Affidavit Of Property Value Exemptions

Description

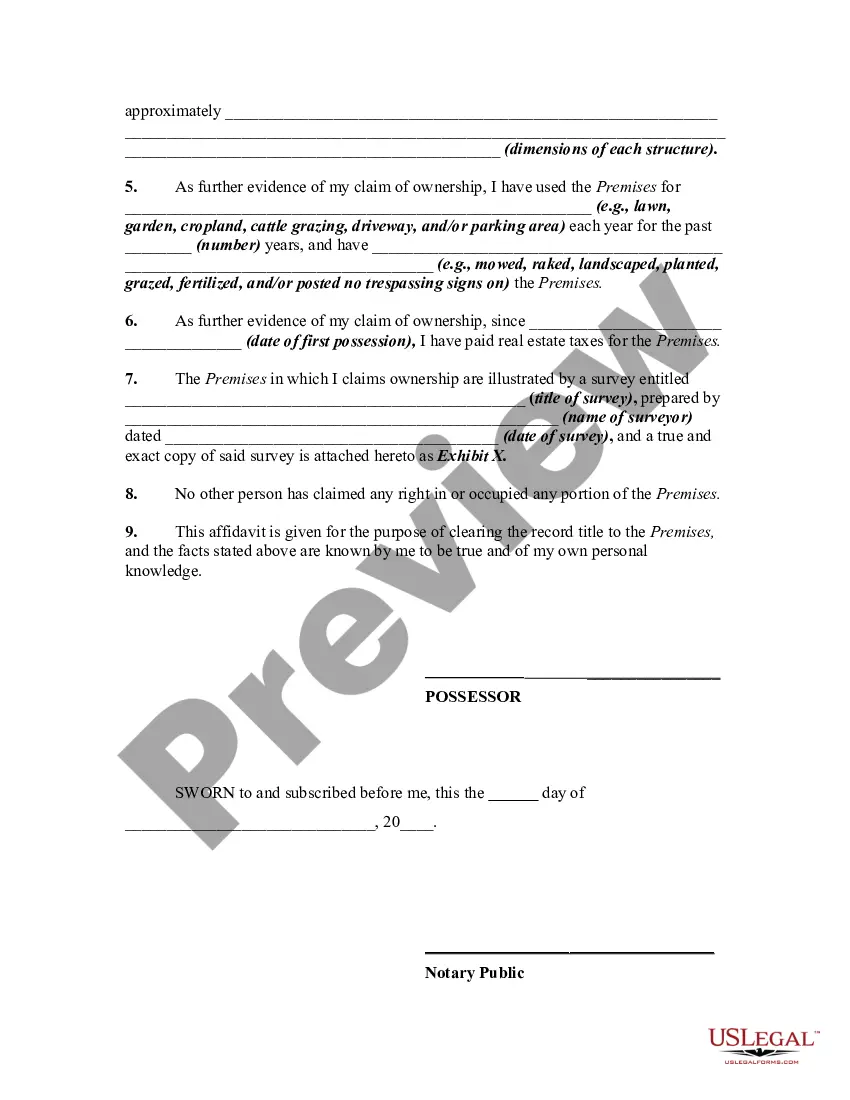

How to fill out Affidavit By Adverse Possessor That Property Held Adversely And Claim Of Title Is Based On Grant Of Ownership From Previous Owner - Squatters Rights?

Dealing with legal documents and processes can be a lengthy addition to your entire day.

Affidavit Of Property Value Exemptions and similar forms often necessitate that you look for them and figure out how to fill them out correctly.

For that reason, whether you are managing financial, legal, or personal matters, having an extensive and user-friendly online library of forms at your disposal will significantly help.

US Legal Forms is the leading online platform for legal templates, boasting over 85,000 specific forms by state and a variety of resources to help you complete your documents effortlessly.

Simply Log In to your account, find Affidavit Of Property Value Exemptions, and download it immediately from the My documents section. You can also access previously downloaded forms.

- Explore the library of relevant documents available with just one click.

- US Legal Forms provides you with state- and county-specific forms accessible at any time for download.

- Protect your document management processes with a premium service that allows you to create any form within minutes without extra or hidden charges.

Form popularity

FAQ

To transfer property title to a family member in Arizona, you will typically need to complete a deed, such as a quit claim deed or a warranty deed. After preparing the necessary document, you must sign it in front of a notary public. Finally, you should file the deed with the county recorder’s office to officially record the transfer. Don't forget to consider any Affidavit of property value exemptions that may apply to the transaction.

This form is used to record the selling price, date of sale and other required information about the sale of property.

Transferring or Adding Someone to the Title of a House in Arizona. Sometimes it is desirable to add someone to the title of a house you own. Arizona offers two ways to accomplish this: a quit claim deed or a warranty deed.

Adding a family member to the deed as a joint owner for no consideration is considered a gift of 50% of the property's fair market value for tax purposes. If the value of the gift exceeds the annual exclusion limit ($16,000 for 2022) the donor will need to file a gift tax return (via Form 709) to report the transfer.

Transferring or Adding Someone to the Title of a House in Arizona. Sometimes it is desirable to add someone to the title of a house you own. Arizona offers two ways to accomplish this: a quit claim deed or a warranty deed.

Real estate or a debt secured by a lien on real property may be transferred to the successor or successors by affidavit if certain requirements are met. This affidavit must be filed in the county where the decedent was domiciled or, if not domiciled in this state, in the county where the property is located.