Condo Lien Foreclosure With Tax

Description

How to fill out Notice Of Lien To A Condominium Unit Owner For Unpaid Assessment Fees?

Whether for professional reasons or for personal issues, everyone must deal with legal matters at some point in their lives.

Completing legal paperwork requires meticulous consideration, starting with choosing the correct form template.

With an extensive US Legal Forms catalog available, you never have to waste time searching for the appropriate template online. Utilize the library’s straightforward navigation to find the right template for any circumstance.

- Locate the template you require through the search bar or catalog navigation.

- Review the form’s description to confirm it aligns with your case, state, and locality.

- Select the form’s preview to examine it.

- If it is the incorrect document, return to the search function to find the Condo Lien Foreclosure With Tax sample you seek.

- Download the template once it meets your needs.

- If you already possess a US Legal Forms account, simply click Log in to access previously stored files in My documents.

- If you do not have an account yet, you may acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Fill out the account registration form.

- Select your payment method: utilize a credit card or PayPal account.

- Choose the document format you prefer and download the Condo Lien Foreclosure With Tax.

- Once saved, you can complete the form using editing software or print it and finish it manually.

Form popularity

FAQ

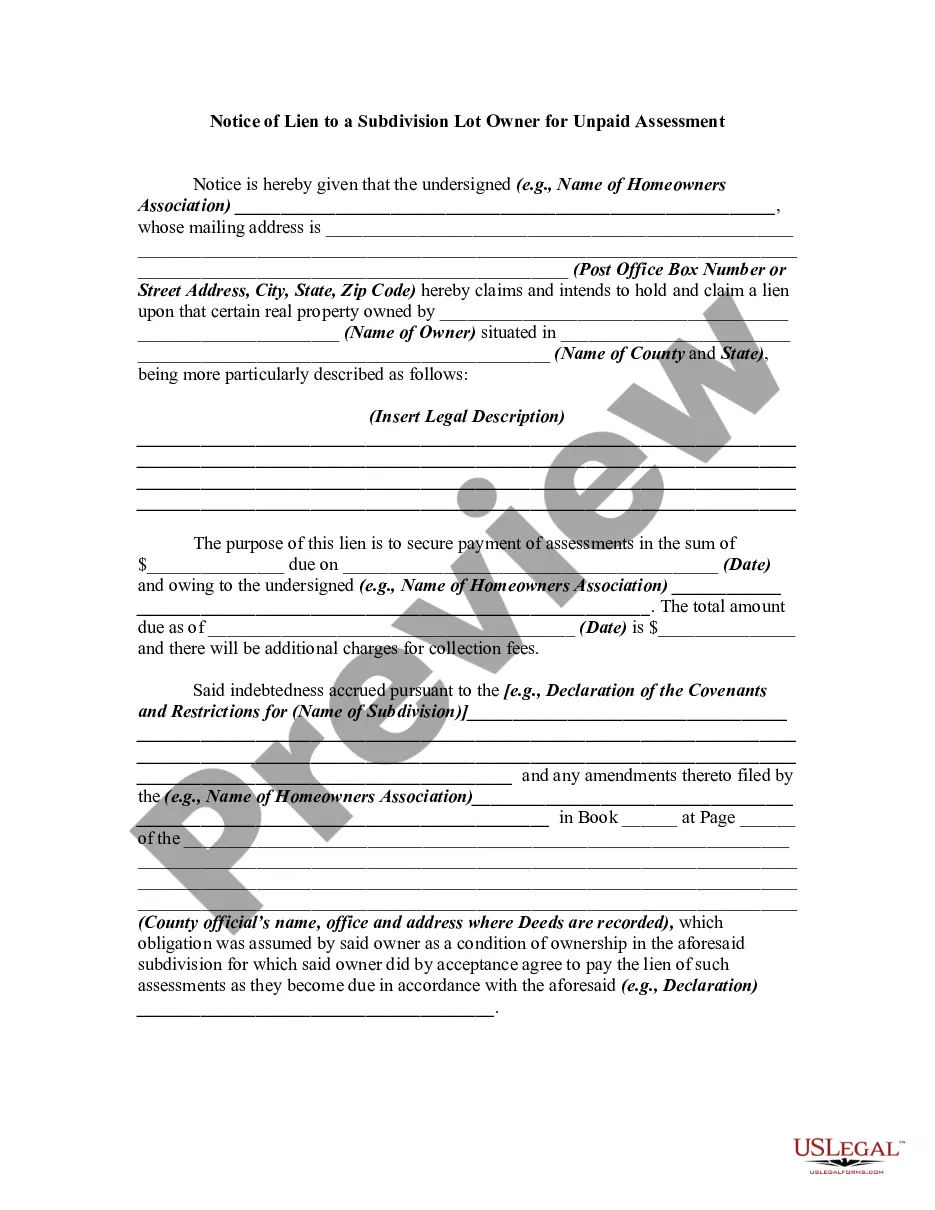

A tax lien foreclosure works by allowing the government to sell a lien on a property due to unpaid taxes. This process often leads to a condo lien foreclosure with tax, where the property is auctioned to recover the owed amount. Buyers can then bid on the property and potentially acquire it for a fraction of its value. Understanding the intricacies of this process can enhance your investment strategy.

Typically, a homeowner must be several months behind on taxes before facing foreclosure. The exact timeframe varies by state, but it generally takes about one to three years of unpaid taxes for a condo lien foreclosure with tax to occur. It's crucial to stay up-to-date on tax payments to avoid losing your property. Consider consulting resources like US Legal Forms for guidance on managing tax obligations.

When a condo goes into foreclosure, the property is typically sold at a public auction to recover unpaid debts. This process can lead to a condo lien foreclosure with tax, where the unpaid taxes are settled from the sale proceeds. Homeowners may lose their rights to the property, and investors often seek these opportunities for potential gains. Understanding the foreclosure process can help you make informed decisions.

