Rental Agreement Form For Ssi

Description

How to fill out Lease - Lot For Mobile Home?

Securing a reliable location to obtain the most up-to-date and pertinent legal templates is a significant part of navigating bureaucracy.

Locating the appropriate legal documents requires accuracy and meticulousness, which is why it is essential to source Rental Agreement Form For Ssi exclusively from reputable providers, such as US Legal Forms. An incorrect template will squander your time and delay your circumstances. With US Legal Forms, your concerns are minimal.

Once the form is saved on your device, you can edit it using the editor or print it for manual completion. Eliminate the hassle associated with your legal documents. Explore the extensive US Legal Forms collection to discover legal templates, verify their applicability to your situation, and download them instantly.

- Use the catalog navigation or search bar to locate your template.

- Examine the form’s overview to determine if it meets the specifications of your state and locality.

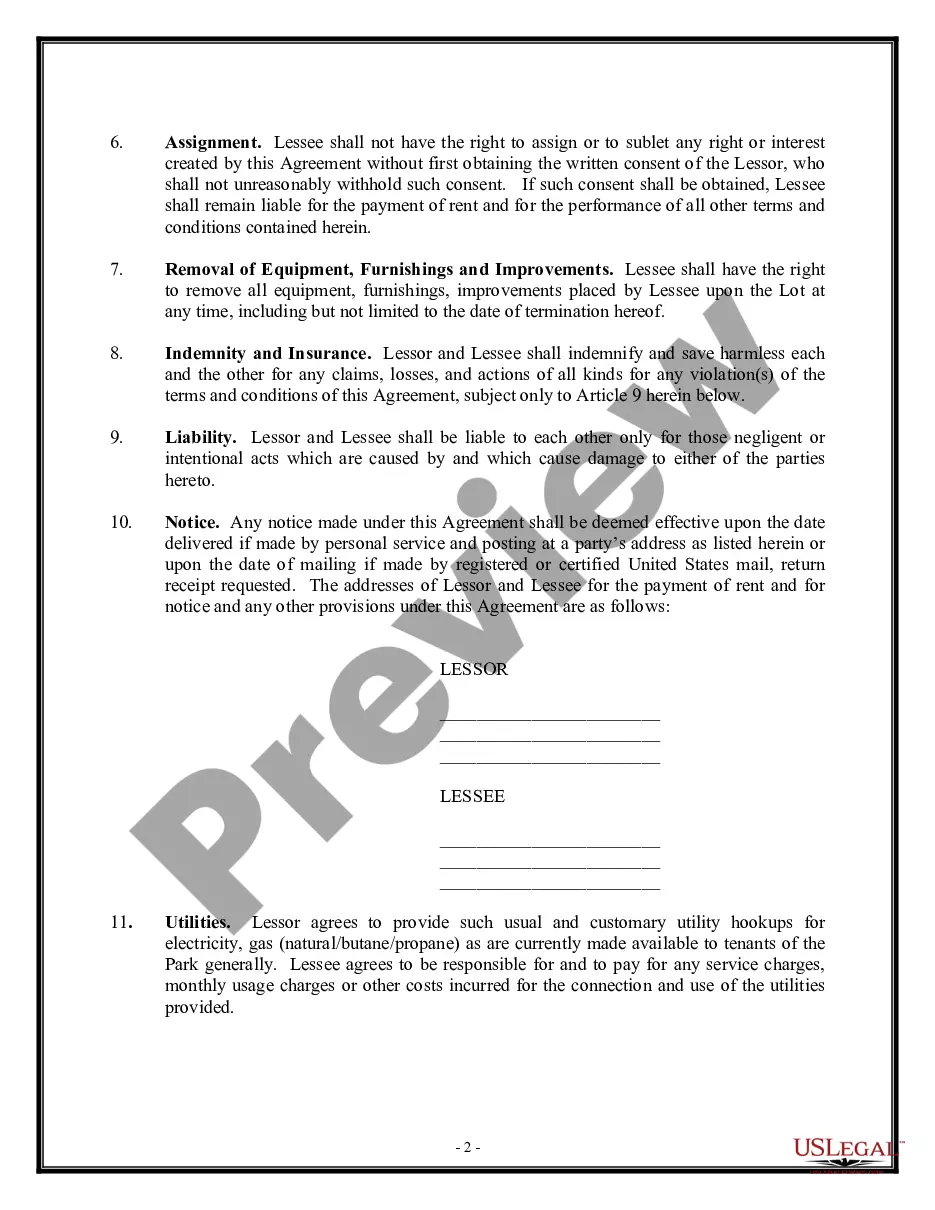

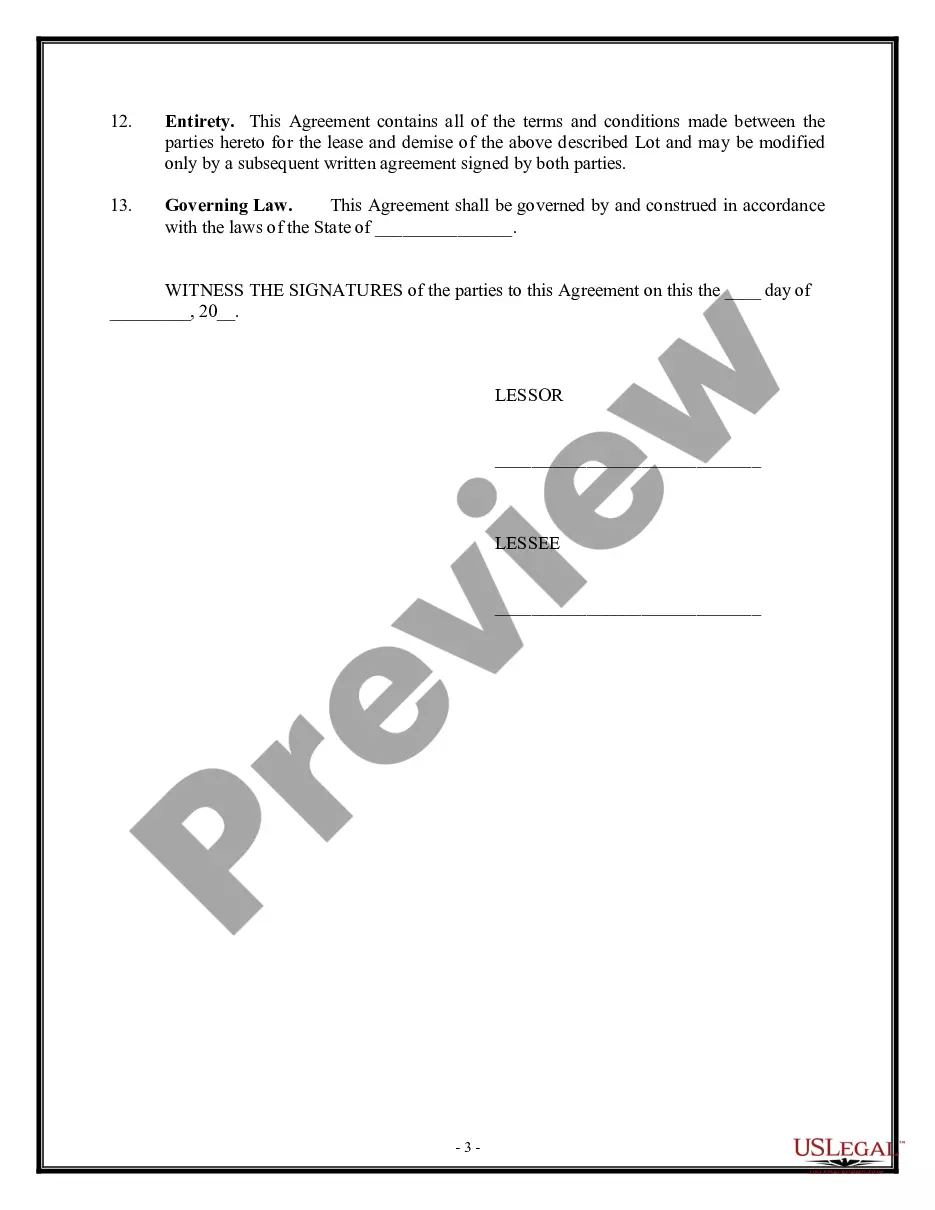

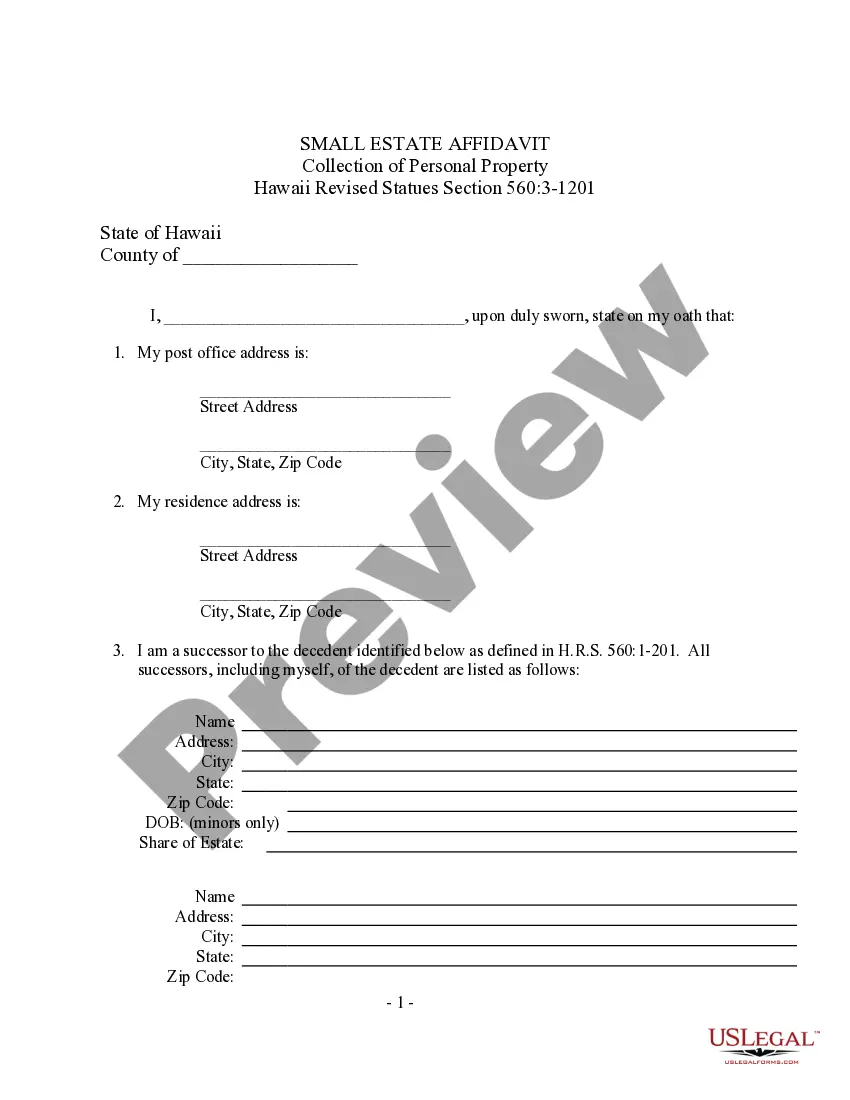

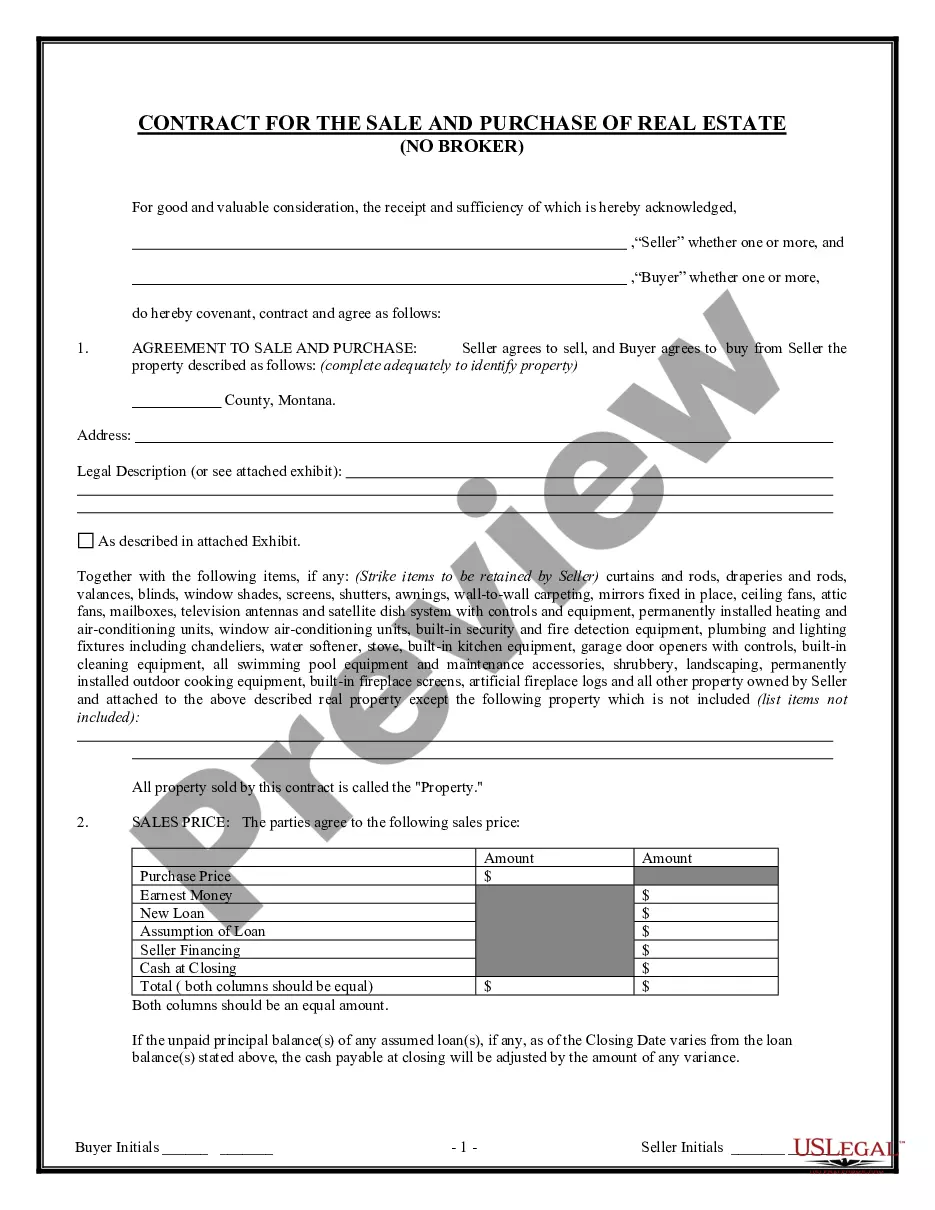

- View the form preview, if one is offered, to confirm the form is indeed the one you need.

- Return to the search and identify the correct template if the Rental Agreement Form For Ssi does not satisfy your requirements.

- Once you are certain about the form’s applicability, download it.

- If you are a registered customer, click Log in to verify and access your selected templates in My documents.

- If you have not created an account yet, click Buy now to acquire the template.

- Choose the pricing option that fits your requirements.

- Continue to the registration process to finalize your purchase.

- Complete your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading the Rental Agreement Form For Ssi.

