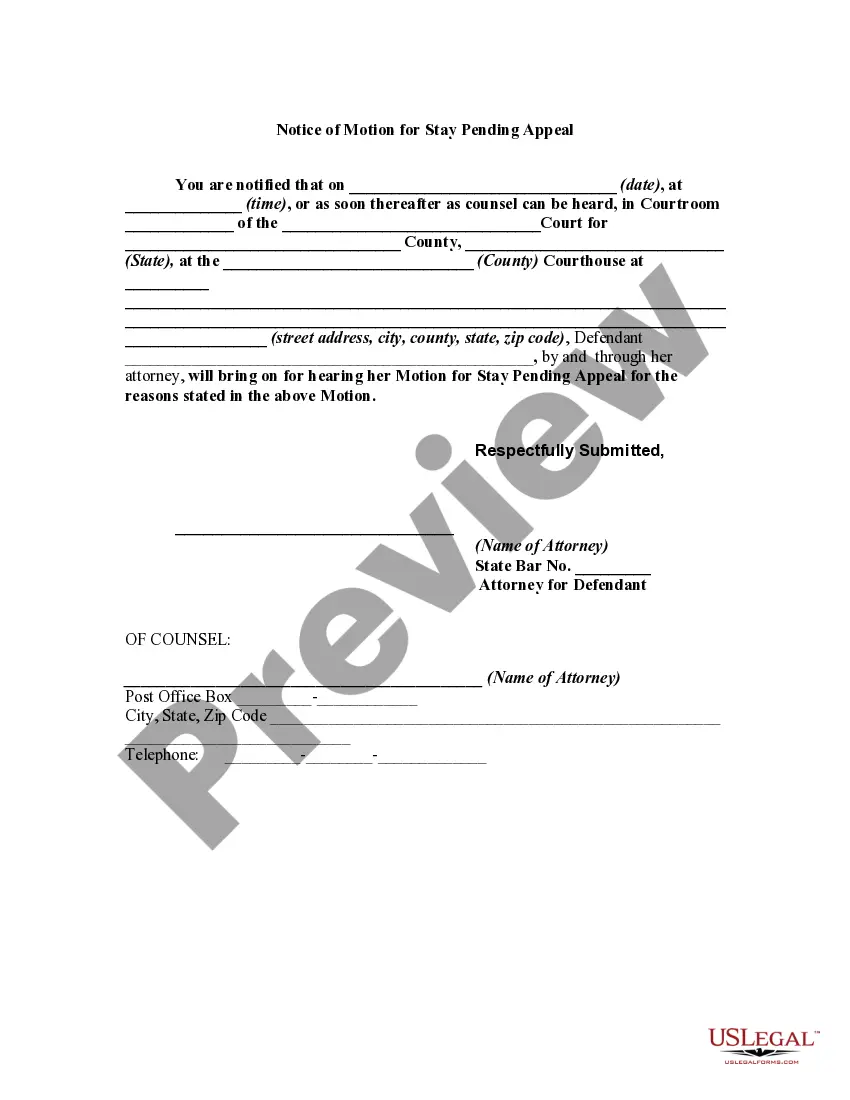

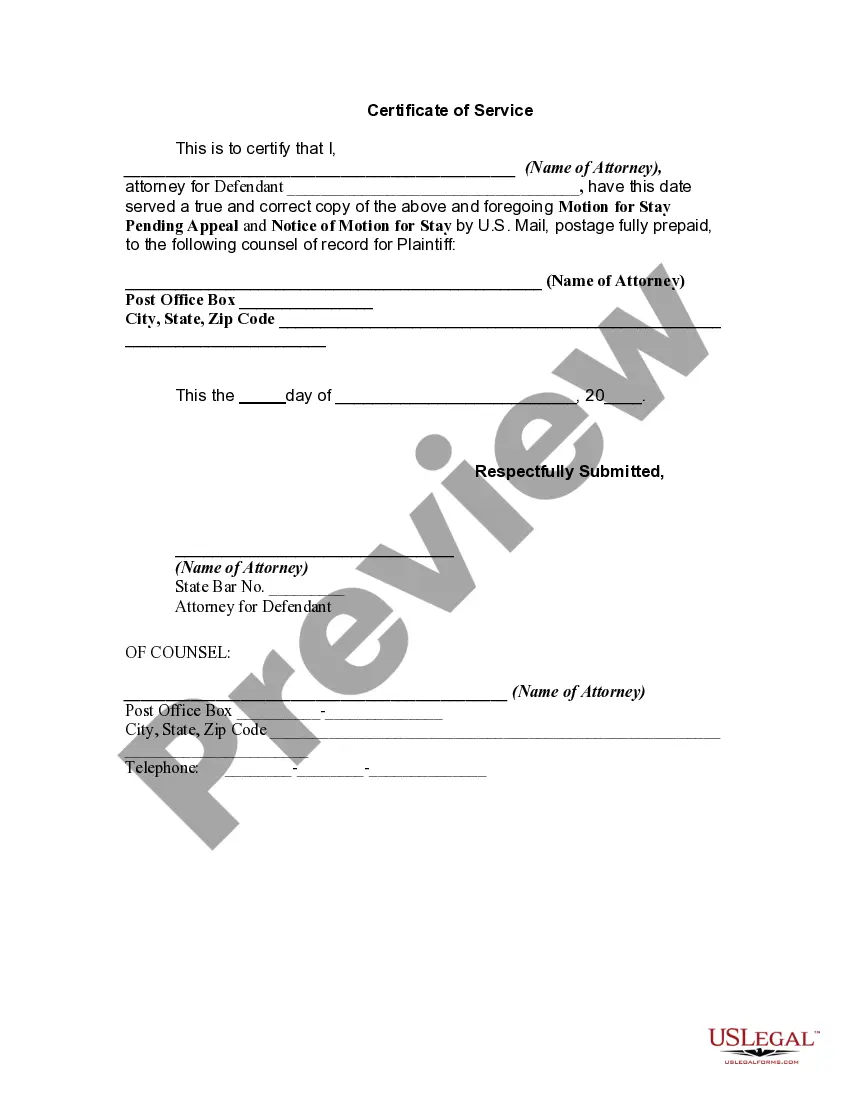

Motion Stay Filed With The Court

Description

How to fill out Motion For Stay Pending Appeal And Notice Of Motion?

Regardless of whether for professional reasons or personal matters, each individual must confront legal circumstances at some point in their lives.

Filling out legal documents necessitates meticulous attention, beginning with choosing the appropriate form template.

- For example, if you select an incorrect version of the Motion Stay Filed With The Court, it will be rejected upon submission.

- Thus, it is crucial to have a reliable source for legal documents like US Legal Forms.

- Should you need to acquire a sample of the Motion Stay Filed With The Court, follow these straightforward steps.

- Obtain the template you require by using the search field or browsing the catalog.

- Review the information of the form to confirm it aligns with your case, state, and locality.

- Click on the form's preview to inspect it.

- If it is not the correct document, return to the search feature to locate the Motion Stay Filed With The Court sample you require.

- Download the file if it meets your specifications.

- If you already have a US Legal Forms account, simply click Log in to retrieve previously saved templates in My documents.

- In case you do not possess an account yet, you may acquire the form by clicking Buy now.

- Select the appropriate payment option.

- Complete the profile registration form.

Form popularity

FAQ

The phrase 'a body in motion stays in motion' suggests that once something is set in motion, it will continue to move or progress until acted upon by an outside force. In legal terms, this can relate to cases where actions are taken swiftly, leading to swift consequences. When a motion stay is filed with the court, it acts as that outside force, allowing for necessary pauses to consider important aspects of a case.

When you see the term 'stay the motion,' it refers to a request to halt or pause the proceedings in a legal case. This action is often necessary when one party needs more time to gather evidence or prepare arguments. When a motion stay is filed with the court, it allows for a temporary break in the legal process, giving parties the opportunity to resolve underlying issues without rushing to a conclusion.

