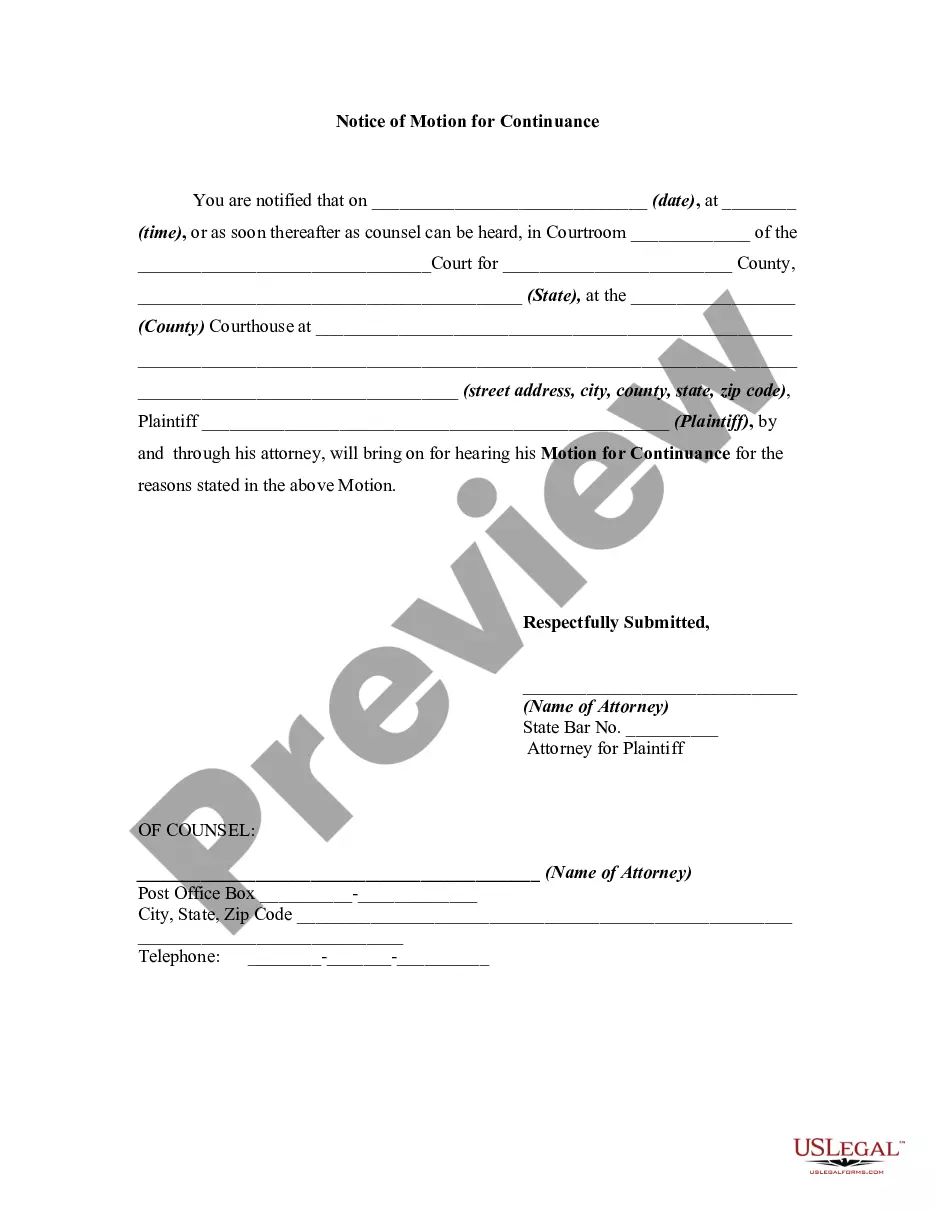

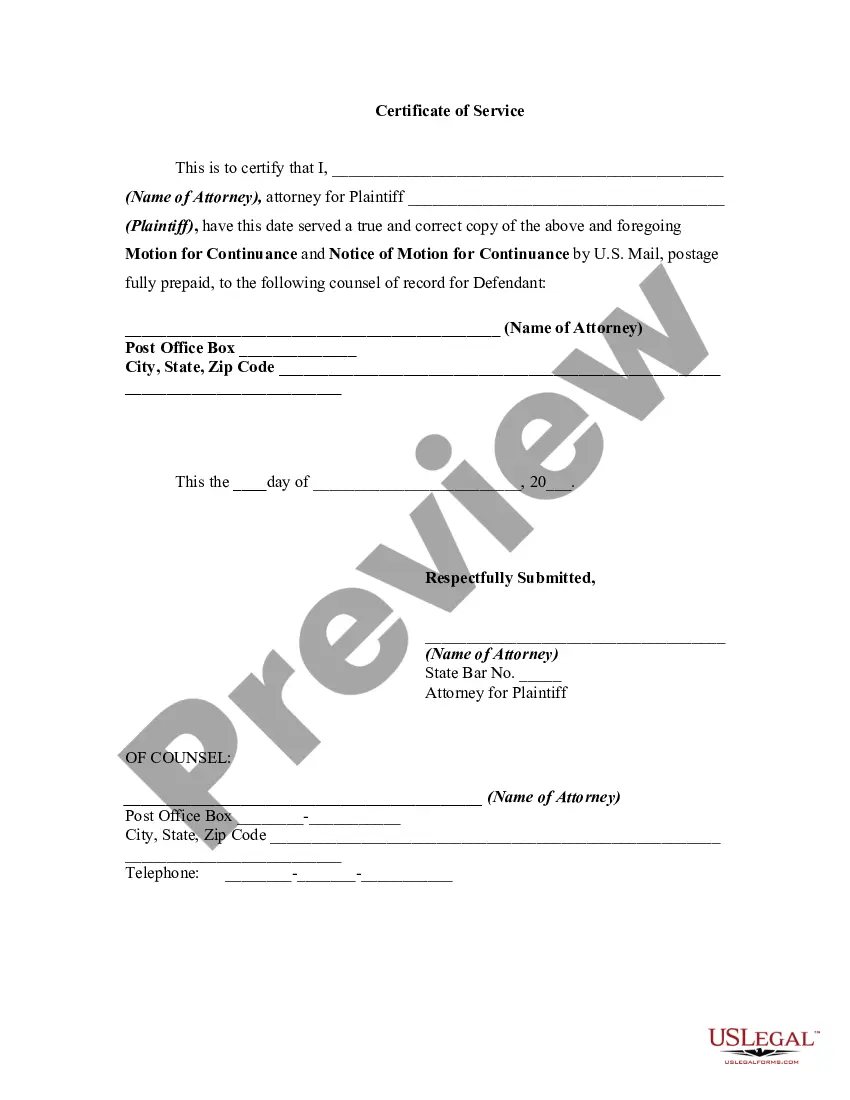

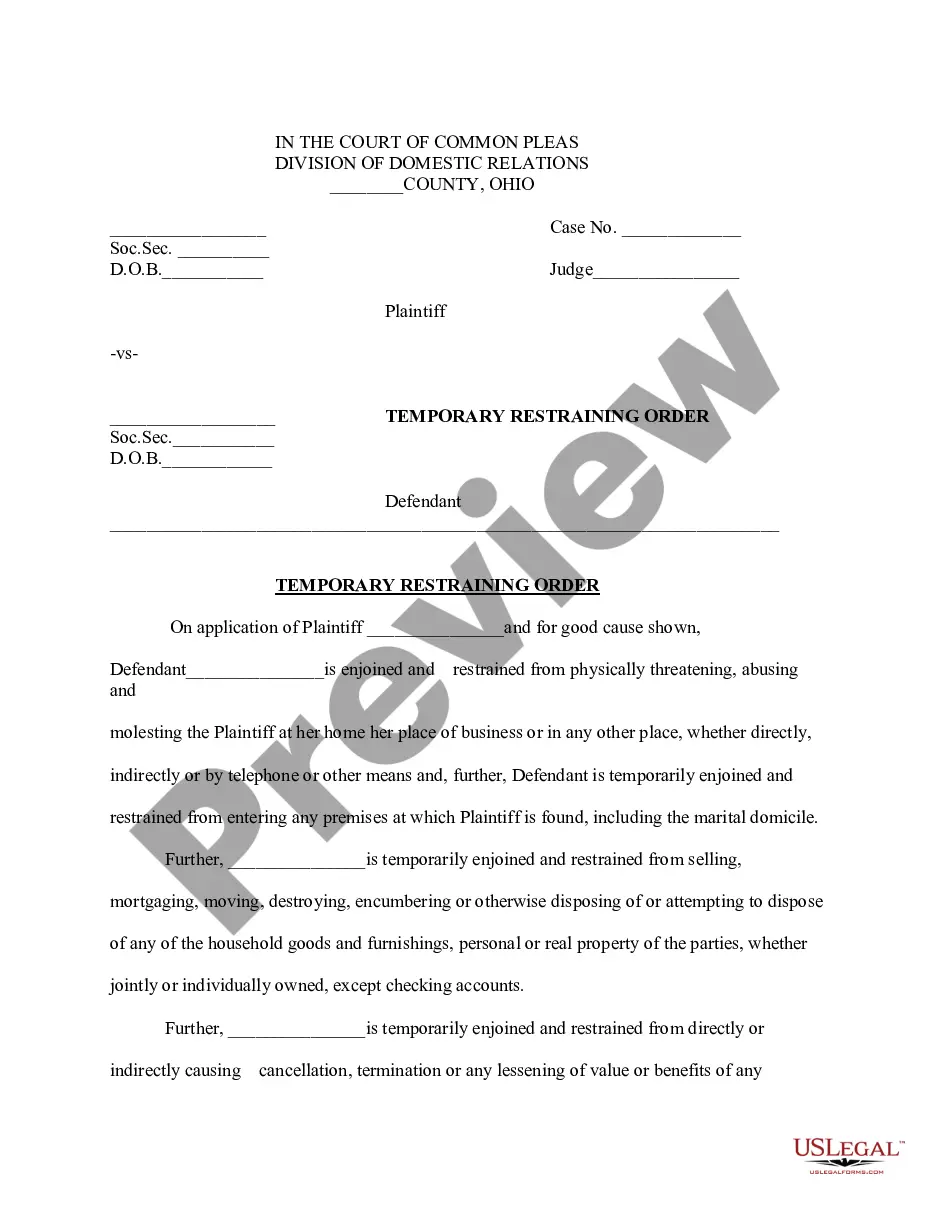

Continuance Sample With Time

Description

How to fill out Generic Motion For Continuance And Notice Of Motion?

Creating legal documents from the ground up can frequently be intimidating.

Certain cases may require extensive research and significant financial expenditure.

If you’re seeking a simpler and more economical approach to preparing Continuance Sample With Time or any other paperwork without the hassle, US Legal Forms is always available to you.

Our online collection of over 85,000 current legal forms covers nearly every facet of your financial, legal, and personal concerns. With just a few clicks, you can swiftly access state- and county-specific forms meticulously assembled for you by our legal professionals.

Examine the document preview and descriptions to verify that you are accessing the correct document. Ensure the template you select meets the standards of your state and county. Choose the appropriate subscription plan to obtain the Continuance Sample With Time. Download the file. Then complete, certify, and print it out. US Legal Forms has a strong reputation and over 25 years of experience. Join us today and make document completion effortless and efficient!

