Continuance Motion With Position Time Graphs

Description

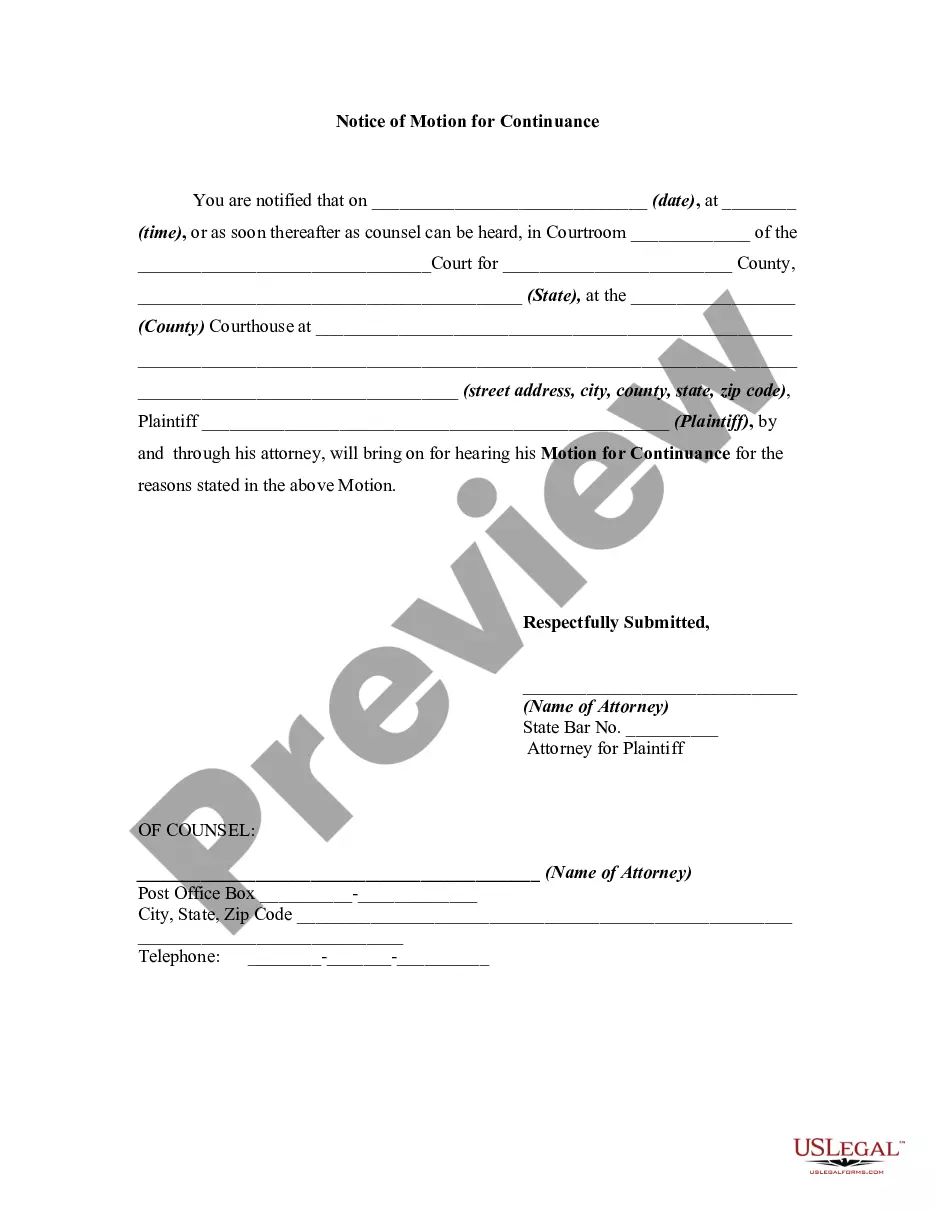

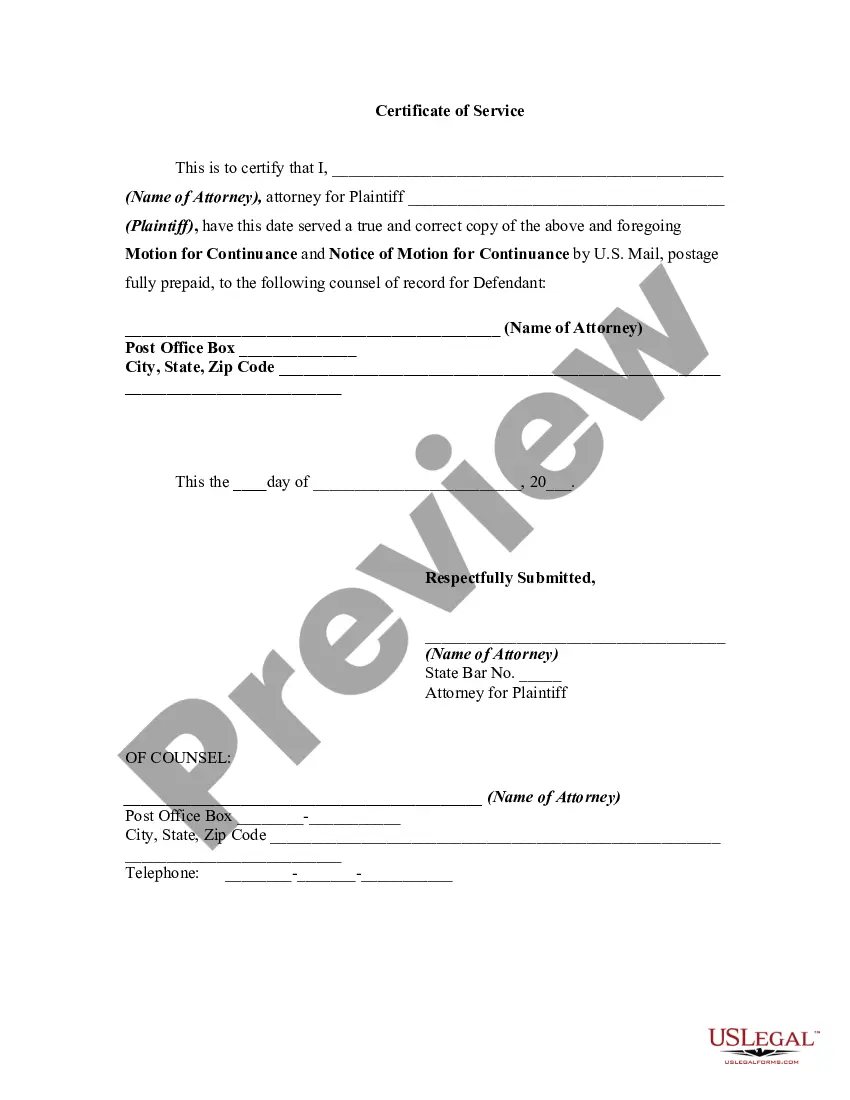

How to fill out Generic Motion For Continuance And Notice Of Motion?

Legal documents management can be daunting, even for the most proficient experts.

When you need a Continuance Motion With Position Time Graphs but lack the time to devote to finding the appropriate and updated version, the process can be strenuous.

Access a resource library of articles, guides, and handbooks relevant to your circumstances and requirements.

Save time and energy in searching for the forms you require and take advantage of US Legal Forms' advanced search and Review tool to locate and download Continuance Motion With Position Time Graphs.

Select Buy Now when you are prepared. Choose a monthly subscription plan. Locate the format you require, then Download, complete, eSign, print, and dispatch your document. Enjoy the US Legal Forms online library backed by 25 years of expertise and trustworthiness. Improve your routine document management through a seamless and user-friendly process today.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the needed form, and download it.

- Check the My documents tab to view the documents you've downloaded and manage your folders as needed.

- If this is your first experience with US Legal Forms, create an account to gain unlimited access to all the library's benefits.

- Once you find the form you need, verify it's the correct one by previewing it and reviewing its description.

- Ensure that the sample is accepted in your state or county.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses any needs you might have, from personal to corporate papers, all in one location.

- Utilize advanced tools to complete and manage your Continuance Motion With Position Time Graphs.

Form popularity

FAQ

When analyzing motion from a position-time graph, the slope of the line is particularly important. A positive slope indicates forward movement, while a negative slope might indicate reverse movement. The steepness of the slope reveals the speed of the object; the steeper the slope, the faster the motion. Mastering how to interpret the slope is key for understanding continuance motion with position time graphs.

