Rent Section For Tds

Description

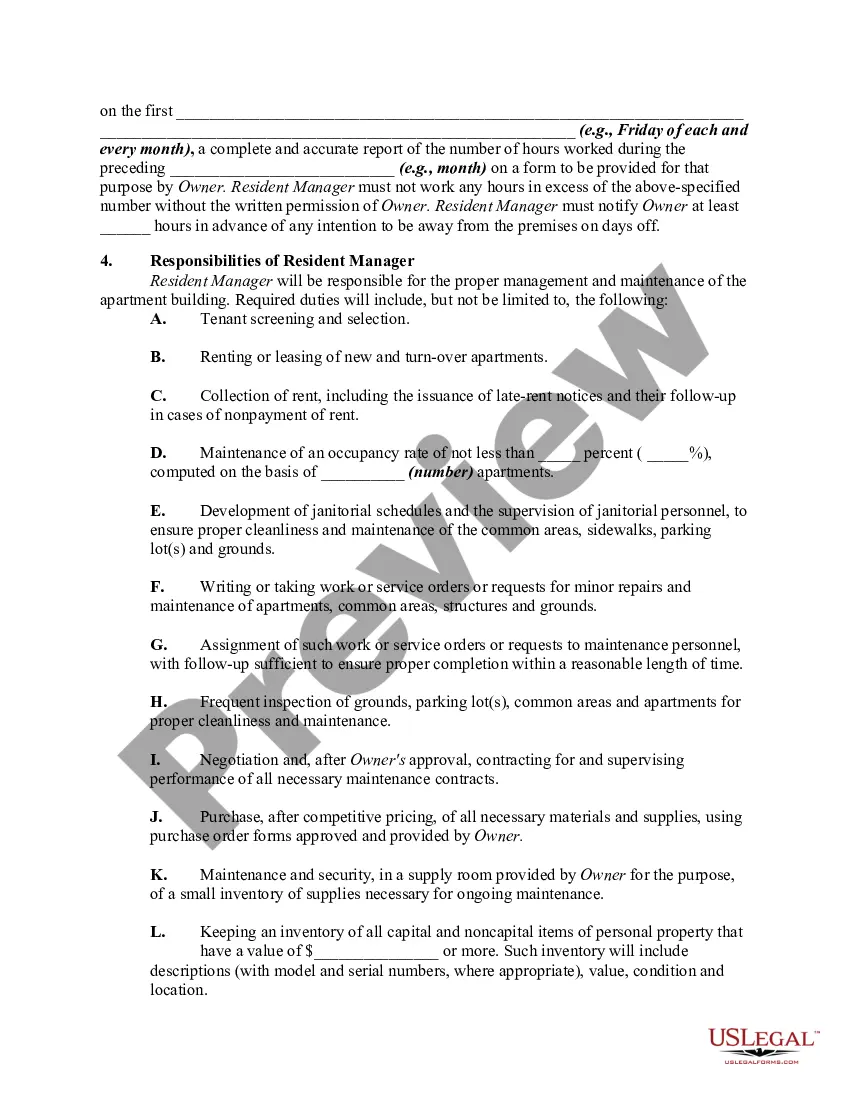

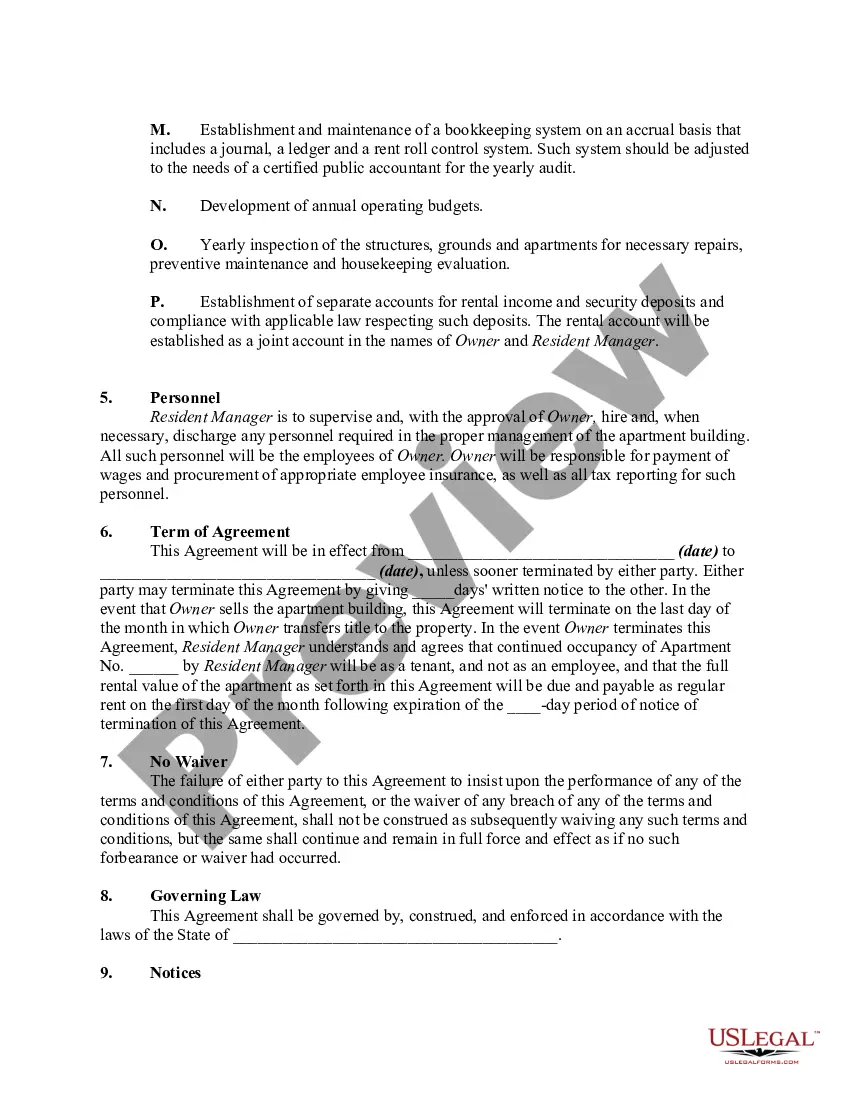

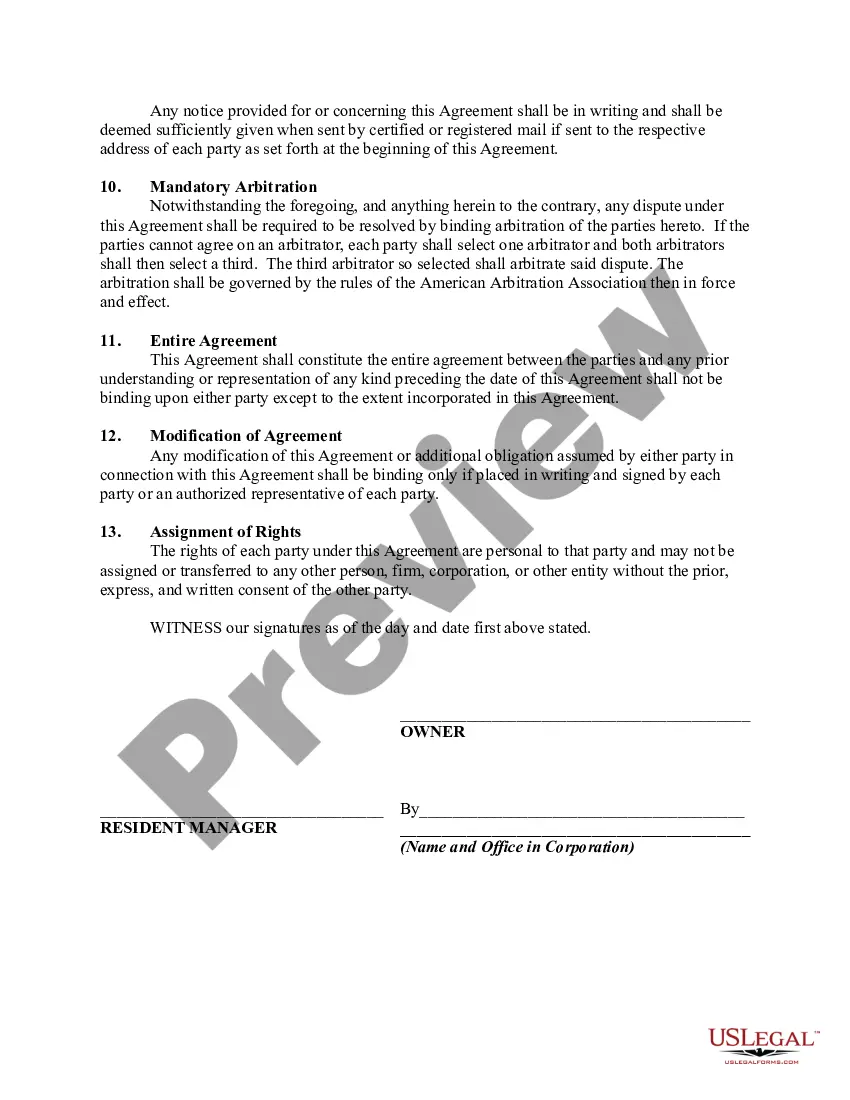

How to fill out Contract Between Owner Of Apartments And Resident Apartment Manager With Rent Credit To Be Part Of Compensation?

Drafting legal paperwork from scratch can often be daunting. Certain scenarios might involve hours of research and hundreds of dollars invested. If you’re searching for a more straightforward and more cost-effective way of preparing Rent Section For Tds or any other forms without jumping through hoops, US Legal Forms is always at your disposal.

Our virtual catalog of over 85,000 up-to-date legal forms addresses almost every element of your financial, legal, and personal affairs. With just a few clicks, you can instantly access state- and county-specific forms carefully put together for you by our legal specialists.

