Continuance Application Withholding Tax

Description

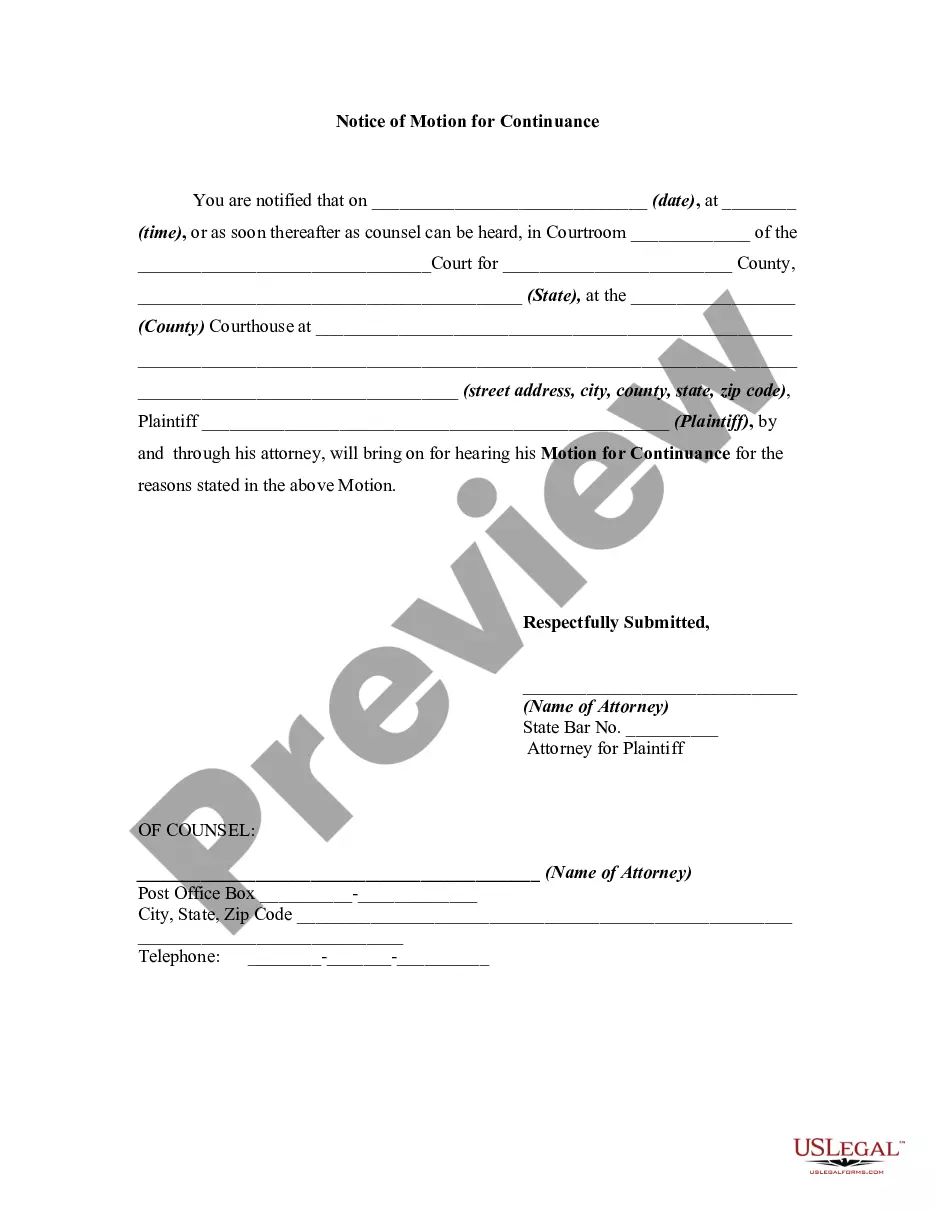

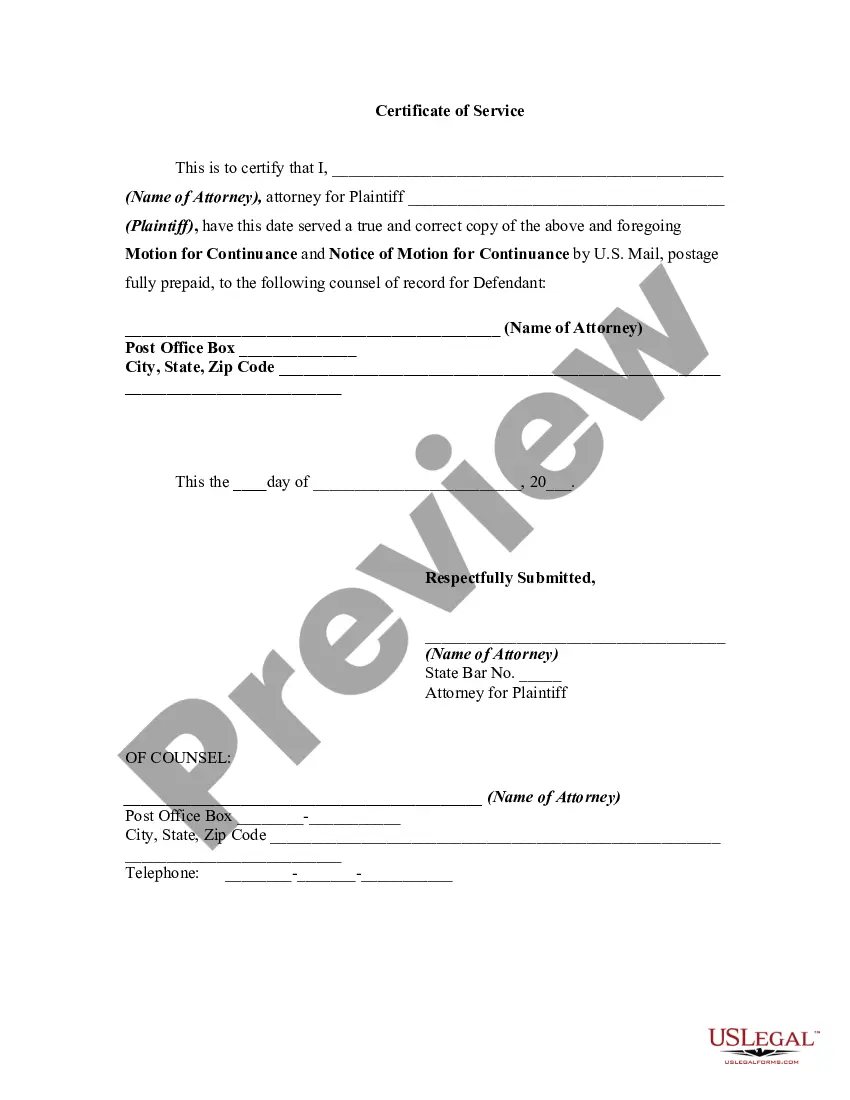

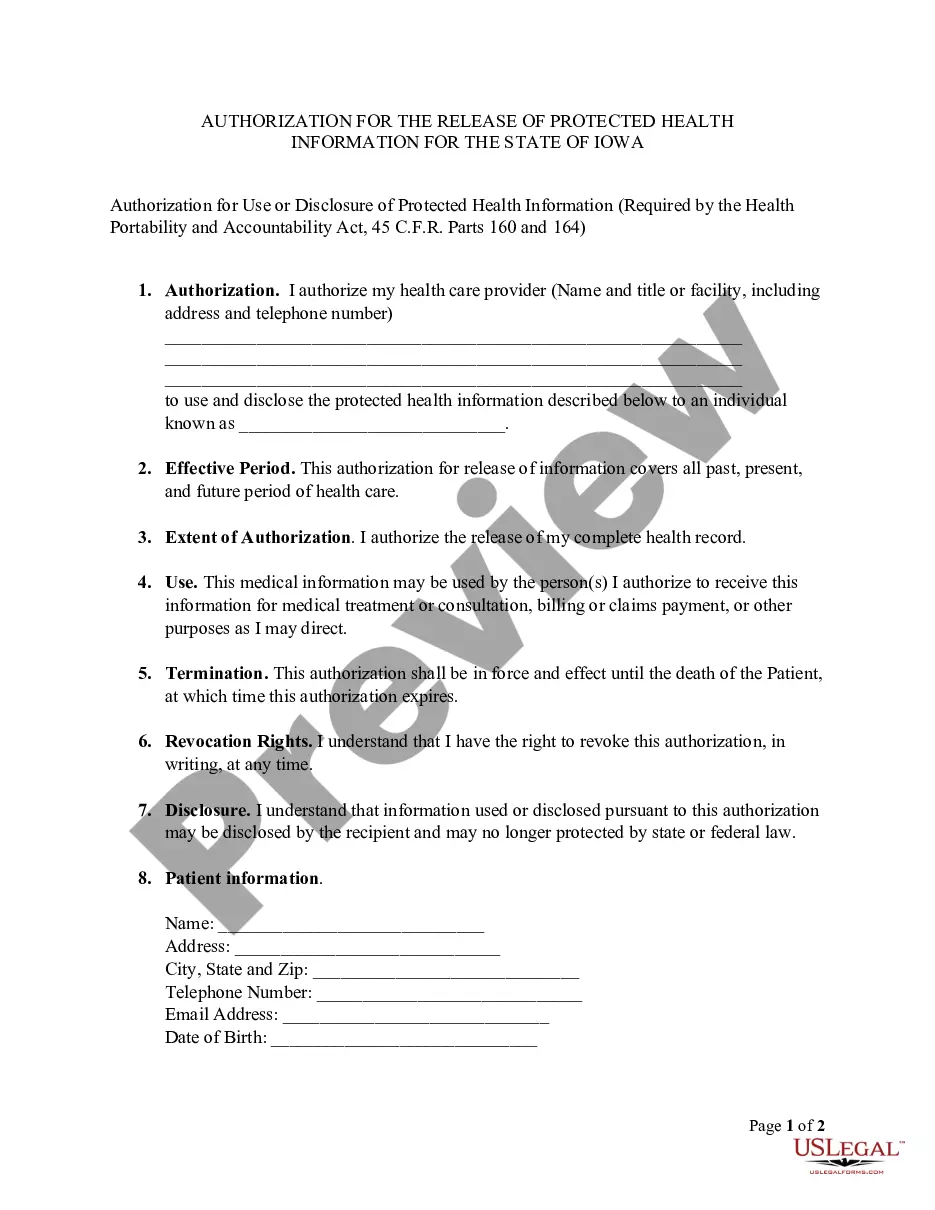

How to fill out Generic Motion For Continuance And Notice Of Motion?

Securing a reliable location to obtain the most up-to-date and pertinent legal templates is a significant part of navigating bureaucracy. Identifying the correct legal documents demands accuracy and meticulousness, which is why it is crucial to source samples of Continuance Application Withholding Tax exclusively from trustworthy providers, such as US Legal Forms. An incorrect template can squander your time and delay your situation. With US Legal Forms, you have minimal concerns. You can access and review all the information regarding the document’s applicability and significance for your circumstances and in your jurisdiction.

Consider the following steps to finalize your Continuance Application Withholding Tax.

Once you have the form on your device, you may modify it using the editor or print it and complete it manually. Alleviate the stress associated with your legal documentation. Explore the vast US Legal Forms library where you can discover legal templates, assess their relevance to your situation, and download them instantly.

