Assessment Lien Without A Contract

Description

How to fill out Notice Of Lien To A Condominium Unit Owner For Unpaid Assessment Fees?

It’s clear that you cannot become a legal expert instantly, nor can you swiftly grasp how to prepare an Assessment Lien Without A Contract without having a specific background.

Compiling legal documents is a lengthy process that demands specialized training and skills.

So why not entrust the creation of the Assessment Lien Without A Contract to the specialists.

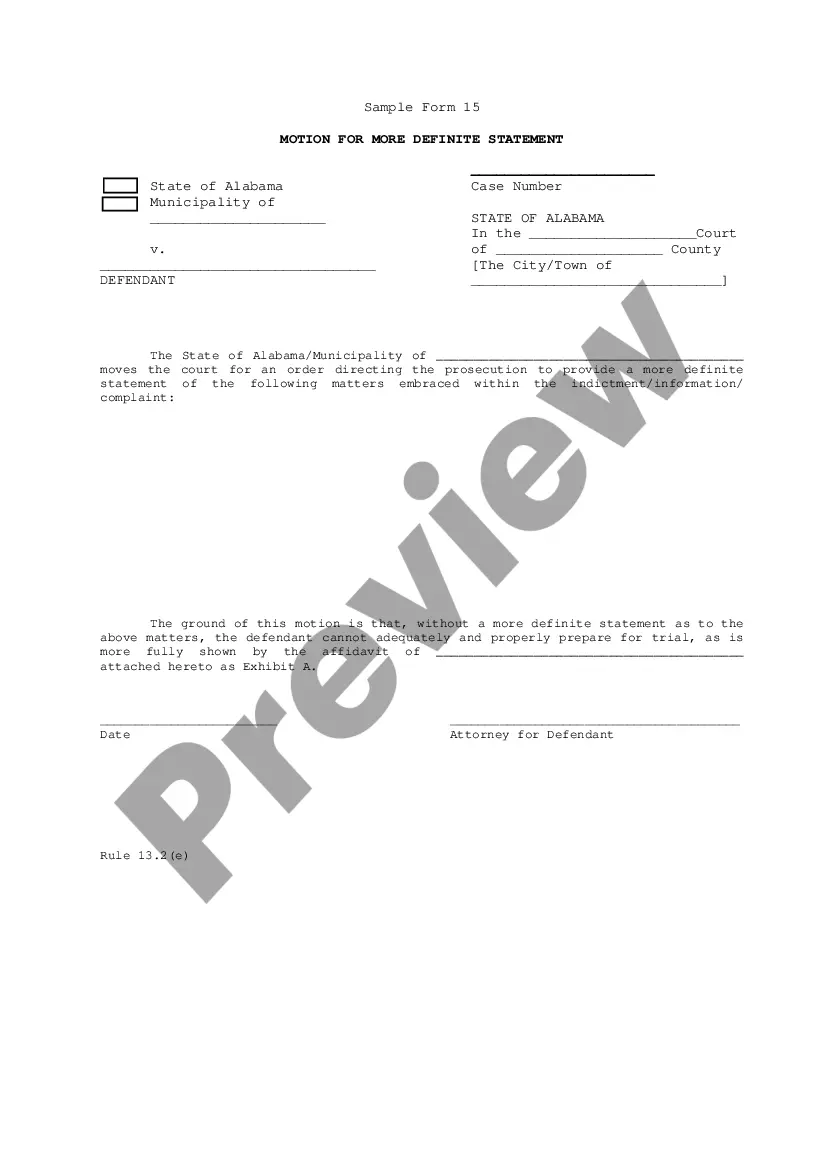

Preview it (if this option is available) and read the accompanying description to ensure whether the Assessment Lien Without A Contract is what you seek.

Create a free account and choose a subscription option to buy the template.

- With US Legal Forms, one of the largest collections of legal documents, you can access everything from court forms to templates for office correspondence.

- We understand the importance of compliance and adherence to both federal and state laws and regulations.

- That’s why, on our website, all templates are specific to their location and current.

- Let’s get started with our platform and acquire the document you need in just a few minutes.

- Find the document you need by utilizing the search bar at the top of the page.

Form popularity

FAQ

Ensuring that the agreement is legally binding Draft a document that includes the details of the payment plan, such as payment amounts, due dates, and other relevant information. Include clauses about interest rates or penalties for late payments. Have both parties read and agree to the terms of the document.

Your payment agreement will serve as a receipt that includes the details of the loan. Failure by either to abide by the terms of a payment contract could be held in breach of contract. Whether you are the lender or borrower getting a payment agreement in writing is an important part of the loan process.

How to Write a Simple Payment Contract Contract Identification. You will need to identify what the payment agreement is being drafted for. Consenting Parties. The next section will need to include detailed information about the parties involved in the contract. Agreement. ... Date. ... Signature.

How to write a letter of agreement Title the document. Add the title at the top of the document. ... List your personal information. ... Include the date. ... Add the recipient's personal information. ... Address the recipient. ... Write an introduction paragraph. ... Write your body. ... Conclude the letter.

How do you write a letter of agreement between two parties? Make sure you detail the specifics of the loan, from the name and address of the debtor and lender to the amount loaned, payment method, and terms of the agreement. Both parties will need to sign the agreement as a way to acknowledge its validity.

The money you pay into a settlement account is yours! Money that a debt settlement company asks you to set aside in an ?escrow? or ?settlement? account belongs to you. You may cancel the account at any time, and the escrow company must refund all of your money minus any fees the settlement company legally earned.

A payment agreement is a legally binding document between a lender and a borrower that outlines the terms and conditions of a loan, including the amount, payment schedule, and penalties.

When drafting a debt settlement agreement, it is essential to include the following: Necessary information about the loan agreement. The contact information of both parties. The date of the agreement. The terms of the agreement. The amount of debt.