Florida Motion For Continuance Form With 2 Points

Description

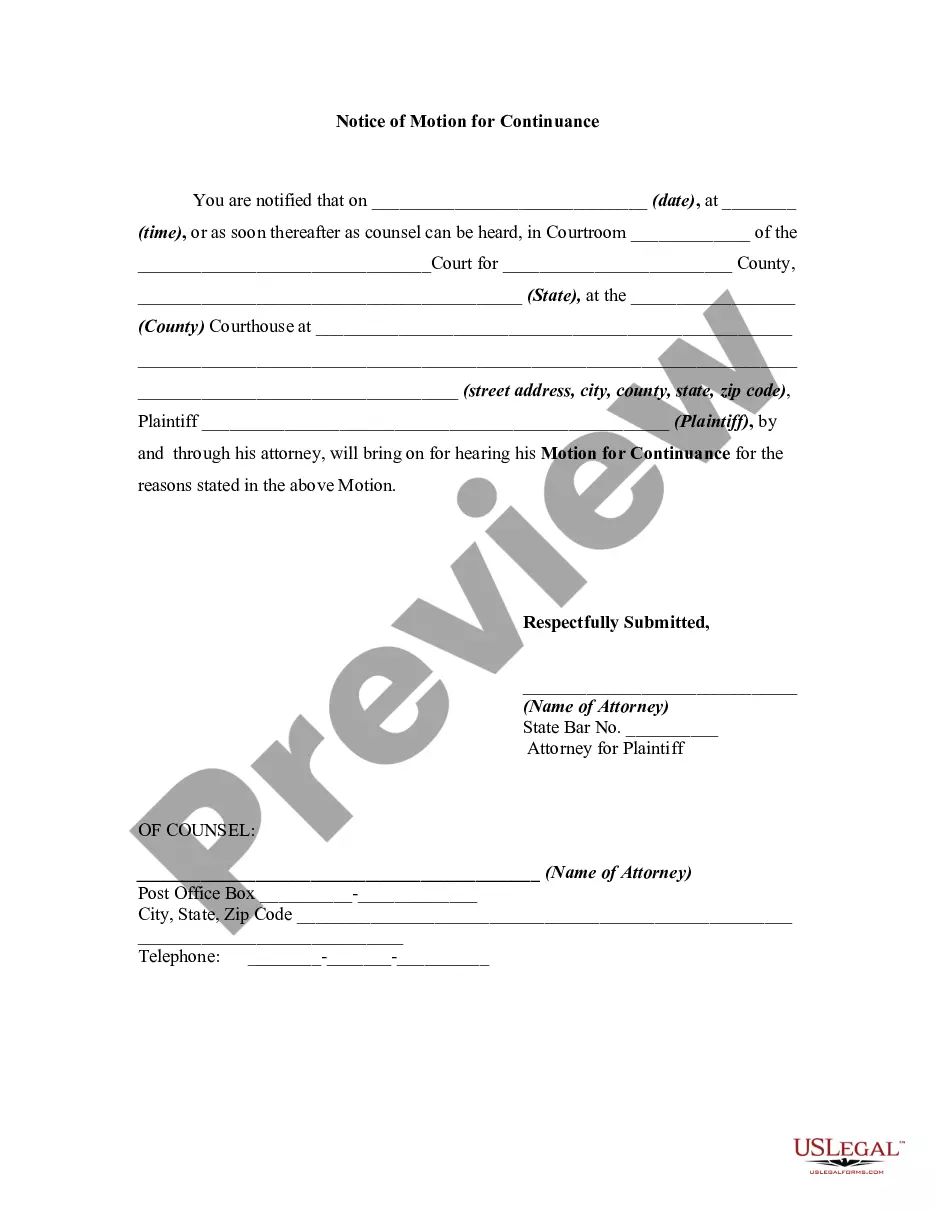

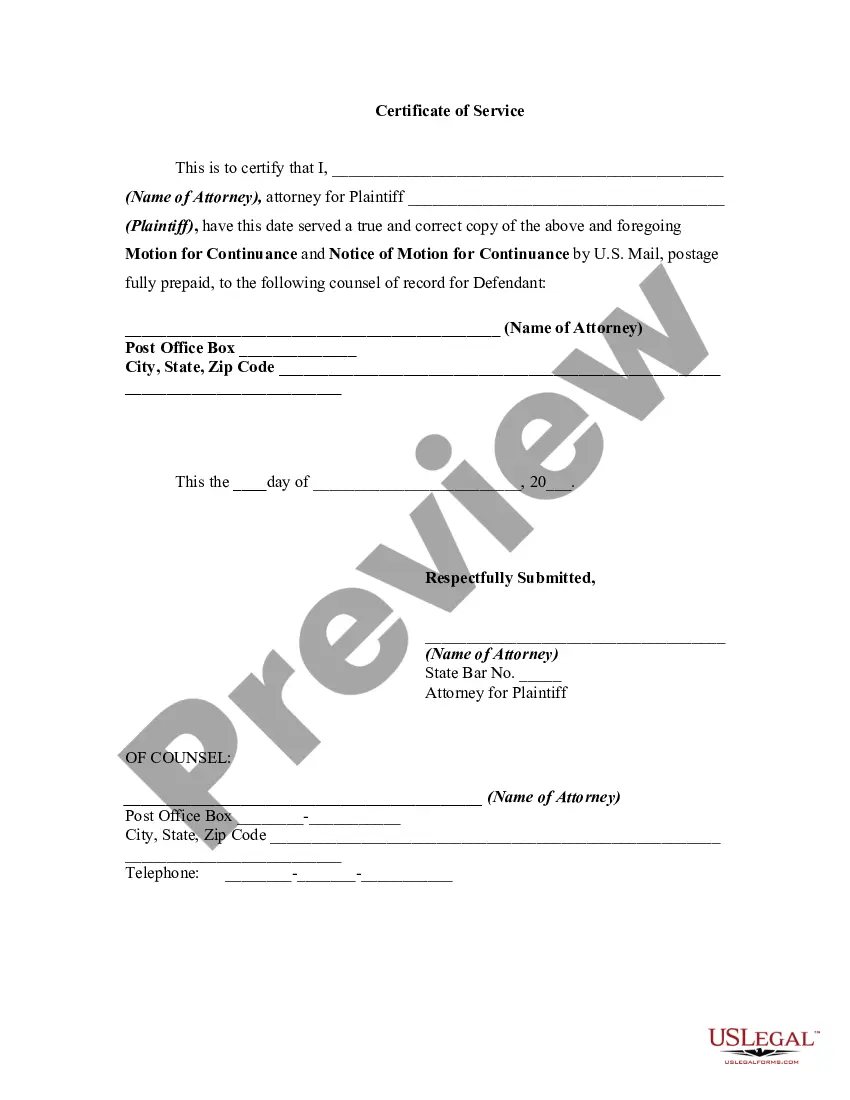

How to fill out Generic Motion For Continuance And Notice Of Motion?

Obtaining legal document examples that comply with federal and local laws is essential, and the internet provides a plethora of choices to select from.

However, why squander time hunting for the suitable Florida Motion For Continuance Form With 2 Points sample online if the US Legal Forms digital repository already consolidates such templates in one location.

US Legal Forms is the largest online legal collection with over 85,000 editable templates created by attorneys for various professional and personal situations. They are simple to navigate, with all documents organized by state and intended use. Our experts keep up with regulatory modifications, ensuring that your documents are always current and compliant when obtaining a Florida Motion For Continuance Form With 2 Points from our site.

All templates you discover through US Legal Forms are reusable. To re-download and complete previously saved documents, navigate to the My documents section in your profile. Benefit from the most comprehensive and user-friendly legal documentation service!

- Acquiring a Florida Motion For Continuance Form With 2 Points is swift and straightforward for both existing and new users.

- If you possess an account with an active subscription, Log In and download the document sample you require in your desired format.

- If you are unfamiliar with our website, adhere to the following instructions.

- Examine the template using the Preview function or through the text description to verify it meets your requirements.

- Utilize the search feature at the top of the page to find another sample if needed.

- Hit Buy Now when you have found the correct form and select a subscription option.

- Establish an account or Log In and complete your payment with PayPal or a credit card.

