Triple Net Lease Buildings For Sale

Description

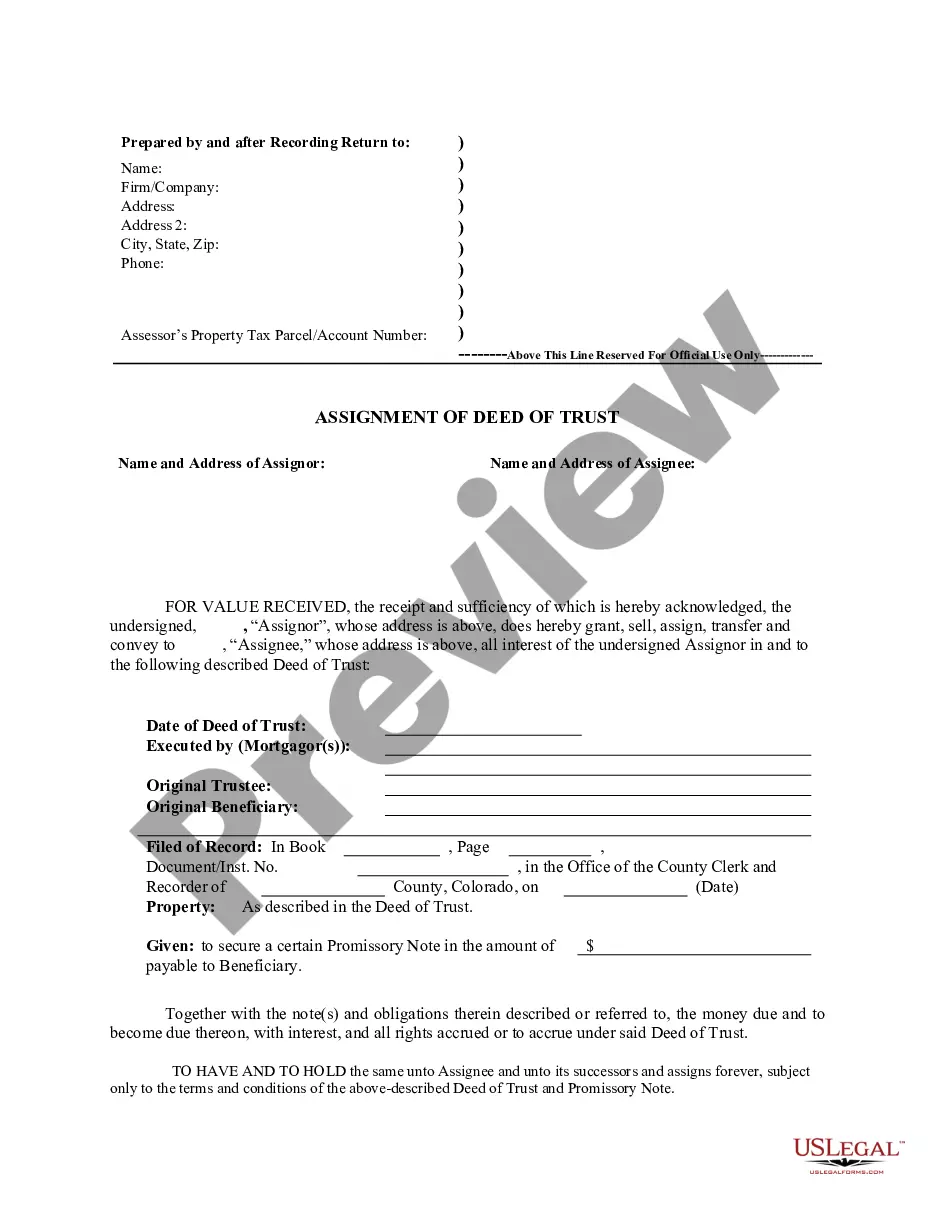

How to fill out Triple Net Lease?

- Log in to your account if you're a returning user to retrieve the required document. Ensure your subscription is active; renew it if necessary.

- Preview the available templates to guarantee you've selected the one that fits your requirements and complies with local regulations.

- Use the search feature if you need to find additional templates that suit your specific needs.

- Select and purchase your desired document by clicking on the 'Buy Now' button and choosing a subscription option. You will need to create an account to access the full library.

- Complete the purchase by entering your payment information via credit card or PayPal.

- Download your chosen form to your device; it can be accessed later in the 'My Forms' section of your account for future use.

US Legal Forms empowers users with a unique collection of over 85,000 legal forms. This extensive resource ensures that both individuals and attorneys can find precisely what they need to execute legal documents efficiently.

Explore the ease of obtaining legal documents today. Visit US Legal Forms and streamline your legal journey!

Form popularity

FAQ

In a triple net lease, the tenant is typically responsible for all property maintenance costs. This means that any repairs, upkeep, and maintenance fees fall on the tenant, allowing property owners to enjoy a passive income without the hassle of day-to-day management. If you are looking for triple net lease buildings for sale, understanding these responsibilities can help you assess the financial implications. You might consider using a platform like US Legal Forms to simplify your lease agreements and ensure clarity about maintenance obligations.

Yes, most aspects of a triple net lease are negotiable. Whether it’s the rent amount, maintenance responsibilities, or lease term length, open communication between the tenant and landlord is essential. If you explore triple net lease buildings for sale, negotiating terms that align with your investment goals can lead to a more successful leasing experience.

In a triple net lease, the tenant typically bears the responsibility for insuring the building. This insurance protects both the tenant and landlord, ensuring coverage for damage and liability. When considering triple net lease buildings for sale, it’s crucial to verify the insurance terms specified in the lease agreement to fully understand your obligations.

The best basis for breaking a commercial lease usually involves unforeseen circumstances, such as significant structural repairs or financial hardship. Most landlords recognize that unexpected situations can arise, and they may offer a solution. If you need to exit a lease for triple net lease buildings for sale, it's beneficial to communicate openly with your landlord.

Getting out of a triple net lease typically involves reviewing your lease terms for any clauses related to early termination. You may need to negotiate an exit with your landlord or potentially assign the lease to another tenant. Always consult with a real estate expert to explore options when dealing with triple net lease buildings for sale, ensuring you make informed decisions.

To value a triple net lease, consider factors like the property's location, tenant creditworthiness, and the remaining lease term. Additionally, calculating net operating income and applying an appropriate capitalization rate can help you assess the investment's worth. When assessing triple net lease buildings for sale, these valuation methods can guide your purchasing decisions.

The most straightforward way to exit a lease is to negotiate an early termination with your landlord. Many property owners prefer retaining good relationships, so offering incentives or finding a replacement tenant may help. If you are opting for triple net lease buildings for sale, it is essential to understand the lease terms to avoid complications when looking to exit.

A triple net lease can provide tax advantages for investors and property owners. With this leasing structure, the tenant covers property taxes, insurance, and maintenance costs, which can potentially reduce the owner's tax liability. You may find that owning triple net lease buildings for sale offers a clearer understanding of your overall tax obligations.

In a triple net lease, tenants typically cover property taxes, insurance, and maintenance costs. This structure allows landlords to enjoy a steady income without the burden of these expenses. However, potential investors should carefully analyze these costs because they can vary significantly depending on the property type and location. Utilizing platforms like US Legal Forms can aid in understanding these financial responsibilities when exploring triple net lease buildings for sale.

While triple net leases offer many benefits, they do come with some disadvantages. For instance, the tenant is responsible for all property expenses, which can lead to unexpected costs if repairs arise. Additionally, since the tenant controls most operational aspects, property owners have less influence over property management. It’s essential to weigh these factors when considering triple net lease buildings for sale.