- Utilize our platform whenever you require a dependable service through which you can swiftly find and download the Continuance Sample With Time.

- If you’re already familiar with our services and have previously established an account with us, simply Log In to your account, locate the form, and download it or re-download it anytime via the My documents section.

- Not registered yet? No problem. It takes just a few minutes to create an account and explore the library.

- But before diving into downloading Continuance Sample With Time, adhere to these suggestions.

Form popularity

FAQ

On the state level, New Hampshire also directly taxes LLCs making income over certain thresholds through a business profits tax and a business enterprise tax. While it has no general state income tax, LLC members may be subject to a tax on interest and dividend income until it is phased out in 2027.

Yes, you can be your own registered agent in New Hampshire. However, after considering the registered agent requirements most business owners elect to hire a registered agent service instead.

How to start an LLC in New Hampshire Name your New Hampshire LLC. Create a business plan. Get a federal employer identification number (EIN) Choose a registered agent in New Hampshire. File for your New Hampshire Certificate of Formation. Obtain business licenses and permits. Understand New Hampshire tax requirements.

You can get an LLC in New Hampshire in 7-10 business days if you file online (or 3-5 weeks if you file by mail).

You can get an LLC in New Hampshire in 7-10 business days if you file online (or 3-5 weeks if you file by mail).

Initial New Hampshire LLC Fees State FeeState Filing TimeExpedited Filing Time$102*4 Weeks10 Business DaysState Fee$102*State Filing Time4 WeeksExpedited Filing Time10 Business Days

Starting an LLC costs $102 in New Hampshire. This is the state filing fee for a document called the New Hampshire Certificate of Formation. The Certificate of Formation is filed with the NH Secretary of State. And once approved, this is what creates your LLC.

To make your New Hampshire LLC official, you need to fill out and submit a form called the Certificate of Formation to the Corporations Division and pay a $100 fee. You can file your Certificate of Formation online, by mail, or in person. Note: All of the information on this form will become part of the public record.