Civil Appeals Process

Description

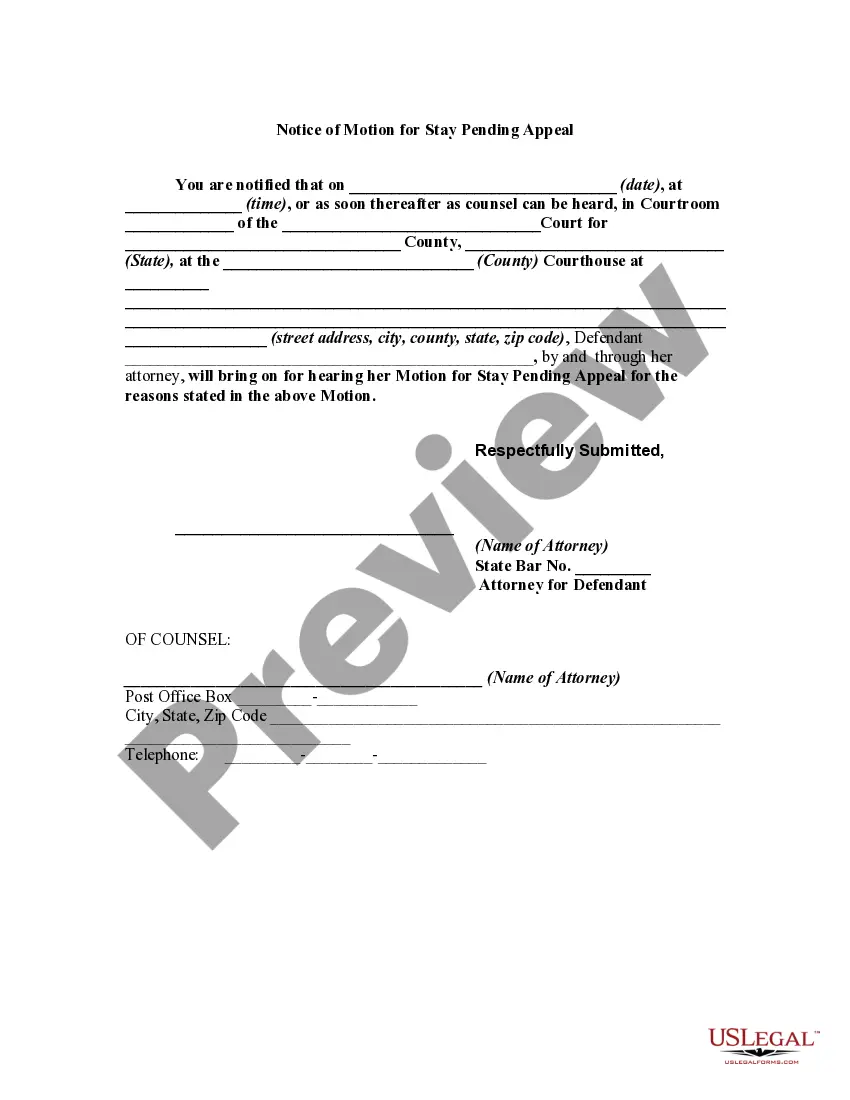

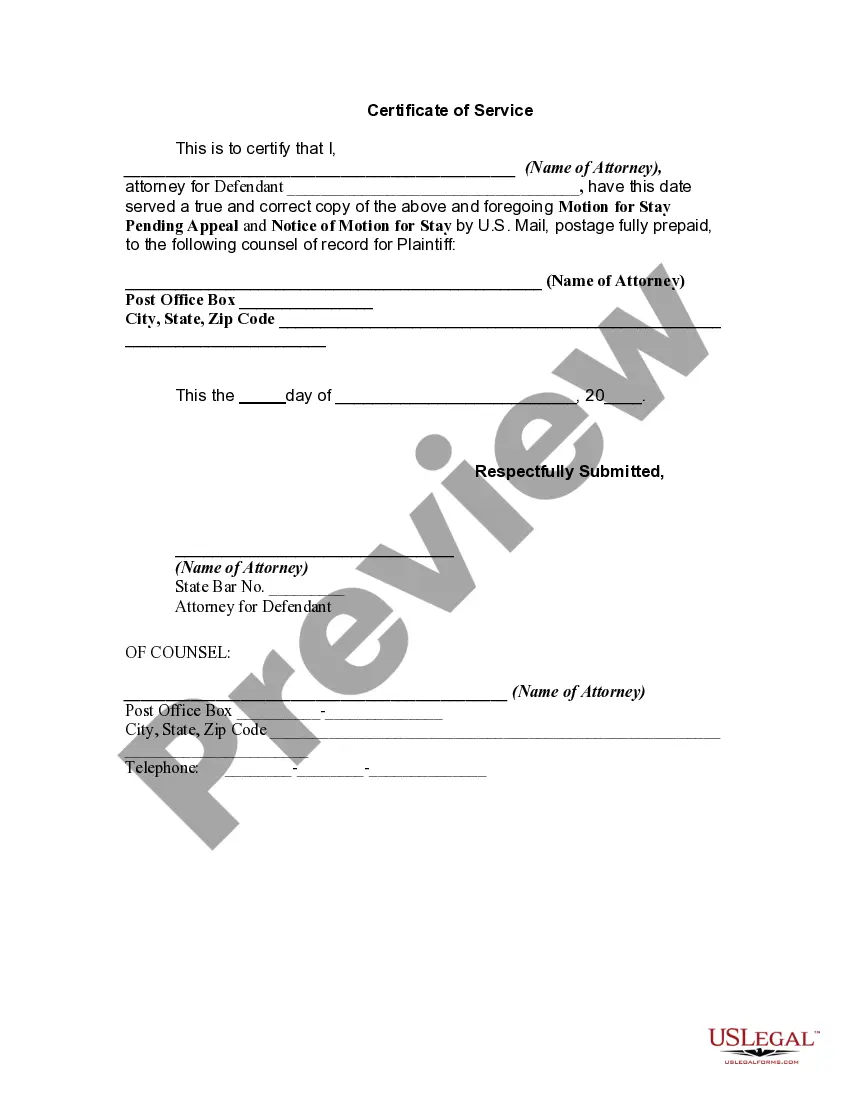

How to fill out Motion For Stay Pending Appeal And Notice Of Motion?

Whether for commercial reasons or for personal affairs, everyone must handle legal issues at some time in their life.

Completing legal documentation necessitates meticulous attention, starting from selecting the correct form sample.

With a vast US Legal Forms catalog available, you don’t have to waste time searching for the right sample online. Utilize the library’s easy navigation to find the suitable form for any occasion.

- Locate the sample you require using the search bar or catalog navigation.

- Review the form’s details to ensure it suits your circumstances, state, and locality.

- Click on the form’s preview to review it.

- If it is the incorrect document, return to the search tool to find the Civil Appeals Process sample you require.

- Download the file when it aligns with your specifications.

- If you have a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- If you don’t possess an account yet, you can acquire the form by clicking Buy now.

- Select the suitable pricing option.

- Complete the account registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the document format you prefer and download the Civil Appeals Process.

- Once it is downloaded, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

The debtor may prepay in full at any time without penalty the debt represented by a personal, family, or household purpose loan agreement that is secured in whole or in part by a first or junior lien on real estate if the aggregate of all sums advanced will not exceed one hundred fifty thousand dollars.

