Notice Potential Lien For Property

Description

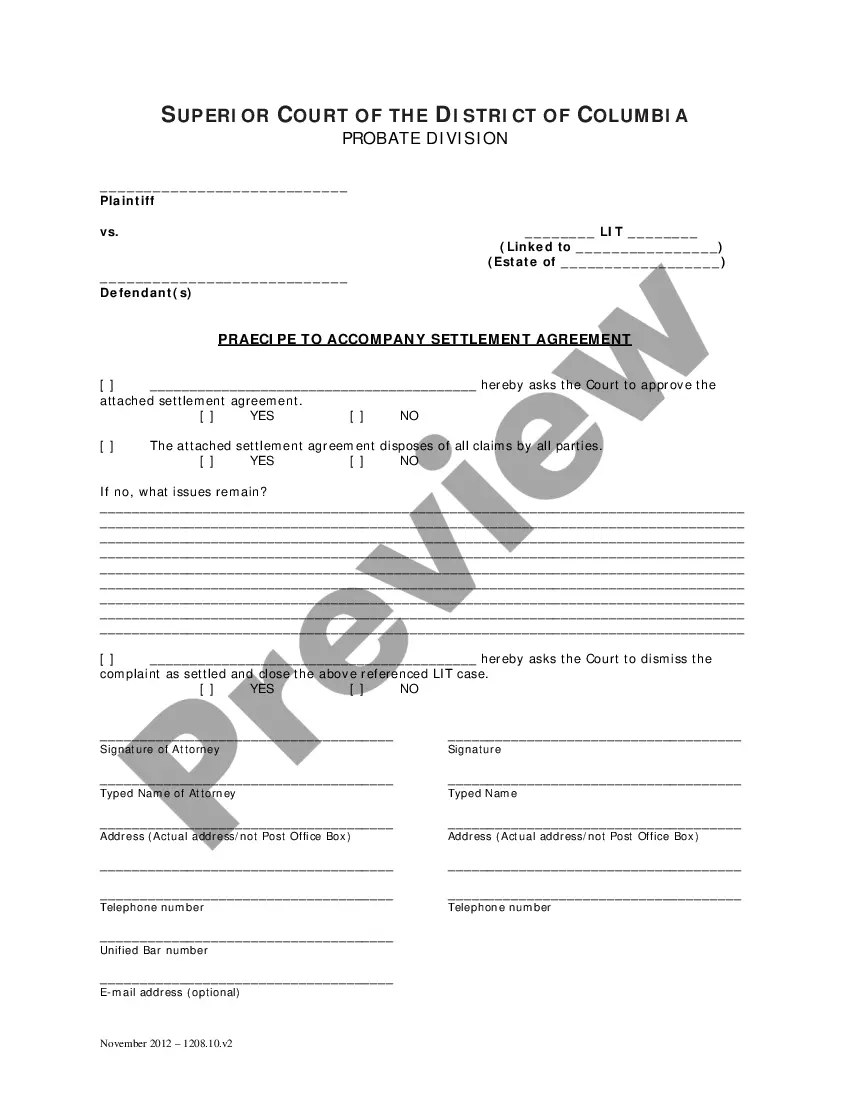

How to fill out Pre-Lien Notice To Owner Regarding Potential Mechanic's Lien For Services To Be Provided To General Contractor?

- Log in to your US Legal Forms account if you're an existing user, or create an account if you are new.

- Browse through our extensive library of over 85,000 legal forms. Use the Search feature to find the specific lien notice template that fits your jurisdiction and needs.

- Preview the form to ensure it meets your requirements and fully complies with local legal standards.

- Select your desired document and choose a subscription plan that best suits your needs.

- Complete the payment process using a credit card or PayPal and confirm your subscription.

- Download the completed form onto your device for further use and easy access through the 'My Forms' section in your profile.

In conclusion, utilizing US Legal Forms not only simplifies the process of noticing potential lien for property but also provides peace of mind with access to premium legal expertise. This ensures that your legal documents are accurate and compliant.

Start your journey towards hassle-free legal documentation today by visiting US Legal Forms and discover the right resources for your needs!

Form popularity

FAQ

In Rhode Island, a notice potential lien for property typically lasts for ten years from the date it is recorded. However, specific circumstances may allow for liens to be extended or renewed, depending on the type of debt or situation. It's essential to monitor these timelines to avoid unintended consequences. If you have questions about managing a lien, consider utilizing resources like US Legal Forms for guidance and effective solutions.

A lien can significantly affect you by attaching to your property and declining its market value. When a notice potential lien for property exists, it can make it difficult to sell or borrow against the property, as lenders often hesitate to finance properties with outstanding liens. This situation can limit your financial options and create stress. Addressing the lien and understanding its implications is crucial for your financial health.

Filing a lien in Illinois can typically be completed within a week if you have all necessary documentation ready. Once filed, the lien notice must be served to the property owner promptly to ensure legal protection. It’s important to act quickly so that the notice potential lien for property does not lapse. Utilizing resources from US Legal Forms can streamline this process and ensure you meet all legal requirements.

Yes, a contractor can file a lien in Illinois without a formal contract under certain conditions. If you provided services that benefited the property, you may still have the right to file a lien, especially if you can prove your work contributed to the property’s value. Always consider issuing a notice potential lien for property to alert the property owner before pursuing more formal actions.

Filing a lien on a property in Illinois involves preparing a lien claim form, which identifies the property and the debtor. You must file this form with the county recorder's office where the property is located, ensuring that the notice potential lien for property is properly documented. Additionally, you should notify the property owner of the lien. Following these steps helps protect your legal rights.

To write a letter of intent for a lien, start by clearly identifying the parties involved, including names and addresses. Next, describe the nature of the debt, mentioning the specific property at stake, which is essential for a notice potential lien for property. Be sure to include a deadline for payment and state your intent to file a lien if the debt remains unpaid. This step helps establish a formal record of your claims.

To obtain a lien release letter, start by ensuring that you have met all obligations associated with the lien. Then, contact the lienholder directly to request the letter. This may involve submitting proof of payment or fulfillment of the obligations. Utilizing US Legal Forms can provide you with helpful resources to facilitate this process efficiently.

Writing a letter to request a lien release involves being clear and concise while including essential details such as your contact information, the lien's specifics, and evidence of payment. It is crucial to maintain a polite tone and express your desire for a prompt release. You may want to consult our templates on the US Legal Forms platform to ensure your letter meets all necessary requirements.

You can find out if a lien has been filed on your property by checking your local county clerk's office or land records office. Many jurisdictions have online databases that allow you to search for liens associated with your property. Staying informed can help you manage any potential lien issues effectively. The US Legal Forms platform offers guidance on accessing these resources.

To obtain a lien release letter, you should first confirm that all obligations related to the lien have been fulfilled. Then, contact the lienholder to request the letter directly. Be prepared to provide documentation showing your compliance with the terms of the obligation. Using US Legal Forms can streamline your efforts by providing templates for this correspondence.