Special Assessment Lien Example

Description

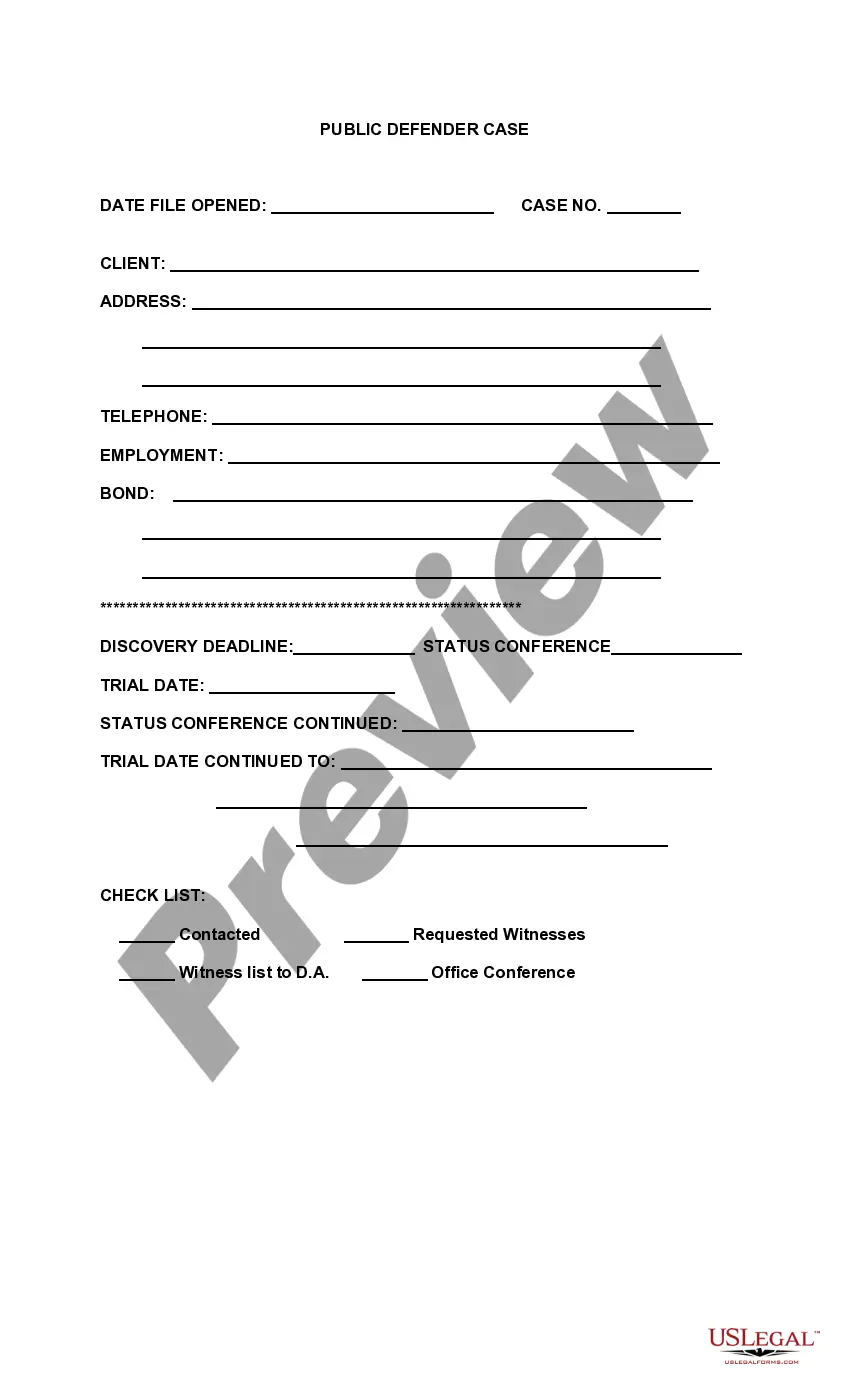

How to fill out Notice Of Lien To A Condominium Unit Owner For Unpaid Assessment Fees?

Creating legal documents from the ground up can frequently be overwhelming.

Some situations may necessitate extensive research and significant expenses.

If you're seeking a more straightforward and economical method of generating Special Assessment Lien Example or any other documents without hassle, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal templates covers nearly every aspect of your financial, legal, and personal matters.

Review the document preview and descriptions to confirm that you have located the form you need. Ensure that the form you select meets the standards of your state and county. Choose the most appropriate subscription option to purchase the Special Assessment Lien Example. Download the file, then fill it out, certify it, and print it. US Legal Forms enjoys a solid reputation with over 25 years of experience. Join us today and make document completion effortless and efficient!

- With just a few clicks, you can swiftly obtain state- and county-compliant documents meticulously prepared by our legal experts.

- Utilize our platform whenever you require a trustworthy and dependable source through which you can easily locate and download the Special Assessment Lien Example.

- If you’re familiar with our services and have previously registered an account with us, simply Log In to your account, find the form you need, and download it or retrieve it later from the My documents section.

- Don’t have an account? No worries. It takes minimal time to register and browse the catalog.

- Before diving straight into downloading the Special Assessment Lien Example, consider these suggestions.

Form popularity

FAQ

A special assessment is a type of statutory lien levied by local governments. This lien specifically ties to a property and is based on the benefits derived from public improvements. Homeowners may face a special assessment lien example when their area undergoes improvements that are financed through these assessments.

Examples of specific liens include mortgage liens, tax liens, and special assessment liens. Each type has its characteristics and implications for property owners. When exploring special assessment lien examples, it's crucial to understand how these liens affect your property and any potential selling scenarios.

The primary purpose of a special assessment is to fund specific public projects that benefit a particular group of properties. For instance, local governments impose these assessments to cover the costs of street repairs or community parks. By doing so, they ensure that the properties receiving benefits contribute fairly to the expenses incurred.

A common example of a special assessment property tax is when a local government funds a road construction project. Homeowners in the affected area may receive a special assessment lien to cover costs associated with the project. This tax provides funds for infrastructure improvements that enhance property values and community convenience.

The two primary types of liens are specific liens and general liens. A specific lien applies to a specific property, ensuring that the obligation is tied directly to that asset, such as a mortgage or a special assessment lien. On the other hand, a general lien affects all assets owned by the debtor. Knowing the difference can help you navigate financial responsibilities effectively, and platforms like USLegalForms can assist you in understanding and managing these liens.

Which statement MOST accurately describes special assessment liens? They take priority over mechanics' liens.

A special assessment tax is a surtax levied on property owners to pay for specific local infrastructure projects such as the construction or maintenance of roads or sewer lines. The tax is charged only to the owners of property in the neighborhood that will benefit from the project.

Generally, priority of a special assessment lien is dictated by a local government ordinance. In one case, an ordinance dictated that special assessment liens after a certain date will be equal to ad valorem taxes and, therefore, superior to all other liens.

The betterment levy or special assessment (as it is known in the United States) is a ?compulsory charge imposed by a government on the owners of a selected group of properties to defray, in whole or in part, the cost of a specific improvement or services that is presumed to be of general benefit to the public and of ...