Notice Lien Provided For Unpaid Common Charges

Description

How to fill out Pre-Lien Notice To Owner Regarding Potential Mechanic's Lien For Services To Be Provided To General Contractor?

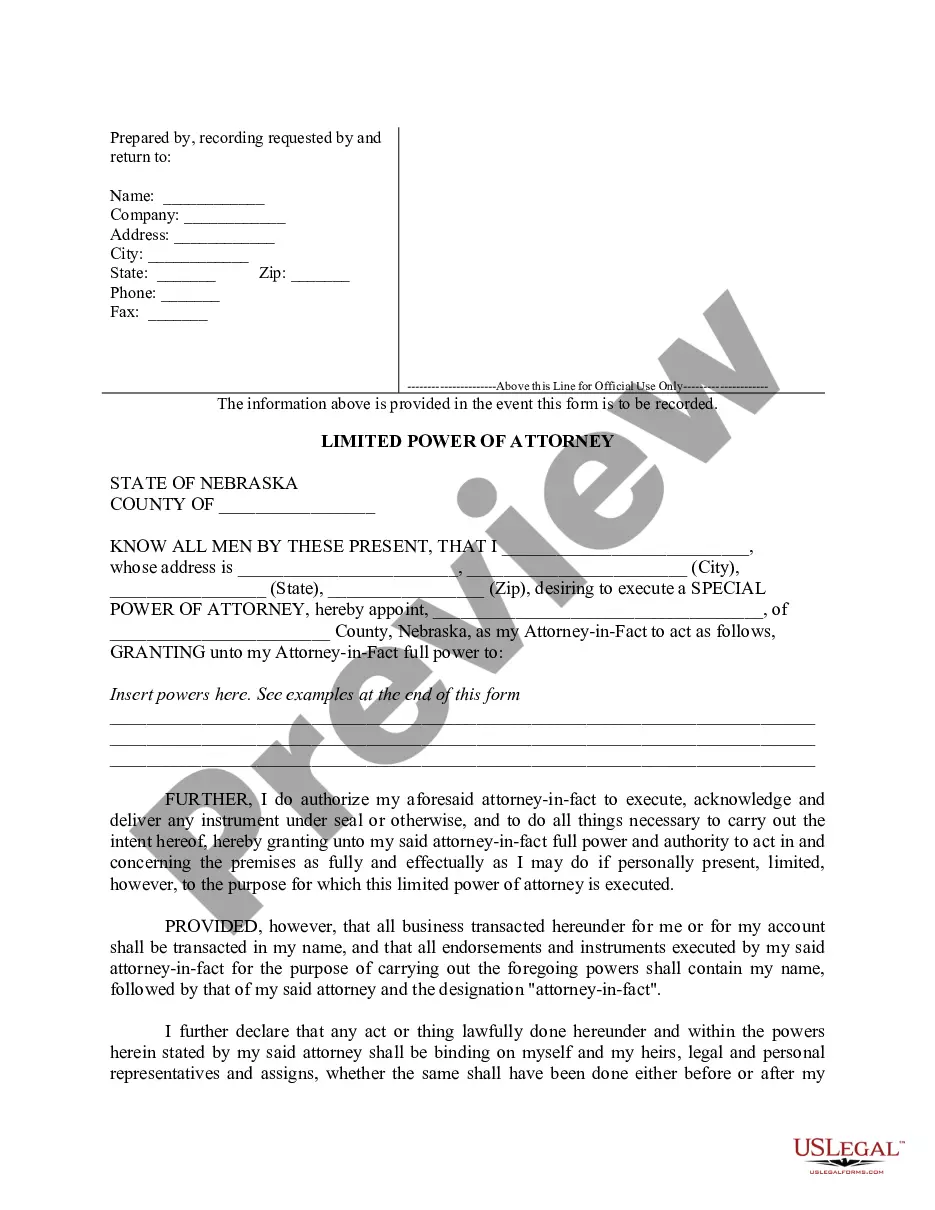

The Notification Lien Designed For Outstanding Common Fees shown on this page is a reusable official template created by skilled attorneys in compliance with national and regional statutes and rules.

For over 25 years, US Legal Forms has supplied individuals, enterprises, and legal experts with over 85,000 authenticated, state-specific documents for any business and personal event. It’s the quickest, easiest, and most dependable way to acquire the papers you require, as the service assures bank-level data security and anti-malware safeguards.

Sign up for US Legal Forms to have authentic legal templates for all of life’s circumstances at your service.

- Search for the document you require and examine it.

- Go through the file you sought and preview it or review the form details to verify it meets your needs. If it doesn’t, utilize the search feature to locate the correct one. Click Buy Now once you’ve found the template you need.

- Register and Log Into your account.

- Select the pricing option that fits you and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and check your subscription to proceed.

- Obtain the editable template.

- Select the format you prefer for your Notification Lien Designed For Outstanding Common Fees (PDF, DOCX, RTF) and save the document on your device.

- Complete and sign the document.

- Print the template to finalize it by hand. Alternatively, use an online multifunctional PDF editor to quickly and accurately complete and sign your form with a legally-binding electronic signature.

- Redownload your documents again.

- Utilize the same document again whenever necessary. Open the My documents tab in your profile to redownload any previously obtained documents.

Form popularity

FAQ

In the event that unpaid common charges are due, any member of the board of managers may file a notice of lien as described herein if no notice of lien has been filed within sixty days after the unpaid charges are due.

Under New York law, the general rule is that liens have priority in the order that they are recorded first in the public land records which is known as the ?first in time, first in right? rule, but there are many exceptions to the general rule.

Because New York is not a super lien state, a bank foreclosure will take priority over a community association's lien and does not require the lender to provide any compensation to the association for unpaid assessments.

Following a first-mortgage foreclosure, all junior liens (including a second mortgage and any junior judgment liens) are extinguished, and the liens are removed from the property's title. But the second-mortgage debt and creditor's judgment remain, even though they're no longer attached to the foreclosed property.

Florida is one of 20 states that are categorized as ?super lien? states with regard to HOA liens. In contrast, most other states HOAs include language in their contracts that places its lien automatically in second or junior position to the mortgage.