Objection Form For Tax Professionals

Description

How to fill out Complaint Objecting To Discharge In Bankruptcy Proceedings For Concealment By Debtor And Omitting From Schedules Fraudulently Transferred Property?

Legal papers managing may be overpowering, even for experienced professionals. When you are searching for a Objection Form For Tax Professionals and do not have the time to spend searching for the correct and updated version, the operations can be stressful. A strong web form catalogue can be a gamechanger for anyone who wants to handle these situations efficiently. US Legal Forms is a market leader in web legal forms, with over 85,000 state-specific legal forms accessible to you at any moment.

With US Legal Forms, you are able to:

- Gain access to state- or county-specific legal and business forms. US Legal Forms handles any needs you could have, from individual to organization papers, in one place.

- Employ advanced resources to accomplish and deal with your Objection Form For Tax Professionals

- Gain access to a resource base of articles, guides and handbooks and resources highly relevant to your situation and requirements

Help save time and effort searching for the papers you will need, and make use of US Legal Forms’ advanced search and Review tool to discover Objection Form For Tax Professionals and acquire it. If you have a subscription, log in in your US Legal Forms account, search for the form, and acquire it. Review your My Forms tab to see the papers you previously downloaded and also to deal with your folders as you see fit.

If it is your first time with US Legal Forms, create an account and obtain unlimited use of all advantages of the platform. Listed below are the steps for taking after getting the form you need:

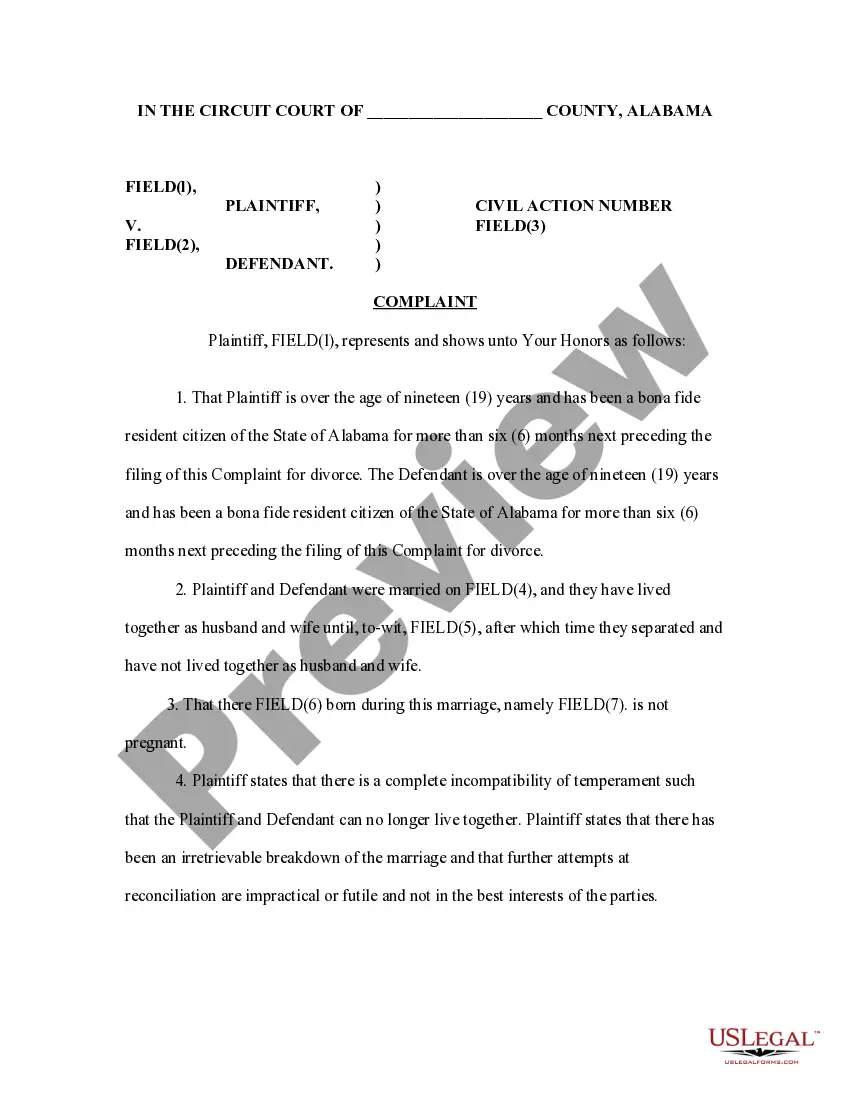

- Confirm this is the right form by previewing it and looking at its information.

- Be sure that the sample is accepted in your state or county.

- Pick Buy Now once you are all set.

- Select a monthly subscription plan.

- Pick the formatting you need, and Download, complete, eSign, print out and deliver your papers.

Enjoy the US Legal Forms web catalogue, supported with 25 years of experience and trustworthiness. Enhance your everyday papers administration in a smooth and intuitive process today.

Form popularity

FAQ

If you have concerns about how we have managed your tax affairs or are dissatisfied with the process involved in how we made a decision, you can: explore a dispute resolution option. contact the decision maker or discuss your concerns with ATO Complaints on 1800 199 010.

To lodge your complaint, you can: access the Complaints form. ... phone 1800 199 010 between am and pm, Monday to Friday (local time), except national public holidays. phone the National Relay Service on 13 36 77 (if you have a hearing, speech or communication impairment) write to.

You can object to tax assessments and most other decisions we make within the time limit, which varies between 60 days to 4 years. If the objection is outside the time limit, you can request an extension of time by including a written request with your objection.

Objecting to an assessment or decision If you are not satisfied with the assessment or decision, you can lodge an objection with the Commissioner. An objection is a written notice to the Commissioner challenging the assessment or decision. You can lodge an objection through our Contact us form or by post.

Link your myGov account to the ATO Sign in to your myGov account. Select View and link services on the myGov home page. Under Link a service heading, select Link next to Australian Taxation Office. Select I agree to the terms and conditions of use. Enter or confirm your personal details.