- Use the catalog navigation or search bar to locate your template.

- Review the form’s description to determine if it meets the criteria of your jurisdiction.

- Preview the form, if available, to ensure the template is indeed the one you need.

- Return to the search to find the appropriate template if the Continuance Application Withholding Tax does not suit your requirements.

- If you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your selected forms in My documents.

- If you do not have an account yet, click Buy now to obtain the form.

- Choose the payment plan that aligns with your preferences.

- Proceed to the registration to finalize your transaction.

- Complete your purchase by selecting a payment option (credit card or PayPal).

- Choose the document format for downloading the Continuance Application Withholding Tax.

Form popularity

FAQ

What Information Do I Need to Fill Out Form 4868? In Part I: Your name, address, Social Security number, and, if applicable, your spouse's Social Security number. In Part II: A good faith estimate of what you think your final taxes will be, after subtracting the total tax payments you already made for the year.

You can get an automatic extension of time to file your tax return by filing Form 4868 electronically. You'll receive an electronic acknowledgment once you complete the transaction. Keep it with your records. Don't mail in Form 4868 if you file electronically, unless you're making a payment with a check or money order.

WASHINGTON ? The Internal Revenue Service today further postponed tax deadlines for most California taxpayers to Nov. 16, 2023. In the wake of last winter's natural disasters, the normal spring due dates had previously been postponed to Oct. 16.

You can file an extension for your taxes by submitting IRS Form 4868 with the Internal Revenue Service (IRS) online or by mail. This must be done before the last day for filing taxes. Filing an extension for your taxes gives you additional months to prepare your tax return no matter the reason you need the extra time.

Do not include any amount you plan to pay with your extension. Enter the total payments you paid through quarterly estimated payments and tax refunds applied to the current year.