Finding displacement on a position-time graph involves measuring the change in position from the starting point to the final point. To calculate this, subtract the initial position from the final position. This value represents the total straight-line distance traveled in a specific direction. Understanding displacement is an integral part of analyzing continuance motion with position time graphs.

A bankruptcy letter should be clear and concise and provide all the necessary information. It should include the name and contact information of the debtor, the date of the filing, the court where the bankruptcy was filed, the case number, and the type of bankruptcy filed.

If you receive this notice, it means one of three things: The address you provided for the creditor in your bankruptcy paperwork was incorrect, The court sent you notice of your own bankruptcy via this form, or. Someone who owes you money filed bankruptcy.

The person filing for bankruptcy is the one who pays for the bankruptcy, either the individual or the creditor in a forced bankruptcy.

1 The automatic stay applies to individual debtors, to businesses, and to all of the chapters of the bankruptcy code. The automatic stay does not apply to non-debtor entities, such as corporate affiliates, corporate officers, co-defendants, or guarantors.

Three key things to include in every letter of explanation: The reason you declared bankruptcy. The steps you've taken to repair your credit. Your plan to pay back the loan you're applying for.

Collect Your Documents To Assess Your Finances & Debts. ... Take the Required Credit Counseling Course From an Approved Provider. ... Complete the Required Bankruptcy Forms. ... Get Your Filing Fee. ... Print and Double-Check Your Bankruptcy Forms. ... Go To Your Local Bankruptcy Court To File Your Forms. ... Mail Documents to Your Trustee.

A 609 letter (also called a credit dispute letter) is a credit repair method that requests credit bureaus to remove erroneous negative entries from your credit report. It's named after section 609 of the Fair Credit Reporting Act (FCRA), a federal law that protects consumers from unfair credit and collection practices.

Secured creditors like banks are going to get paid first. This is because their credit is secured by assets?typically ones that your business controls. Your plan and the courts may consider how integral the assets are that secure your loans to determine which secured creditors get paid first though.