The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

Bankruptcy Discharge Form

Description

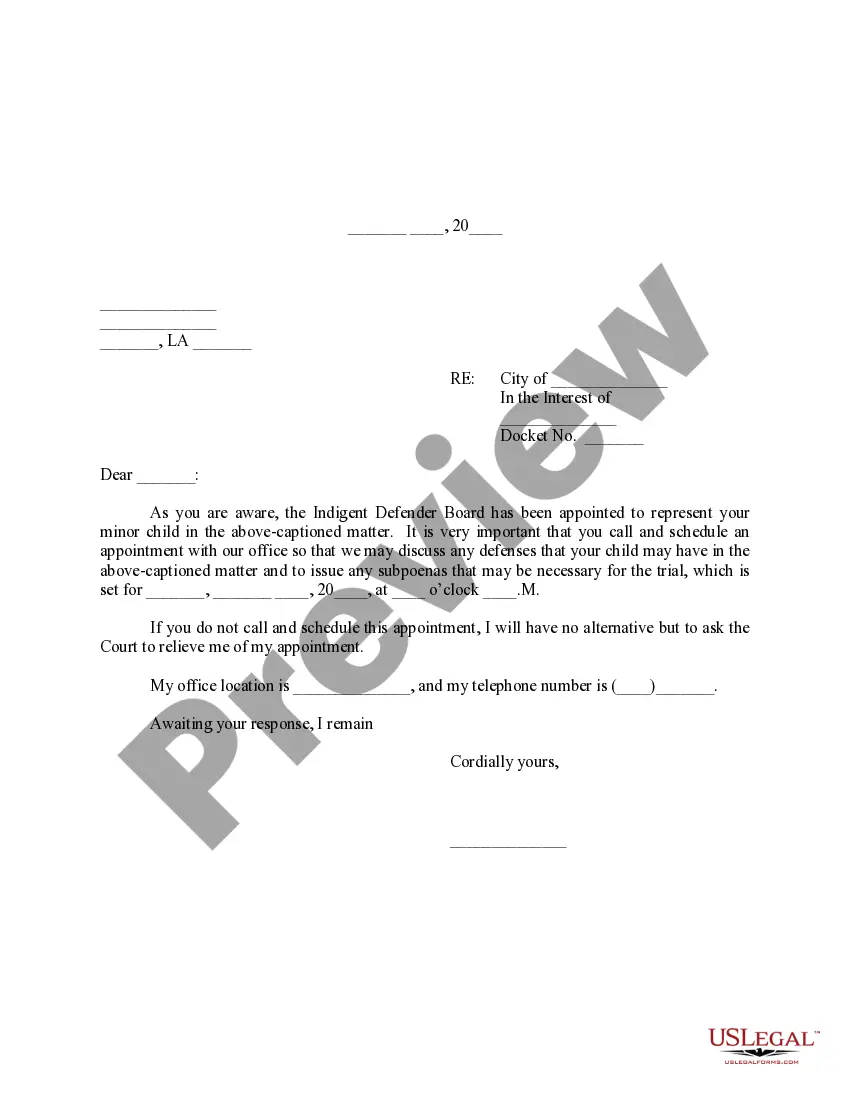

How to fill out Complaint Objecting To Discharge In Bankruptcy Proceedings For Concealment By Debtor And Omitting From Schedules Fraudulently Transferred Property?

When you need to submit a Bankruptcy Discharge Form that adheres to your local state's laws and regulations, there may be numerous options to choose from.

You don't have to verify each form to ensure it fulfills all the legal requirements if you are a US Legal Forms member.

It is a dependable resource that can assist you in obtaining a reusable and current template on any subject.

Select the most appropriate pricing plan, sign in to your account, or create one. Pay for a subscription (Payment methods such as PayPal and credit cards are accepted). Download the template in your chosen file format (PDF or DOCX). Print the document or fill it out electronically using an online editor. Obtaining professionally drafted formal documents is easy with US Legal Forms. Additionally, Premium users can also take advantage of comprehensive integrated solutions for online PDF editing and signing. Give it a try today!

