Complaint Promissory Note Without Interest Tax Implications

Description

How to fill out Complaint For Past Due Promissory Note?

What is the most reliable platform to obtain the Complaint Promissory Note Without Interest Tax Consequences and other current versions of legal documentation? US Legal Forms is the solution! It boasts the best assortment of legal documents for any situation. Each sample is meticulously crafted and confirmed for compliance with federal and local regulations.

They are categorized by region and state of application, making it easy to find exactly what you need.

Alternative document search. If there are any discrepancies, use the search bar in the header to find another sample. Click Buy Now to select the appropriate one. Registration and subscription payment. Choose the most appropriate pricing plan, Log In or register an account, and pay for your subscription via PayPal or credit card. Downloading the document. Choose the format in which you want to save the Complaint Promissory Note Without Interest Tax Implications (PDF or DOCX) and click Download to get it. US Legal Forms is an ideal option for anyone who needs to handle legal paperwork. Premium users can enjoy even more features as they can complete and authorize previously saved documents electronically at any time using the built-in PDF editing tool. Explore it today!

- Experienced users of the site only need to Log In to the platform, check if their subscription is active, and click the Download button next to the Complaint Promissory Note Without Interest Tax Implications to obtain it.

- Once saved, the sample remains accessible for future use within the My documents section of your account.

- If you don't yet have an account with us, here are the steps you need to follow to create one.

- Form compliance confirmation. Before acquiring any template, ensure it meets your use case requirements and adheres to your state or county laws. Review the form description and utilize the Preview if available.

Form popularity

FAQ

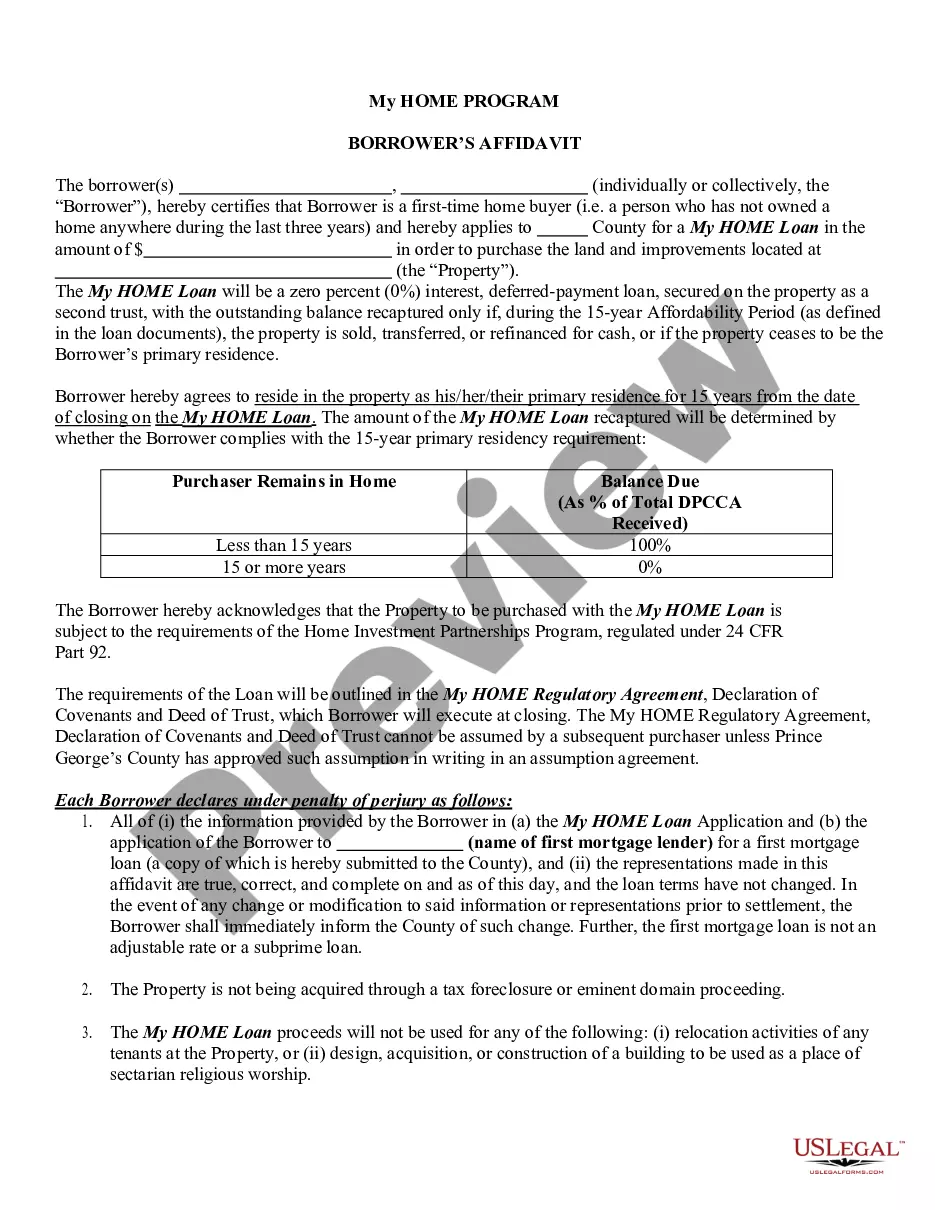

The buyer doesn't want to have to pay interest, and the seller feels funny asking for it, so they agree, no interest. Unfortunately, the IRS may impute interest received to the seller, even if the parties agreed to zero interest or a rate below the IRS' published rates.

Principal and interest are payable in lawful money of the United States of America. Maker may prepay this Note in full or in part at any time without a prepayment charge. DEFAULT/ACCELERATION.

A simple promissory note will state the full amount is due on the stated date; you won't need a payment schedule. You can decide whether to charge interest on the loan amount and include the interest in the document if needed.

Generally, any income you generate from a promissory note is taxable income and must be reported. The income generated is simply the interest you earned on the note for the tax year in question. If you lent the money personally rather than through your business, report the income on your personal income tax return.

If you are receiving the promissory interest, enter it as if you received form 1099-INT. In the Received from box, you may enter Promissory Note Interest Income and the name and any tax ID, if you have it. Only the amount is required however.