Buying tax liens can come with risks. One downside is the potential for the property owner to redeem the lien, which means you may not gain ownership of the condo. Additionally, if the property is in poor condition, the condo lien foreclosure with tax may not yield a profit. It's essential to conduct thorough research before making any purchases.

Foreclosing on a tax lien property involves a legal process where the lienholder seeks to claim the property due to unpaid taxes. To initiate a condo lien foreclosure with tax, you must follow state-specific procedures, including notifying the property owner and filing necessary documents. This process can be intricate, so using resources like USLegalForms can guide you through the legal requirements and help you understand your rights.

When a lien is placed on a condo, it signifies that the property has an outstanding debt, typically related to unpaid bills or taxes. This situation can complicate ownership, especially if the condo faces a condo lien foreclosure with tax. The lien must be resolved before you can sell the property or clear the title. Addressing these issues promptly can save you from further complications.

Yes, you can foreclose on a house with a tax lien, but the process may be more complicated. The tax lien takes priority over other types of liens, which may affect the foreclosure proceedings. If you're facing a condo lien foreclosure with tax, consider using platforms like US Legal Forms to navigate the legal complexities involved.

If there is a lien on your condo, it means that a creditor has a claim against your property due to unpaid debts. This can complicate your ability to sell or refinance your condo. If the debt is not settled, it could lead to a condo lien foreclosure with tax, putting your property at risk.

In Arkansas, you can be delinquent on property taxes for up to two years before the local government can initiate a tax lien foreclosure. During this period, interest and penalties may accrue, increasing your total debt. It's wise to address any delinquent taxes promptly to avoid a condo lien foreclosure with tax.

Federal tax liens do not automatically get wiped out during a foreclosure process. However, the priority of the lien may affect how it is addressed in the sale. When dealing with condo lien foreclosure with tax, it's crucial to consult a legal expert to understand your specific situation and the implications of federal tax liens.