Claim Adverse Possession File Format

Description

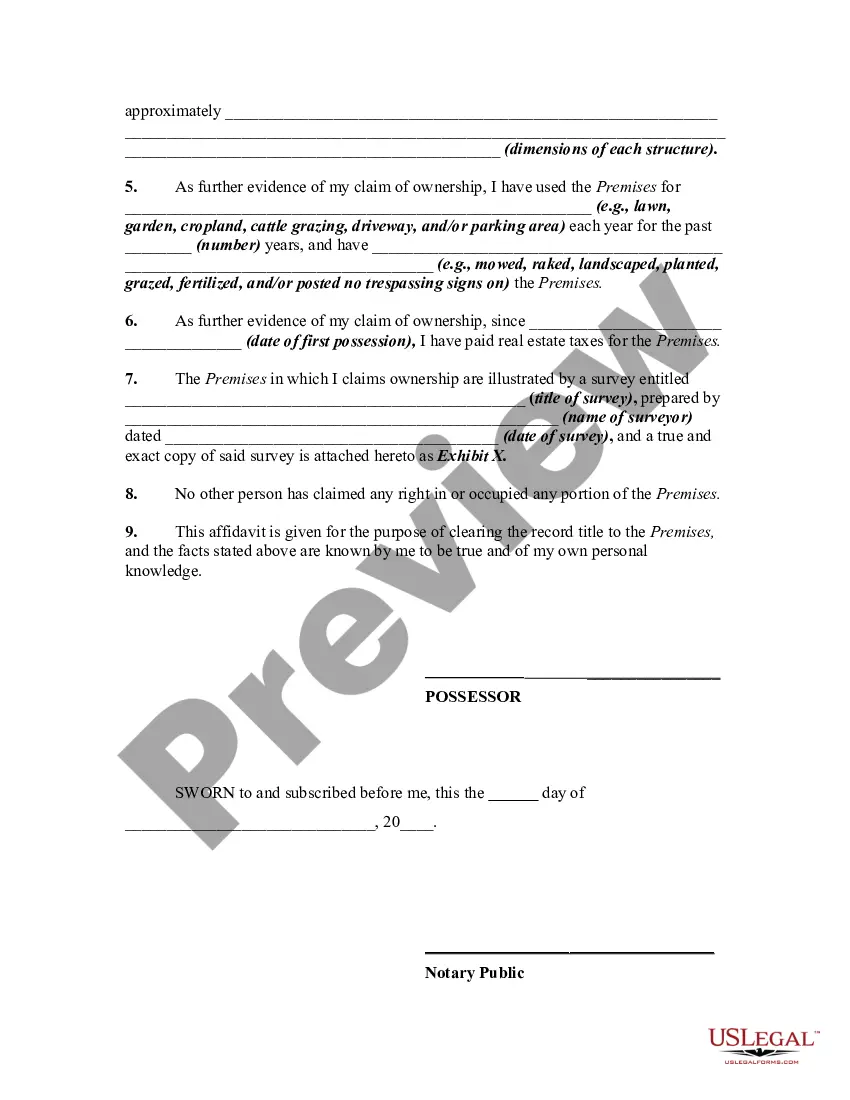

How to fill out Affidavit By Adverse Possessor That Property Held Adversely And Claim Of Title Is Based On Grant Of Ownership From Previous Owner - Squatters Rights?

Whether for business purposes or for individual affairs, everybody has to manage legal situations at some point in their life. Filling out legal documents demands careful attention, beginning from choosing the proper form sample. For instance, when you select a wrong edition of the Claim Adverse Possession File Format, it will be turned down when you submit it. It is therefore important to have a trustworthy source of legal documents like US Legal Forms.

If you need to get a Claim Adverse Possession File Format sample, follow these simple steps:

- Get the template you need by using the search field or catalog navigation.

- Check out the form’s description to ensure it suits your situation, state, and region.

- Click on the form’s preview to examine it.

- If it is the incorrect form, go back to the search function to locate the Claim Adverse Possession File Format sample you require.

- Get the template if it matches your requirements.

- If you have a US Legal Forms account, simply click Log in to gain access to previously saved documents in My Forms.

- If you don’t have an account yet, you can download the form by clicking Buy now.

- Choose the correct pricing option.

- Finish the account registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the document format you want and download the Claim Adverse Possession File Format.

- When it is downloaded, you can complete the form with the help of editing applications or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you never have to spend time searching for the right template across the web. Utilize the library’s easy navigation to get the correct form for any situation.

Form popularity

FAQ

Adverse possession is a doctrine under which a person in possession of land owned by someone else may acquire valid title to it, so long as certain requirements are met, and the adverse possessor is in possession for a sufficient period of time, as defined by a statute of limitations.

There must be actual, open, and notorious occupation of the premises in such a manner that constitutes reasonable notice to the record owner. Occupation must be both exclusive and hostile to the title of the true owner. There must be uninterrupted and continuous possession for at least five years.

One who seeks to assert title in land by adverse possession must prove each of the following for a period of more than ten years: that he has held the land adversely and that the possession has been actual, open and notorious, exclusive, continuous, and under a claim of title or color of title.

To trigger adverse possession (i.e., to acquire title to property owned by someone else without the owner's consent), the person claiming title must actually enter and possess property owned by another, and the time and manner of possession must be: (1) continuous, (2) hostile to the interests of the true owner, (3) ...

The Florida Department of Revenue Adverse Possession form, DE-452, must be completed by the adverse possessor and filed with the property appraiser in the county where the property is located within one year after entering into possession and has subsequently paid all taxes and matured installments of special ...