Form popularity

FAQ

Form PA-100 (Pennsylvania Enterprise Registration Form) is used by Pennsylvania businesses to register for certain tax accounts with the Pennsylvania Department of Revenue and the Pennsylvania Department of Labor and Industry. New businesses file PA-100 to set up state tax accounts.

Pennsylvania State Income Tax Single member LLCs, only have to pay the state's personal income tax, which is 3.07%. If your LLC is filing as a C-corp, you pay Pennsylvania's 9.99% corporate net income tax rate and the state's corporate loans tax, which is 4 mill on each dollar.

Certificate of Annual Registration fees: See 15 Pa. C.S. §8998(b)(1). The base fee was increased to $610 on December 31, 2021.

The first step is to file a form called the Certificate of Amendment with the Bureau of Corporations and wait for it to be approved. This is how you officially change your LLC name in Pennsylvania. The filing fee for a Certificate of Amendment in Pennsylvania is $70.

Beginning in 2025, every Pennsylvania LLC will need to file an Annual Report each year to renew their LLC. Note: Pennsylvania used to require that LLCs file a report every 10 years (called a Decennial Report).

An entity (which includes an individual) that registers a fictitious name is required by 54 Pa. C.S. § 311(g) to advertise its intention to file or the filing of an application for registration of fictitious name.

After registering your LLC, you'll need to file a Decennial Report and pay a fee of $70 to the Pennsylvania Department of State every ten years. Your report can be filed anytime during the year as long as it has been ten years since your last filing.

A: Pennsylvania requires annual filings for all limited liability partnerships, domestic and foreign, as well as by restricted professional limited liability companies, domestic and foreign.