Interest Rates Laws in South Carolina Code SectionSouth Carolina Code of Laws 34-31-20: Legal Rate of InterestLegal Maximum Rate of Interest8.75% (§34-31-20)Penalty for Usury (Unlawful Interest Rate)Usury penalty laws repealed June 25, 1982, but old law may apply to transactions before then (formerly §34-31-50)2 more rows

Application for licensure; information required; identification of managing principal; filing fee; surety bond; issuance of license. (iii) as to which the applicant is the current or proposed managing principal or a current or proposed branch manager.

(26) "Loan originator" means a natural person who, in exchange for compensation or gain or in the expectation of compensation or gain as an employee of a licensed mortgage lender, solicits, negotiates, accepts, or offers to accept applications for mortgage loans, including electronic applications, or includes direct ...

SECTION 37-22-120. Licensing requirements. (2) circulate or use advertising, including electronic means, make a representation or give information to a person which indicates or reasonably implies activity within the scope of this chapter.

South Carolina is one of the states where car title loans are allowed to be given out. Like many states South Carolina does have its own sets of rules and regulations. South Carolina does have some rules in place to help protect borrowers so it may be a good state to look into title loans for.

Each licensee shall submit its mortgage loan log data and the data identified in 12 C.F.R. Part 1003, et seq., in a form determined by the administrator by March thirty-first of each year.

Section 37-22-210 - Commissioner's records; segregated escrow funds; licensee ceasing business activities. (A) The commissioner shall keep a list of all applicants for licensure pursuant to this chapter which includes the date of application, name, and place of residence and whether the license was granted or refused.