The Disadvantage of a Revocable Living Trust Expansive: Creating a revocable living trust can be more expensive than a simple will due to legal fees and document preparation. Complexity: Managing a trust requires ongoing paperwork and record-keeping, which can be burdensome and time-consuming.

BENEFICIARY REQUIREMENTS For a trust to be valid in Maryland, there must be a definite beneficiary, unless the trust is: ? A charitable trust. ? For the benefit of an animal. can exist for no longer than 21 years.

A revocable trust and living trust are separate terms that describe the same thing: a trust in which the terms can be changed at any time. An irrevocable trust describes a trust that cannot be modified after it is created without the beneficiaries' consent.

A living trust can help you manage and pass on a variety of assets. However, there are a few asset types that generally shouldn't go in a living trust, including retirement accounts, health savings accounts, life insurance policies, UTMA or UGMA accounts and vehicles.

A revocable living trust is a trust document created by an individual that can be changed over time. Revocable living trusts are used to avoid probate and to protect the privacy of the trust owner and beneficiaries of the trust as well as minimize estate taxes.

A trust amendment is a legal document that changes specific provisions of a revocable living trust but leaves all of the other provisions unchanged, while a restatement of a trust?which is also known as a complete restatement or an amendment and complete restatement?completely replaces and supersedes all of the ...

Your share of joint tenancy bank accounts (but not joint tenancy real estate) payable-on-death bank accounts. transfer-on-death securities or security accounts, and. property in a living trust.

Revocable living trusts have a few key benefits, like avoiding probate, privacy protection and protection in the case of incapacitation. However, revocable living trusts can be expensive, don't have direct tax benefits, and don't protect against creditors.