Use our website whenever you need a trusted and reliable services through which you can easily find and download the Rent Section For Tds. If you’re not new to our website and have previously created an account with us, simply log in to your account, locate the template and download it away or re-download it anytime later in the My Forms tab.

Not registered yet? No worries. It takes minutes to set it up and explore the catalog. But before jumping directly to downloading Rent Section For Tds, follow these recommendations:

- Check the document preview and descriptions to make sure you are on the the document you are searching for.

- Make sure the form you select complies with the regulations and laws of your state and county.

- Pick the best-suited subscription option to get the Rent Section For Tds.

- Download the form. Then complete, certify, and print it out.

US Legal Forms has a spotless reputation and over 25 years of experience. Join us today and transform form execution into something easy and streamlined!

Form popularity

FAQ

Ing to Section 194IB, it is mandatory for any person, i.e. individuals / HUF not liable to audit u/s 44AB, to deduct taxes for rent paid to a resident, exceeding Rs 50,000 per month.

The challan-cum-statement, or Form 26 QC, is the payment method allowed by Section 194IC. In order to demonstrate that the tenant has deposited tax, the tenant must also furnish Form 16C. Form 16C is also a TDS certificate. Payments can be made without a TAN (Tax Deduction Account Number).

Q1: What is the difference between section 194-I and 194-IB? Answer: Section 194-I is applicable only if tenant being Individual or HUF who is liable for Tax Audit in previous year and Section 194-IB is applicable only if tenant being Individual or HUF who is not liable for Tax Audit in previous year.

Wondering what TDS is on rent? The TDS on rent section is Section 194-I of the IT Act. The rent received from the renting out or subletting of property is subject to Tax Deduction at Source(TDS).

Yes, the deduction of tax at source (TDS) on salary is compulsory under section 192 of the Income Tax act. An employer who pays wages to his/her employee must deduct TDS from the salary if the total income exceeds a certain threshold.