- US Legal Forms is the largest online repository containing over 85,000 ready-to-use documents for business and personal legal situations.

- All templates are verified to comply with each state's regulations.

- Therefore, when downloading a Bankruptcy Discharge Form from our platform, you can be assured that you possess a valid and current document.

- Acquiring the necessary sample from our platform is exceptionally simple.

- If you already have an account, just Log In to the system, ensure your subscription is valid, and save the chosen file. Later, you can access the My documents tab in your profile and retrieve the Bankruptcy Discharge Form whenever you wish.

- If it's your initial experience with our site, please adhere to the instructions below.

- Browse the suggested page and ensure it meets your requirements.

- Utilize the Preview mode and review the form description if available.

- Search for another sample using the Search bar in the header if needed.

- Click Buy Now once you find the appropriate Bankruptcy Discharge Form.

Form popularity

FAQ

Yes, a bankruptcy discharge will appear on your credit report. Generally, it remains visible for up to 10 years, potentially impacting your credit score and future credit applications. To navigate this process, consider using a Bankruptcy discharge form from USLegalForms. This form can help ensure your bankruptcy is handled correctly while minimizing long-term effects on your credit history.

To qualify for a Chapter 13 hardship discharge, you must prove that your financial situation has changed significantly, making it impossible to complete your payment plan. This often involves documenting unexpected circumstances, such as job loss or medical emergencies. Additionally, you will need to demonstrate that you have made all required payments up to the point of hardship. Consider consulting with a legal professional to navigate the complexities of your situation, including the necessary bankruptcy discharge forms.

You can obtain bankruptcy paperwork from several sources, such as your local bankruptcy court or legal aid offices. Additionally, you can find comprehensive bankruptcy discharge forms online through reputable platforms like US Legal Forms. Using these resources will ensure you have the correct forms needed to file for bankruptcy. Always double-check to ensure you are using the most up-to-date versions of the bankruptcy discharge forms.

There are specific conditions that can disqualify you from filing for bankruptcy. For instance, if you have filed a bankruptcy case in the last eight years, or if you fail to meet the income requirements or do not complete the required credit counseling, you may be ineligible. Furthermore, not adhering to guidelines related to your bankruptcy discharge form can negatively impact your case. Understanding these factors can help you avoid unnecessary obstacles.

Bankruptcies can be denied for several reasons. Common issues include failure to complete mandatory credit counseling, missing deadlines for filing bankruptcy forms, or not meeting eligibility criteria. Additionally, if you don't provide accurate or complete information on your bankruptcy discharge form, your case may face significant hurdles. It's essential to ensure all paperwork is correct and submitted on time to avoid complications.

To obtain a discharge from bankruptcy, you must complete a bankruptcy discharge form after fulfilling all required obligations during your case. This may involve attending a creditor meeting and making various disclosures about your finances. For a smoother experience, consider using US Legal Forms, which can aid in preparing and filing the necessary paperwork accurately.

Certain types of debt cannot be discharged in bankruptcy, including student loans, child support, and most tax debts. These obligations persist even after the bankruptcy discharge process. Understanding these limitations is essential, and platforms like US Legal Forms can provide clarity on which debts are eligible for discharge.

After receiving a bankruptcy discharge, the waiting period to file for another bankruptcy varies depending on the type of bankruptcy previously filed. Generally, you must wait eight years to file Chapter 7 again. For Chapter 13, the waiting period is two years, encouraging responsible financial practices in the meantime.

Applying for a bankruptcy discharge involves completing the necessary bankruptcy discharge form after meeting specific conditions. You typically need to wait until your bankruptcy case is filed and your creditors have had a chance to respond. Using services like US Legal Forms can simplify this process, allowing you to ensure that all documentation is accurate and submitted on time.

Yes, it is possible to withdraw a bankruptcy filing, but this requires submitting a request to the court. Keep in mind that doing so might not be beneficial and could complicate your financial situation. If you are considering this option, exploring resources on US Legal Forms can provide the necessary support and documentation.