Dynasty Trust Explained With Example

Description

How to fill out Irrevocable Generation Skipping Or Dynasty Trust Agreement For Benefit Of Trustor's Children And Grandchildren?

Finding a reliable source to obtain the latest and suitable legal templates is a significant part of navigating bureaucracy.

Selecting the appropriate legal documents requires precision and careful consideration, which is why it is crucial to source examples of Dynasty Trust Explained With Example exclusively from trustworthy providers, such as US Legal Forms. An incorrect template can squander your time and delay the issues you are facing.

Eliminate the hassle that comes with your legal paperwork. Explore the extensive US Legal Forms library to find legal templates, assess their relevance to your situation, and download them instantly.

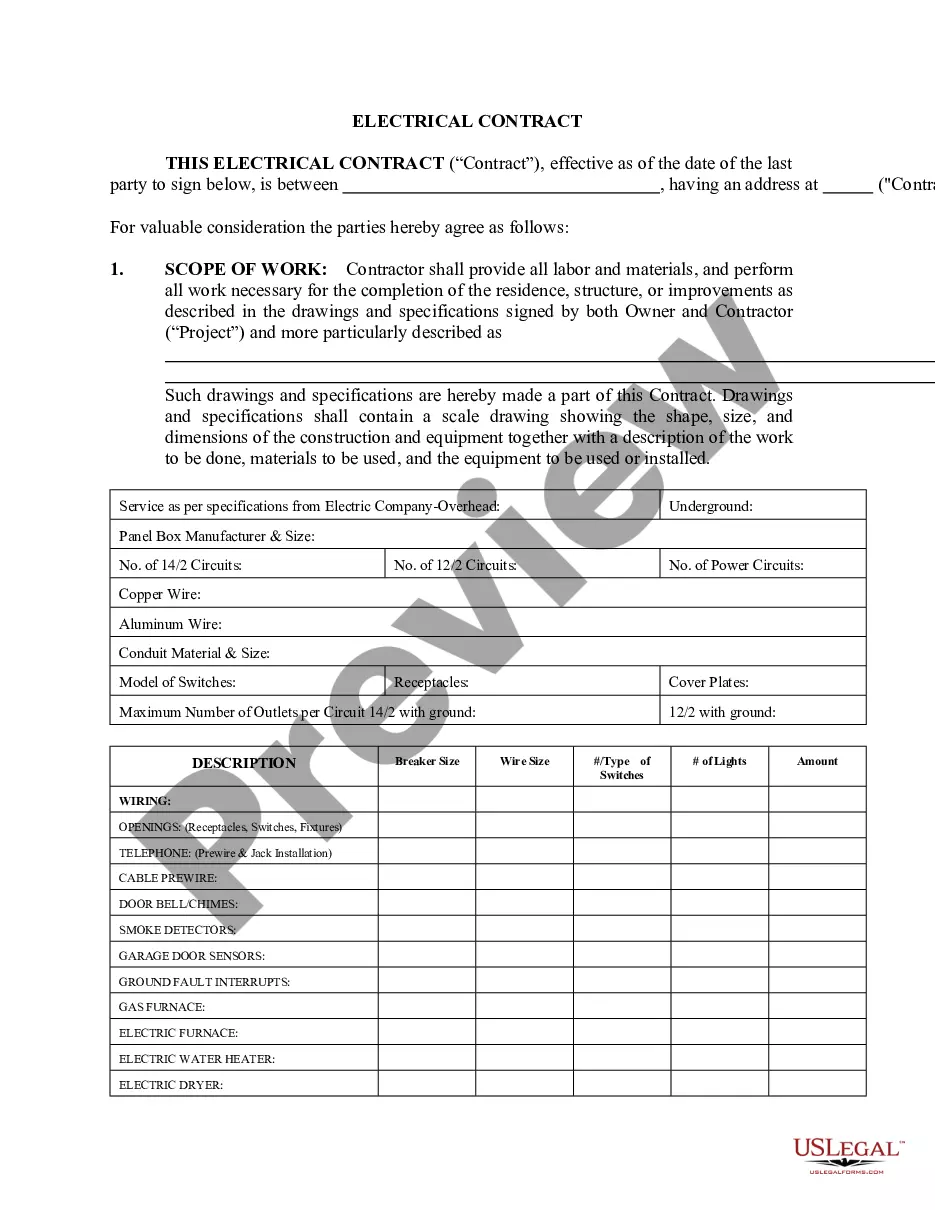

- Utilize the catalog browsing or search feature to locate your template.

