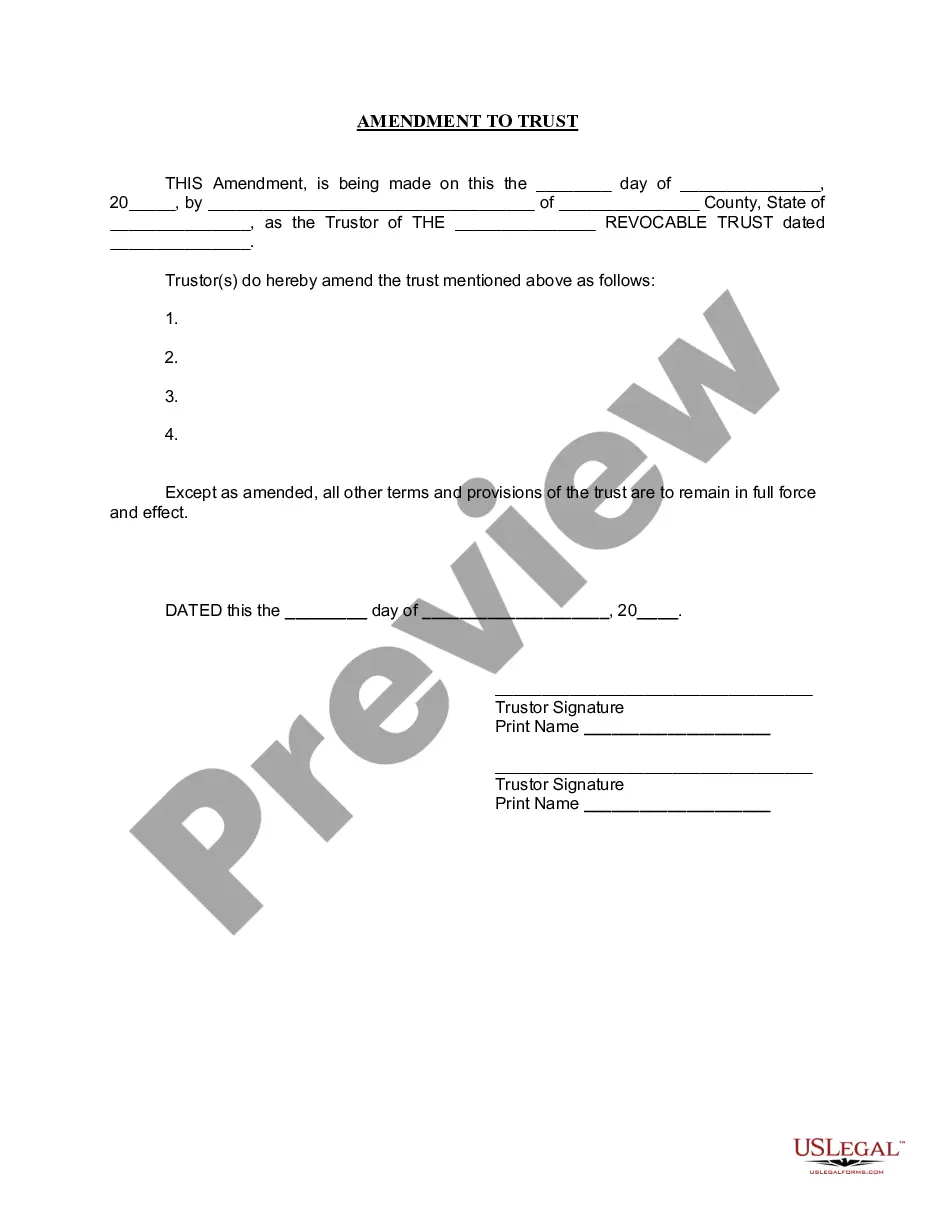

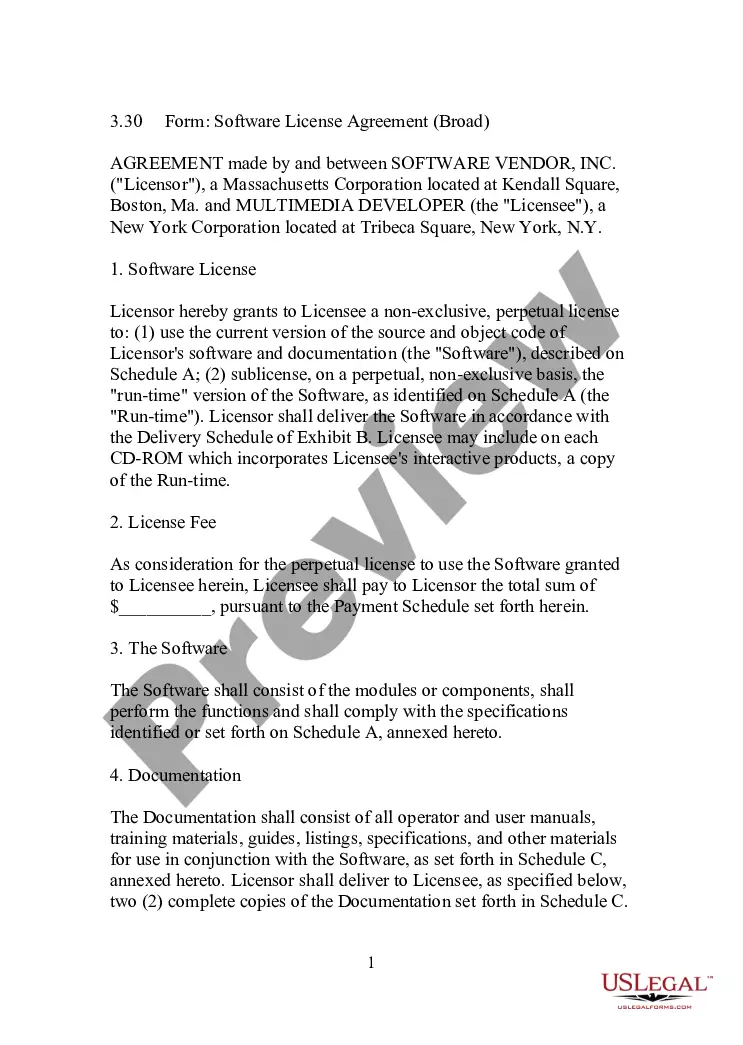

- Access the form preview, if available, to ensure it is the document you need.

- Return to the search and find the correct template if the Continuing Writ Garnishment Florida Without Notice does not satisfy your requirements.

- If you are certain about the form's relevance, download it.

- As a registered user, click Log in to verify your identity and gain access to your selected forms in My documents.

- If you don't have an account yet, click Buy now to acquire the template.

- Select the pricing plan that suits your needs.

- Proceed to register to finalize your purchase.

- Complete your payment by choosing a transaction method (credit card or PayPal).

- Select the document format for downloading Continuing Writ Garnishment Florida Without Notice.

- After you have the form on your device, you can modify it using the editor or print it out to complete it manually.

Form popularity

FAQ

PURPOSE OF FORM Use Form N-358 to figure and claim the health- care preceptor income tax credit under section 235-110.25, Hawaii Revised Statutes (HRS).

Purpose of Form Use Form N-163 to figure and claim the fuel tax credit for commercial fishers under sections 235-110.6, HRS, and 18-235- 110.6, Hawaii Administrative Rules.

Hawaii recognizes the federal S corporation election and does not require a state-level S corporation election.

To form an S Corp in California, you must file Form 2553 (Election by a Small Business Corporation) with the IRS and then complete additional requirements with the state of California, including filing articles of incorporation, obtaining licenses and permits, and appointing directors.

An LLC can choose to be treated as an S corporation in a two-step process: File a Form 8832, Entity Classification Election. This causes the business to be taxed as a C corporation. Then file Form 2553 to elect an S corporation tax structure.

To form a Hawaii S corp, you'll need to ensure your company has a Hawaii formal business structure (LLC or corporation), and then you can elect S corp tax designation. If you've already formed an LLC or corporation, file Form 2553 with the Internal Revenue Service (IRS) to designate S corp taxation status.

Form N-35 is used to report the income, de- ductions, gains, losses, etc., of an S corporation doing business in Hawaii.

To register a business as an S corporation, Articles of Incorporation (sometimes called a Certificate of Incorporation or Certificate of Formation), must be filed with the state and the necessary filing fees paid. After incorporation, Form 2553 must be filed with the IRS in order to elect S corporation status.