Affidavit For Property Tax Protest

Description

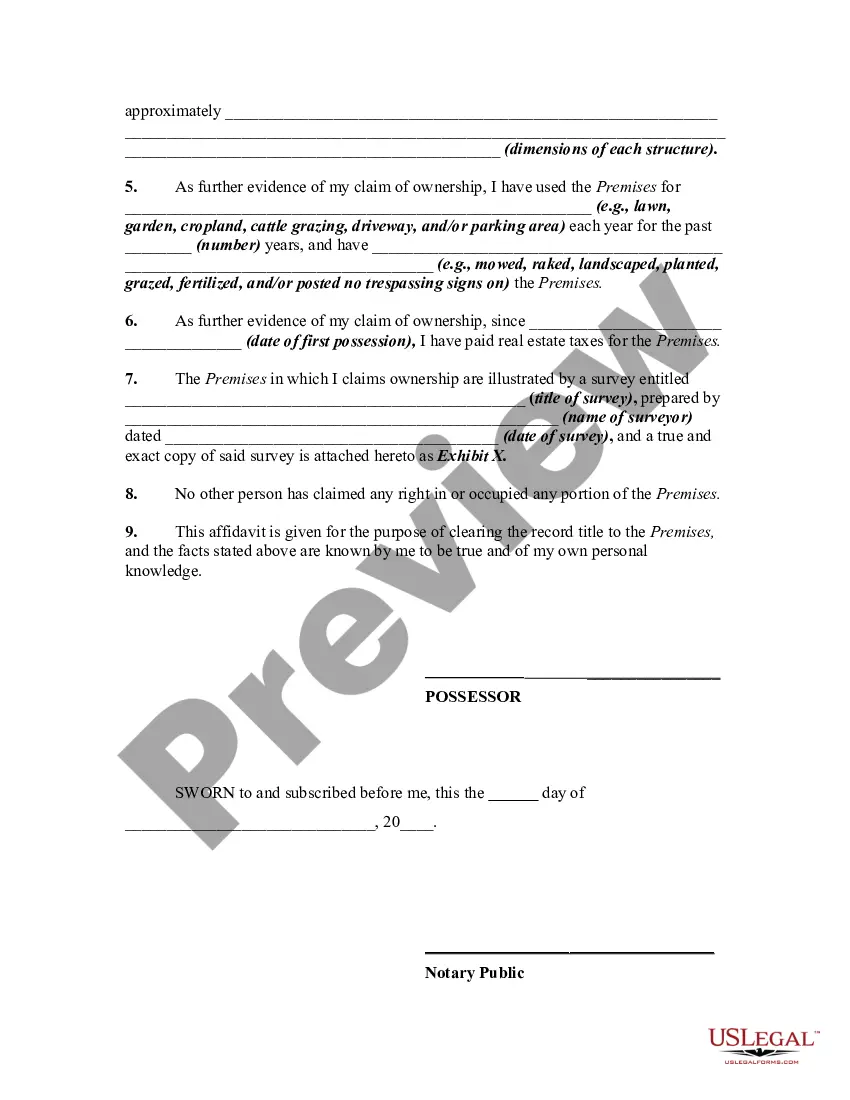

How to fill out Affidavit By Adverse Possessor That Property Held Adversely And Claim Of Title Is Based On Grant Of Ownership From Previous Owner - Squatters Rights?

It’s widely acknowledged that you cannot transform into a legal expert immediately, nor can you discover how to swiftly prepare an Affidavit For Property Tax Protest without possessing a unique set of abilities.

Compiling legal documents is an arduous task that demands specific education and proficiency. Hence, why not entrust the crafting of the Affidavit For Property Tax Protest to the experts.

With US Legal Forms, one of the most extensive legal document collections, you can locate anything from court forms to templates for internal communication.

If you require a different form, restart your search.

Create a free account and choose a subscription option to purchase the template.

- We recognize the significance of adhering to federal and local regulations.

- That’s why all templates on our platform are location-specific and current.

- Begin on our website and acquire the form you require within minutes.

- Utilize the search bar at the top of the page to find the form you seek.

- Preview it (if available) and review the accompanying description to ascertain if the Affidavit For Property Tax Protest meets your needs.

Form popularity

FAQ

Automated Protest (Available in Most Counties) To conduct an automated protest, you'll need to have your property tax notice or bill available. Then, simply visit your county appraisal district website. If you already have an online account with your appraisal district, log in.

You should gather all information about your property that may be relevant in considering the true value of your home such as: Photographs of property (yours and comparables) Receipts or estimates for repairs. Sales price documentation, such as listings, closing statements and other information.

A protest may also be filed online at: .tad.org using the Online Account PIN found on your Value Notice. The ARB is an independent board of citizens that hears and determines protests regarding property appraisals or other concerns listed above.

One effective approach to disputing property taxes in Texas is by finding comparable properties that have sold at lower prices or have lower assessed values. By conducting thorough research and providing this information during your protest, you can build a strong case for reducing your property's assessed value.

One effective approach to disputing property taxes in Texas is by finding comparable properties that have sold at lower prices or have lower assessed values. By conducting thorough research and providing this information during your protest, you can build a strong case for reducing your property's assessed value.