- Examine the document's description to verify if it meets your state's and region's requirements.

- Check the form preview, if available, to confirm that the template matches your needs.

- If the Dynasty Trust Explained With Example does not align with your requirements, return to search for the appropriate template.

- If you are confident about the form's suitability, proceed to download it.

- If you are a registered user, click Log in to verify your identity and access your chosen templates in My documents.

- If you do not have an account yet, click Buy now to acquire the form.

- Select the pricing option that fits your needs.

- Continue to the registration process to finalize your purchase.

- Complete your transaction by choosing a payment method (credit card or PayPal).

- Choose the file format for downloading Dynasty Trust Explained With Example.

- Once the form is on your device, you can modify it using the editor or print it and complete it by hand.

Form popularity

FAQ

You can place various assets into a trust, including real estate, investments, and savings accounts. It is essential to choose assets that align with your estate planning goals. When considering what assets to include, think about their potential appreciation and the benefits they may provide to your beneficiaries. Understanding how to effectively allocate these assets is crucial, and a dynasty trust explained with example can help guide this decision-making process.

One downside of a dynasty trust is the complexity involved in setting it up and maintaining it. Since a dynasty trust can last for generations, this requires careful planning and regular legal oversight. Additionally, the trust may face strict tax regulations, which can impact its long-term viability. Therefore, when considering a dynasty trust explained with example, be aware of the ongoing administrative responsibilities and potential costs.

One of the challenges with dynasty trusts is the complexity of setup and administration, which can lead to high legal fees and potential disagreements among beneficiaries. Additionally, state laws regarding dynasty trusts vary, impacting their effectiveness and longevity. It's important to carefully navigate these issues, and platforms like US Legal Forms can simplify the process, helping you understand the implications of a dynasty trust explained with example.

A dynasty trust avoids estate taxes by keeping assets in trust for several generations rather than transferring them directly to heirs. This structure helps to bypass estate taxes that can be levied each time wealth is passed down. Instead, beneficiaries receive distributions without the full tax burden. This aspect is crucial to grasp when exploring how a dynasty trust is explained with example.

A dynasty trust is designed to last for multiple generations, allowing wealth to pass down without triggering estate taxes at each generation level. In contrast, a regular trust typically operates within a single generation, distributing assets according to specific terms. This makes the dynasty trust an effective tool for long-term wealth preservation. Understanding the differences helps you make informed decisions about estate planning, especially when considering a dynasty trust explained with example.

While dynasty trusts offer numerous benefits, they also come with certain downsides. Setting up a dynasty trust can involve high legal fees and complex administration. Additionally, if not managed correctly, beneficiaries might misuse access to funds, leading to family disputes. Being informed about these considerations helps you make better decisions in your estate planning journey, with resources available on our platform to guide you.

Setting up a dynasty trust requires essential legal documentation, typically crafted with the assistance of an estate planning attorney. You will need to determine the assets to include, select a trustworthy trustee, and outline how and when beneficiaries can access the trust funds. Additionally, it’s crucial to understand state-specific laws regarding the duration of the trust. For comprehensive assistance, consider using our platform, which simplifies this process.

An example of a dynasty trust could involve a family with significant investments in a business that they want to pass down. They establish a trust that allows their children and grandchildren access to income generated by these investments, while principal amounts remain protected from estate taxes for generations. This approach exemplifies how a dynasty trust can effectively manage wealth and ensure financial security for future heirs. Explore more about these examples on our website.

The best assets for a dynasty trust include real estate, stocks, and business interests, which appreciate over time and can continue to grow for future generations. By placing these assets within a dynasty trust, you essentially shield them from estate taxes while allowing your beneficiaries to benefit from them. It's important to consider liquidity and how each asset aligns with your family's financial goals. Our platform offers guidance on selecting the optimal assets for your situation.

To structure a dynasty trust, you first need to choose a trustee who will manage the trust assets. Next, you will define the beneficiaries, often spanning multiple generations, and clarify the terms under which they can access the funds. Additionally, it’s essential to incorporate specific provisions that allow the trust to exist for as long as state laws permit. Understanding this setup allows you to see how a dynasty trust is an effective wealth preservation tool, as demonstrated in our resources.