Triple Net Lease For Tenant

Description

How to fill out Triple Net Lease?

- Log into your US Legal Forms account if you are an existing user. Ensure your subscription is active, or renew it through your payment plan.

- Browse the extensive online library and preview the form descriptions to find the right triple net lease template that fits your jurisdiction and needs.

- If you don't find the desired template, use the search feature to locate another form that might be more suitable.

- Select the form you need and click on the Buy Now button to choose a subscription plan that best meets your requirements; you will need to create an account for full access.

- Complete your purchase using your credit card or PayPal and save the document on your device to be able to fill it out at your convenience.

- Access your downloaded form anytime through the My Forms section in your profile.

In conclusion, US Legal Forms simplifies the process of obtaining a triple net lease for tenant. With an extensive library of over 85,000 legal forms, users receive comprehensive support to ensure their documents are accurate and legally sound.

Start your journey to secure your rental space today by visiting US Legal Forms and taking advantage of their robust collection!

Form popularity

FAQ

In a triple net lease for tenant, certain expenses may not be included, such as the owner’s mortgage payments or internal repairs not related to the property itself. Typically, the tenant is responsible for operating costs but not for major capital improvements or structural repairs. It is essential to understand these distinctions clearly to avoid unexpected financial obligations.

To calculate nnn charges for a triple net lease for tenant, start by identifying the property's operating expenses. These can include property taxes, insurance, and maintenance costs. Next, estimate the total annual charges and allocate a portion based on the leased space proportion. This comprehensive approach ensures clarity in understanding your financial responsibilities.

One key disadvantage of a triple net lease for tenants is the added responsibility for property expenses. This means that tenants are liable for costs such as property taxes, insurance, and maintenance. If unexpected expenses arise, they can significantly impact your budget. Understanding these obligations thoroughly before signing a lease is crucial to avoid surprises.

To qualify for NNN, tenants should prepare financial statements that reflect their stability. Providing tax returns, bank statements, and past lease agreements can be helpful. Additionally, having references from previous landlords can establish your credibility. Using tools from USLegalForms can help in gathering the necessary documents for a successful application.

Qualifying for a triple net lease often involves demonstrating financial capability and business reliability. Landlords will assess your credit history, income sources, and overall financial health. Having a well-structured business plan that outlines how you will manage other costs can further strengthen your application. You might find valuable templates and resources on USLegalForms to assist in this process.

To get approved for a NNN lease, tenants should first demonstrate their financial stability. This often involves presenting proof of income, creditworthiness, and business history. Further, building a strong relationship with the landlord can greatly enhance your approval chances, as landlords want to ensure responsible tenancy. Utilizing resources like USLegalForms can help you prepare all necessary documentation effectively.

In a triple net lease for tenant, the responsibility for HVAC costs usually falls on the tenant. This includes both repair and maintenance expenses, which can be significant over time. Therefore, it's important to factor in these responsibilities when assessing a potential lease. US Legal Forms offers templates and forms that can help clarify these responsibilities, ensuring you enter into your lease with full knowledge of your obligations.

$28 NNN indicates that the base rent for a commercial space is $28 per square foot, excluding triple net expenses. This means that, in addition to the rent, tenants will also be responsible for property taxes, insurance, and maintenance costs. Understanding this terminology is crucial for budgeting accurately when entering a triple net lease. On US Legal Forms, you can access more insights about such terms and their meanings.

The costs of a triple net lease for tenant typically include rent, property taxes, insurance, and maintenance expenses. These additional costs make this leasing structure different from a gross lease, where the landlord covers most expenses. It's essential for tenants to understand these obligations, as they can significantly impact monthly expenses. By using US Legal Forms, you can find detailed resources that help clarify these costs and their implications.

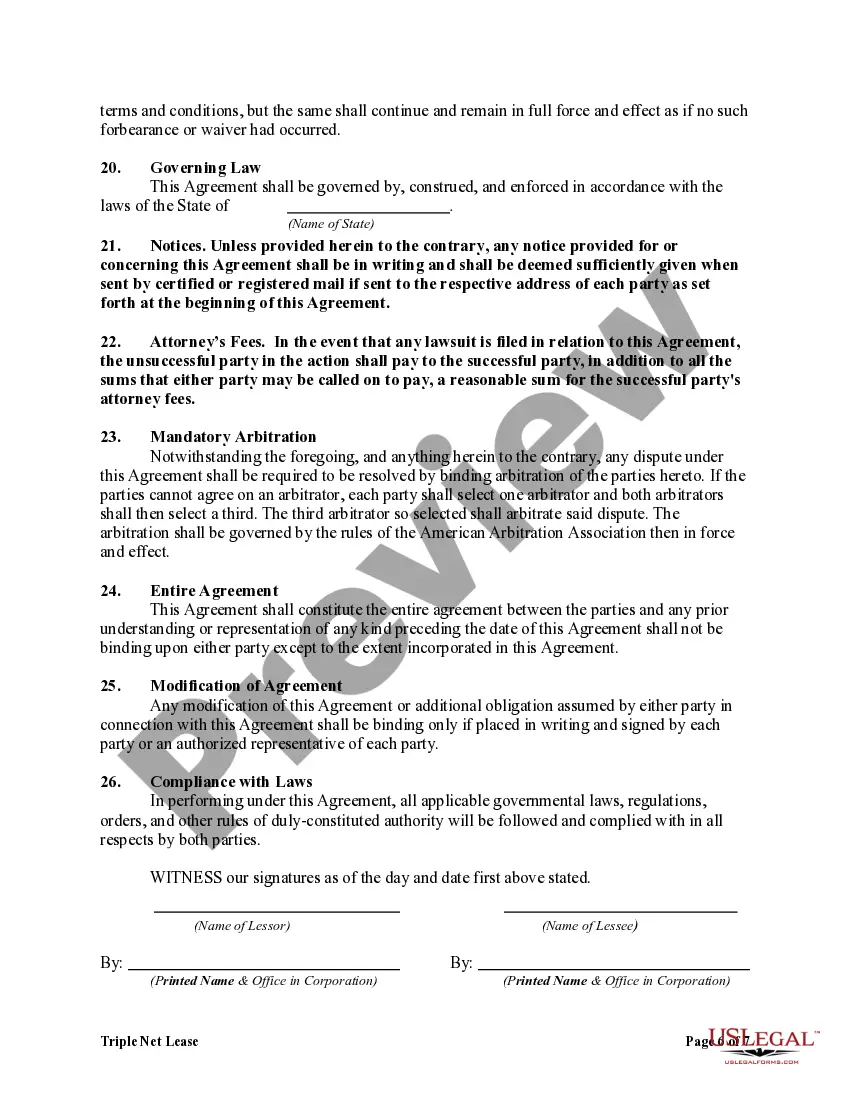

Structuring a triple net lease involves clearly defining terms regarding rent, property taxes, insurance, and maintenance responsibilities. It's crucial to outline each party's obligations in detail to avoid future misunderstandings. Using resources from platforms like uslegalforms can help make this process seamless and ensure compliance. A well-structured triple net lease for tenant protects both parties and fosters a positive rental experience.