- Select the appropriate format for your Florida Motion For Continuance Form With 2 Points and download it.

Form popularity

FAQ

DOR does not guarantee a specific date that a refund will be deposited into a taxpayer's financial account and cannot issue written notices to taxpayers to confirm direct deposits. You may check the status of your refund online at TAP. If you cannot check online, you may call (601) 923-7801.

You may check the status of your refund online at TAP. If you cannot check online, you may call (601) 923-7801. Office representatives do not have any information that you cannot view online in TAP.

Mississippi's Republican-controlled legislature passed legislation in 2022 that will eliminate the state's 4% income tax bracket starting in 2023. In the following three years, the 5% bracket will be reduced to 4%.

Per the Mississippi Tax Commission website Gambling Winnings: Gambling winnings reported on a W2G, 1099, or other informational return from Mississippi s are subject to a three percent (3%) non-refundable income tax.

A few common reasons you may not have received your refund: An incorrect or incomplete mailing address was on your return. Your refund is being held because of a prior year tax liability. Examples: Income Tax, Sales Tax, Withholding Tax, etc.

Any entity operating in the state of Mississippi may be liable for taxes and should register with the Department of Revenue. If you have questions, you may call the Department of Revenue at (601) 923-7700, contact us by e-mail, or refer to information concerning the Mississippi Tax Structure.

Contact Information (601) 923-7700. ??(601) 923-7801 - 24 Hour Refund Line. ??(601) 923-7700 - Daily Phone (8am-5pm)?

If you e-filed your tax return, allow ten business days before calling about your refund. All other returns which are filed early are processed before and usually more quickly than returns filed closer to the due date.